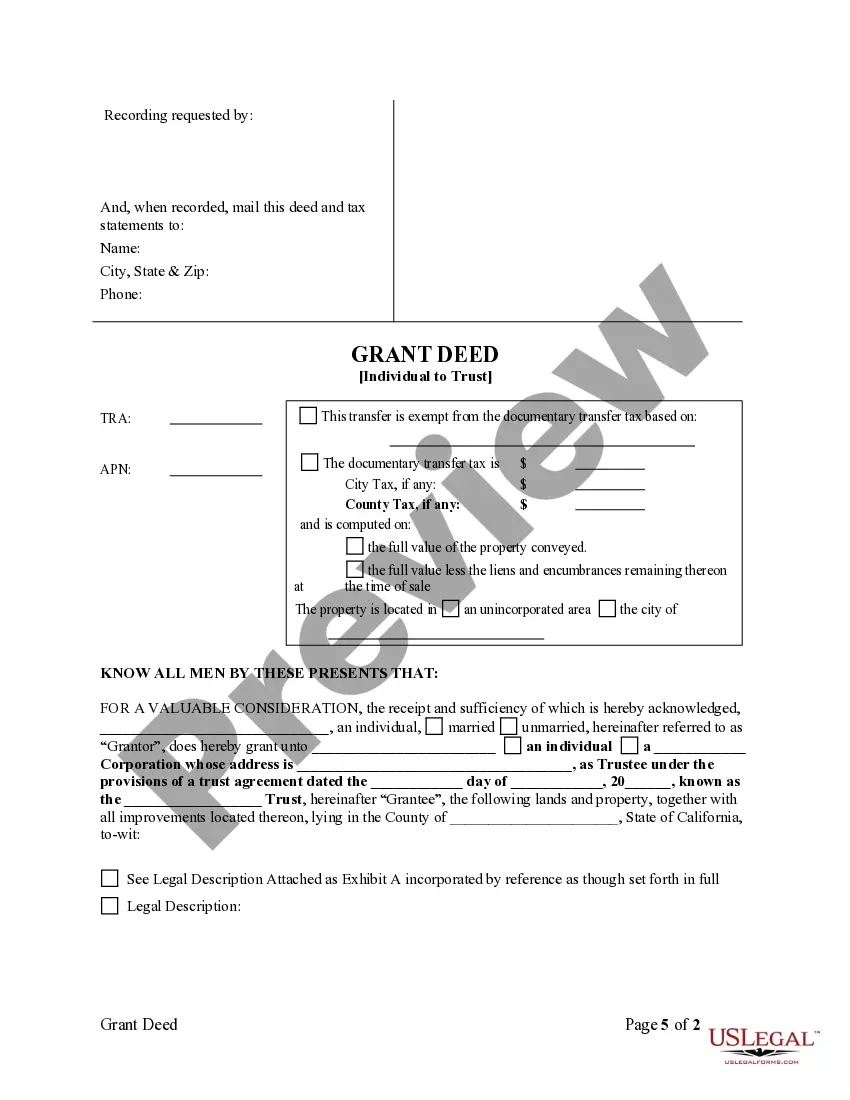

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Fullerton California grant deed from an individual to a trust is a legal document that conveys real property ownership rights from an individual property owner, referred to as the granter, to a trust, known as the grantee. This type of deed allows the transfer of ownership to be held in the trust's name, providing various benefits and advantages, such as asset protection and estate planning. The Fullerton California grant deed from individual to trust is commonly used to transfer real estate assets into a trust. By utilizing this deed, the granter ensures that the property is held and managed under the terms and conditions outlined in the trust agreement. Moreover, it allows the granter to distribute the property's ownership without going through the probate process, thereby providing privacy and avoiding potential complications. There are different variations of Fullerton California grant deeds from an individual to trust, each serving unique purposes depending on the specific circumstances. These variations include: 1. Fullerton California Revocable Living Trust Grant Deed: Also known as an inter vivos trust, this grant deed transfers ownership of real property to a revocable living trust. With this type of deed, the granter retains the ability to modify or revoke the trust during their lifetime, thereby offering flexibility and control over the property. 2. Fullerton California Irrevocable Living Trust Grant Deed: In contrast to the revocable living trust grant deed, the irrevocable living trust grant deed transfers ownership to an irrevocable trust. Once executed, this type of deed cannot be modified or revoked without the consent of the beneficiaries or a court order. Irrevocable trusts are typically used for long-term asset protection and estate tax planning purposes. 3. Fullerton California Special Needs Trust Grant Deed: This grant deed is specifically designed to transfer property to a special needs trust. Such trusts are created for individuals with disabilities, allowing them to maintain eligibility for certain government benefits while receiving supplemental support from the trust. 4. Fullerton California Testamentary Trust Grant Deed: Unlike the previously mentioned grant deeds, the testamentary trust grant deed takes effect only upon the granter's death. It is established within the granter's will and transfers property to a trust for the benefit of specific beneficiaries, in accordance with the terms outlined in the will. When executing a Fullerton California grant deed from an individual to a trust, it is crucial to ensure compliance with applicable laws and regulations. Consulting with a qualified attorney or real estate professional is advisable to navigate the complexities of the process and ensure a legally valid and binding transfer of property ownership rights.