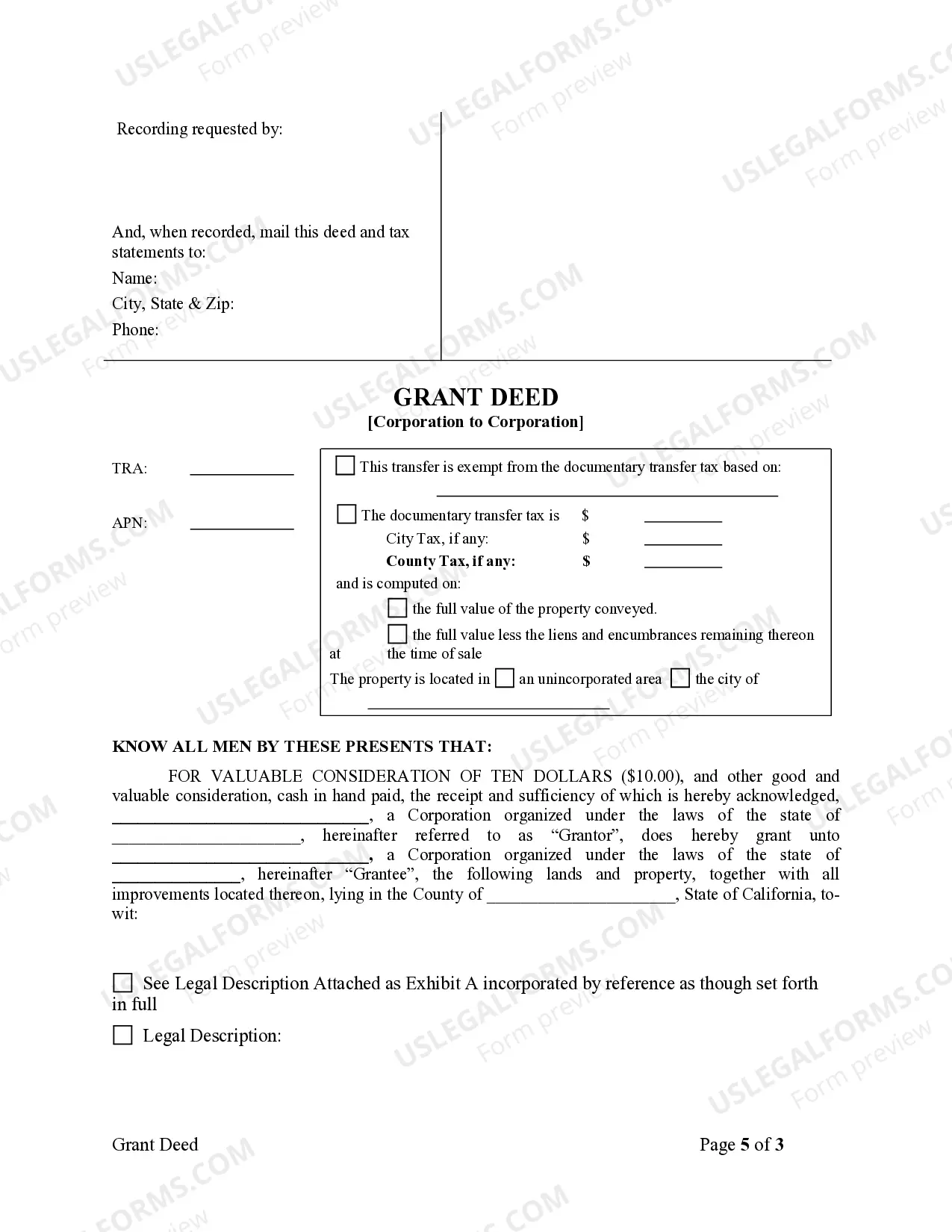

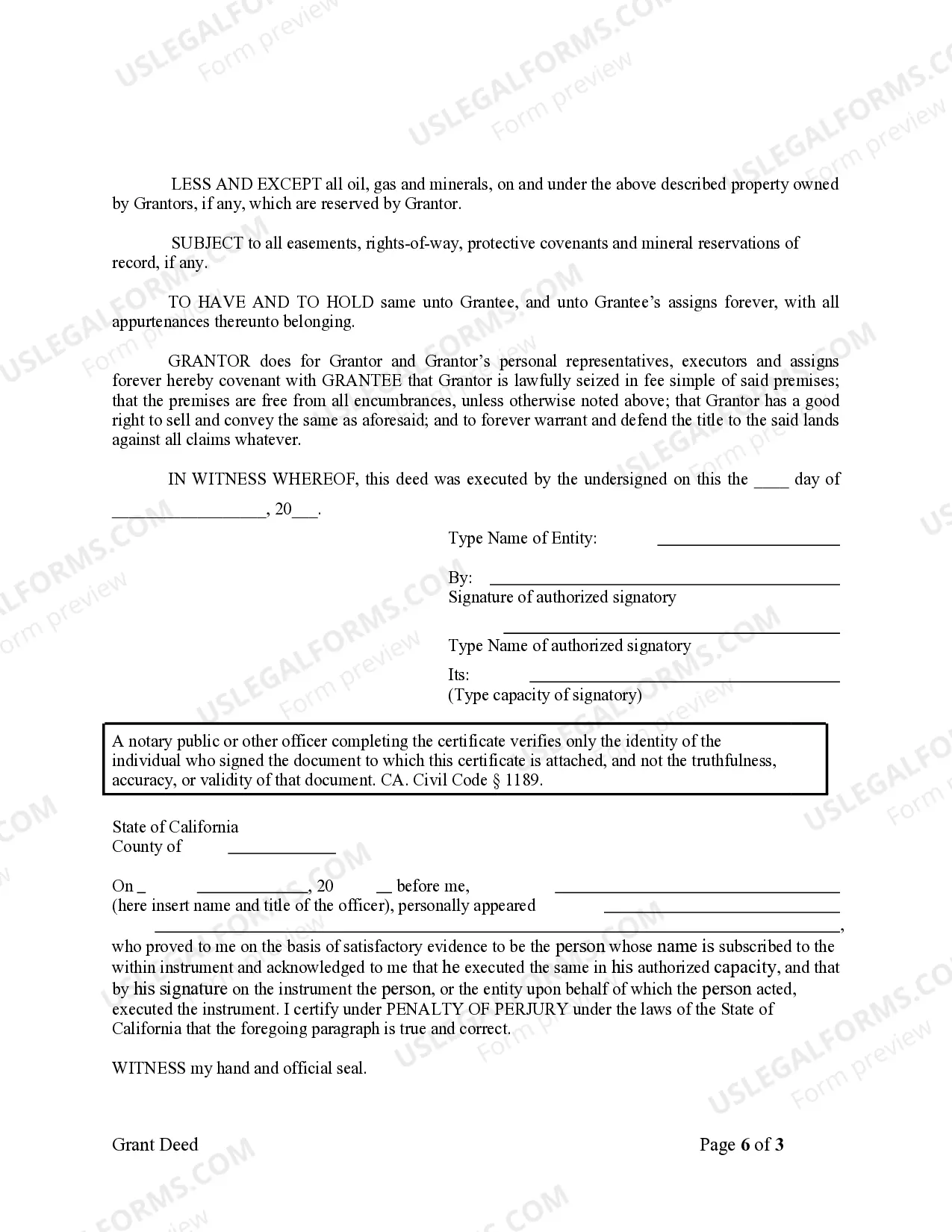

This Warranty Deed from Corporation to Corporation form is a Warranty Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Irvine California Grant Deed from Corporation to Corporation

Description

How to fill out Irvine California Grant Deed From Corporation To Corporation?

Are you seeking a trustworthy and economical provider of legal documents to obtain the Irvine California Grant Deed from Corporation to Corporation? US Legal Forms is your ideal option.

Whether you require a straightforward contract to establish guidelines for living with your partner or a collection of documents to facilitate your divorce proceedings, we have you covered. Our site features over 85,000 current legal document templates for personal and business needs. All templates we provide are not generic and are tailored based on the standards of specific states and counties.

To retrieve the document, you must Log Into your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can set up an account in just a few minutes, but before that, ensure to do the following.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment has been processed, download the Irvine California Grant Deed from Corporation to Corporation in any available format. You can revisit the website whenever you need and redownload the document without any additional charges.

Accessing current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal paperwork online once and for all.

- Verify if the Irvine California Grant Deed from Corporation to Corporation complies with the laws of your state and locality.

- Examine the description of the form (if available) to determine who and what the document is meant for.

- Restart the search if the form is not appropriate for your legal situation.

Form popularity

FAQ

DEEDS IN GENERAL It must be in writing; 2. The parties must be properly described; 3. The parties must be competent to convey and capable of receiving the grant of the property; 4. The property conveyed must be described so as to distinguish it from other parcels of real property.; 5.

Code, §1217.) Thus, an unrecorded deed is valid as between the parties and as to all those who have notice thereof. (Cal.

The deed must be signed by the party or parties making the conveyance or grant; and 7. It must be delivered and accepted. Contrary to the law and established custom in other states, the expression ?to have and to hold? (called the ?habendum clause? of a deed) is not necessary, nor are witnesses or seal required.

In California, grant deeds are filed at the county assessor's office with a Preliminary Change of Ownership Request, applicable fees and a Tax Affidavit. All must be notarized for legal transfer and recording.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

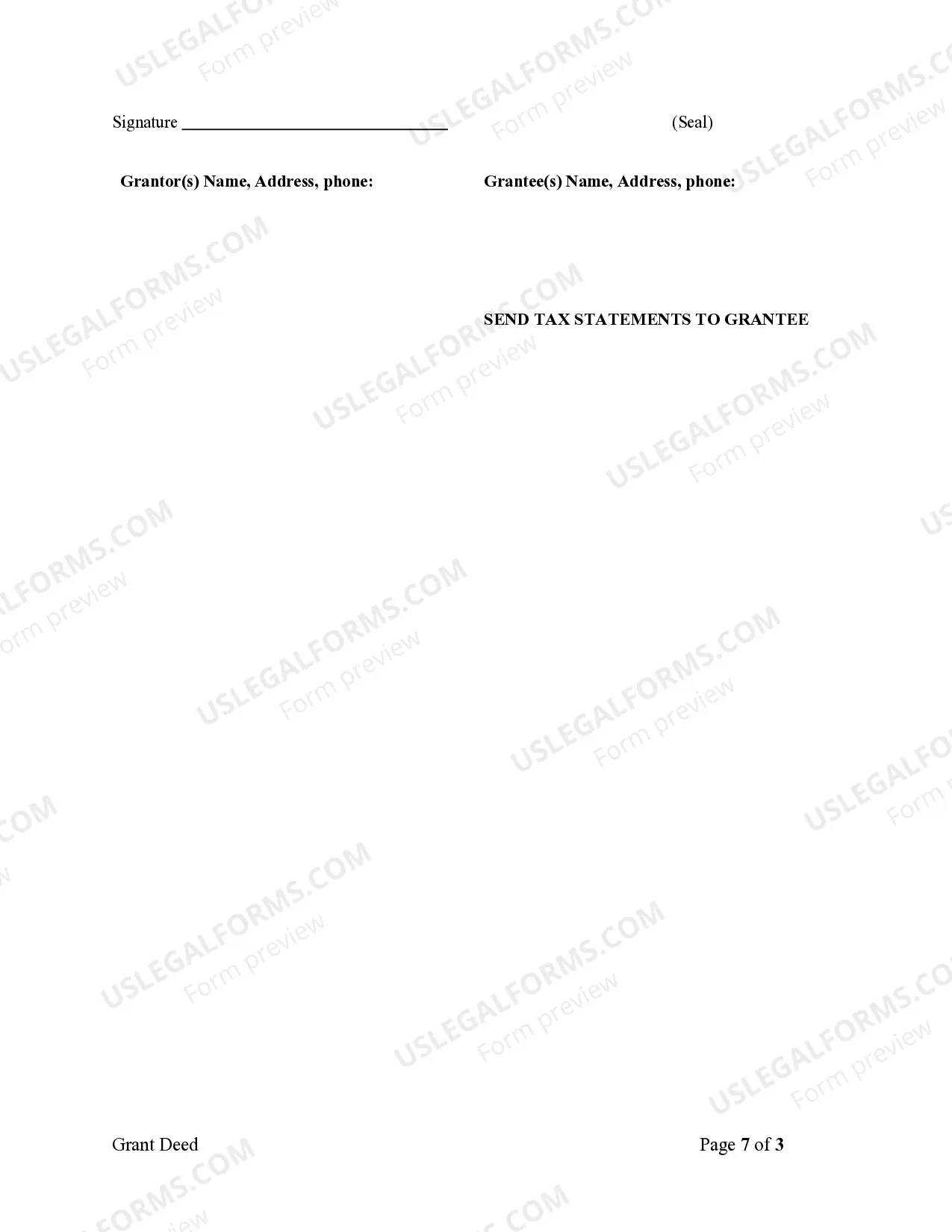

Take the deed to the recorder's office in the county where the property is located. Complete a Preliminary Change of Ownership Report, available in the recorder's office and online, by providing the names of the grantor and grantee, the type of transfer, the terms of transfer and the transfer price.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

You can obtain a copy of your Grant Deed directly from the Los Angeles County Registrar-Recorder/County Clerk. No third party assistance is needed. The County Registrar-Recorder mails the original Grant Deed document to the homeowner after it is recorded. Therefore, you should already have your original Grant Deed.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.