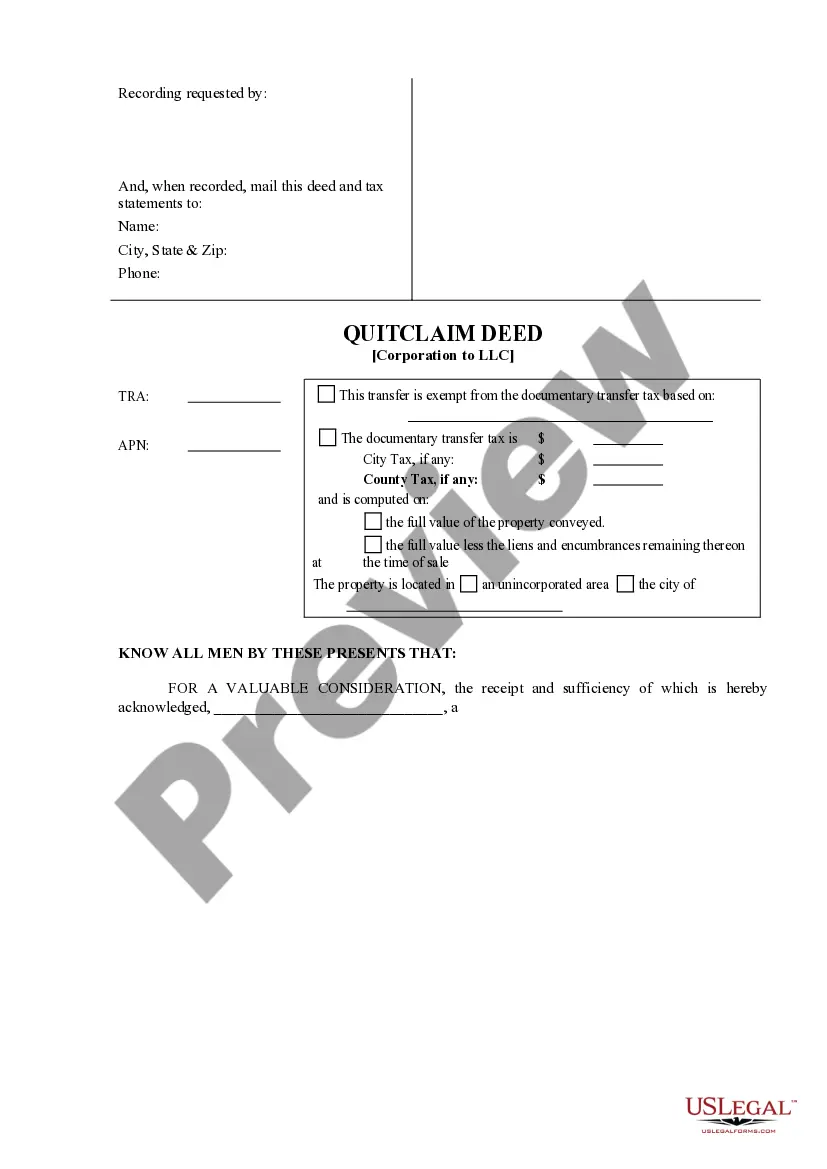

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A San Jose, California Quitclaim Deed from Corporation to LLC is a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC). This process is also known as conveying real property. A quitclaim deed is a type of deed that conveys the interest or claim the granter (corporation) has in the property without making any warranties about the property's title. In other words, the corporation transfers its ownership rights to the LLC, and any potential issues or claims on the property are not guaranteed or resolved by the corporation. There are a few different types of quitclaim deeds that may be used in this situation. These include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used when transferring property from a corporation to an LLC. It conveys all the corporation's interest in the property to the LLC without specifying any exceptions or restrictions. 2. Special Quitclaim Deed: This type of quitclaim deed is used when the corporation wants to transfer specific rights or interests in the property to the LLC. For example, if the corporation only wants to transfer certain usage rights or easements to the LLC, a special quitclaim deed would be used. 3. Deed in Lieu of Foreclosure: In some cases, a corporation may use a quitclaim deed to transfer property ownership to an LLC instead of going through foreclosure proceedings. This type of quitclaim deed allows the corporation to transfer ownership voluntarily to avoid the foreclosure process. When preparing a San Jose, California Quitclaim Deed from Corporation to LLC, it is important to include specific information about both the corporation and the LLC, such as their full legal names, addresses, and the date of the transfer. The legal description of the property being transferred should also be included, along with any relevant attachments or exhibits. It is highly recommended consulting with a real estate attorney or a qualified professional when drafting or executing a quitclaim deed, as transfer of property ownership can be a complex process with potential legal implications. The attorney can ensure all necessary steps are followed, and proper documentation is prepared to protect the interests of both the corporation and the LLC.A San Jose, California Quitclaim Deed from Corporation to LLC is a legal document used to transfer property ownership rights from a corporation to a limited liability company (LLC). This process is also known as conveying real property. A quitclaim deed is a type of deed that conveys the interest or claim the granter (corporation) has in the property without making any warranties about the property's title. In other words, the corporation transfers its ownership rights to the LLC, and any potential issues or claims on the property are not guaranteed or resolved by the corporation. There are a few different types of quitclaim deeds that may be used in this situation. These include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used when transferring property from a corporation to an LLC. It conveys all the corporation's interest in the property to the LLC without specifying any exceptions or restrictions. 2. Special Quitclaim Deed: This type of quitclaim deed is used when the corporation wants to transfer specific rights or interests in the property to the LLC. For example, if the corporation only wants to transfer certain usage rights or easements to the LLC, a special quitclaim deed would be used. 3. Deed in Lieu of Foreclosure: In some cases, a corporation may use a quitclaim deed to transfer property ownership to an LLC instead of going through foreclosure proceedings. This type of quitclaim deed allows the corporation to transfer ownership voluntarily to avoid the foreclosure process. When preparing a San Jose, California Quitclaim Deed from Corporation to LLC, it is important to include specific information about both the corporation and the LLC, such as their full legal names, addresses, and the date of the transfer. The legal description of the property being transferred should also be included, along with any relevant attachments or exhibits. It is highly recommended consulting with a real estate attorney or a qualified professional when drafting or executing a quitclaim deed, as transfer of property ownership can be a complex process with potential legal implications. The attorney can ensure all necessary steps are followed, and proper documentation is prepared to protect the interests of both the corporation and the LLC.