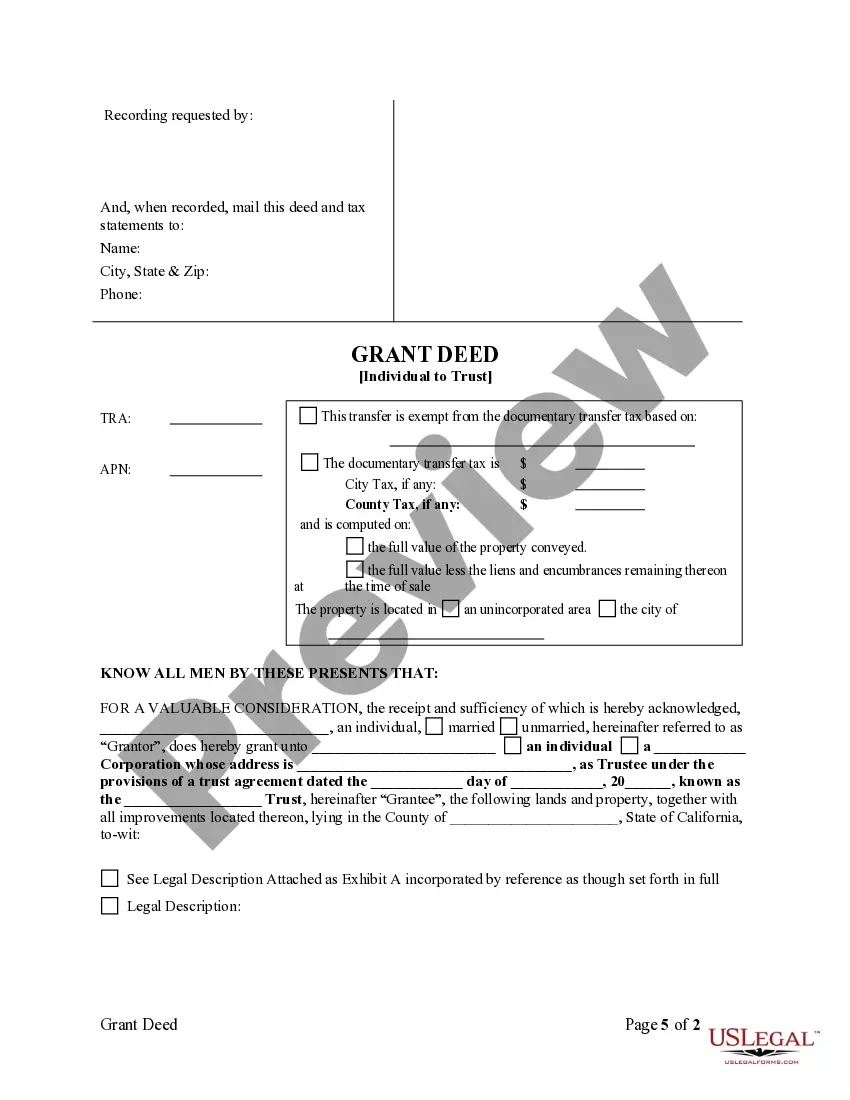

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

El Cajon California Grant Deed from Individual to Trust: A Comprehensive Overview In El Cajon, California, a Grant Deed from Individual to Trust is a legal document that facilitates the transfer of real estate ownership from an individual property owner to a trust. This type of deed is commonly used when an individual wants to transfer their property into a trust for various reasons, such as estate planning, asset protection, or managing property taxes. The Grant Deed is an essential legal instrument that maps out the specifics of the property transfer, ensuring a smooth and legally binding transaction. By executing this deed, the individual (granter) effectively transfers their legal interest and rights in a property to the trust (grantee). Key Elements of an El Cajon California Grant Deed from Individual to Trust: 1. Identification: The deed clearly identifies the granter, the individual transferring the property, and the grantee, the trust entity that will receive and hold the property. 2. Property Description: The deed includes a detailed description of the property being transferred, including its physical address, legal description, and Assessor's Parcel Number (APN), which uniquely identifies the property within the county's database. 3. Consideration: The consideration section specifies the monetary value or other valuable consideration involved in the property transfer. It can indicate both nominal and actual consideration, although nominal amounts (e.g., "$10 and other good and valuable consideration") are common when transferring property to a trust. 4. Granter's Statement: This section states that the granter holds fee simple interest in the property and has the right to transfer it. It also guarantees that the property is free of encumbrances, except those explicitly stated in the deed. 5. Trust Acceptance: The deed must include an acceptance statement from the trustee or trustees of the trust, acknowledging their role as grantee and agreeing to accept the property into the trust. Different Types of El Cajon California Grant Deed from Individual to Trust: 1. Revocable Living Trust Grant Deed: This type of grant deed transfers real estate ownership to a revocable living trust, allowing the property owner (granter) to retain control over the trust assets while alive. It offers the flexibility to make changes to the trust terms or revoke it entirely. 2. Irrevocable Trust Grant Deed: This grant deed facilitates the transfer of property ownership to an irrevocable trust, which cannot be modified or terminated without the consent of the trust beneficiaries. Irrevocable trusts are often used for estate planning and asset protection purposes. 3. Marital Trust Grant Deed: Used in cases of marital estate planning, this grant deed transfers property ownership from an individual spouse to a trust established to benefit the surviving spouse. It ensures the seamless transfer of assets between spouses while minimizing estate taxes. It's crucial to consult an experienced real estate attorney or a trusted legal professional familiar with El Cajon's specific laws and regulations when preparing and executing a Grant Deed from Individual to Trust.El Cajon California Grant Deed from Individual to Trust: A Comprehensive Overview In El Cajon, California, a Grant Deed from Individual to Trust is a legal document that facilitates the transfer of real estate ownership from an individual property owner to a trust. This type of deed is commonly used when an individual wants to transfer their property into a trust for various reasons, such as estate planning, asset protection, or managing property taxes. The Grant Deed is an essential legal instrument that maps out the specifics of the property transfer, ensuring a smooth and legally binding transaction. By executing this deed, the individual (granter) effectively transfers their legal interest and rights in a property to the trust (grantee). Key Elements of an El Cajon California Grant Deed from Individual to Trust: 1. Identification: The deed clearly identifies the granter, the individual transferring the property, and the grantee, the trust entity that will receive and hold the property. 2. Property Description: The deed includes a detailed description of the property being transferred, including its physical address, legal description, and Assessor's Parcel Number (APN), which uniquely identifies the property within the county's database. 3. Consideration: The consideration section specifies the monetary value or other valuable consideration involved in the property transfer. It can indicate both nominal and actual consideration, although nominal amounts (e.g., "$10 and other good and valuable consideration") are common when transferring property to a trust. 4. Granter's Statement: This section states that the granter holds fee simple interest in the property and has the right to transfer it. It also guarantees that the property is free of encumbrances, except those explicitly stated in the deed. 5. Trust Acceptance: The deed must include an acceptance statement from the trustee or trustees of the trust, acknowledging their role as grantee and agreeing to accept the property into the trust. Different Types of El Cajon California Grant Deed from Individual to Trust: 1. Revocable Living Trust Grant Deed: This type of grant deed transfers real estate ownership to a revocable living trust, allowing the property owner (granter) to retain control over the trust assets while alive. It offers the flexibility to make changes to the trust terms or revoke it entirely. 2. Irrevocable Trust Grant Deed: This grant deed facilitates the transfer of property ownership to an irrevocable trust, which cannot be modified or terminated without the consent of the trust beneficiaries. Irrevocable trusts are often used for estate planning and asset protection purposes. 3. Marital Trust Grant Deed: Used in cases of marital estate planning, this grant deed transfers property ownership from an individual spouse to a trust established to benefit the surviving spouse. It ensures the seamless transfer of assets between spouses while minimizing estate taxes. It's crucial to consult an experienced real estate attorney or a trusted legal professional familiar with El Cajon's specific laws and regulations when preparing and executing a Grant Deed from Individual to Trust.