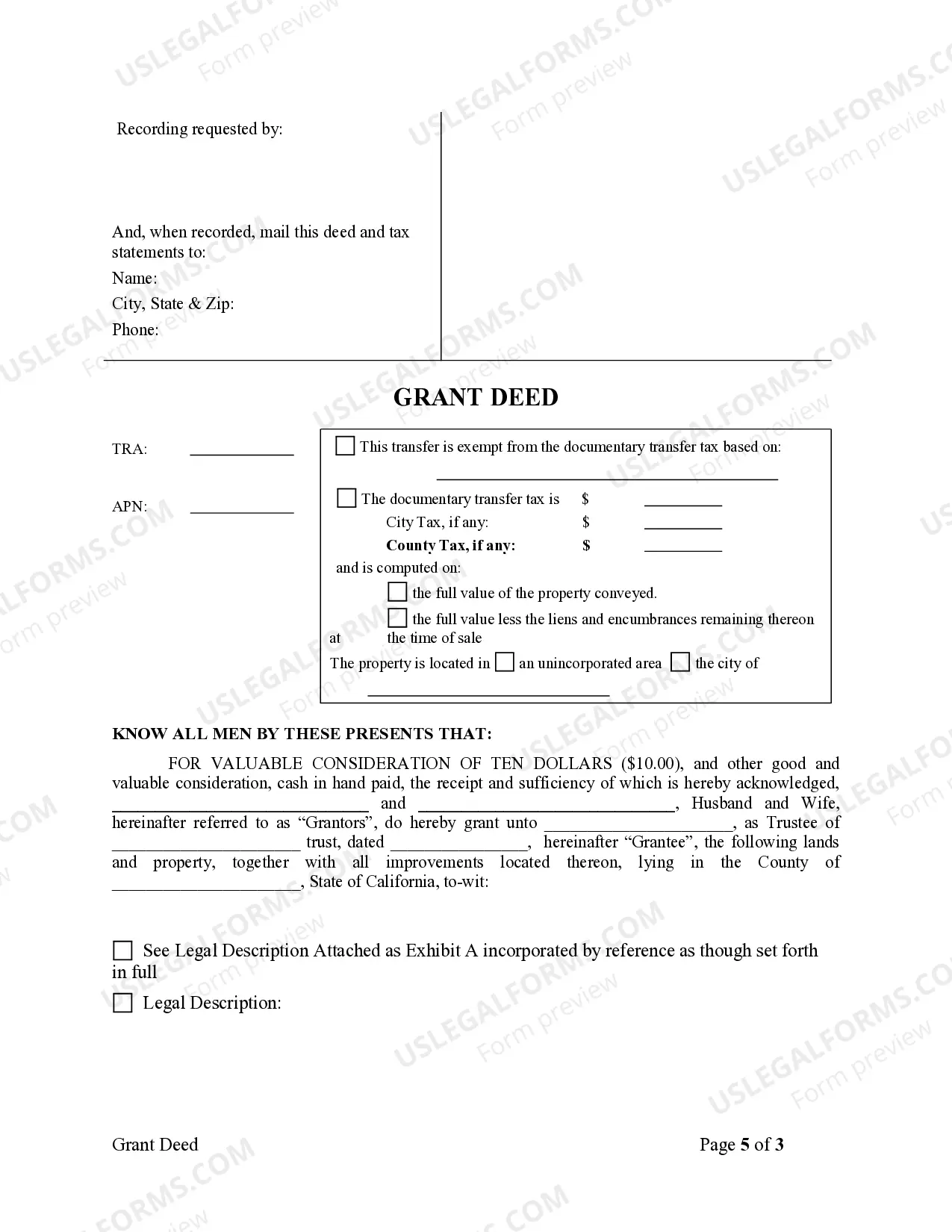

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Fullerton California Grant Deed from Husband and Wife to Trust is a legal document that transfers ownership of real estate from a married couple (husband and wife) to a trust. This type of deed is commonly used to protect and manage real property assets in estate planning and asset protection. The granter of the deed is the husband and wife, who are typically identified by their full legal names, and the grantee is the trust established by them. By executing this grant deed, the couple transfers their ownership interest in the property to the trust, which then manages the property on behalf of the beneficiaries designated in the trust. The Fullerton California Grant Deed from Husband and Wife to Trust must meet certain requirements to be legally valid. It should contain a complete legal description of the property, including the address and any relevant parcel or lot numbers. The document should clearly state the granter's intent to convey the property to the trust, using explicit language like "grant(s), bargain(s), sell(s), and convey(s)." Both spouses must sign the deed in the presence of a notary public or another authorized official. There are different variations of the Fullerton California Grant Deed from Husband and Wife to Trust, which may include: 1. Fullerton California Inter Vivos Trust Grant Deed from Husband and Wife: This type of grant deed is used when the husband and wife transfer the property to an inter vivos trust during their lifetime. Inter vivos trusts are created for estate planning purposes and can provide flexibility in managing assets during the granter's lifetime. 2. Fullerton California Revocable Trust Grant Deed from Husband and Wife: In this case, the granter transfers the property to a revocable trust established by the husband and wife. A revocable trust can be modified or revoked by the granter(s) at any time, allowing them to maintain control over the property while providing for its management after their passing. 3. Fullerton California Irrevocable Trust Grant Deed from Husband and Wife: An irrevocable trust grant deed is utilized when the husband and wife transfer ownership of the property to an irrevocable trust. Unlike revocable trusts, irrevocable trusts cannot be altered or revoked without the consent of the beneficiaries, offering enhanced asset protection and estate tax planning benefits. The Fullerton California Grant Deed from Husband and Wife to Trust is an essential legal tool for individuals or couples seeking to protect and effectively manage their real estate assets. It ensures a seamless transfer of ownership to a trust, providing a framework for asset protection, estate planning, and the smooth transition of property to designated beneficiaries.