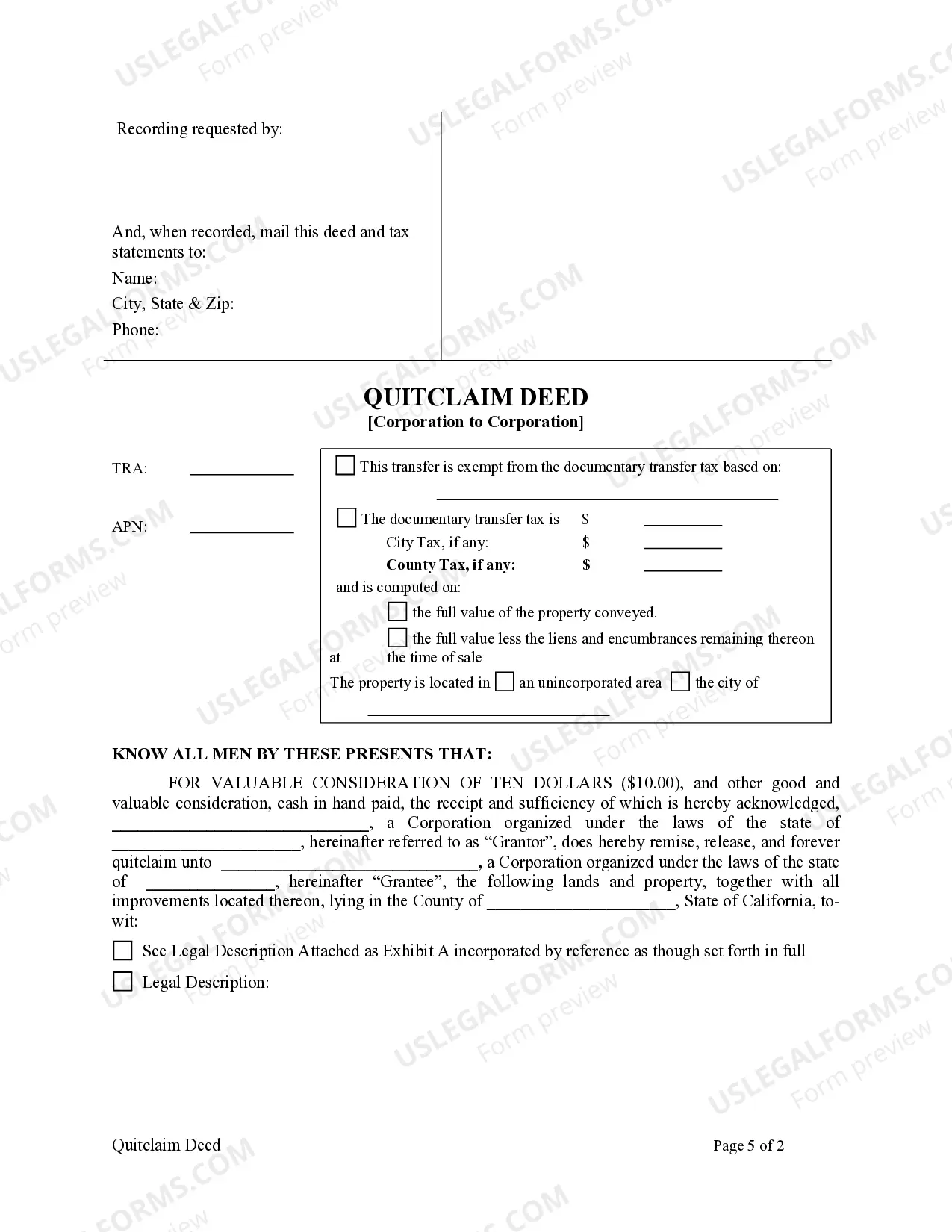

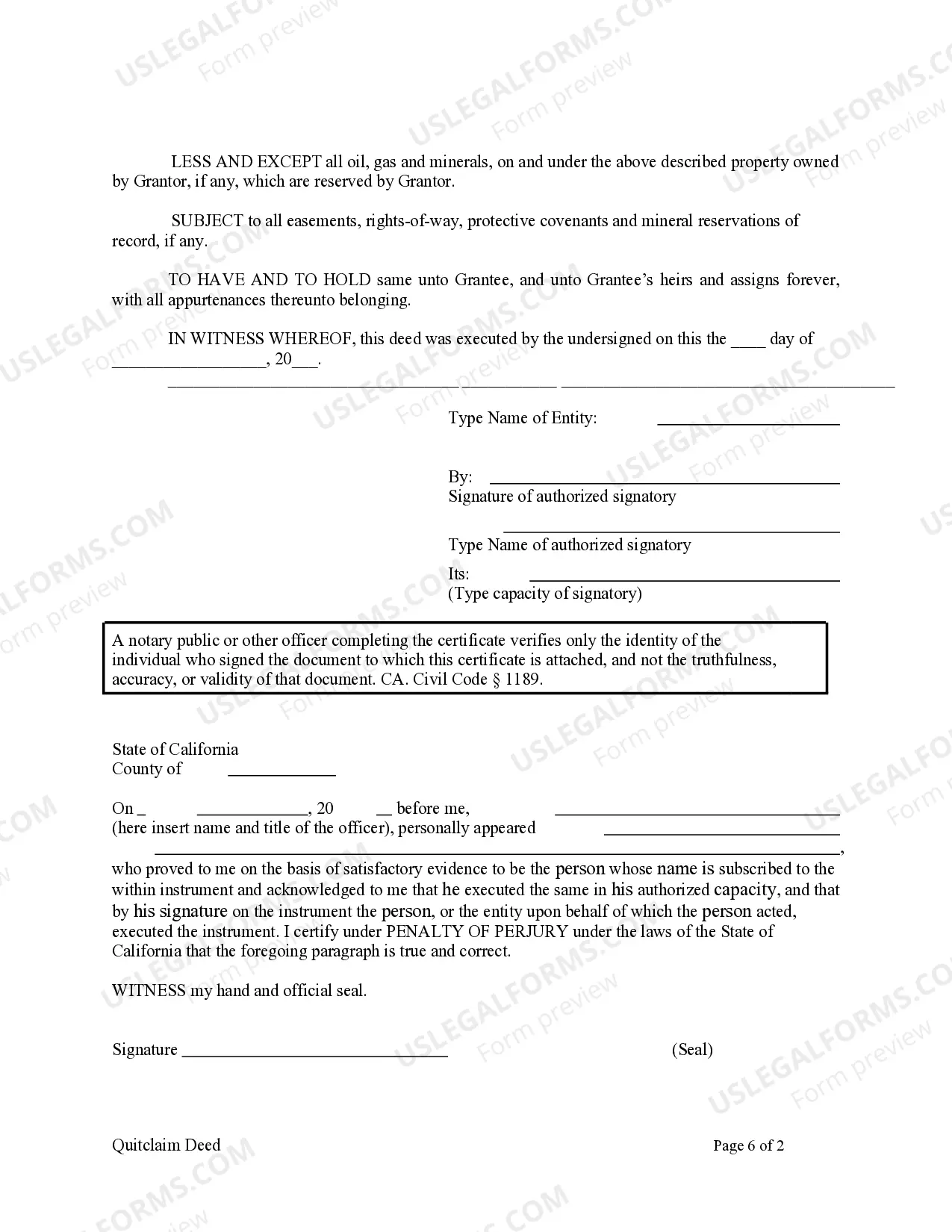

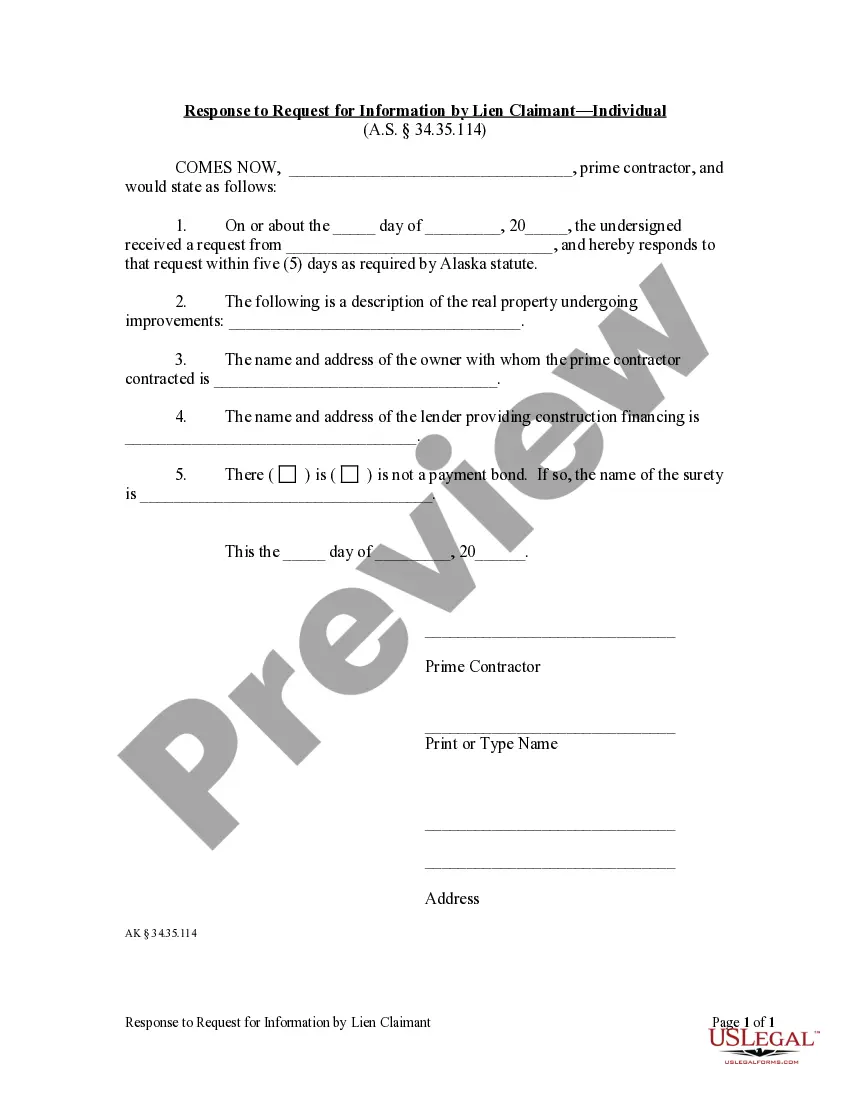

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Irvine California Quitclaim Deed from Corporation to Corporation

Description

How to fill out Irvine California Quitclaim Deed From Corporation To Corporation?

Do you require a dependable and low-cost provider of legal forms to acquire the Irvine California Quitclaim Deed transferring from Corporation to Corporation? US Legal Forms is your ideal answer.

Whether you seek a straightforward agreement to establish guidelines for living together with your partner or a set of documents to facilitate your divorce process through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and corporate use. All templates we provide are not generic but tailored based on the needs of specific states and counties.

To obtain the document, you must Log In to your account, find the needed template, and click the Download button next to it. Please remember that you can download your previously acquired document templates anytime in the My documents tab.

Are you unfamiliar with our platform? No problem. You can create an account in just a few minutes; however, before that, ensure to do the following.

Now you can register for your account. Next, select the subscription option and proceed to payment. Once the payment is completed, download the Irvine California Quitclaim Deed from Corporation to Corporation in any available file format. You can revisit the website whenever needed and redownload the document without any additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today and bid farewell to wasting your precious time searching for legal paperwork online.

- Verify if the Irvine California Quitclaim Deed from Corporation to Corporation abides by the laws of your state and locality.

- Review the form’s specifics (if provided) to ascertain who and what the document is geared towards.

- Re-initiate the search if the template is not appropriate for your unique situation.

Form popularity

FAQ

Take your quit claimdeed to the Orange County Clerk-Recorder Office for filing and recording at 12 Civic Center Plaza, Room 101, Santa Ana, CA 92701. Call 714-834-2500 for directions or more information. Pay the fees to make the change on your real estate title to complete the transaction.

Once you have filled out a California quitclaim deed, you will need to get it notarized. Next, you will need to need to visit your appropriate local government office to file some paperwork. Depending on your county of sale, that may be a Recorder's office, a County Clerk's Office, or an Assessor's office.

Individual Estate Documents Description of Individual Documents (Notary fees additional)PriceTrust Amendment$200 and upTrust Transfer Deed and Preliminary Change of Ownership (California property)$200Trust Transfer Deed (Out-of-State property)$275Trust Transfer Deed (Timeshare)$2755 more rows ?

The California quitclaim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

Call (714) 834-2887 to speak to a document examiner....Mail-In Document Recording Service Documents may be presented for recording by mail, FedEx or UPS.The document(s) shall be legible. Please include the name of the party requesting the recording, and a name and address where the document should be returned.

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.

File the forms. The recording fee will vary by county, but you can expect as a range to pay between $6 and $21 for the first page and $3 for any additional page. In Sacramento County, for example, the Recorder charges $21 for the first page and $3 for each additional page for recording.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.

Recording Fee for Quitclaim DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.004 more rows

Interesting Questions

More info

Fill out and sign the Quitclaim Deed below. We have included the name, address, and telephone number you can contact the granter by. If you do not have an owner, the signatory is the holder of the personal property. Fill out and sign the Quitclaim Deed below. We have included the name, address, and telephone number you can contact the granter by. If you do not have an owner, the signatory is the holder of the personal property. You will need to complete a Quitclaim Deed with the appropriate parties. You will need to complete the Quitclaim Deed with the appropriate parties. Get a Copy of a Family Certificate of Death to be filled out by the person's next of kin. A person may have more than one executor. All executors are given a copy of the Certificate of Death, as well as a copy of the Deed to be filled out. The Certificate of Death will list the person at the death and the Deed to be filled out and filed with the proper records.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.