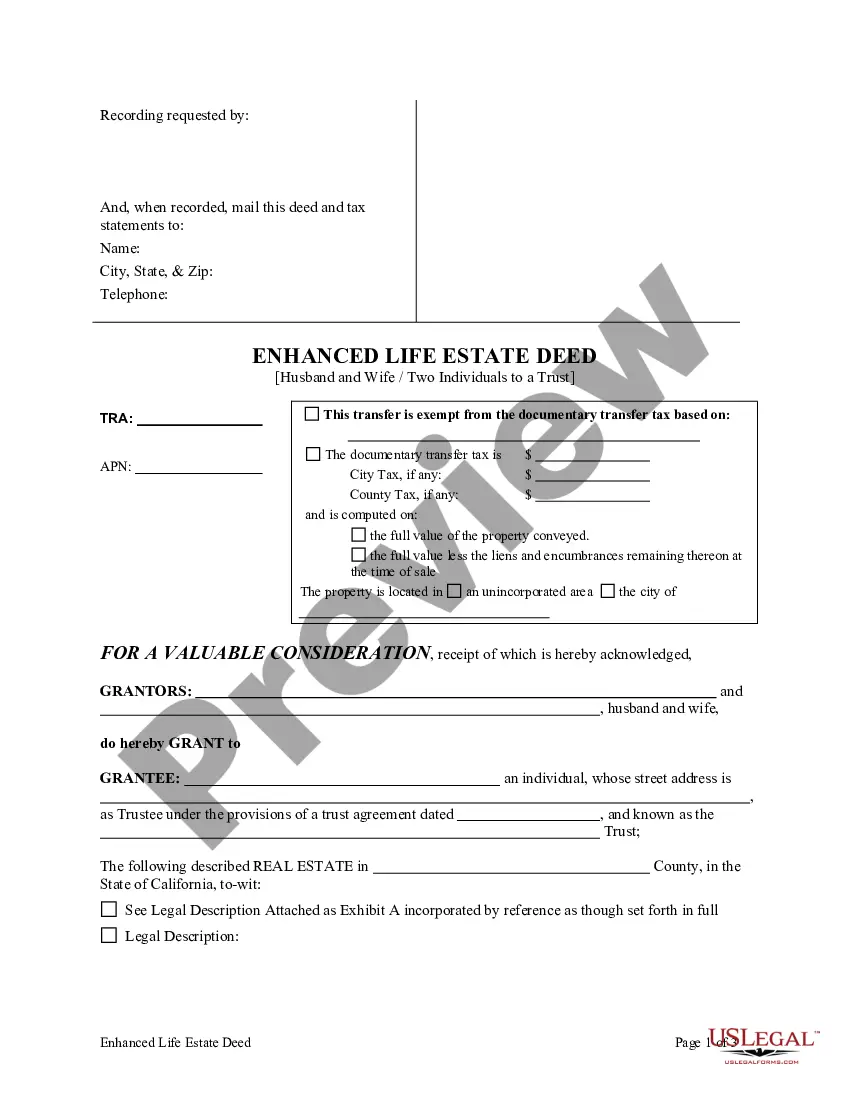

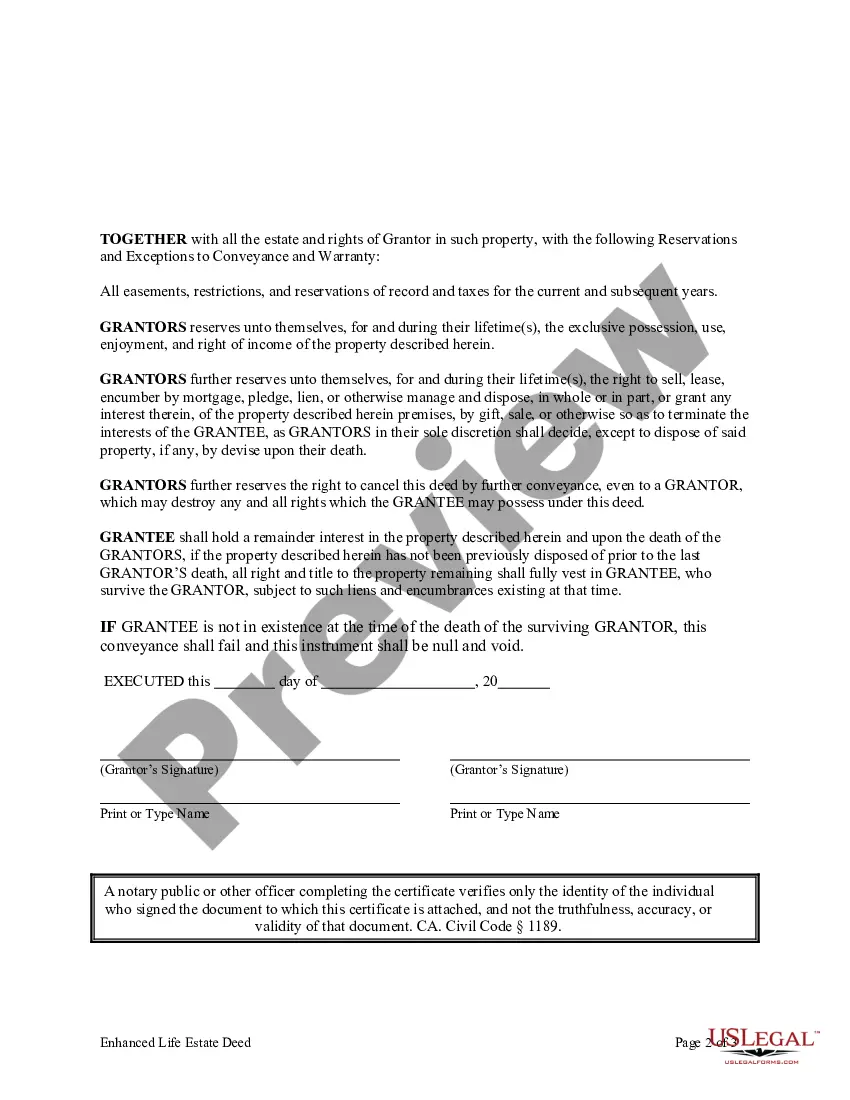

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantors are husband and wife, or two individuals, and the Grantees are three individuals. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors, and each of them, retain the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

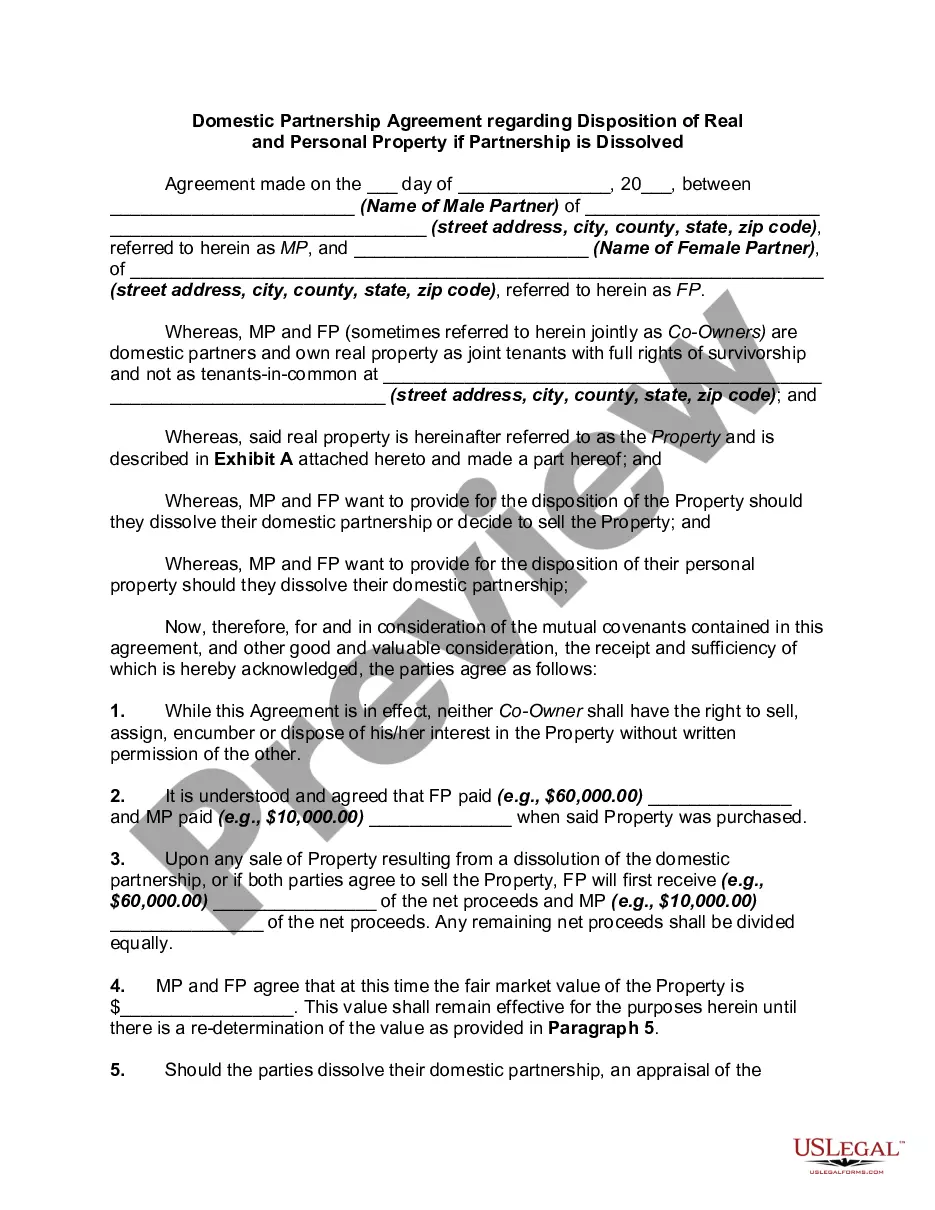

An Enhanced Life Estate Deed from Husband and Wife, or two individuals, to a Trust in West Covina, California provides a powerful estate planning tool that enables the transfer of property ownership to a Trust while still allowing the individuals (the Granters) to retain control and benefits during their lifetime. When utilizing this legal arrangement, the Granters, who are typically spouses or two individuals, convey their real estate property to a Trust while reserving a life estate for themselves. This means they maintain the right to live on and use the property for as long as they live. The Granters also have the ability to sell, mortgage, or otherwise dispose of the property with the Trust's approval. The primary purpose of this type of deed is to streamline the transfer of ownership upon the Granters' passing, avoiding probate and minimizing potential estate taxes or legal complexities. By transferring the property to a Trust, the Granters can name beneficiaries who will inherit the property outright, bypassing the need for court involvement. The West Covina, California Enhanced Life Estate Deed from Husband and Wife, or two individuals, to a Trust comes in different variations to suit specific needs and preferences. Some common types include: 1. Enhanced Life Estate Deed with Reserved Powers: In this arrangement, the Granters retain certain powers, such as the right to change the beneficiaries, sell the property, or revoke the Trust altogether. This flexibility ensures they have control over the property and can adapt the Trust to changing circumstances. 2. Enhanced Life Estate Deed with Remainder Interests: With this type of deed, the Granters convey the property to the Trust, reserving a life estate interest and designating beneficiaries who will receive the property upon their passing. The remainder interests can be distributed among multiple beneficiaries or organizations. 3. Enhanced Life Estate Deed with Gifting Provisions: This variation allows the Granters to gift portions of the property to beneficiaries during their lifetime while still retaining their life estate interest. This strategy can provide tax benefits and allows the Granters to witness the impact of their gifts. 4. Enhanced Life Estate Deed with Charitable Remainder Trust: For those wishing to support charitable causes, this deed variation allows the Granters to retain the right to reside on the property while designating a charitable organization as the ultimate beneficiary. This arrangement enables individuals to contribute to a cause they care about, maintaining control over their property in the meantime. In conclusion, the West Covina, California Enhanced Life Estate Deed from Husband and Wife, or two individuals, to a Trust is an estate planning tool that offers flexibility, control, and potential tax benefits. By transferring property ownership to a Trust while retaining a life estate interest, individuals can simplify the transfer of assets, minimize probate, and ensure the smooth distribution of their property to designated beneficiaries.