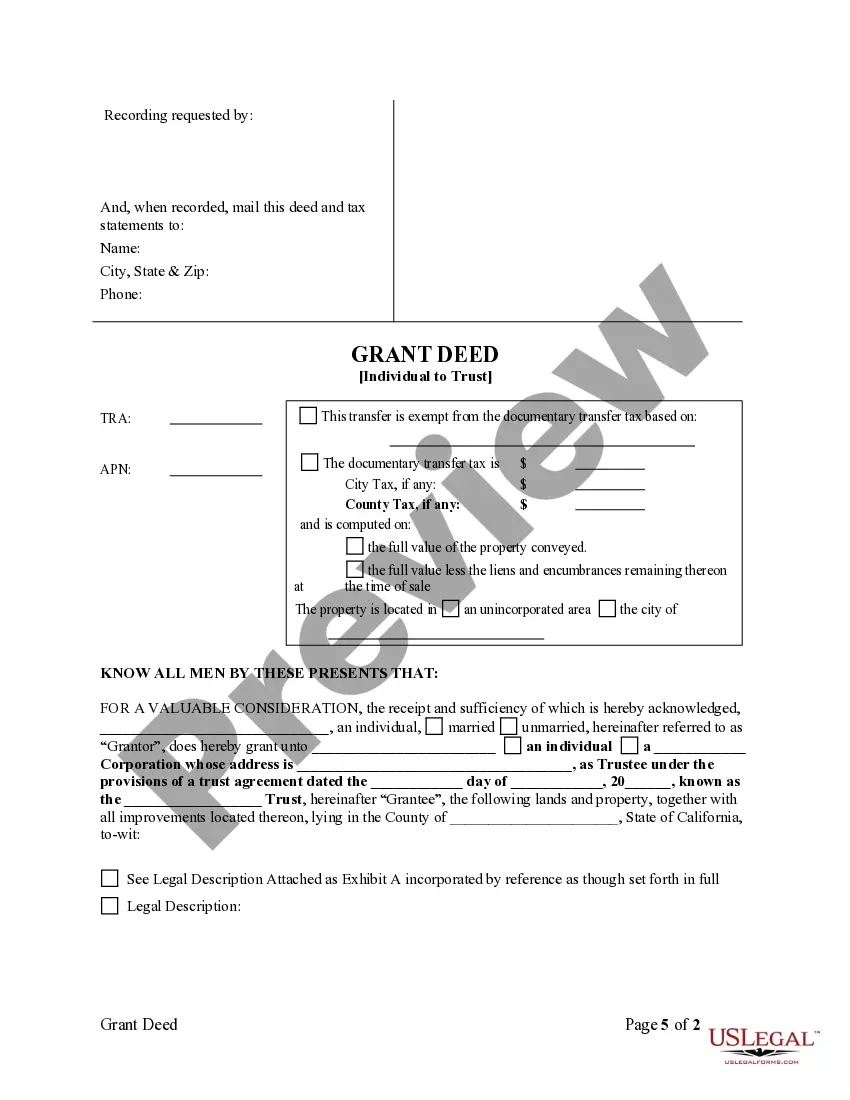

This form is a Grant or Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Thousand Oaks California Grant Deed from Individual to Trust is a legal document used to transfer ownership of real property from an individual to a trust in the city of Thousand Oaks, California. This type of deed is commonly used when an individual wishes to transfer their property to a trust for estate planning purposes, asset protection, or to facilitate smoother property management and distribution after their passing. The Grant Deed is a legal instrument that confirms the transfer of ownership rights from the individual (the granter) to the trust (the grantee). The granter relinquishes their ownership rights, title, and interest in the property, while the trust becomes the new legal owner. There may be various types of Grant Deeds from Individual to Trust in Thousand Oaks, California, depending on the specific circumstances and intentions of the parties involved. Some common types of Grant Deeds include: 1. Revocable Living Trust Grant Deed: This type of Grant Deed is frequently used for estate planning purposes. It allows the granter to transfer real property into a revocable living trust, which provides flexibility as the granter retains the ability to modify or revoke the trust during their lifetime. 2. Irrevocable Trust Grant Deed: This Grant Deed is utilized when the granter seeks to transfer ownership of property to an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be changed or terminated without the consent of the beneficiaries or a court order. It is often used for asset protection or tax planning purposes. 3. Testamentary Trust Grant Deed: This type of Grant Deed is implemented to transfer property to a trust that becomes effective upon the granter's death. It is usually established through a will or living trust, ensuring that the property is distributed according to the granter's instructions after their passing. 4. Special Needs Trust Grant Deed: This Grant Deed is employed when the granter wishes to transfer property to a trust that benefits a person with special needs. It helps ensure the individual receives the necessary care and financial support while preserving their eligibility for government benefits. In the City of Thousand Oaks, California, these various types of Grant Deeds from Individual to Trust serve as essential legal tools for estate planning and asset management. They provide a clear and legally binding transfer of property ownership from an individual to a trust, ensuring the proper management and distribution of assets according to the granter's wishes.