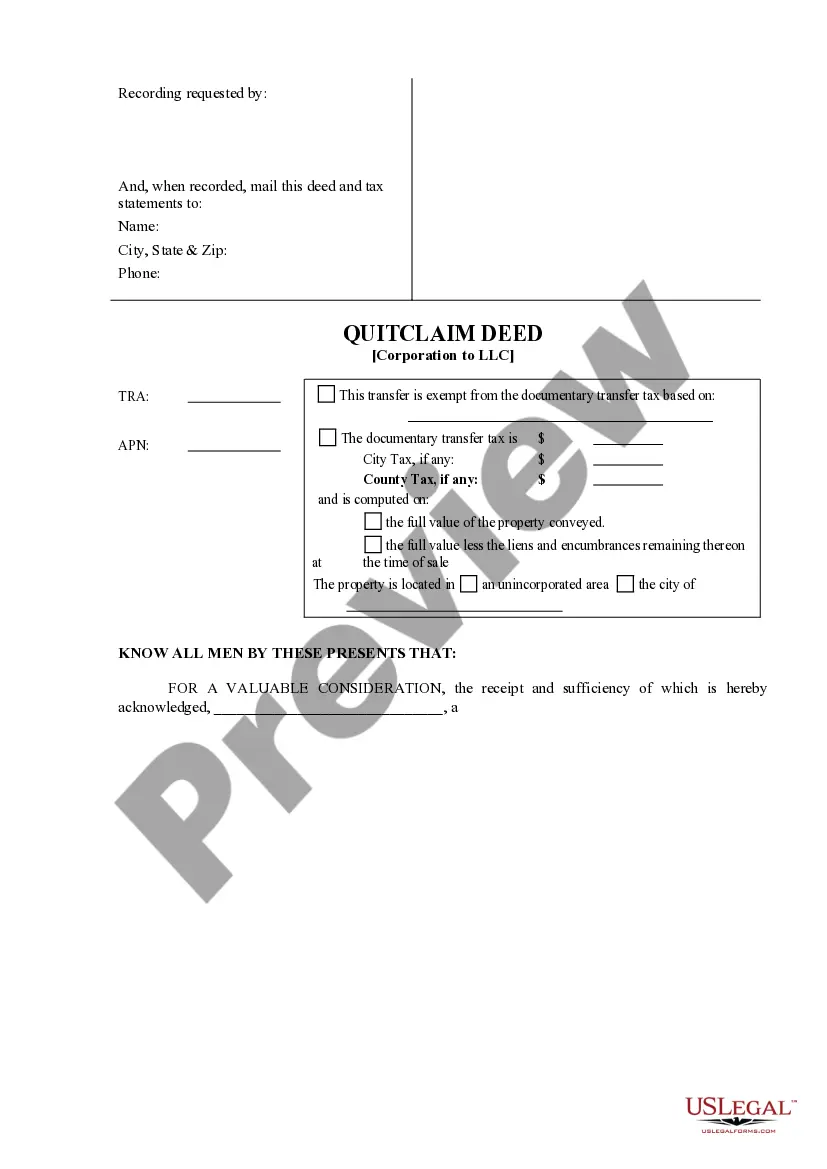

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer ownership of property from one entity to another without any guarantees of title. In the context of San Bernardino County, California, a quitclaim deed from a corporation to a Limited Liability Company (LLC) entails a transfer of property ownership from a corporate entity to an LLC entity. This type of quitclaim deed is commonly used when a corporation decides to transfer its real estate assets to an LLC it has formed for various reasons, such as restructuring or asset protection. The process involves the corporation granting, transferring, and assigning all its interest or claim in the property to the LLC, thereby transferring both the legal and equitable rights in the property. Keywords: San Bernardino California, quitclaim deed, corporation, LLC, property transfer, ownership, title, real estate assets, restructuring, asset protection, legal document. In San Bernardino County, different versions of a quitclaim deed from a corporation to an LLC may exist based on specific circumstances or additional clauses included in the deed. These variations or types may include: 1. General Quitclaim Deed from Corporation to LLC: This is the basic form of the deed, where the corporation relinquishes its rights and interests in the property to the LLC without making any warranties or guarantees regarding the title or any other claims. 2. With Covenants: This type of quitclaim deed may include special covenants or warranties made by the corporation, providing assurances to the LLC regarding the title, encumbrances, or other claims associated with the property being transferred. 3. With Consideration: Sometimes, a quitclaim deed from a corporation to an LLC may involve monetary consideration, wherein the LLC pays a certain amount to the corporation as part of the transfer transaction. This consideration may be mentioned explicitly in the deed. 4. With Additional Clauses: Depending on the specific requirements or agreements between the corporation and LLC, additional clauses can be added to the quitclaim deed. Such clauses may address issues like tax liabilities, indemnification, or any other conditions agreed upon by both parties. It is important to note that consulting with a qualified attorney or a real estate professional familiar with California and San Bernardino County laws is crucial while drafting or executing a quitclaim deed. This ensures that the deed accurately reflects the intentions of both the corporation and the LLC while adhering to legal requirements and safeguards.A quitclaim deed is a legal document used to transfer ownership of property from one entity to another without any guarantees of title. In the context of San Bernardino County, California, a quitclaim deed from a corporation to a Limited Liability Company (LLC) entails a transfer of property ownership from a corporate entity to an LLC entity. This type of quitclaim deed is commonly used when a corporation decides to transfer its real estate assets to an LLC it has formed for various reasons, such as restructuring or asset protection. The process involves the corporation granting, transferring, and assigning all its interest or claim in the property to the LLC, thereby transferring both the legal and equitable rights in the property. Keywords: San Bernardino California, quitclaim deed, corporation, LLC, property transfer, ownership, title, real estate assets, restructuring, asset protection, legal document. In San Bernardino County, different versions of a quitclaim deed from a corporation to an LLC may exist based on specific circumstances or additional clauses included in the deed. These variations or types may include: 1. General Quitclaim Deed from Corporation to LLC: This is the basic form of the deed, where the corporation relinquishes its rights and interests in the property to the LLC without making any warranties or guarantees regarding the title or any other claims. 2. With Covenants: This type of quitclaim deed may include special covenants or warranties made by the corporation, providing assurances to the LLC regarding the title, encumbrances, or other claims associated with the property being transferred. 3. With Consideration: Sometimes, a quitclaim deed from a corporation to an LLC may involve monetary consideration, wherein the LLC pays a certain amount to the corporation as part of the transfer transaction. This consideration may be mentioned explicitly in the deed. 4. With Additional Clauses: Depending on the specific requirements or agreements between the corporation and LLC, additional clauses can be added to the quitclaim deed. Such clauses may address issues like tax liabilities, indemnification, or any other conditions agreed upon by both parties. It is important to note that consulting with a qualified attorney or a real estate professional familiar with California and San Bernardino County laws is crucial while drafting or executing a quitclaim deed. This ensures that the deed accurately reflects the intentions of both the corporation and the LLC while adhering to legal requirements and safeguards.