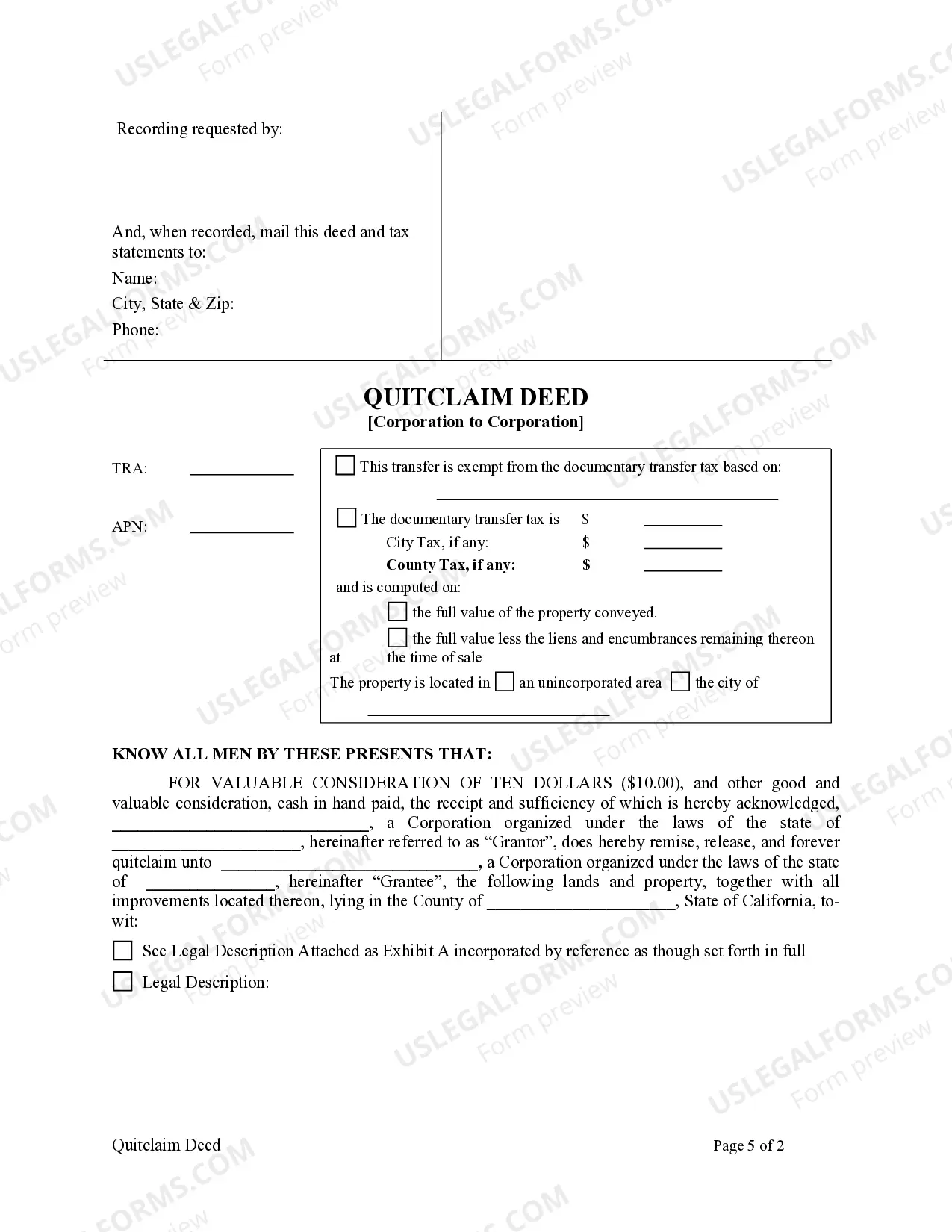

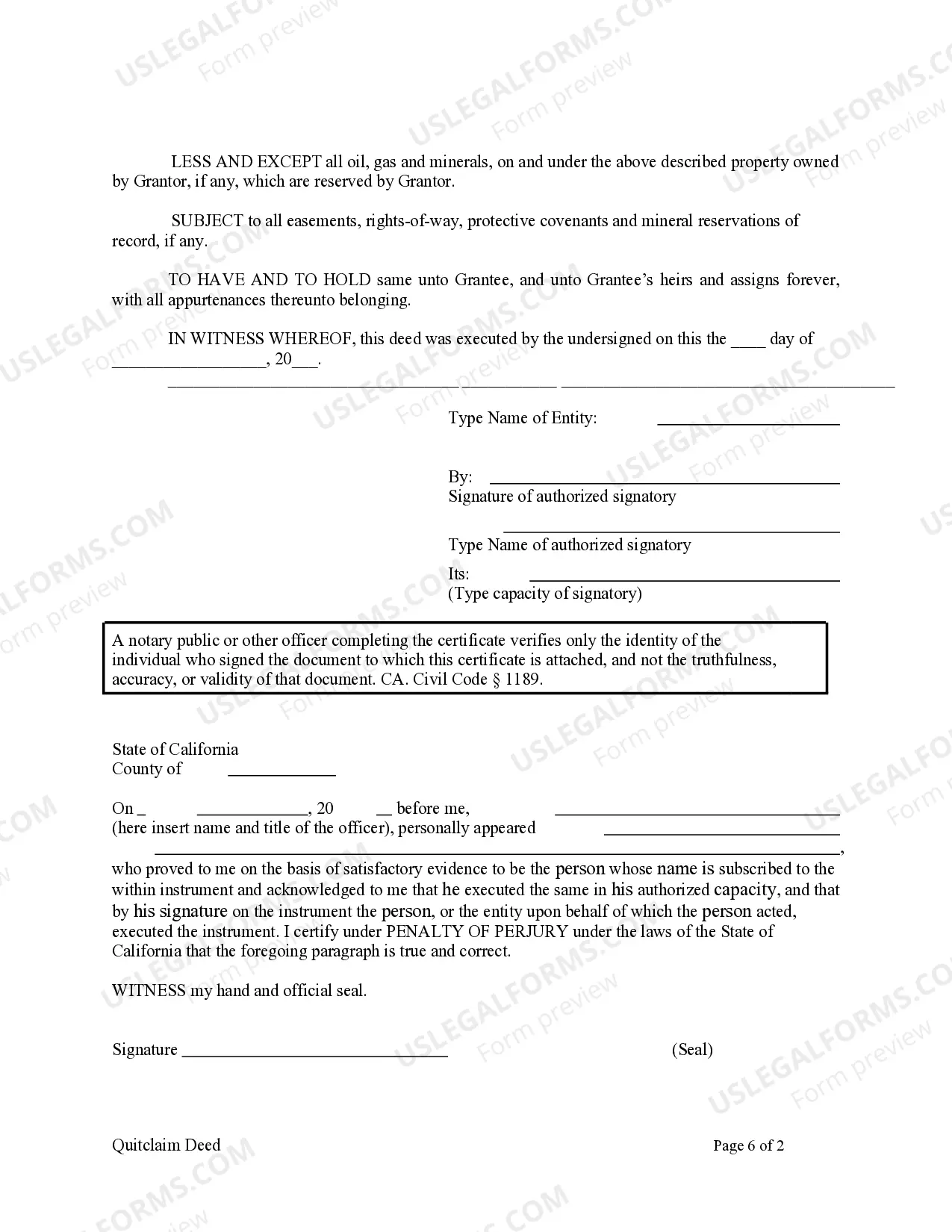

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Sacramento California Quitclaim Deed from Corporation to Corporation is a legal document used to transfer the ownership of property from one corporation to another in the Sacramento area. This type of deed allows for the transfer of the corporation's interest in the property without making any warranties or guarantees about the property's title. Keywords: Sacramento California, Quitclaim Deed, Corporation to Corporation, legal document, transfer of ownership, property, warranties, guarantees, title. There are several types of Sacramento California Quitclaim Deeds from Corporation to Corporation, including: 1. General Sacramento California Quitclaim Deed from Corporation to Corporation: This type of deed transfers the corporation's entire interest in the property to another corporation. It is a simple and straightforward transfer without any specific conditions or limitations. 2. Limited Sacramento California Quitclaim Deed from Corporation to Corporation: With this type of deed, the transfer of ownership is subject to certain conditions or limitations specified in the document. These conditions could include restrictions on the use of the property or limitations on how the property can be transferred in the future. 3. Partial Sacramento California Quitclaim Deed from Corporation to Corporation: This deed allows for the transfer of only a portion of the corporation's interest in the property. It might be used when one corporation wants to sell or transfer a specific portion or parcel of a larger property to another corporation. 4. Sacramento California Quitclaim Deed from Corporation to Corporation with Reservation: In this type of deed, the transferring corporation reserves certain rights or interest in the property even after the transfer. These reservations might include easements, mineral rights, or any other specific rights the corporation wishes to retain. 5. Sacramento California Quitclaim Deed from Dissolved Corporation to Corporation: If a corporation is dissolved or ceases to exist, this type of deed allows for the transfer of its property to another corporation. It is important to properly handle these transfers to ensure legal and orderly transfer of assets. In conclusion, a Sacramento California Quitclaim Deed from Corporation to Corporation is a legal document used to transfer property ownership between corporations in the Sacramento area. Depending on the specific circumstances, there can be different types of these deeds, such as general, limited, partial, with reservation, or for dissolved corporations. It is important to consult with legal professionals to ensure the proper handling of such transfers and adherence to relevant laws and regulations.