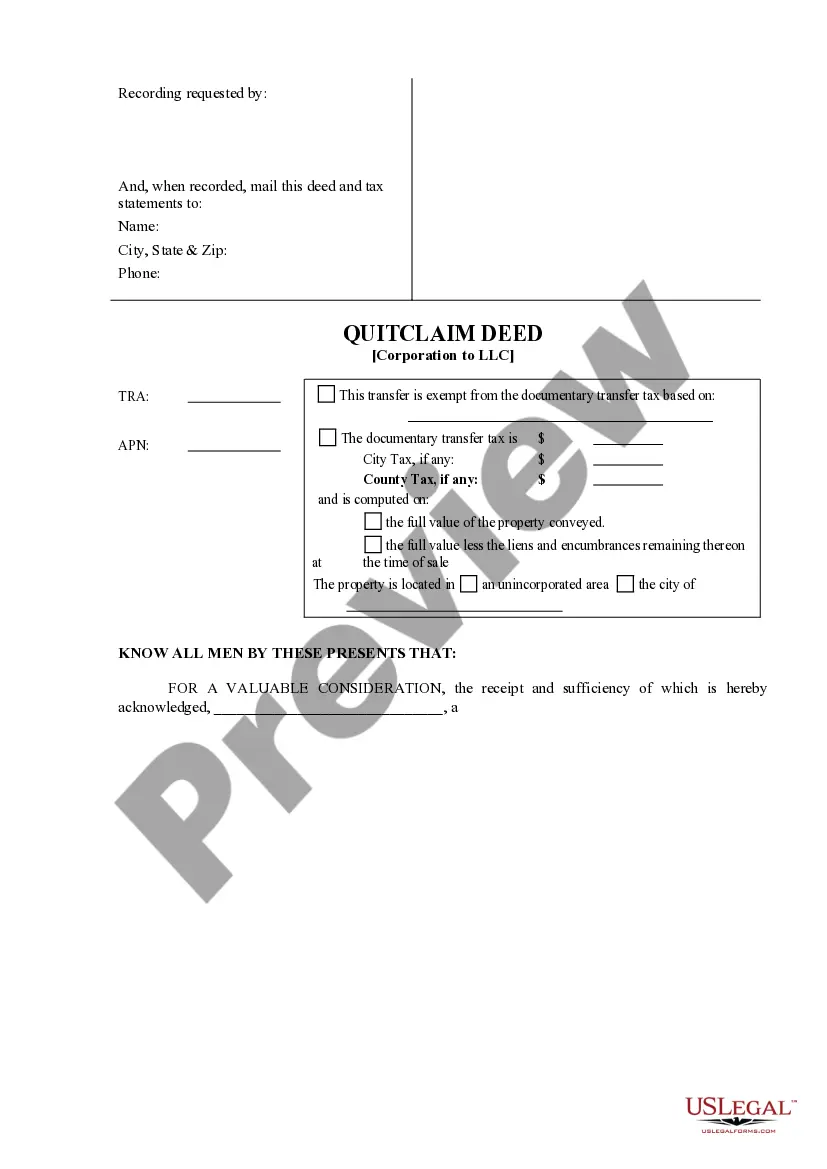

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

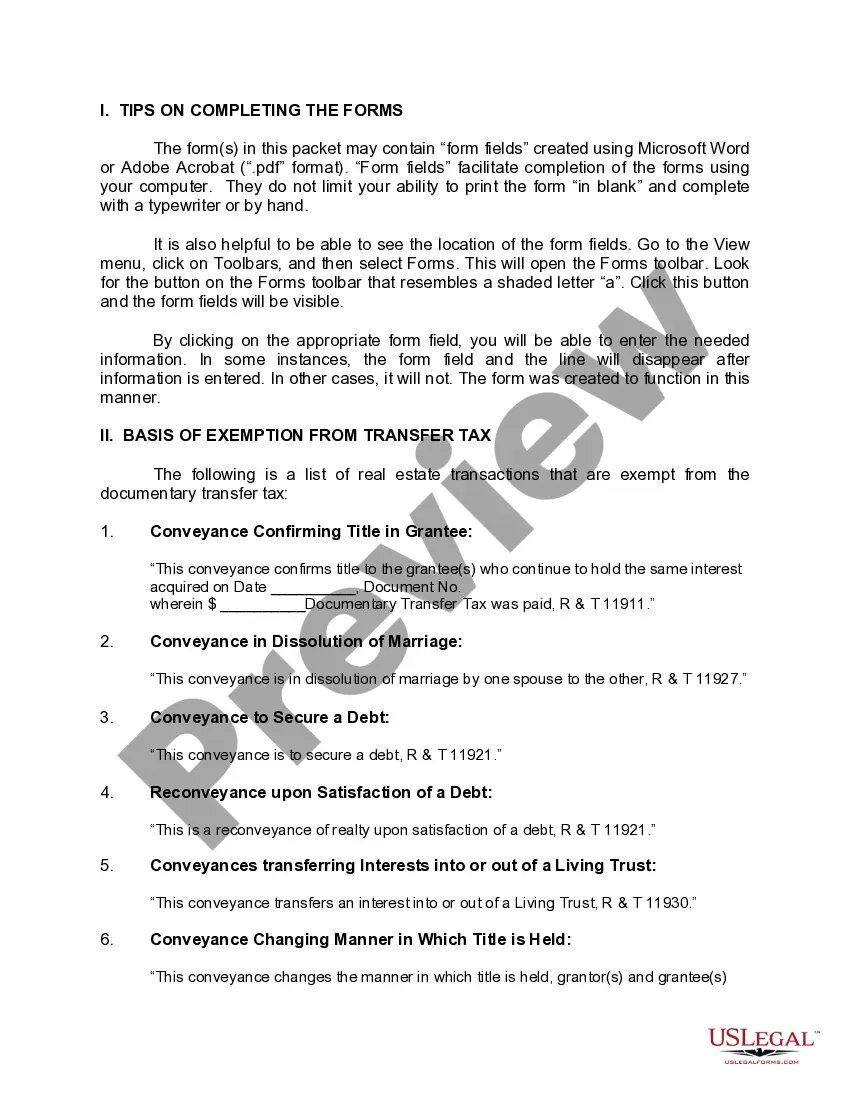

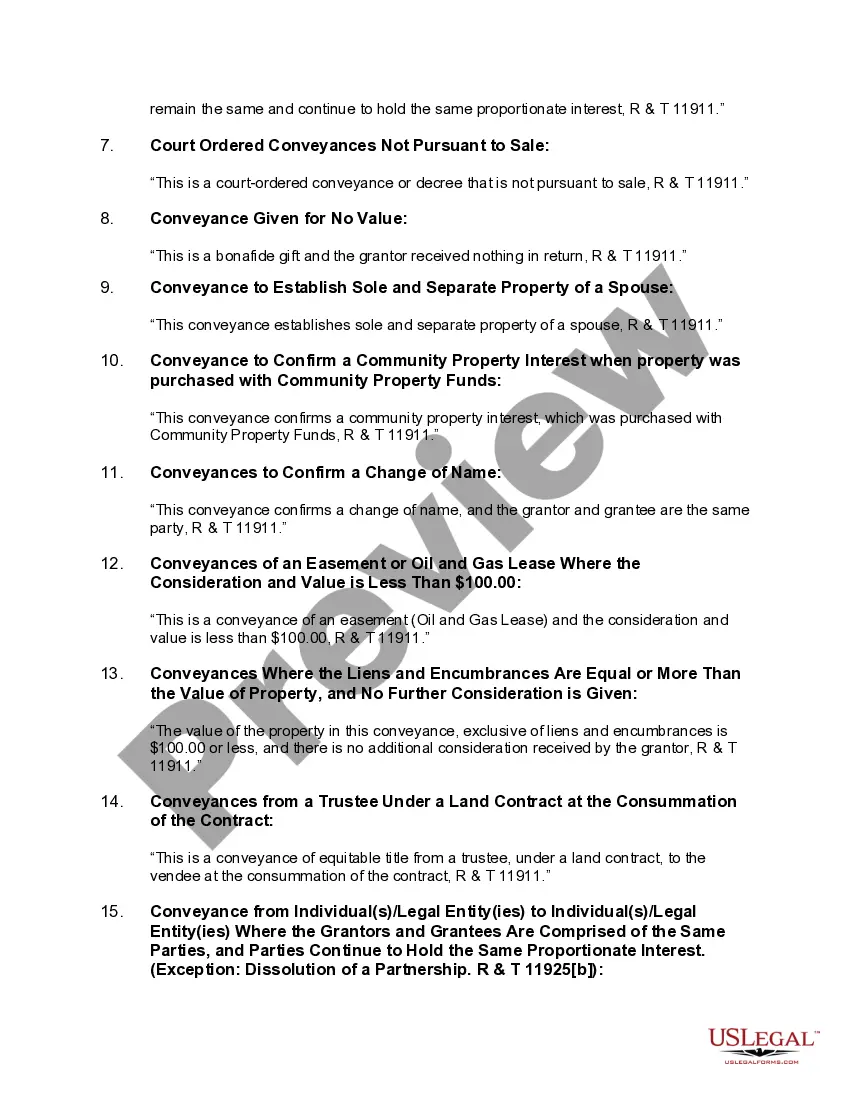

Palmdale California Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) based in Palmdale, California. This type of deed is commonly used when a corporation decides to transfer property to an LLC owned by the same entity or its shareholders. Here, we will explore the different types of Palmdale California Quitclaim Deed from Corporation to LLC. 1. Voluntary Transfer: This type of Quitclaim Deed occurs when the corporation willingly transfers the property to an LLC under its control. It often happens when the corporation wishes to restructure its assets, consolidate ownership, or take advantage of the benefits provided by an LLC structure. 2. Restructuring or Reorganization Transfer: In cases where corporations undergo internal restructuring or reorganization, this type of Quitclaim Deed may be utilized. It involves transferring property ownership to an LLC as part of a larger strategy to streamline operations, manage liabilities, or enhance tax efficiency. 3. Dissolution Transfer: When a corporation decides to dissolve and wind up its affairs, it may opt to transfer its assets, including properties, to an LLC before finalizing the dissolution process. This ensures that the property's ownership is effectively transferred and properly managed by the LLC, which may continue the operations or liquidate the assets. 4. Shareholder or Officer Equity Transfer: In some instances, a corporation's shareholders or officers may individually own properties that are used for corporate purposes. To streamline ownership and management, a Quitclaim Deed can be employed to transfer those properties from individuals to an LLC owned by the same shareholders or officers but operating under a more collective strategy. Key Benefits of Palmdale California Quitclaim Deed from Corporation to LLC: — Liability Protection: By transferring property ownership to an LLC, the corporation can limit its liability exposure. This is because an LLC provides limited liability protection to its members, shielding them from personal liability in case of legal claims against the property. — Operational Flexibility: An LLC structure allows for more flexibility in managing and operating the transferred property. It enables decision-making enhancements and streamlining efforts that may not be possible within the confines of a corporation. — Tax Advantages: Depending on the specific circumstances and revenue considerations, transferring property to an LLC may provide tax advantages. LCS often have more favorable tax treatments, including pass-through taxation, which reduces the overall tax burden on the property. In conclusion, a Palmdale California Quitclaim Deed from Corporation to LLC serves as a legal instrument to transfer ownership of properties from a corporation to an LLC, whether for voluntary restructuring, dissolution, reorganization, or individual equity transfers. This type of deed offers benefits such as limited liability protection, operational flexibility, and potential tax advantages. It is essential to consult with legal professionals to ensure compliance with local laws and regulations throughout the process.Palmdale California Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company (LLC) based in Palmdale, California. This type of deed is commonly used when a corporation decides to transfer property to an LLC owned by the same entity or its shareholders. Here, we will explore the different types of Palmdale California Quitclaim Deed from Corporation to LLC. 1. Voluntary Transfer: This type of Quitclaim Deed occurs when the corporation willingly transfers the property to an LLC under its control. It often happens when the corporation wishes to restructure its assets, consolidate ownership, or take advantage of the benefits provided by an LLC structure. 2. Restructuring or Reorganization Transfer: In cases where corporations undergo internal restructuring or reorganization, this type of Quitclaim Deed may be utilized. It involves transferring property ownership to an LLC as part of a larger strategy to streamline operations, manage liabilities, or enhance tax efficiency. 3. Dissolution Transfer: When a corporation decides to dissolve and wind up its affairs, it may opt to transfer its assets, including properties, to an LLC before finalizing the dissolution process. This ensures that the property's ownership is effectively transferred and properly managed by the LLC, which may continue the operations or liquidate the assets. 4. Shareholder or Officer Equity Transfer: In some instances, a corporation's shareholders or officers may individually own properties that are used for corporate purposes. To streamline ownership and management, a Quitclaim Deed can be employed to transfer those properties from individuals to an LLC owned by the same shareholders or officers but operating under a more collective strategy. Key Benefits of Palmdale California Quitclaim Deed from Corporation to LLC: — Liability Protection: By transferring property ownership to an LLC, the corporation can limit its liability exposure. This is because an LLC provides limited liability protection to its members, shielding them from personal liability in case of legal claims against the property. — Operational Flexibility: An LLC structure allows for more flexibility in managing and operating the transferred property. It enables decision-making enhancements and streamlining efforts that may not be possible within the confines of a corporation. — Tax Advantages: Depending on the specific circumstances and revenue considerations, transferring property to an LLC may provide tax advantages. LCS often have more favorable tax treatments, including pass-through taxation, which reduces the overall tax burden on the property. In conclusion, a Palmdale California Quitclaim Deed from Corporation to LLC serves as a legal instrument to transfer ownership of properties from a corporation to an LLC, whether for voluntary restructuring, dissolution, reorganization, or individual equity transfers. This type of deed offers benefits such as limited liability protection, operational flexibility, and potential tax advantages. It is essential to consult with legal professionals to ensure compliance with local laws and regulations throughout the process.