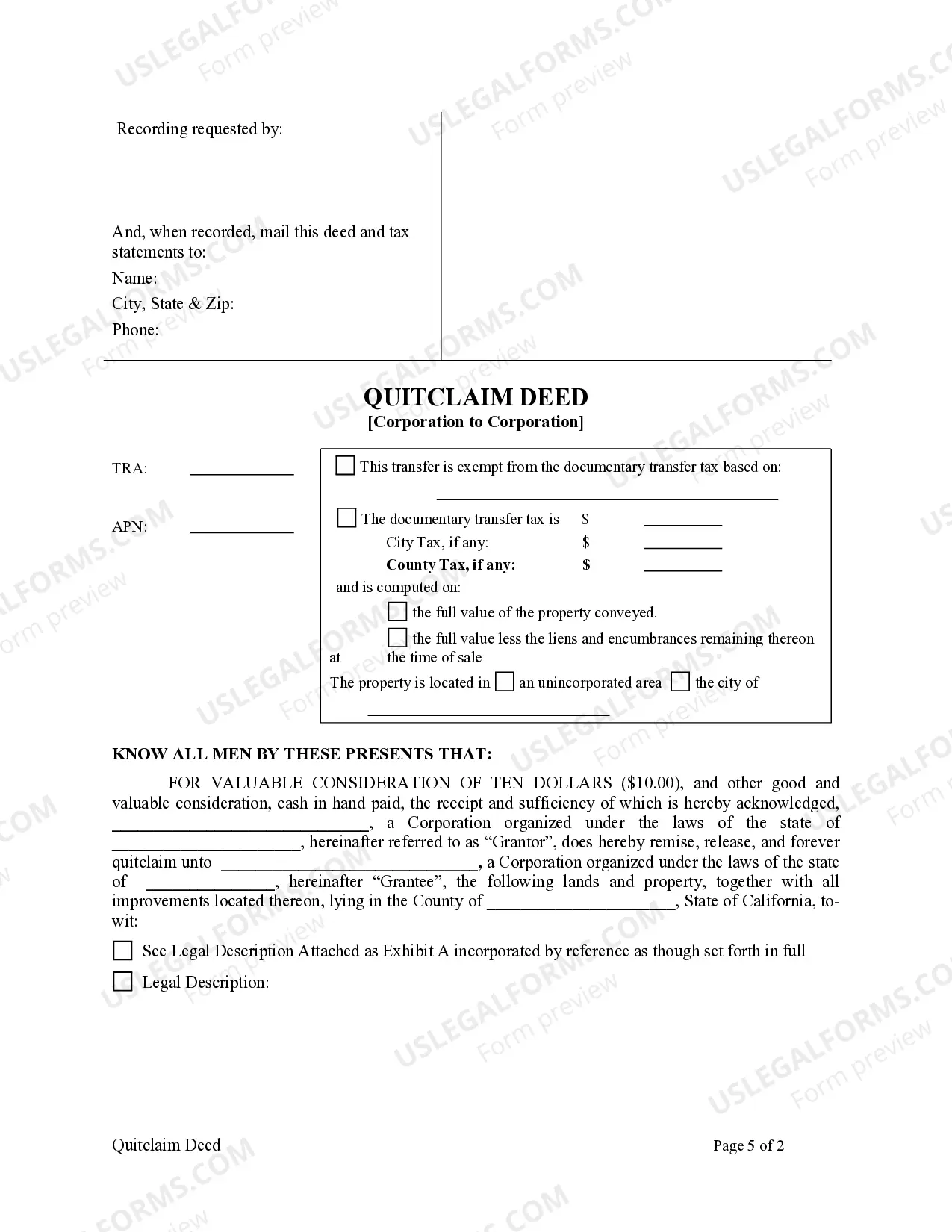

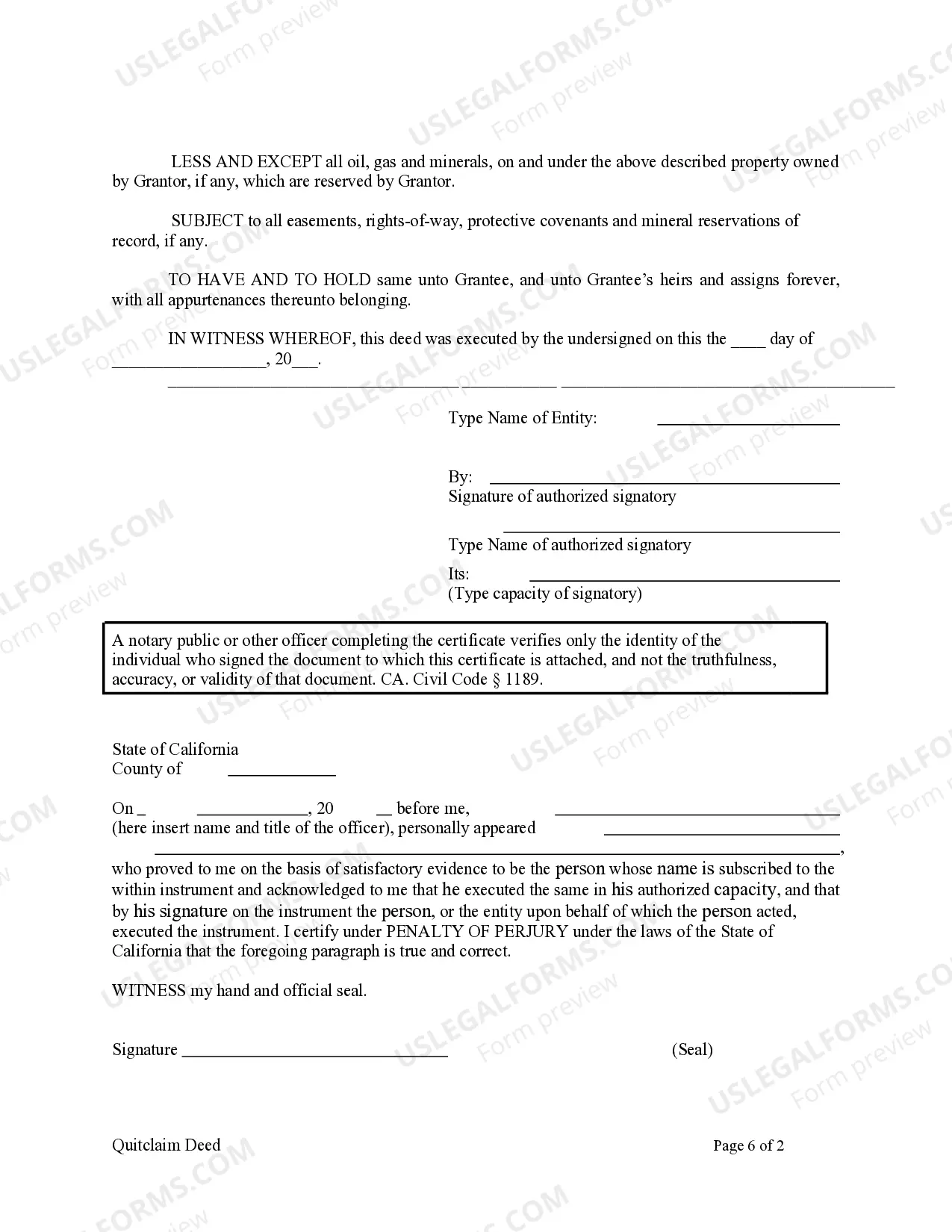

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer ownership of property from one party to another. When it comes to Alameda, California, quitclaim deeds from corporation to corporation involve specialized processes and considerations. This article provides a detailed description of what an Alameda California quitclaim deed from corporation to corporation entails, along with relevant keyword usage. Keywords: Alameda California, quitclaim deed, corporation to corporation, legal document, property ownership transfer, specialized process, considerations. Description: An Alameda California quitclaim deed from corporation to corporation is a legal instrument used to transfer property ownership from one corporation to another in the city of Alameda, California. This deed serves to convey the interest, title, and rights of the transferring corporation (granter) to the acquiring corporation (grantee). The quitclaim deed process in Alameda, California, involves a legally binding agreement where the granter corporation releases any claims or interests it may have had on the property being transferred. It is important to note that unlike a warranty deed, a quitclaim deed does not guarantee or warrant clear title to the property. It simply transfers the interest held by the granter corporation without making any promises regarding the property's status or possible encumbrances. There may be various types of Alameda California quitclaim deeds from corporation to corporation, including: 1. General Quitclaim Deed: This is the most common type used when a corporation wishes to transfer property ownership to another corporation. It conveys all interests held by the granter corporation without any specific limitations or conditions. 2. Partial Quitclaim Deed: In some cases, a corporation may transfer only a portion of its property interests to another corporation. This type of quitclaim deed specifies the exact portion of the property being transferred, leaving the remaining interests with the granter corporation. 3. Special Purpose Quitclaim Deed: This type of quitclaim deed is drafted when the transferring corporation intends to convey property for a specific purpose or under specific conditions. For example, it could involve transferring property to a sister corporation for development purposes. It is crucial for both the granter and grantee corporations to involve legal counsel when executing an Alameda California quitclaim deed from corporation to corporation. This helps ensure that the deed is properly prepared, executed, and recorded in compliance with California State laws and regulations. Additionally, both parties may need to consider potential tax implications, zoning restrictions, and any liens or encumbrances associated with the property being transferred. In conclusion, an Alameda California quitclaim deed from corporation to corporation is an important legal document that facilitates the transfer of property ownership. Understanding the different types of quitclaim deeds and seeking professional legal advice can help corporations navigate the complexities of such transactions effectively.