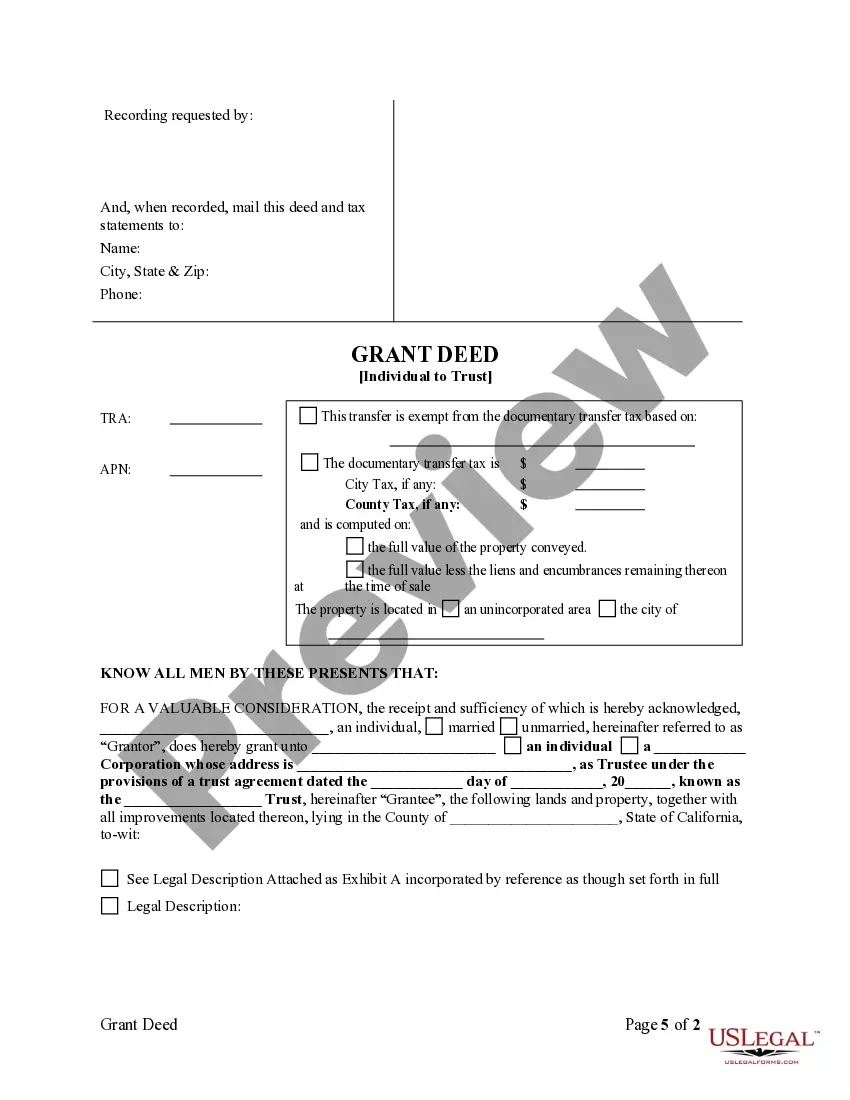

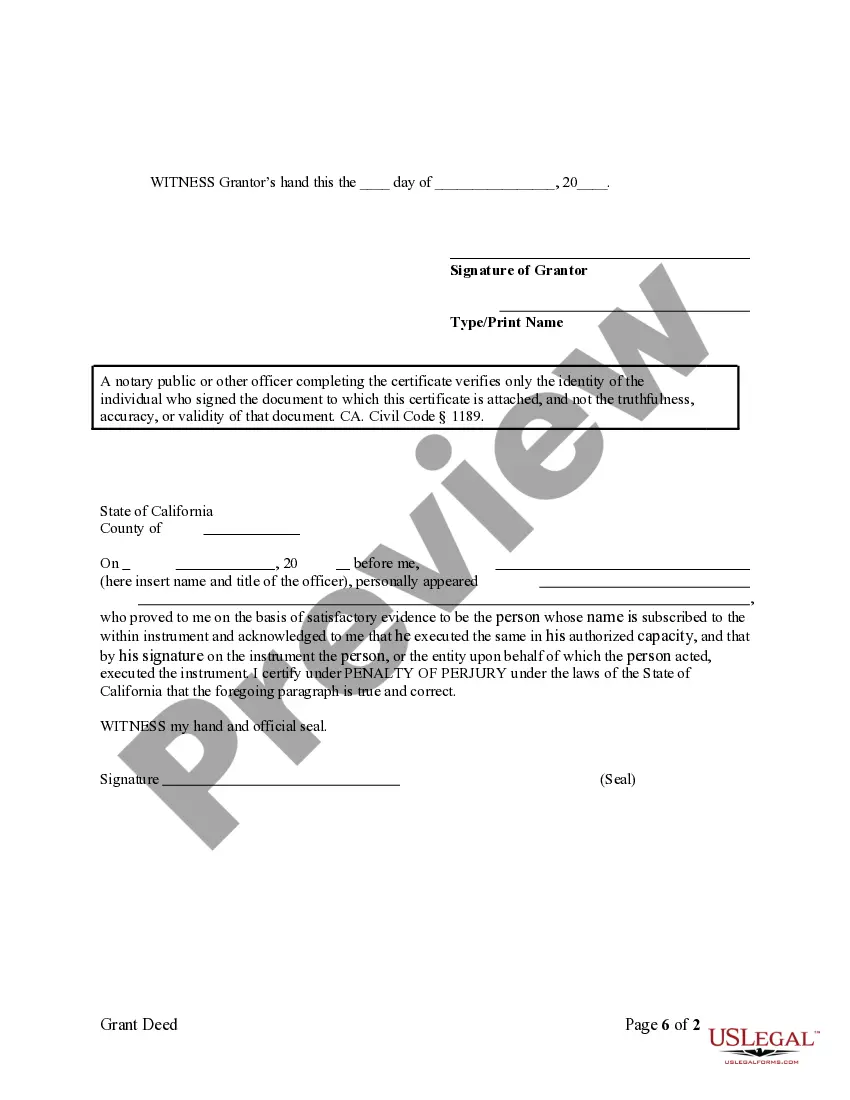

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Norwalk California Grant Deed from Individual to Trust is a legal document that facilitates the transfer of real property ownership from an individual to a trust in Norwalk, California. This type of transfer is common when an individual wishes to transfer their property into a trust, which can offer various advantages such as estate planning, asset protection, and the avoidance of probate. The grant deed is a legal instrument that conveys the property rights of the granter (individual) to the trustee (in this case, the trust). It confirms the transfer of ownership, describing the property being transferred and containing relevant details about the transaction. This document acts as concrete evidence of the change in property ownership and helps to ensure a smooth and legally binding transfer. There are different types and variations of Norwalk California Grant Deeds from Individual to Trust, each serving a specific purpose or addressing unique circumstances: 1. Revocable Living Trust Grant Deed: This is the most common type of grant deed used for transferring real estate into a revocable living trust. With a revocable trust, the granter maintains control over the property during their lifetime and can revoke or amend the trust as needed. 2. Irrevocable Trust Grant Deed: Unlike the revocable living trust, an irrevocable trust cannot be easily altered or revoked by the granter. The transfer of property into an irrevocable trust is typically done for estate planning and tax purposes, as it removes the property from the granter's estate. 3. Testamentary Trust Grant Deed: This type of grant deed is utilized when an individual wants their property to be transferred into a trust upon their death. The terms and conditions of the trust are outlined in the granter's will and become effective only after their passing. 4. Special Needs Trust Grant Deed: A special needs trust is created to provide for an individual with special needs while preserving their eligibility for government benefits. A grant deed specifically designed for this type of trust ensures that the property is held in trust and managed for the benefit of the individual with special needs. Overall, a Norwalk California Grant Deed from Individual to Trust enables a seamless transfer of property ownership while allowing individuals to enjoy various benefits and protections provided by the trust. It is crucial to consult with an experienced attorney or real estate professional to ensure the proper preparation and execution of this legal document.A Norwalk California Grant Deed from Individual to Trust is a legal document that facilitates the transfer of real property ownership from an individual to a trust in Norwalk, California. This type of transfer is common when an individual wishes to transfer their property into a trust, which can offer various advantages such as estate planning, asset protection, and the avoidance of probate. The grant deed is a legal instrument that conveys the property rights of the granter (individual) to the trustee (in this case, the trust). It confirms the transfer of ownership, describing the property being transferred and containing relevant details about the transaction. This document acts as concrete evidence of the change in property ownership and helps to ensure a smooth and legally binding transfer. There are different types and variations of Norwalk California Grant Deeds from Individual to Trust, each serving a specific purpose or addressing unique circumstances: 1. Revocable Living Trust Grant Deed: This is the most common type of grant deed used for transferring real estate into a revocable living trust. With a revocable trust, the granter maintains control over the property during their lifetime and can revoke or amend the trust as needed. 2. Irrevocable Trust Grant Deed: Unlike the revocable living trust, an irrevocable trust cannot be easily altered or revoked by the granter. The transfer of property into an irrevocable trust is typically done for estate planning and tax purposes, as it removes the property from the granter's estate. 3. Testamentary Trust Grant Deed: This type of grant deed is utilized when an individual wants their property to be transferred into a trust upon their death. The terms and conditions of the trust are outlined in the granter's will and become effective only after their passing. 4. Special Needs Trust Grant Deed: A special needs trust is created to provide for an individual with special needs while preserving their eligibility for government benefits. A grant deed specifically designed for this type of trust ensures that the property is held in trust and managed for the benefit of the individual with special needs. Overall, a Norwalk California Grant Deed from Individual to Trust enables a seamless transfer of property ownership while allowing individuals to enjoy various benefits and protections provided by the trust. It is crucial to consult with an experienced attorney or real estate professional to ensure the proper preparation and execution of this legal document.