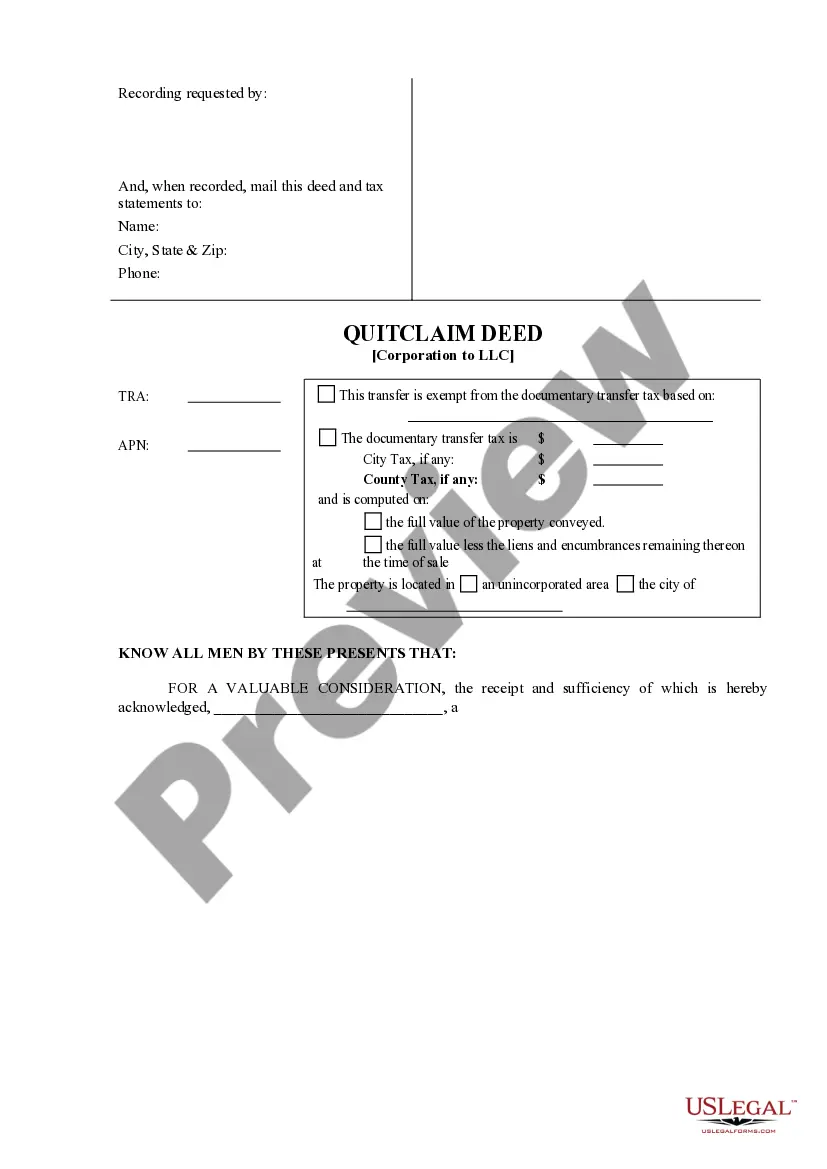

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Norwalk California Quitclaim Deed from Corporation to LLC is a legal document used to transfer property ownership from a corporation to a Limited Liability Company (LLC) in Norwalk, California. This type of deed ensures a smooth and official transfer of assets between two entities. The process of utilizing a Norwalk California Quitclaim Deed begins when a corporation decides to transfer property or real estate to an LLC. The reasons for such a transfer can include restructuring, tax advantages, or liability protection. By using a Quitclaim Deed, the corporation relinquishes its claim and rights to the property, transferring them to the LLC. The Norwalk California Quitclaim Deed from Corporation to LLC is a comprehensive legal instrument that compiles essential details of the transaction. These details may include the names and contact information of both the corporation and the LLC, a complete legal description of the property, and the date of transfer. There are different types of Norwalk California Quitclaim Deeds from Corporation to LLC, depending on the specific scenario and needs of the entities involved. Some common variations include: 1. Norwalk California Quitclaim Deed with Consideration: This type of deed includes a monetary consideration offered by the LLC in exchange for the transfer of the property. The amount of consideration is typically stated in the deed and contributes to the transaction's legal validity. 2. Norwalk California Quitclaim Deed without Consideration: In cases where the transfer is a gift or performed for other non-monetary reasons, a Quitclaim Deed without consideration may be used. This type of deed indicates the absence of any financial exchange and ensures a clear transfer of ownership. 3. Norwalk California Quitclaim Deed with Restrictive Covenants: This deed may include additional terms and restrictions imposed on the LLC by the corporation. These restrictive covenants could regulate the future use of the property, limit resale options, or outline specific conditions for maintaining ownership. It is crucial to consult with a qualified attorney or legal professional specializing in California real estate transactions to ensure the proper creation and execution of a Norwalk California Quitclaim Deed from Corporation to LLC. This expert advice ensures compliance with local laws and regulations, providing a secure and valid transfer of property rights.