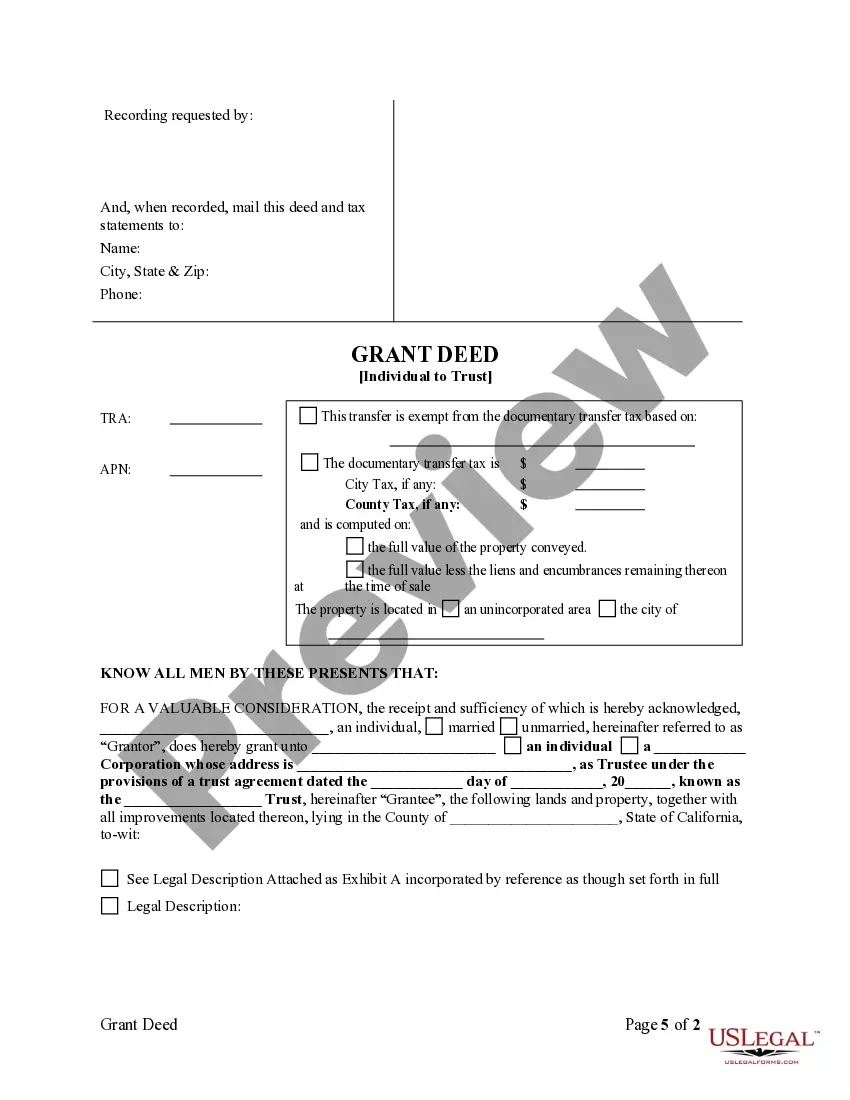

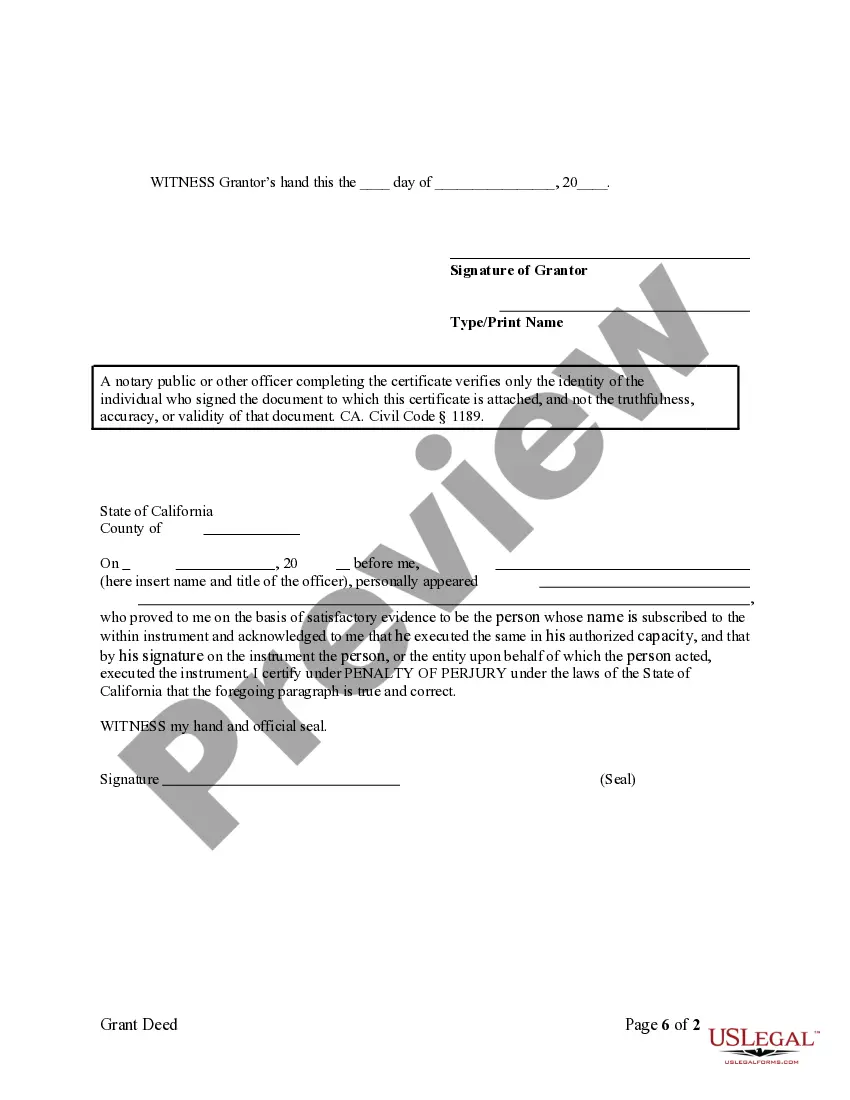

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Grant Deed from Individual to Trust is a legal document used in San Jose, California, to transfer ownership of real property from an individual to a trust. This type of deed is commonly utilized when an individual wishes to transfer their property into a trust for estate planning purposes or to ensure efficient asset management. The Grant Deed serves as proof of the transfer of ownership and typically includes relevant information such as the names of the granter (individual) and the grantee (trust), a legal description of the property being transferred, and any conditions or restrictions that may apply to the transfer. There are several variations of the Grant Deed from Individual to Trust in San Jose, California, based on specific circumstances and requirements: 1. General Grant Deed from Individual to Trust: This type of deed transfers the property from an individual owner to a trust without any warranties or guarantees regarding the title of the property. It simply implies that the granter has the right to transfer the property and conveys whatever interest they possess. 2. Special Grant Deed from Individual to Trust: In this case, the granter includes specific warranties or guarantees related to the title of the property being transferred. The granter assures that they have clear ownership of the property and that it is free from any encumbrances or claims, except those stated in the deed. 3. Quitclaim Deed from Individual to Trust: Although not technically a grant deed, a Quitclaim Deed is often employed for transferring property into a trust. This type of deed transfers whatever interest the granter possesses at the time of transfer, but it does not provide any warranties or guarantees regarding the ownership or title of the property. When creating a San Jose California Grant Deed from Individual to Trust, it is important to consult with a qualified attorney or legal professional to ensure compliance with all relevant laws and regulations. Proper execution of the deed, accurate descriptions of the property, and full disclosure of any conditions or restrictions will help to safeguard the transfer of ownership and protect the interests of all parties involved.