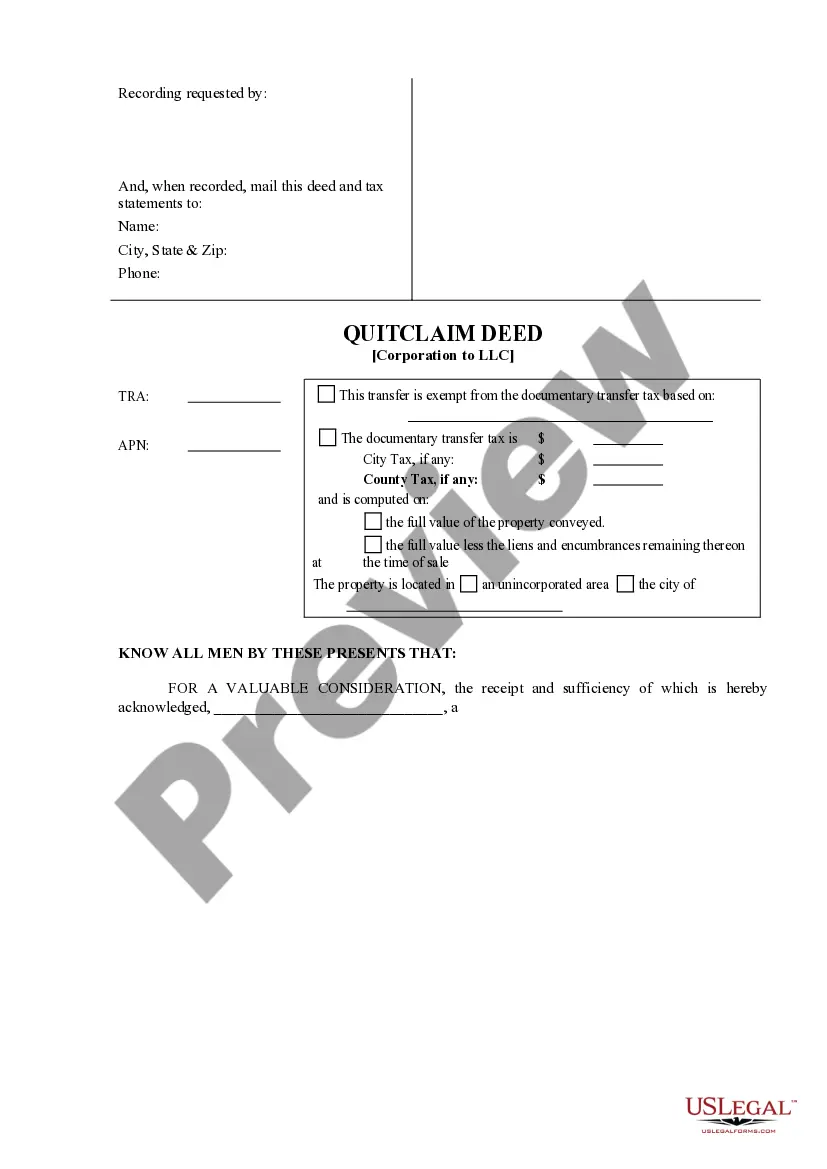

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer ownership of property from one party to another. In the context of Orange California, a quitclaim deed is specifically used when a corporation wants to transfer property ownership to a limited liability company (LLC). This type of transfer allows the corporation to retain an ownership interest in the property while transferring the day-to-day management and liability to the LLC. Quitclaim deed from corporation to LLC in Orange California is a legal instrument that signifies the intent of a corporation to transfer its interest in a property to an LLC. This type of transfer is commonly used when a corporation wishes to reorganize its assets and liabilities or to protect its assets. There are a few different types of Orange California quitclaim deeds from a corporation to an LLC, depending on the specific circumstances of the transaction. These may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer property ownership between entities. It conveys the corporation's interest in the property to the LLC without making any warranties or guarantees about the title. 2. Limited Quitclaim Deed: In some cases, a corporation may only transfer a limited or partial interest in the property to the LLC. This type of quitclaim deed specifies the exact portion of ownership being transferred. 3. Quitclaim Deed with Conditions: In certain situations, the corporation may include specific conditions in the quitclaim deed, such as restrictions on land use or obligations the LLC must adhere to. These conditions are legally binding and must be followed by the LLC. 4. Special Purpose Quitclaim Deed: This type of quitclaim deed is used when the transfer of ownership is for a specific purpose or to accomplish a specific goal. For example, if the corporation wants to donate a property to an LLC for charitable purposes, a special purpose quitclaim deed would be used. It's important to note that the specifics and requirements of quitclaim deeds can vary from state to state, including Orange California. Consulting with a qualified attorney or real estate professional familiar with California real estate laws and regulations is highly recommended ensuring the deed is properly executed and all legal requirements are met.A quitclaim deed is a legal document used to transfer ownership of property from one party to another. In the context of Orange California, a quitclaim deed is specifically used when a corporation wants to transfer property ownership to a limited liability company (LLC). This type of transfer allows the corporation to retain an ownership interest in the property while transferring the day-to-day management and liability to the LLC. Quitclaim deed from corporation to LLC in Orange California is a legal instrument that signifies the intent of a corporation to transfer its interest in a property to an LLC. This type of transfer is commonly used when a corporation wishes to reorganize its assets and liabilities or to protect its assets. There are a few different types of Orange California quitclaim deeds from a corporation to an LLC, depending on the specific circumstances of the transaction. These may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer property ownership between entities. It conveys the corporation's interest in the property to the LLC without making any warranties or guarantees about the title. 2. Limited Quitclaim Deed: In some cases, a corporation may only transfer a limited or partial interest in the property to the LLC. This type of quitclaim deed specifies the exact portion of ownership being transferred. 3. Quitclaim Deed with Conditions: In certain situations, the corporation may include specific conditions in the quitclaim deed, such as restrictions on land use or obligations the LLC must adhere to. These conditions are legally binding and must be followed by the LLC. 4. Special Purpose Quitclaim Deed: This type of quitclaim deed is used when the transfer of ownership is for a specific purpose or to accomplish a specific goal. For example, if the corporation wants to donate a property to an LLC for charitable purposes, a special purpose quitclaim deed would be used. It's important to note that the specifics and requirements of quitclaim deeds can vary from state to state, including Orange California. Consulting with a qualified attorney or real estate professional familiar with California real estate laws and regulations is highly recommended ensuring the deed is properly executed and all legal requirements are met.