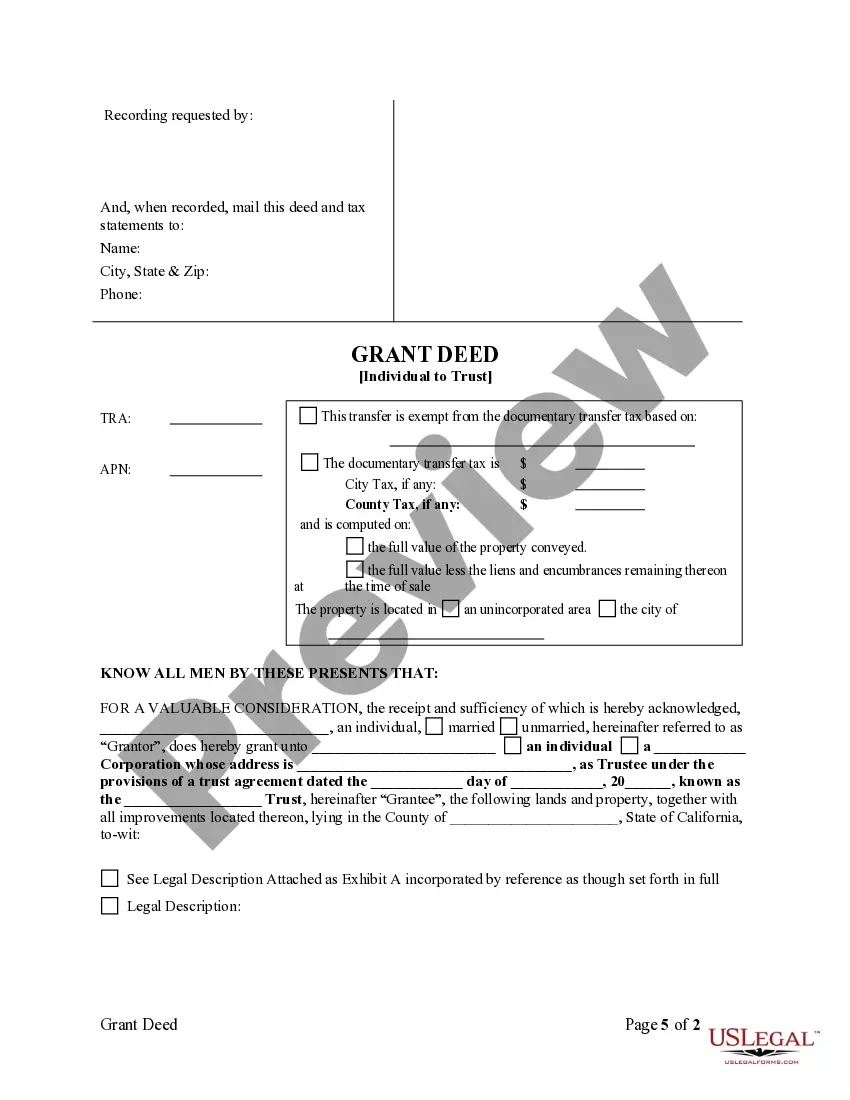

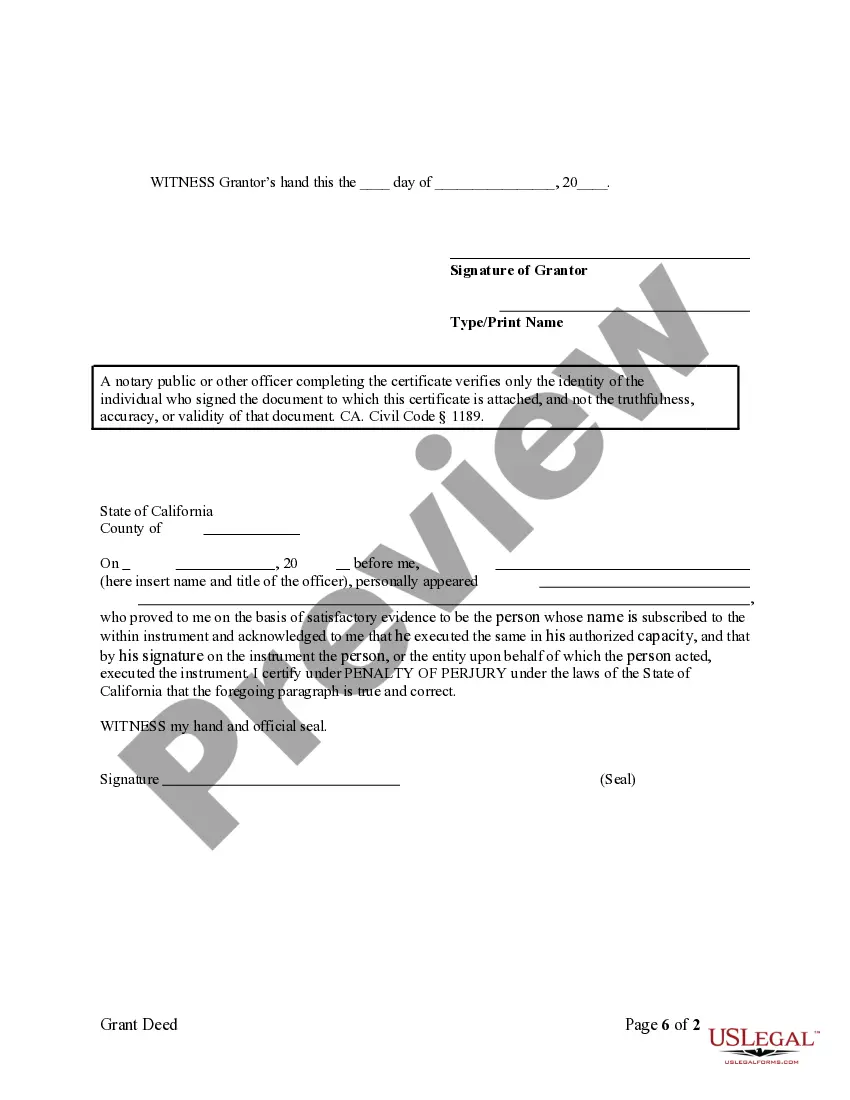

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

The Hayward California Grant Deed from Individual to Trust refers to a legal document that transfers real property ownership from an individual to a trust. This deed is commonly used in Hayward, California, and is crucial in estate planning and asset protection. A grant deed is a written instrument that guarantees the owner (granter) has the legal right to transfer the property to another party (grantee) without any undisclosed claims. In this scenario, an individual, also known as the granter, is conveying property ownership to a trust, acting as the grantee. There are several types of Hayward California Grant Deeds from Individual to Trust, including: 1. Revocable Living Trust Grant Deed: This type of grant deed is often used for estate planning purposes. It transfers ownership of real estate from an individual to their revocable living trust, allowing seamless asset management and distribution upon the individual's incapacitation or death. 2. Irrevocable Trust Grant Deed: An irrevocable trust is one that cannot be modified or terminated without the consent of the beneficiaries. The irrevocable trust grant deed transfers property ownership to this type of trust, typically used for long-term asset protection and reducing estate taxes. 3. Special Needs Trust Grant Deed: This grant deed pertains specifically to properties being transferred to a special needs trust. Such trusts are established to provide financial support for individuals with disabilities, ensuring that they can still receive government benefits while benefiting from the trust's assets. 4. Charitable Trust Grant Deed: A charitable trust grant deed facilitates the transfer of property ownership from an individual to a trust created for charitable purposes. By transferring the property, the individual contributes to a cause they are passionate about, while potentially receiving tax benefits. 5. Testamentary Trust Grant Deed: This grant deed is executed as part of a testamentary trust, which is created through a will and comes into effect only after the granter's death. The property is transferred to the trust upon the granter's passing, ensuring proper management and distribution as per their wishes. In conclusion, the Hayward California Grant Deed from Individual to Trust is a crucial legal instrument utilized for transferring property ownership to a trust. The intricacies of each type of grant deed cater to various estate planning strategies, including revocable living trusts, irrevocable trusts, special needs trusts, charitable trusts, and testamentary trusts. It is essential to consult with an attorney or legal professional to ensure compliance with relevant laws and achieve desired estate planning objectives.The Hayward California Grant Deed from Individual to Trust refers to a legal document that transfers real property ownership from an individual to a trust. This deed is commonly used in Hayward, California, and is crucial in estate planning and asset protection. A grant deed is a written instrument that guarantees the owner (granter) has the legal right to transfer the property to another party (grantee) without any undisclosed claims. In this scenario, an individual, also known as the granter, is conveying property ownership to a trust, acting as the grantee. There are several types of Hayward California Grant Deeds from Individual to Trust, including: 1. Revocable Living Trust Grant Deed: This type of grant deed is often used for estate planning purposes. It transfers ownership of real estate from an individual to their revocable living trust, allowing seamless asset management and distribution upon the individual's incapacitation or death. 2. Irrevocable Trust Grant Deed: An irrevocable trust is one that cannot be modified or terminated without the consent of the beneficiaries. The irrevocable trust grant deed transfers property ownership to this type of trust, typically used for long-term asset protection and reducing estate taxes. 3. Special Needs Trust Grant Deed: This grant deed pertains specifically to properties being transferred to a special needs trust. Such trusts are established to provide financial support for individuals with disabilities, ensuring that they can still receive government benefits while benefiting from the trust's assets. 4. Charitable Trust Grant Deed: A charitable trust grant deed facilitates the transfer of property ownership from an individual to a trust created for charitable purposes. By transferring the property, the individual contributes to a cause they are passionate about, while potentially receiving tax benefits. 5. Testamentary Trust Grant Deed: This grant deed is executed as part of a testamentary trust, which is created through a will and comes into effect only after the granter's death. The property is transferred to the trust upon the granter's passing, ensuring proper management and distribution as per their wishes. In conclusion, the Hayward California Grant Deed from Individual to Trust is a crucial legal instrument utilized for transferring property ownership to a trust. The intricacies of each type of grant deed cater to various estate planning strategies, including revocable living trusts, irrevocable trusts, special needs trusts, charitable trusts, and testamentary trusts. It is essential to consult with an attorney or legal professional to ensure compliance with relevant laws and achieve desired estate planning objectives.