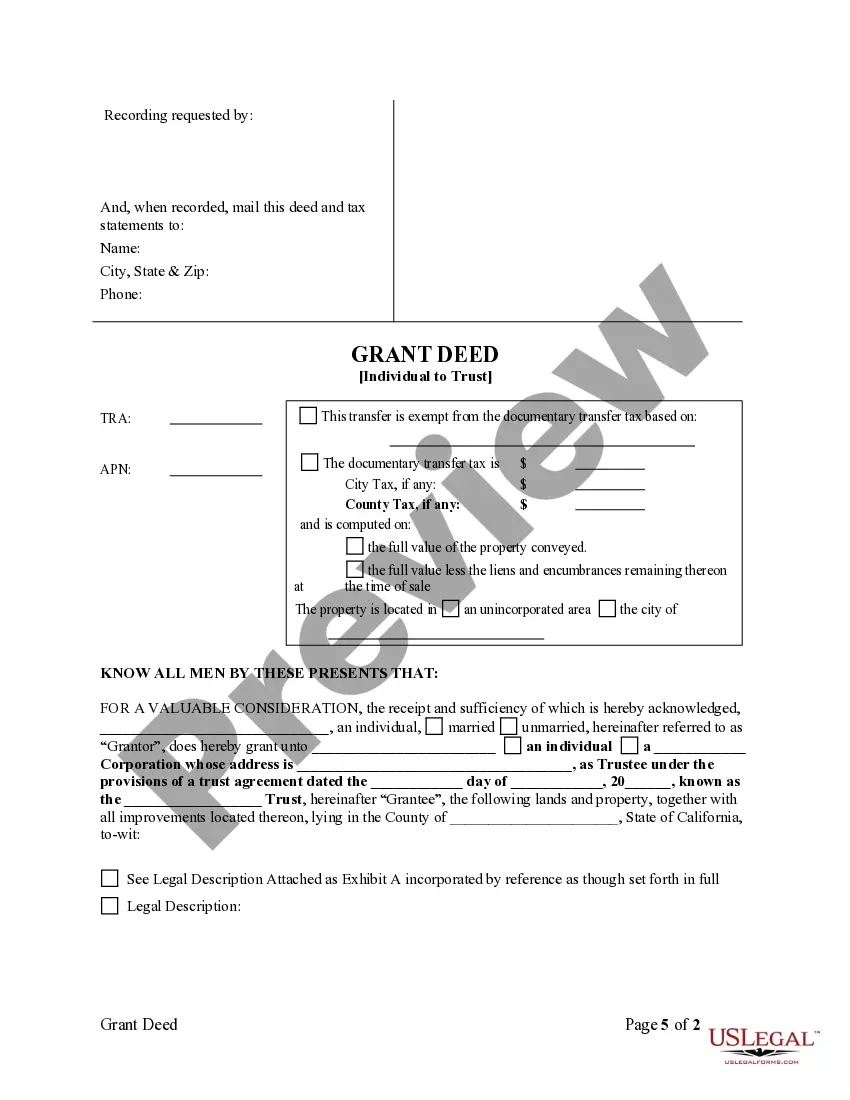

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Sacramento California Grant Deed from Individual to Trust

Description

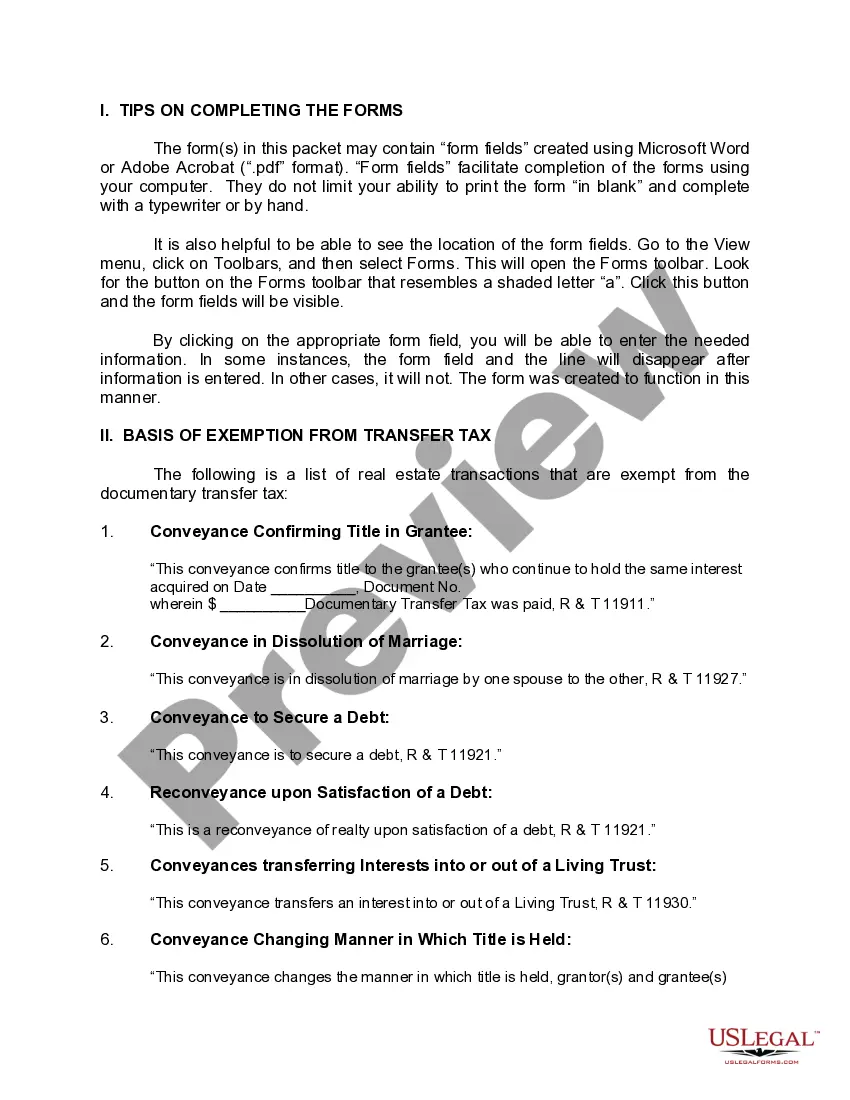

How to fill out California Grant Deed From Individual To Trust?

Finding authentic templates relevant to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements, along with various real-life scenarios.

All documents are properly categorized by usage area and jurisdictional categories, making it quick and simple to acquire the Sacramento California Grant Deed from Individual to Trust.

Keeping documents organized and in compliance with legal standards is of utmost importance. Take advantage of the US Legal Forms library to always have vital document templates readily available for any requirements!

- Examine the Preview mode and document description.

- Ensure you’ve chosen the accurate one that fulfills your requirements and aligns with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you encounter any discrepancies, utilize the Search tab above to locate the correct one. If it fits your needs, proceed to the next step.

- Proceed with the purchase.

Form popularity

FAQ

To place your property in a trust in California, you should begin by creating a trust document, which outlines the terms and conditions of the trust. Once the trust is established, you will need to execute a grant deed, transferring the property from your name to the trust. Using the Sacramento California Grant Deed from Individual to Trust can simplify this process significantly. Finally, remember to record the grant deed with your local county recorder to complete the process.

To transfer a deed to a trust in California, you need to file a specific type of document known as a grant deed. This document identifies the property and states the transfer from your name to the trust's name. Using the Sacramento California Grant Deed from Individual to Trust is essential to ensure all legal requirements are met. Additionally, make sure to record the deed with your county recorder’s office to finalize the transfer.

While putting your house in a trust in California can help with avoiding probate, there are disadvantages to consider. First, transferring your property may incur costs, such as filing fees or attorney fees, when preparing a Sacramento California Grant Deed from Individual to Trust. Additionally, you may lose some control over how the property is managed, impacting your flexibility in making future decisions. It's essential to weigh these factors carefully before making the transfer.

To transfer property to a trust in California, you must prepare a Sacramento California Grant Deed from Individual to Trust form. First, you’ll complete the deed, which outlines the current owner's information and the details of the trust. Then, sign the deed in front of a notary public and file it with the county recorder's office. This process ensures that the property title is legally transferred into the trust.

A deed is evidence of a specific event of transferring the title of the property from one person to another. A title is the legal right to use and modify the property how you see fit, or transfer interest or any portion that you own to others via a deed. A deed represents the right of the owner to claim the property.

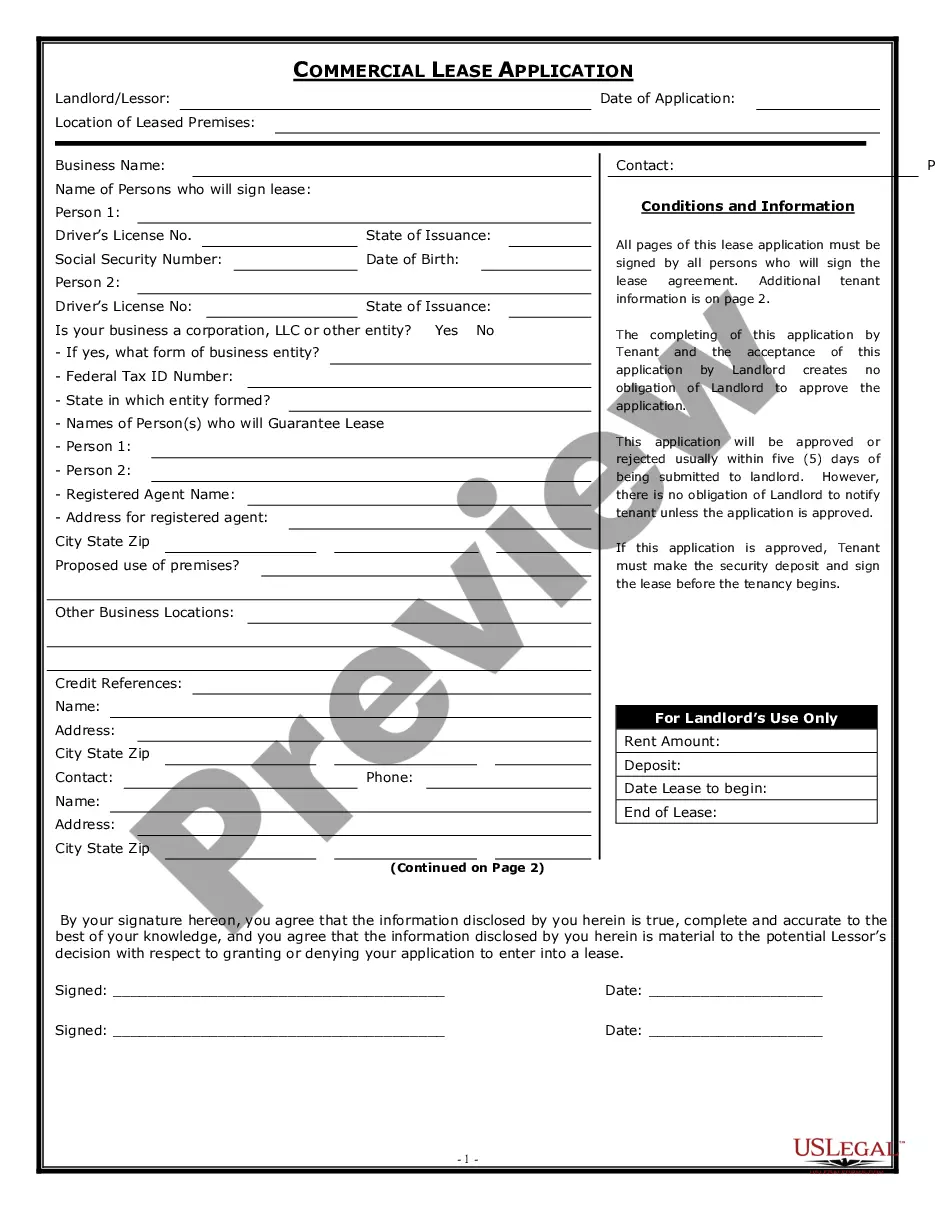

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

A grant deed is a transaction between two people or entities without securing the property as collateral. A deed of trust is used by mortgage companies when a homeowner takes out a loan against the property.

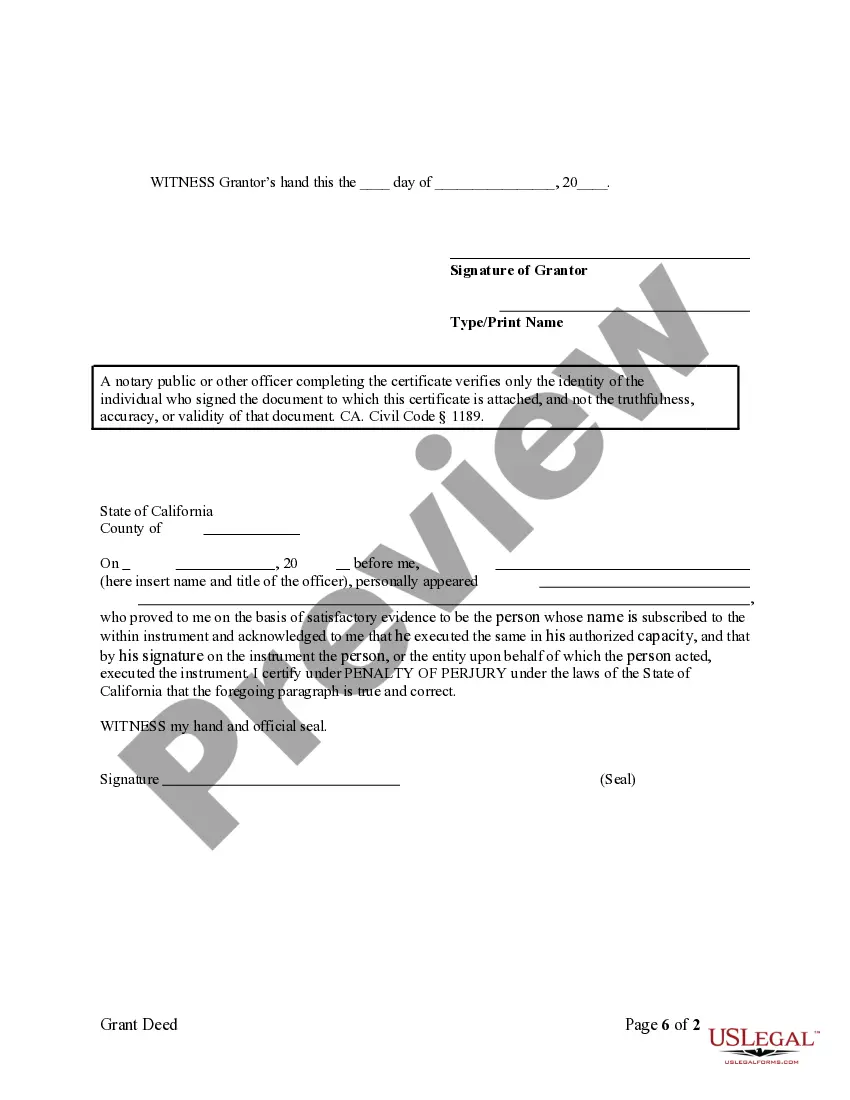

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.