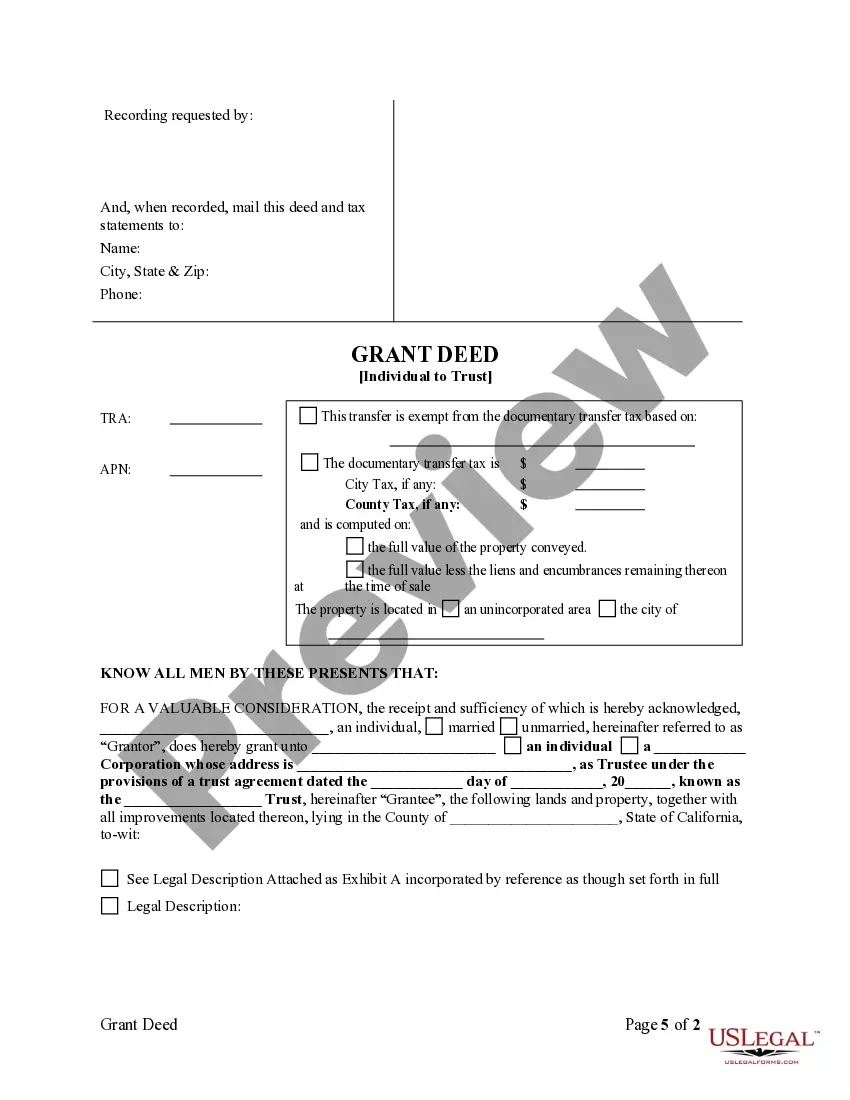

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

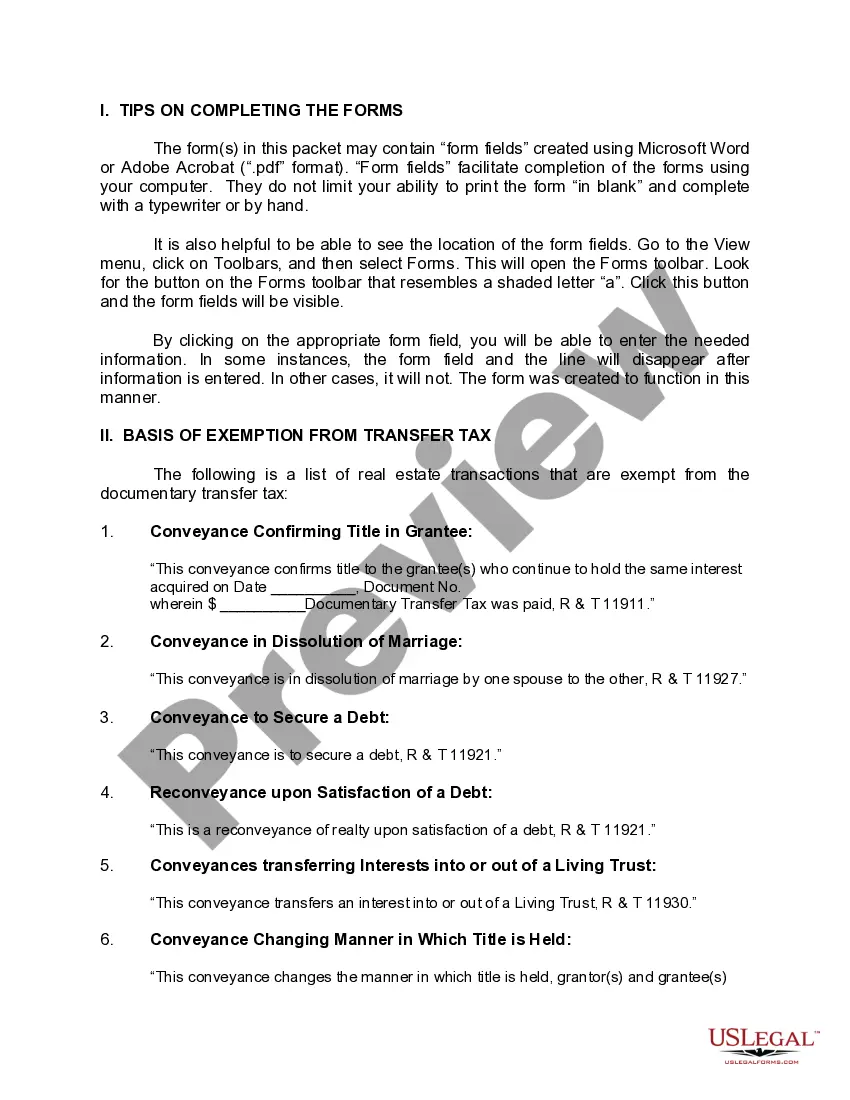

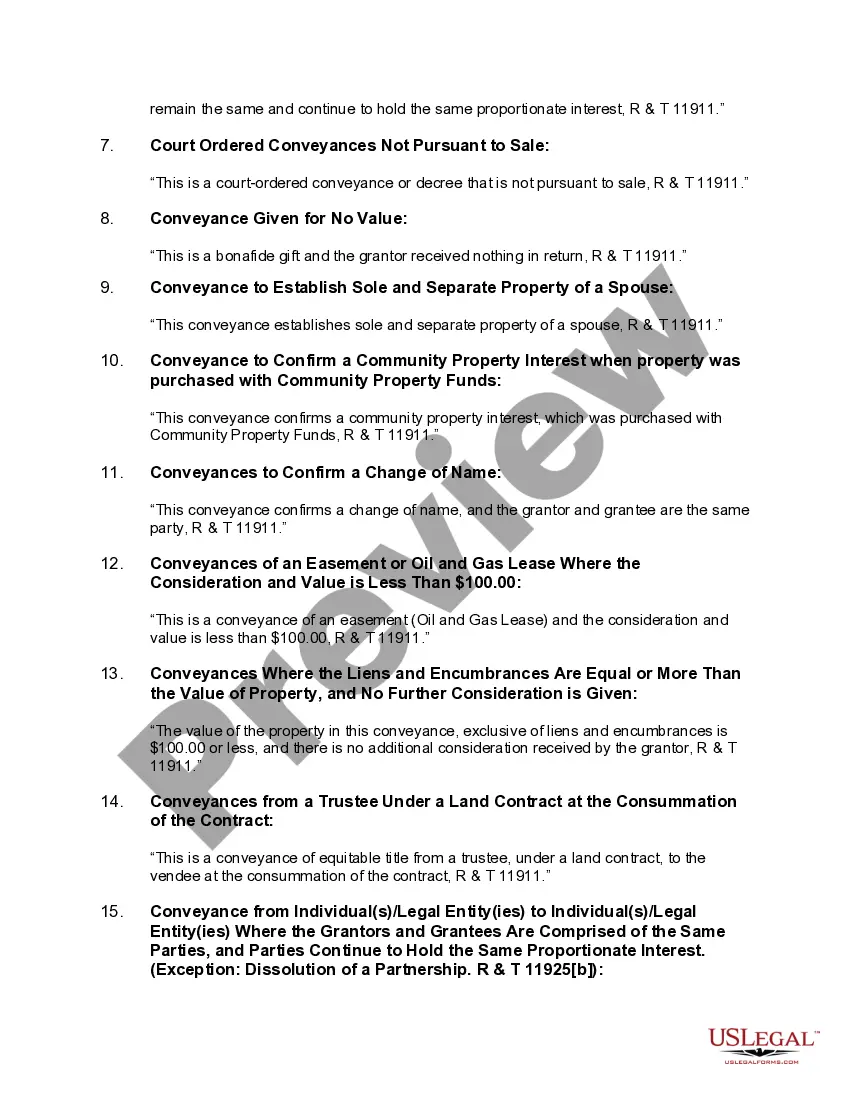

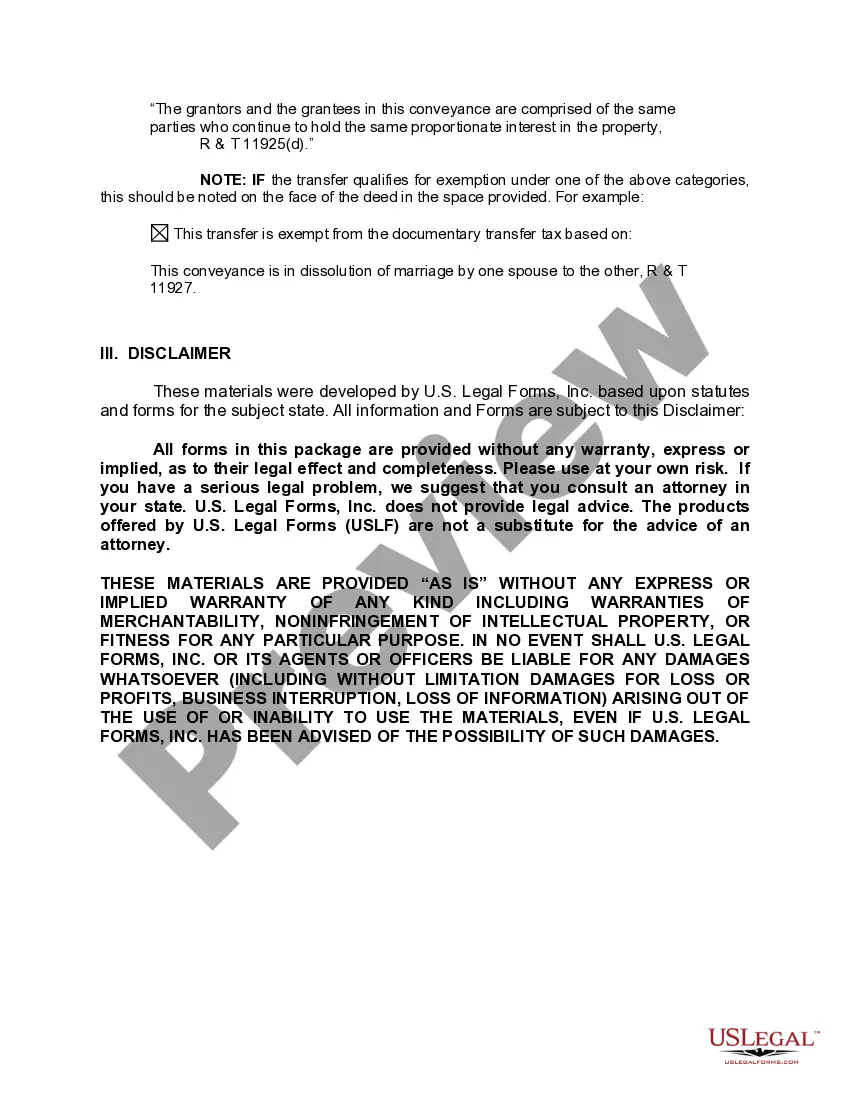

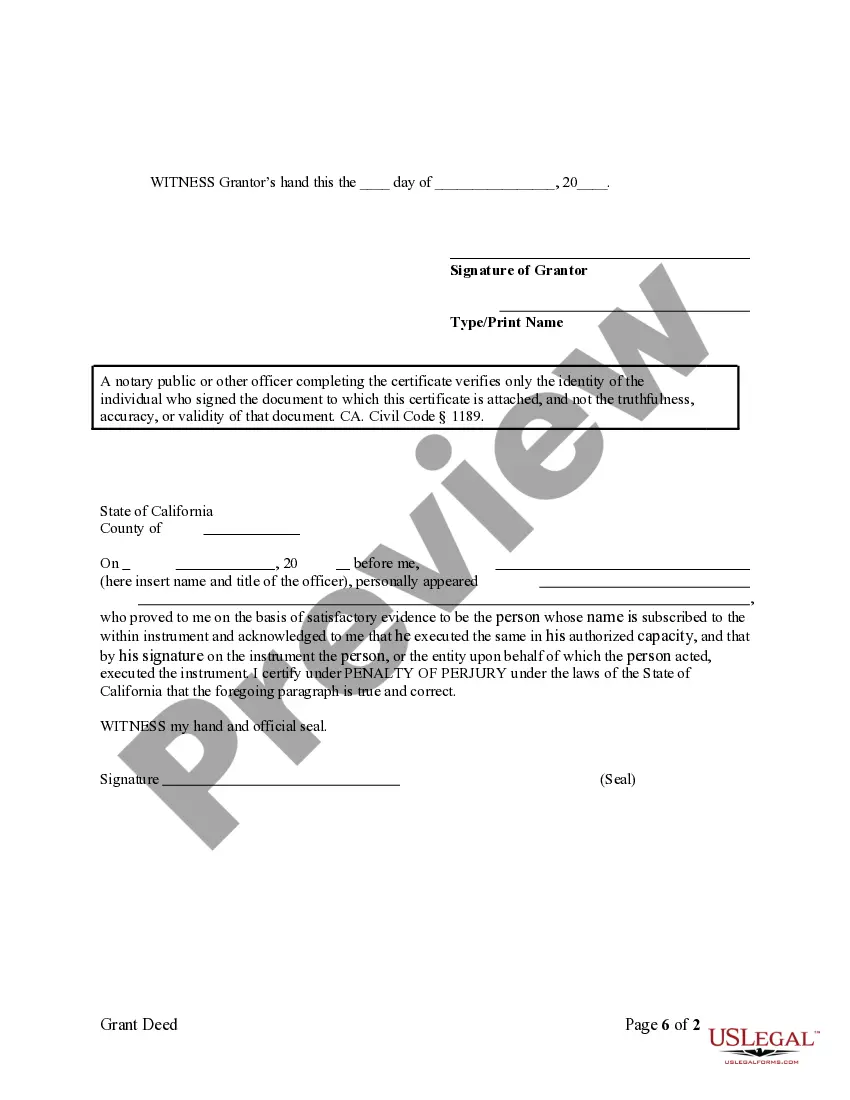

Title: Understanding the Inglewood California Grant Deed from Individual to Trust Introduction: Inglewood, California provides a legal and formal method to transfer property ownership from an individual to a trust. Known as the Inglewood California Grant Deed from Individual to Trust, this process ensures a smooth and legally recognized transfer. This article aims to provide a detailed description of the grant deed and shed light on any variations that may exist. 1. What is an Inglewood California Grant Deed? An Inglewood California Grant Deed from Individual to Trust is a legal document used to transfer the ownership of property from an individual (granter) to a trust (grantee). This deed serves as proof of the property's conveyance and establishes the trust as the new owner. It is crucial to consult with an attorney or legal professional to ensure the correct completion and recording of the deed. 2. Steps Involved in Transferring Property with a Grant Deed: — Consultation with an Attorney: Before proceeding, it is essential to seek legal advice to ascertain the specific requirements and implications of transferring property to a trust. — Prepare the Grant Deed: A grant deed form can be obtained from a legal professional or the county recorder's office. The completed form should include the necessary details, such as the granter's and grantee's names, property description, and legal description. — Execution and Notarization: Thgranteror must sign the deed in the presence of a notary public, who will verify their identity and witness the signature. — Record the Deed: The fully executed and notarized grant deed should be recorded with the county recorder's office where the property is located. This step ensures the transfer's public record and protects the interests of both parties involved. 3. Potential Variations of Inglewood California Grant Deed from Individual to Trust: While the general process of transferring ownership from an individual to a trust remains consistent, there may be variations in specific circumstances. Some possible variations of the Inglewood California Grant Deed from Individual to Trust include: — Irrevocable Trust Grant Deed: This type of grant deed is used to transfer property from an individual to an irrevocable trust, where the granter relinquishes their rights and control over the property permanently. — Revocable Trust Grant Deed: In contrast to the irrevocable trust, the revocable trust grant deed allows the granter to retain the power to modify or revoke the trust during their lifetime, while still transferring property ownership. Conclusion: Understanding the intricacies of the Inglewood California Grant Deed from Individual to Trust is crucial when transferring property to a trust entity. By following the necessary steps and consulting with legal professionals, individuals can ensure a smooth and legally recognized transfer. Whether using a revocable or irrevocable trust, proper execution, notarization, and recording of the grant deed safeguard the interests of both the granter and the trust.Title: Understanding the Inglewood California Grant Deed from Individual to Trust Introduction: Inglewood, California provides a legal and formal method to transfer property ownership from an individual to a trust. Known as the Inglewood California Grant Deed from Individual to Trust, this process ensures a smooth and legally recognized transfer. This article aims to provide a detailed description of the grant deed and shed light on any variations that may exist. 1. What is an Inglewood California Grant Deed? An Inglewood California Grant Deed from Individual to Trust is a legal document used to transfer the ownership of property from an individual (granter) to a trust (grantee). This deed serves as proof of the property's conveyance and establishes the trust as the new owner. It is crucial to consult with an attorney or legal professional to ensure the correct completion and recording of the deed. 2. Steps Involved in Transferring Property with a Grant Deed: — Consultation with an Attorney: Before proceeding, it is essential to seek legal advice to ascertain the specific requirements and implications of transferring property to a trust. — Prepare the Grant Deed: A grant deed form can be obtained from a legal professional or the county recorder's office. The completed form should include the necessary details, such as the granter's and grantee's names, property description, and legal description. — Execution and Notarization: Thgranteror must sign the deed in the presence of a notary public, who will verify their identity and witness the signature. — Record the Deed: The fully executed and notarized grant deed should be recorded with the county recorder's office where the property is located. This step ensures the transfer's public record and protects the interests of both parties involved. 3. Potential Variations of Inglewood California Grant Deed from Individual to Trust: While the general process of transferring ownership from an individual to a trust remains consistent, there may be variations in specific circumstances. Some possible variations of the Inglewood California Grant Deed from Individual to Trust include: — Irrevocable Trust Grant Deed: This type of grant deed is used to transfer property from an individual to an irrevocable trust, where the granter relinquishes their rights and control over the property permanently. — Revocable Trust Grant Deed: In contrast to the irrevocable trust, the revocable trust grant deed allows the granter to retain the power to modify or revoke the trust during their lifetime, while still transferring property ownership. Conclusion: Understanding the intricacies of the Inglewood California Grant Deed from Individual to Trust is crucial when transferring property to a trust entity. By following the necessary steps and consulting with legal professionals, individuals can ensure a smooth and legally recognized transfer. Whether using a revocable or irrevocable trust, proper execution, notarization, and recording of the grant deed safeguard the interests of both the granter and the trust.