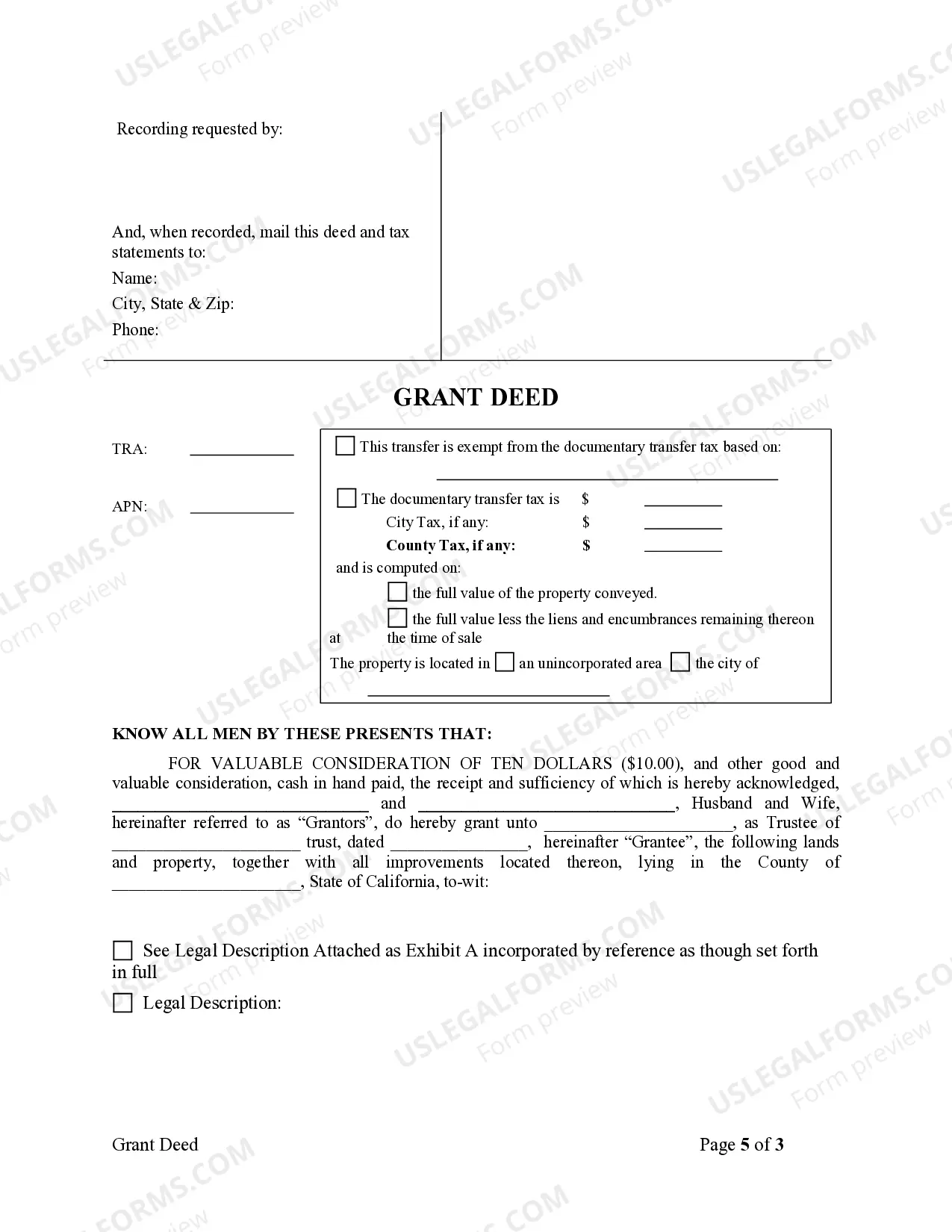

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Understanding El Cajon California Grant Deed from Husband and Wife to Trust: Types and Detailed Explanation Keywords: El Cajon California, Grant Deed, Husband and Wife, Trust, Real Estate, Property Transfer, Legal Document Introduction: El Cajon, California, is a city known for its residential neighborhoods and thriving real estate market. When it comes to transferring property ownership between spouses and a trust, the El Cajon California Grant Deed is a crucial legal document. This detailed article will provide you with an understanding of this type of deed, its significance, and the various types of El Cajon California Grant Deed from Husband and Wife to Trust. 1. What is a Grant Deed from Husband and Wife to Trust? A Grant Deed from Husband and Wife to Trust is a legal document used to transfer property ownership from spouses to a trust. This type of deed allows the couple to maintain control over the property and subsequently transfer it to a trust for estate planning purposes. 2. Types of El Cajon California Grant Deed from Husband and Wife to Trust: a) Joint Tenancy Grant Deed: In a Joint Tenancy Grant Deed, the husband and wife hold equal ownership rights and interest in the property. If one spouse passes away, their share automatically transfers to the surviving spouse. Once the transfer takes place, the surviving spouse can choose to place the property into a trust through a Grant Deed, ensuring a smooth transition of property upon their death. b) Tenancy in Common Grant Deed: With a Tenancy in Common Grant Deed, both the husband and wife have separate, undivided ownership interests in the property. Each spouse can dispose of their share as they wish, including transferring it to a trust. This type of deed allows flexibility for individual estate planning within the trust. c) Community Property Grant Deed: In community property states like California, all assets acquired during marriage are considered community property. When a husband and wife wish to transfer their jointly owned property to a trust, they can use a Community Property Grant Deed. This deed ensures that both spouses transfer their equal ownership interests to the trust, maintaining community property status within the trust structure. 3. Key Features of El Cajon California Grant Deed from Husband and Wife to Trust: a) Legal Requirements: To create a valid Grant Deed from Husband and Wife to Trust in El Cajon, California, certain legal requirements must be fulfilled. These include a clear description of the property, the names of the granters (husband and wife), the name of the trust, and the signatures of both spouses. b) Notarization and Recording: Once the Grant Deed is prepared, it must be notarized by a certified notary public and recorded with the county recorder's office in El Cajon, California. Recording the deed establishes a public record of the property transfer. Conclusion: The El Cajon California Grant Deed from Husband and Wife to Trust plays a crucial role in transferring property ownership from spouses to a trust, granting peace of mind for estate planning and asset protection. By understanding the different types of Grant Deeds and their legal requirements, individuals can ensure a smooth and secure transfer of their property. Consulting with a qualified attorney or real estate professional is recommended to navigate the complex legalities of property transfers and to customize the process according to individual needs.Title: Understanding El Cajon California Grant Deed from Husband and Wife to Trust: Types and Detailed Explanation Keywords: El Cajon California, Grant Deed, Husband and Wife, Trust, Real Estate, Property Transfer, Legal Document Introduction: El Cajon, California, is a city known for its residential neighborhoods and thriving real estate market. When it comes to transferring property ownership between spouses and a trust, the El Cajon California Grant Deed is a crucial legal document. This detailed article will provide you with an understanding of this type of deed, its significance, and the various types of El Cajon California Grant Deed from Husband and Wife to Trust. 1. What is a Grant Deed from Husband and Wife to Trust? A Grant Deed from Husband and Wife to Trust is a legal document used to transfer property ownership from spouses to a trust. This type of deed allows the couple to maintain control over the property and subsequently transfer it to a trust for estate planning purposes. 2. Types of El Cajon California Grant Deed from Husband and Wife to Trust: a) Joint Tenancy Grant Deed: In a Joint Tenancy Grant Deed, the husband and wife hold equal ownership rights and interest in the property. If one spouse passes away, their share automatically transfers to the surviving spouse. Once the transfer takes place, the surviving spouse can choose to place the property into a trust through a Grant Deed, ensuring a smooth transition of property upon their death. b) Tenancy in Common Grant Deed: With a Tenancy in Common Grant Deed, both the husband and wife have separate, undivided ownership interests in the property. Each spouse can dispose of their share as they wish, including transferring it to a trust. This type of deed allows flexibility for individual estate planning within the trust. c) Community Property Grant Deed: In community property states like California, all assets acquired during marriage are considered community property. When a husband and wife wish to transfer their jointly owned property to a trust, they can use a Community Property Grant Deed. This deed ensures that both spouses transfer their equal ownership interests to the trust, maintaining community property status within the trust structure. 3. Key Features of El Cajon California Grant Deed from Husband and Wife to Trust: a) Legal Requirements: To create a valid Grant Deed from Husband and Wife to Trust in El Cajon, California, certain legal requirements must be fulfilled. These include a clear description of the property, the names of the granters (husband and wife), the name of the trust, and the signatures of both spouses. b) Notarization and Recording: Once the Grant Deed is prepared, it must be notarized by a certified notary public and recorded with the county recorder's office in El Cajon, California. Recording the deed establishes a public record of the property transfer. Conclusion: The El Cajon California Grant Deed from Husband and Wife to Trust plays a crucial role in transferring property ownership from spouses to a trust, granting peace of mind for estate planning and asset protection. By understanding the different types of Grant Deeds and their legal requirements, individuals can ensure a smooth and secure transfer of their property. Consulting with a qualified attorney or real estate professional is recommended to navigate the complex legalities of property transfers and to customize the process according to individual needs.