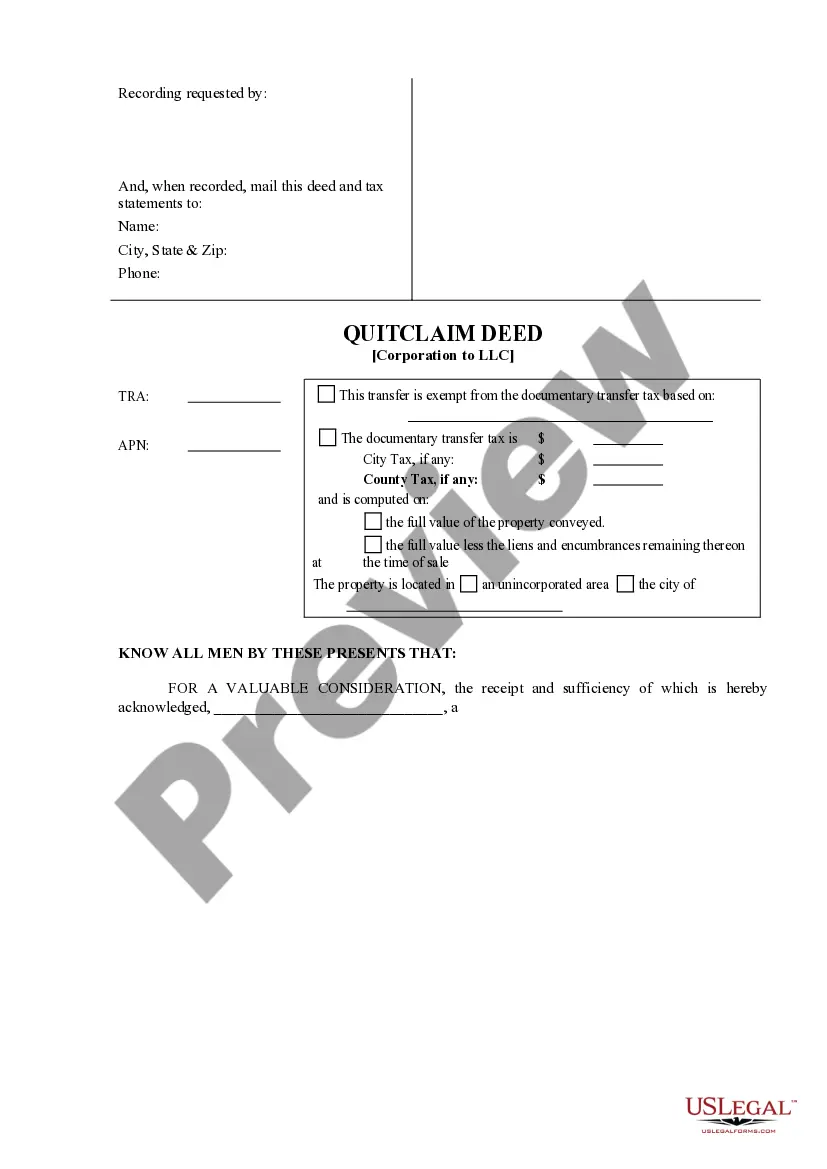

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer interest or ownership of a property from one entity to another. In the context of El Cajon, California, a Quitclaim Deed from Corporation to LLC refers specifically to the transfer of property ownership from a corporation to a limited liability company (LLC) in El Cajon, a city located in San Diego County. When a corporation decides to transfer property ownership to an LLC, a Quitclaim Deed can be used as the legal instrument for this transaction. It allows the corporation to convey their interest in the property to the LLC without making any warranties about the ownership or title of the property. There are different types of El Cajon California Quitclaim Deed from Corporation to LLC, each serving specific purposes or addressing particular circumstances: 1. General Quitclaim Deed from Corporation to LLC: This type of Quitclaim Deed transfers the corporation's ownership interest in a property to an LLC without any warranties. It is a straightforward transfer without any specific conditions or guarantees. 2. Special Quitclaim Deed from Corporation to LLC: A Special Quitclaim Deed may be used when there are specific conditions or limitations on the transfer of ownership. This type of deed may outline particular restrictions or clauses related to the transfer of the property. 3. Assumption Quitclaim Deed from Corporation to LLC: An Assumption Quitclaim Deed may be utilized when the LLC agrees to assume certain liabilities or obligations associated with the property being transferred. This type of deed acknowledges the LLC's willingness to take on existing debts or legal responsibilities. 4. Partial Quitclaim Deed from Corporation to LLC: In some cases, a corporation may only transfer a partial ownership interest in a property to an LLC. A Partial Quitclaim Deed specifies the exact portion or percentage of ownership being transferred from the corporation to the LLC. By utilizing a Quitclaim Deed from Corporation to LLC in El Cajon, California, both parties can ensure a legal and seamless transfer of property ownership. It is always essential to consult with legal professionals or real estate experts when dealing with such transfers to ensure compliance with applicable laws and regulations.A Quitclaim Deed is a legal document used to transfer interest or ownership of a property from one entity to another. In the context of El Cajon, California, a Quitclaim Deed from Corporation to LLC refers specifically to the transfer of property ownership from a corporation to a limited liability company (LLC) in El Cajon, a city located in San Diego County. When a corporation decides to transfer property ownership to an LLC, a Quitclaim Deed can be used as the legal instrument for this transaction. It allows the corporation to convey their interest in the property to the LLC without making any warranties about the ownership or title of the property. There are different types of El Cajon California Quitclaim Deed from Corporation to LLC, each serving specific purposes or addressing particular circumstances: 1. General Quitclaim Deed from Corporation to LLC: This type of Quitclaim Deed transfers the corporation's ownership interest in a property to an LLC without any warranties. It is a straightforward transfer without any specific conditions or guarantees. 2. Special Quitclaim Deed from Corporation to LLC: A Special Quitclaim Deed may be used when there are specific conditions or limitations on the transfer of ownership. This type of deed may outline particular restrictions or clauses related to the transfer of the property. 3. Assumption Quitclaim Deed from Corporation to LLC: An Assumption Quitclaim Deed may be utilized when the LLC agrees to assume certain liabilities or obligations associated with the property being transferred. This type of deed acknowledges the LLC's willingness to take on existing debts or legal responsibilities. 4. Partial Quitclaim Deed from Corporation to LLC: In some cases, a corporation may only transfer a partial ownership interest in a property to an LLC. A Partial Quitclaim Deed specifies the exact portion or percentage of ownership being transferred from the corporation to the LLC. By utilizing a Quitclaim Deed from Corporation to LLC in El Cajon, California, both parties can ensure a legal and seamless transfer of property ownership. It is always essential to consult with legal professionals or real estate experts when dealing with such transfers to ensure compliance with applicable laws and regulations.