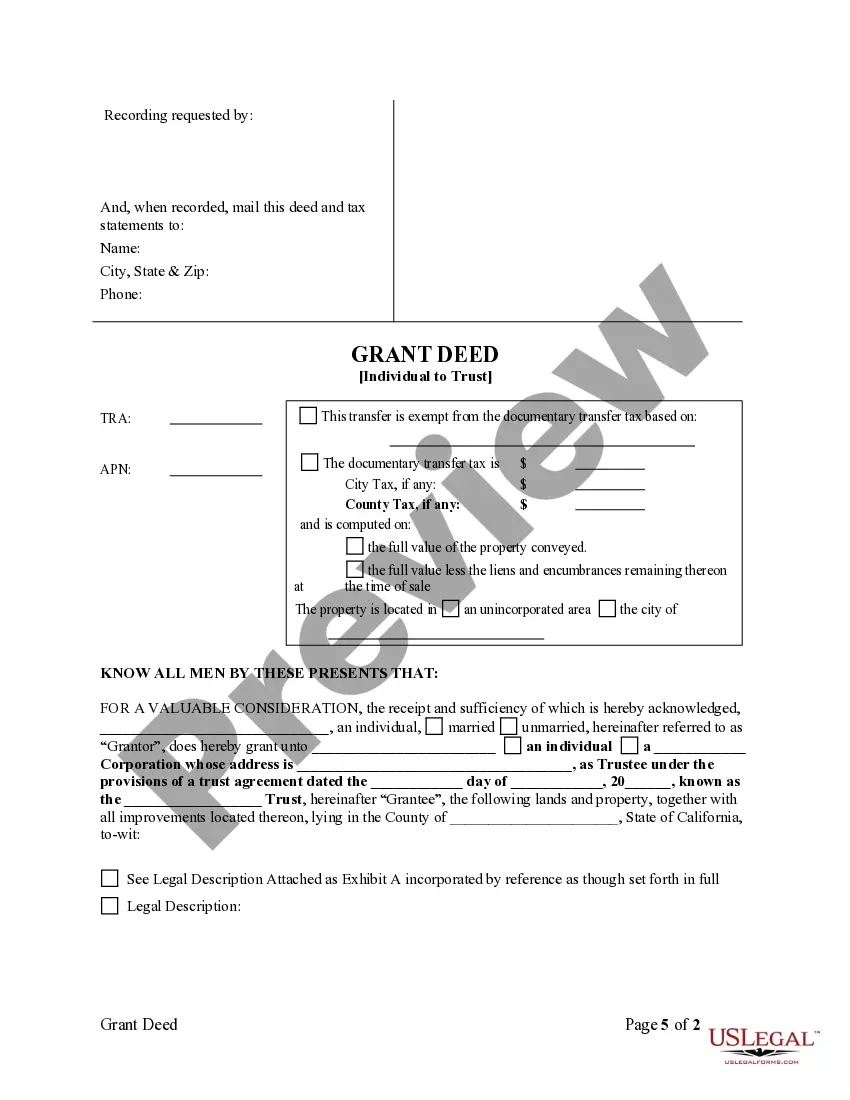

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Orange California Grant Deed from Individual to Trust is a legal document used to transfer real estate ownership from an individual property owner to a trust entity in Orange, California. This type of deed is commonly utilized for estate planning purposes, allowing individuals to transfer their property assets into a trust for various benefits such as asset protection, property management, and minimizing probate expenses. When an individual decides to create a trust to hold their real estate, they can execute an Orange California Grant Deed from Individual to Trust. This ensures that the property's title is legally transferred from the individual to the trust, solidifying the trust as the new owner of the property. There are several types of Orange California Grant Deeds from Individual to Trust, varying based on the specific details and requirements of the transfer: 1. Revocable Living Trust Grant Deed: This type of grant deed is commonly used when an individual wants to transfer property assets to a revocable living trust, which allows them to maintain control and benefit from the property during their lifetime. With a revocable living trust grant deed, the property owner becomes the granter, transferring ownership to the trust where they are typically named as the trustee. 2. Irrevocable Trust Grant Deed: Irrevocable trust grant deeds are used when an individual intends to permanently transfer ownership of their property to an irrevocable trust. By doing so, the granter relinquishes control over the property, and the trust becomes the new legal owner. This type of trust provides asset protection, estate tax planning, and other long-term benefits. 3. Inter Vivos Trust Grant Deed: Inter Vivos trust grant deeds are executed when an individual wants to transfer property into a trust during their lifetime. Also known as a "living trust" or "trust inter vivos," this type of transfer takes place before the individual's passing, allowing them to plan how their property will be managed and distributed upon their death. 4. Testamentary Trust Grant Deed: A testamentary trust grant deed is created through a will and is effective after the property owner's death. This type of grant deed allows for the transfer of property into a trust as specified in the individual's will, ensuring the property is distributed according to their wishes. It is important to consult with an experienced attorney when drafting and executing an Orange California Grant Deed from Individual to Trust, as the specific legal requirements and implications may vary based on individual circumstances and property ownership details.