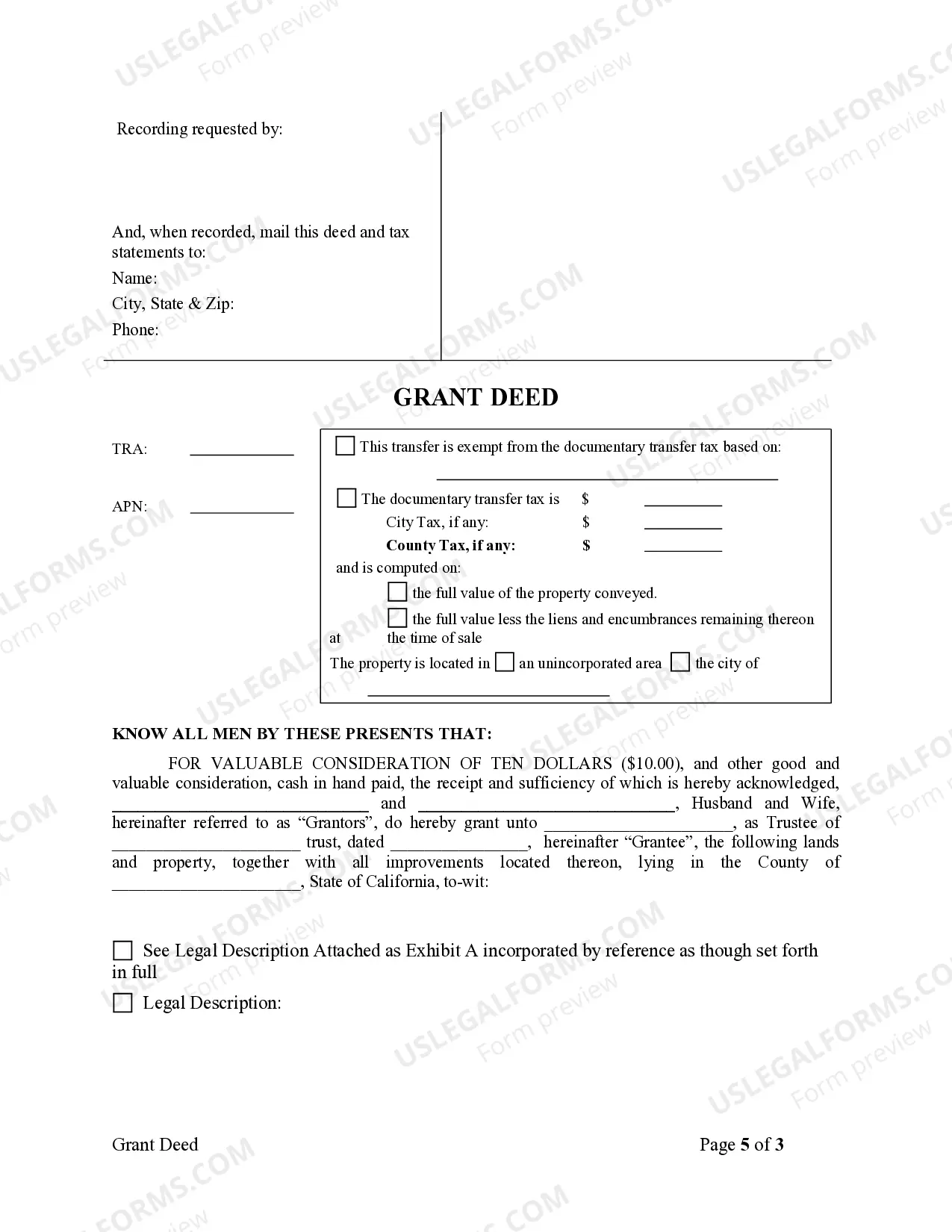

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Downey California Grant Deed from Husband and Wife to Trust is a legal document that transfers real property ownership from a married couple to a trust. This type of deed is commonly used in estate planning, allowing the couple to transfer their property to their trust for management and distribution purposes. The Downey California Grant Deed from Husband and Wife to Trust is an important tool for those looking to protect their assets, plan for potential incapacity or death, and streamline the transfer of property to beneficiaries. By transferring ownership to the trust, the couple can ensure that their property will pass smoothly to their chosen beneficiaries, avoiding probate and potential disputes. This deed is typically used in a revocable living trust, which is created by the couple during their lifetime and can be modified or revoked at any time. The trust, in essence, becomes the new legal owner of the property, while the couple retains control and use of the property during their lifetime. After their passing, the trust's designated trustee takes over management and distribution of the property according to the terms outlined in the trust document. The Downey California Grant Deed from Husband and Wife to Trust comes in different variations, each tailored to specific situations or requirements. Some of these variations include: 1. Revocable Living Trust Deed: This grant deed transfers ownership of the property to a revocable living trust created by the couple. The trust allows for flexibility in managing and distributing assets during their lifetime and ensures smooth transfer without the need for probate. 2. Irrevocable Trust Deed: This grant deed transfers ownership of the property to an irrevocable trust instead of a revocable one. Once created, an irrevocable trust cannot be easily modified or revoked, providing more certainty and asset protection. 3. Survivor's Trust Deed: This grant deed transfers ownership to a specific type of trust often used by married couples to manage their property and finances. The survivor's trust ensures that the surviving spouse retains control and benefits from the trust assets after the other spouse passes away. 4. Family Trust Deed: In this variation, the grant deed transfers property ownership to a family trust that encompasses not only the couple but also their descendants and beneficiaries. The family trust allows for broader estate planning and wealth preservation strategies. Overall, the Downey California Grant Deed from Husband and Wife to Trust is a crucial legal instrument for individuals or couples seeking to safeguard their assets, plan for the future, and ensure an efficient transfer of property. By transferring ownership to a trust, they can maintain control during their lifetime while simplifying succession and avoiding potential complications.