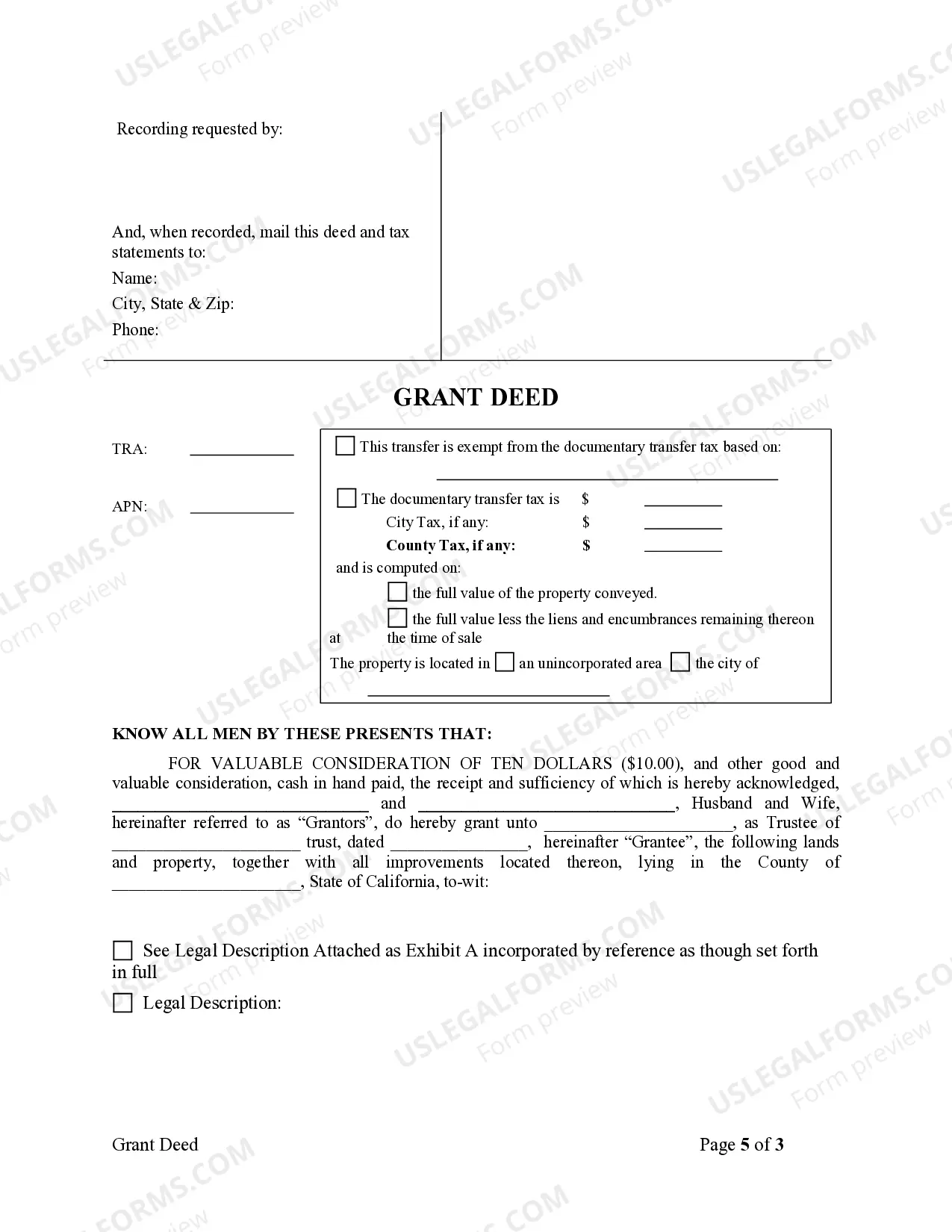

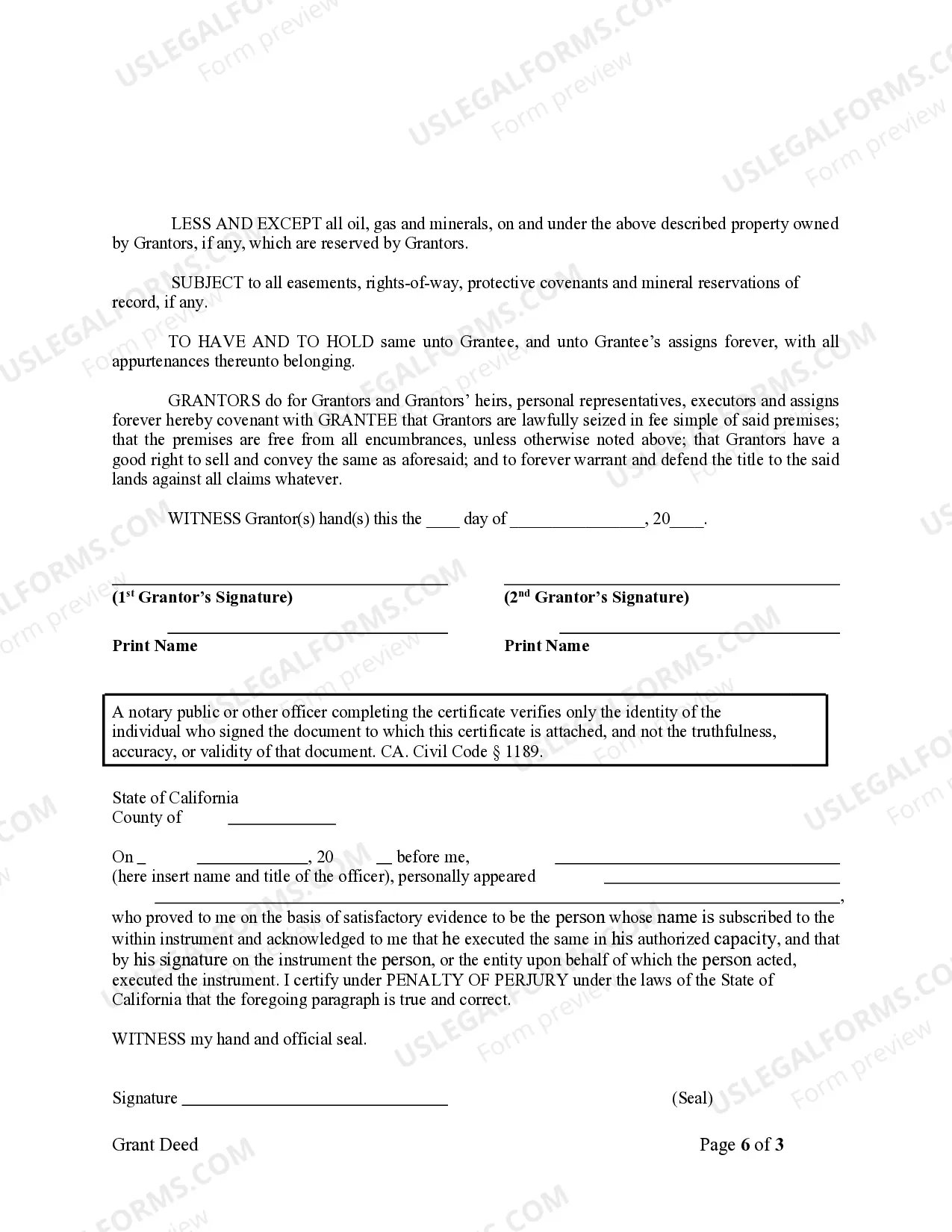

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

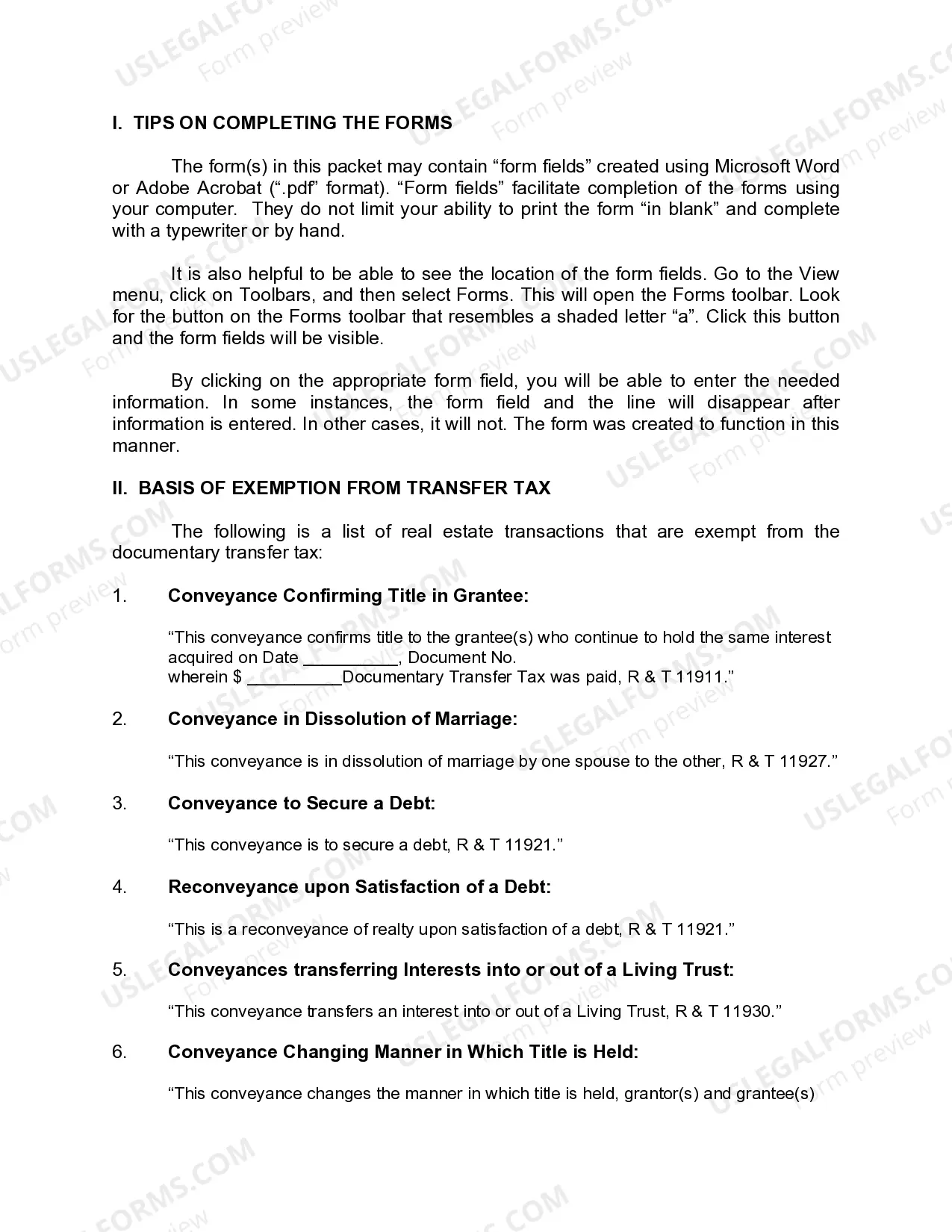

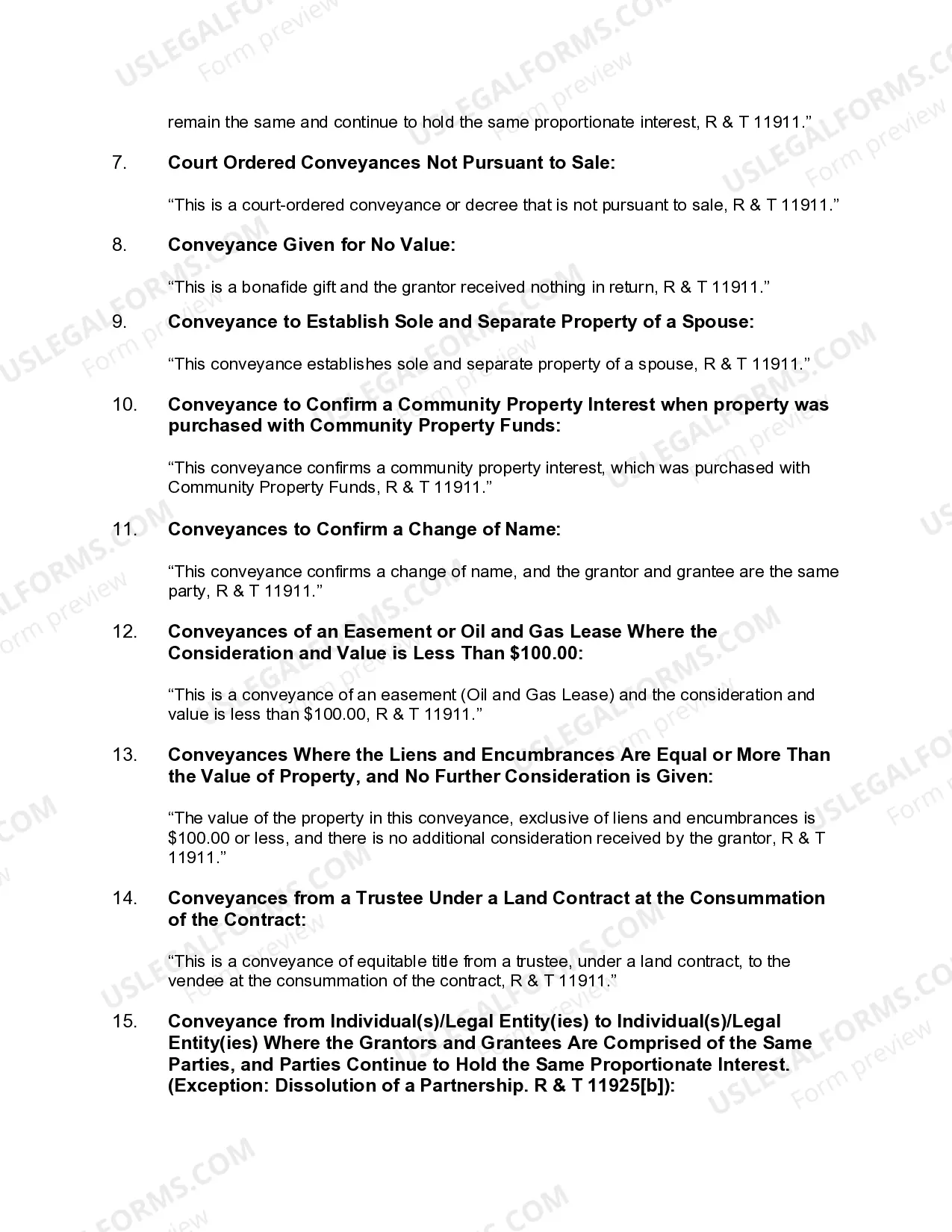

A Garden Grove California Grant Deed from Husband and Wife to Trust is a legal document that transfers ownership of a property from a married couple to a trust. This type of deed is commonly used when spouses wish to transfer their property into a trust for estate planning or asset protection purposes. The Garden Grove California Grant Deed allows the husband and wife, referred to as granters, to transfer their property to a trust, referred to as the grantee. By transferring ownership to a trust, the property is held and managed by the trust, allowing for greater control and flexibility in managing assets and passing them on to beneficiaries. In the state of California, there are two common types of Garden Grove California Grant Deeds from Husband and Wife to Trust: 1. Revocable Living Trust: Also known as a family trust, a revocable living trust is created by the husband and wife during their lifetime to hold their assets, including real estate. The trust is revocable, meaning it can be changed or dissolved by the granters at any time. This type of trust allows for easy management and flexibility during the granters' lifetime, while also ensuring a smooth transfer of assets to beneficiaries upon their passing. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked by the granters once it is established. Transferring property to an irrevocable trust can provide certain tax benefits and asset protection. This type of trust is often used for more complex estate planning strategies, such as reducing estate taxes or protecting assets from creditors. When preparing a Garden Grove California Grant Deed from Husband and Wife to Trust, it is crucial to consult with an experienced attorney or a qualified estate planner to ensure the document is drafted correctly and complies with state laws. Additionally, the deed should accurately identify the property being transferred and include detailed legal descriptions and appropriate signatures from both spouses as granters.A Garden Grove California Grant Deed from Husband and Wife to Trust is a legal document that transfers ownership of a property from a married couple to a trust. This type of deed is commonly used when spouses wish to transfer their property into a trust for estate planning or asset protection purposes. The Garden Grove California Grant Deed allows the husband and wife, referred to as granters, to transfer their property to a trust, referred to as the grantee. By transferring ownership to a trust, the property is held and managed by the trust, allowing for greater control and flexibility in managing assets and passing them on to beneficiaries. In the state of California, there are two common types of Garden Grove California Grant Deeds from Husband and Wife to Trust: 1. Revocable Living Trust: Also known as a family trust, a revocable living trust is created by the husband and wife during their lifetime to hold their assets, including real estate. The trust is revocable, meaning it can be changed or dissolved by the granters at any time. This type of trust allows for easy management and flexibility during the granters' lifetime, while also ensuring a smooth transfer of assets to beneficiaries upon their passing. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked by the granters once it is established. Transferring property to an irrevocable trust can provide certain tax benefits and asset protection. This type of trust is often used for more complex estate planning strategies, such as reducing estate taxes or protecting assets from creditors. When preparing a Garden Grove California Grant Deed from Husband and Wife to Trust, it is crucial to consult with an experienced attorney or a qualified estate planner to ensure the document is drafted correctly and complies with state laws. Additionally, the deed should accurately identify the property being transferred and include detailed legal descriptions and appropriate signatures from both spouses as granters.