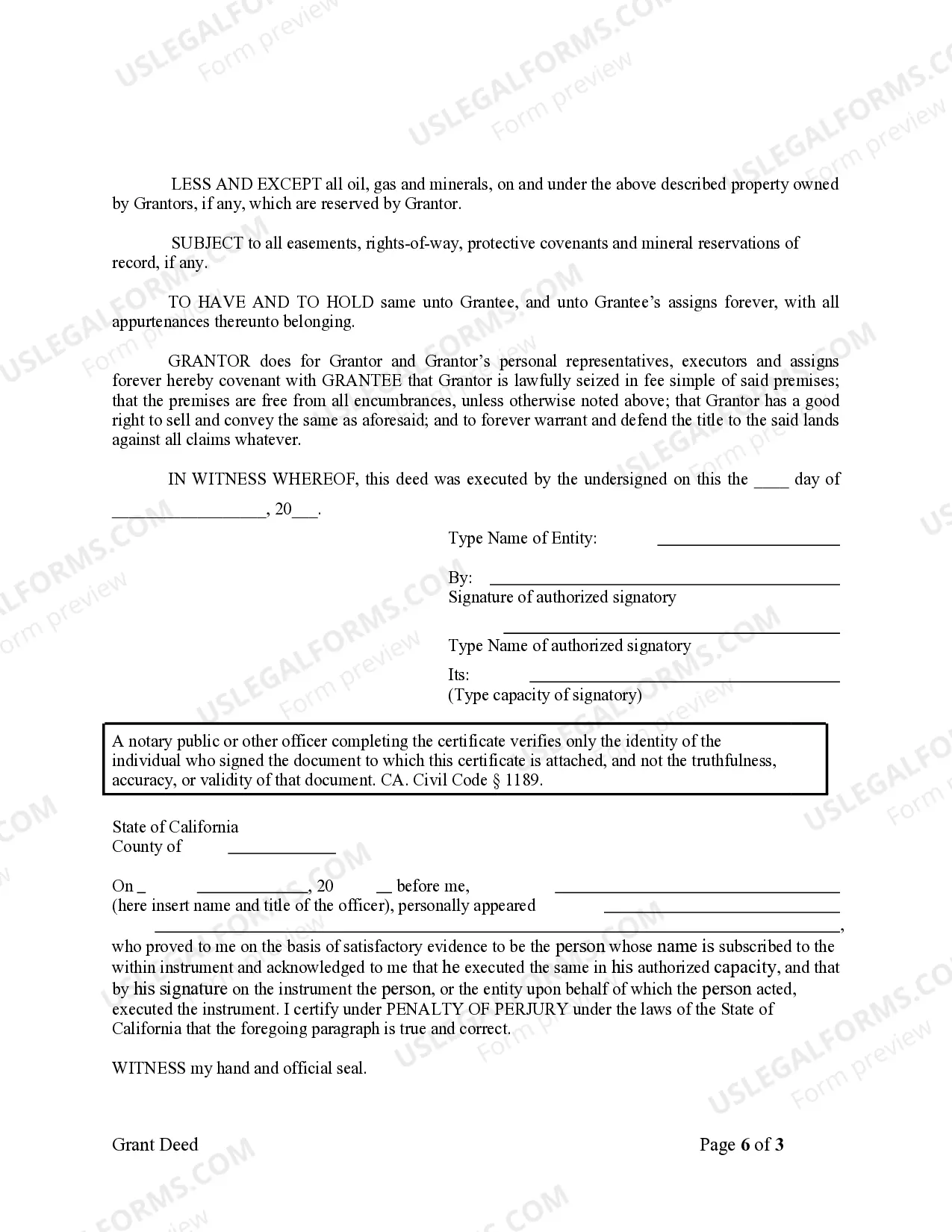

This Warranty Deed from Corporation to Corporation form is a Warranty Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

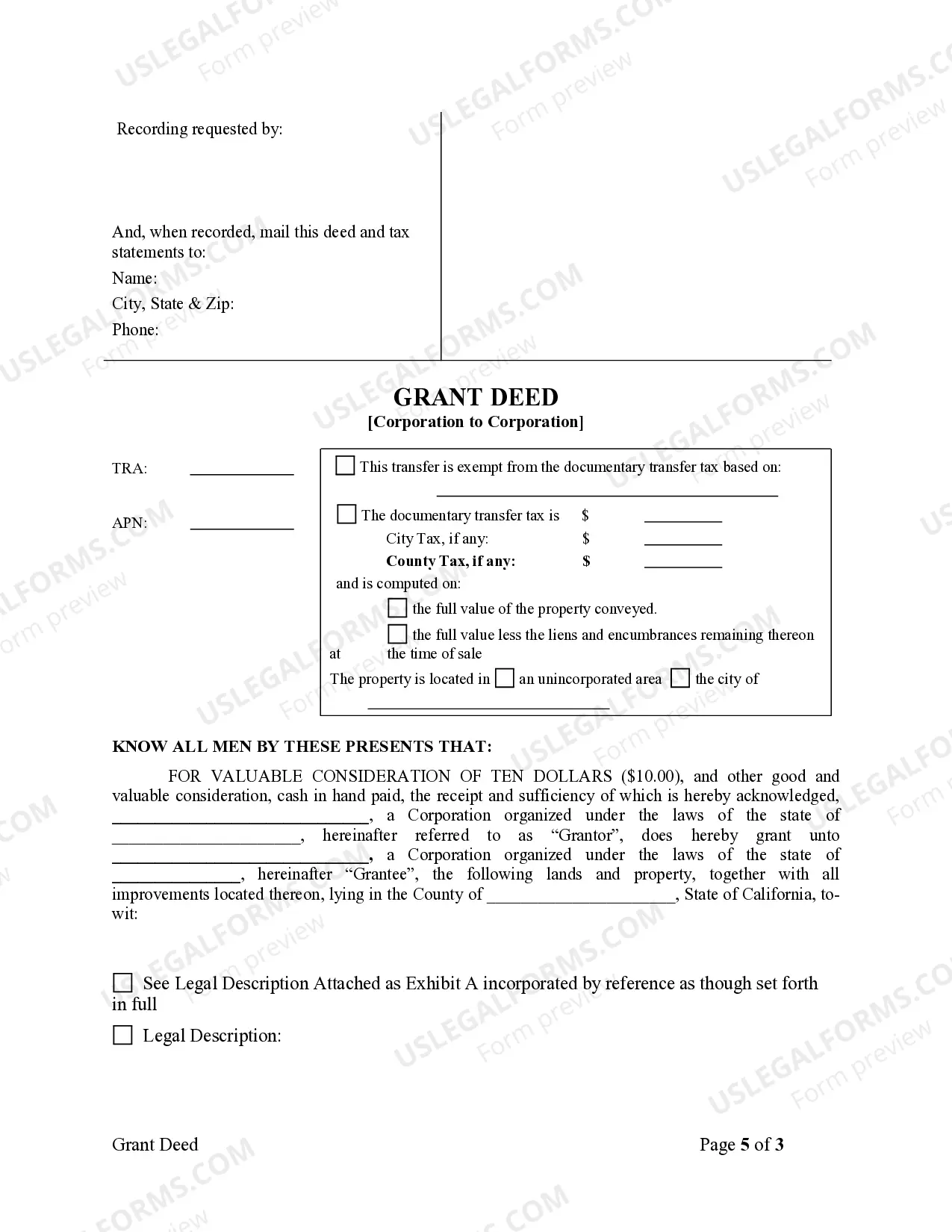

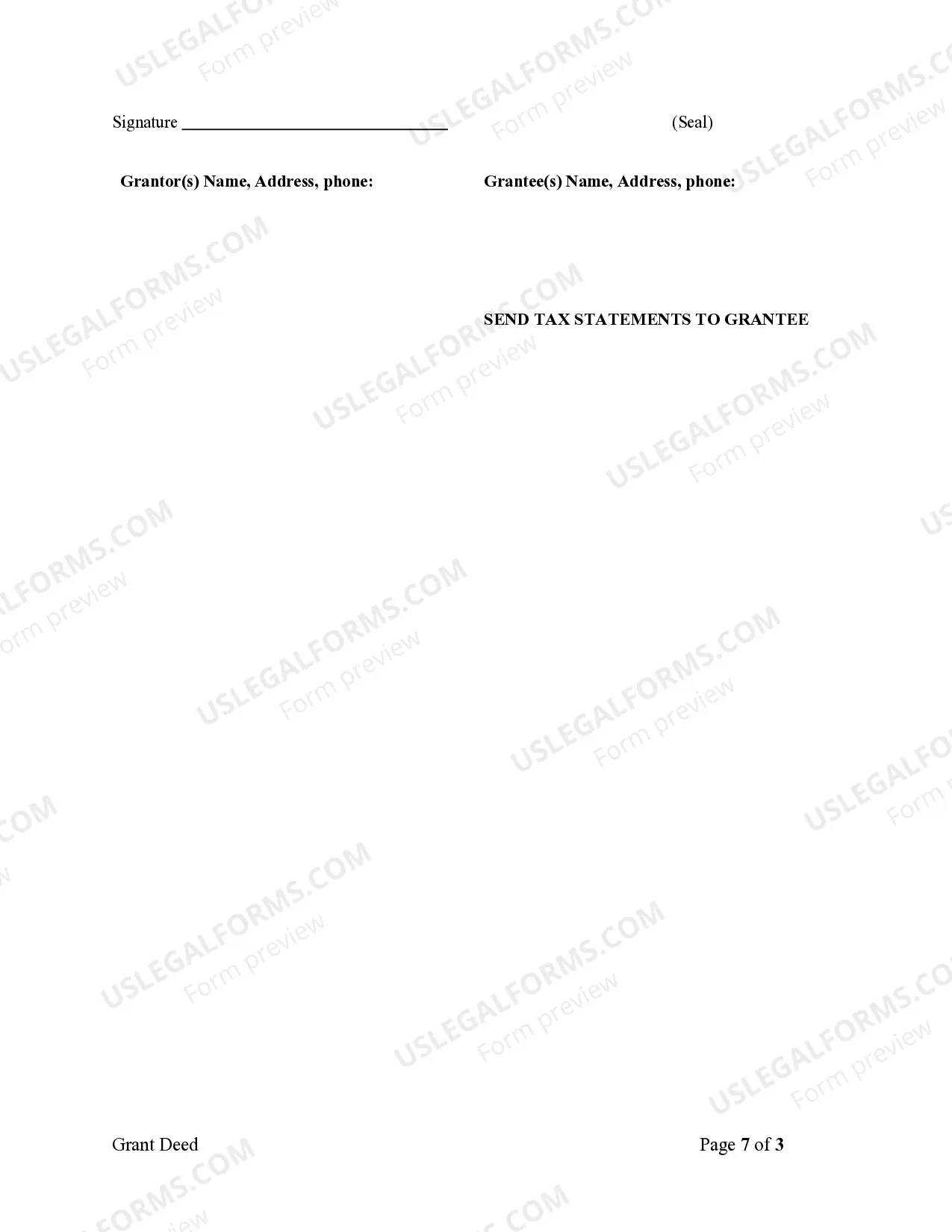

Orange California Grant Deed from Corporation to Corporation is a legal document that facilitates the transfer of real property ownership between two corporations with a transfer of ownership in Orange, California. This type of deed is commonly used for corporate transactions involving the transfer of real estate assets. A Grant Deed is a legally binding instrument that outlines the transfer of ownership rights from a granter (corporation selling the property) to a grantee (corporation purchasing the property). It acts as proof of transfer and ensures the grantee's title is free from any encumbrances or claims. In Orange County, California, there are various types of Grant Deeds from Corporation to Corporation, including: 1. General Orange California Grant Deed from Corporation to Corporation: This is the most common type of grant deed used in Orange County. It transfers ownership and guarantees that the granter has the authority to sell the property. 2. Special Orange California Grant Deed from Corporation to Corporation: This type of grant deed has specific conditions or limitations attached to the transfer of ownership. These conditions may restrict the use or development of the property, making it necessary for both corporations to agree upon and adhere to such limitations. 3. Quitclaim Orange California Grant Deed from Corporation to Corporation: This type of grant deed is used when the corporation transferring the property makes no guarantees or warranties about the property's title. The granter releases any claim to the property, leaving it up to the grantee to assess any potential risks. 4. Trustee Orange California Grant Deed from Corporation to Corporation: This grant deed is used when a corporation holds the property as a trustee of a trust. It ensures the trust's assets are transferred to a new corporation effectively, as dictated by the trust agreement. When executing an Orange California Grant Deed from Corporation to Corporation, both parties must carefully evaluate the property's condition, title history, and any potential encumbrances. It is advisable to seek legal assistance to ensure the deed is correctly drafted, signed, and recorded with the Orange County Recorder's Office. This step guarantees a smooth transfer of ownership and minimizes future legal issues.