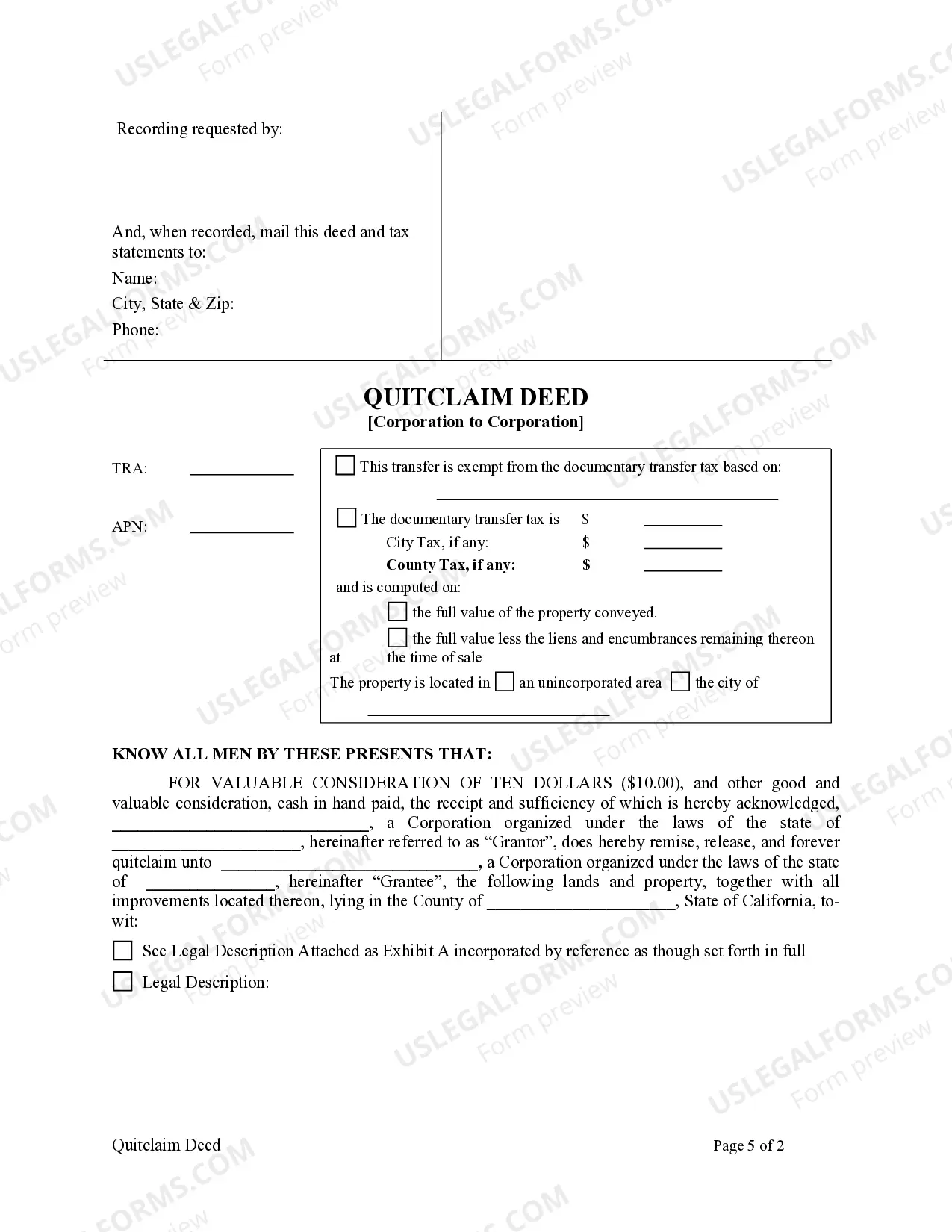

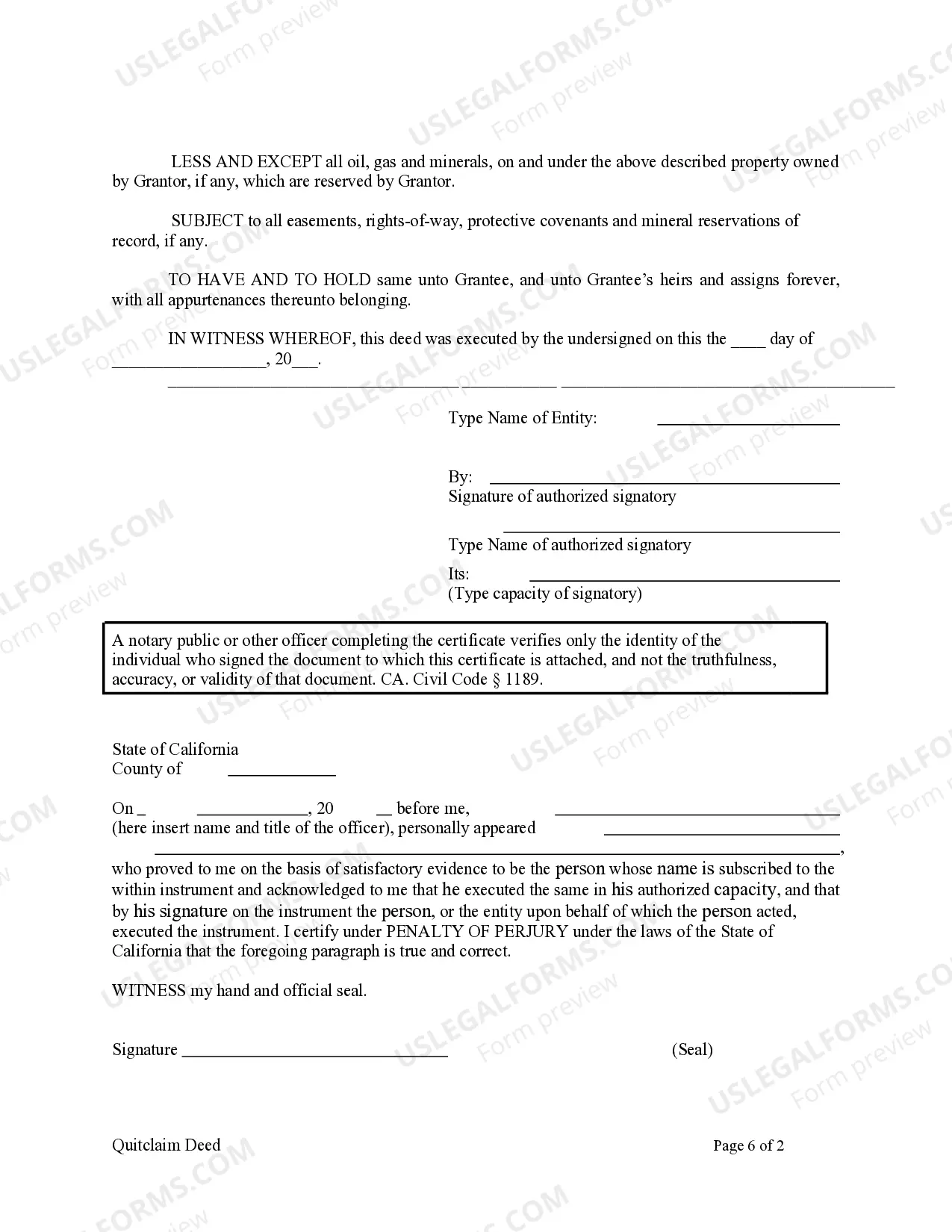

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Riverside California Quitclaim Deed from Corporation to Corporation is a legal document used to convey ownership of real property between two corporations in Riverside, California. This type of deed is often utilized when one corporation no longer wishes to hold ownership of a specific property and wants to transfer it to another corporation. The Quitclaim Deed acts as a legal instrument that ensures the corporation transferring the property (the granter) is giving up any claims or rights they may have over the property, while the corporation receiving the property (the grantee) is accepting ownership, without any guarantees or warranties of title from the granter. Different types of Riverside California Quitclaim Deeds from Corporation to Corporation may include: 1. General Riverside California Quitclaim Deed from Corporation to Corporation: This is the most common type of quitclaim deed used in Riverside, California. It transfers the property from the granter corporation to the grantee corporation without any specific conditions or restrictions. 2. Specific Purpose Riverside California Quitclaim Deed from Corporation to Corporation: This type of quitclaim deed may include additional provisions or conditions that specify the purpose of the transfer or any restrictions on the use of the property. For example, it may indicate that the property is being transferred for a specific development project or for corporate expansion purposes. 3. Partial Interest Riverside California Quitclaim Deed from Corporation to Corporation: In some cases, a corporation may only want to transfer a partial interest in the property to another corporation. This type of quitclaim deed allows for the transfer of a specific percentage or fraction of the ownership while retaining the remaining interest. 4. Reverse Riverside California Quitclaim Deed from Corporation to Corporation: This type of quitclaim deed is less common but may occur when a corporation wants to transfer a property back to the original granter corporation. It can be useful in situations where the initial transfer was for temporary purposes or as part of a larger transaction that has now concluded. It's important to note that a Riverside California Quitclaim Deed from Corporation to Corporation should be drafted and executed with the assistance of an attorney or qualified legal professional to ensure compliance with local laws and regulations. Additionally, conducting a thorough title search and obtaining title insurance is highly recommended protecting both parties involved in the transaction.