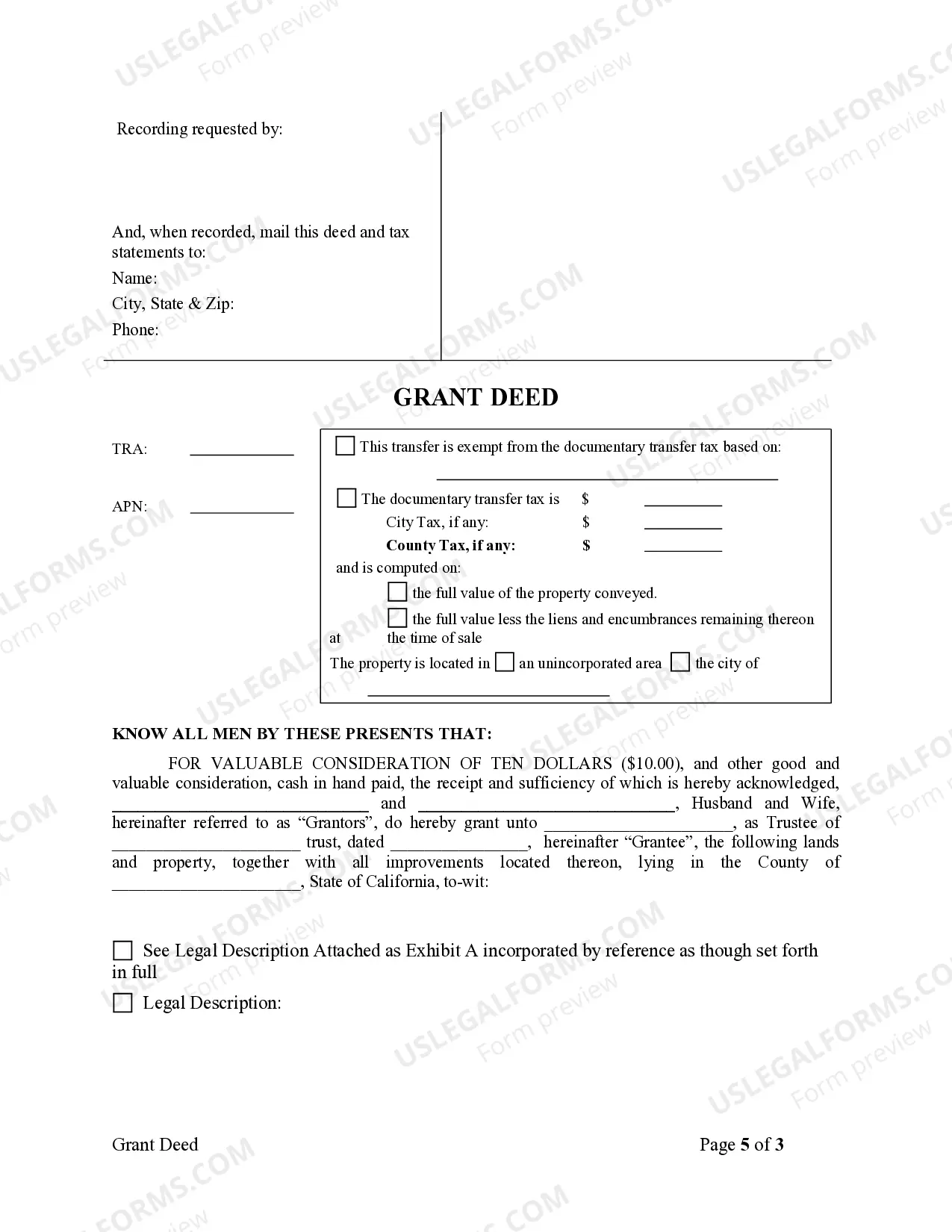

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Inglewood, California Grant Deed from Husband and Wife to Trust: A Grant Deed is a legal document that allows the transfer of ownership of real property from one party (the granter) to another party (the grantee). In the case of an Inglewood, California Grant Deed from Husband and Wife to Trust, it refers to the transfer of ownership of a property located in Inglewood, California, from a married couple (husband and wife) to a trust. This type of grant deed is commonly used when a couple wishes to transfer the ownership of their property to a trust, for various reasons such as estate planning, asset protection, or tax purposes. By transferring the property to a trust, the couple ensures that the property will be managed and distributed according to their wishes, bypassing the probate process upon their passing. The Inglewood, California Grant Deed from Husband and Wife to Trust explicitly states that the granters (the husband and wife) are conveying the property to a trust, which typically bears a specific name, such as the "Smith Family Trust" or the "Johnson Living Trust." The trust is a legal entity that holds title to the property and typically holds the couple's assets for the benefit of designated beneficiaries. Keywords: Inglewood, California, Grant Deed, Husband and Wife, Trust, real property, ownership, transfer, married couple, estate planning, asset protection, tax purposes, probate process, convey, specific name, legal entity, title, assets, beneficiaries. Types of Inglewood, California Grant Deeds from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This type of grant deed transfers the ownership of the property to a revocable living trust. The granters (husband and wife) have the ability to modify, revoke, or dissolve the trust during their lifetime, providing flexibility and control over the property. 2. Irrevocable Trust Grant Deed: In this case, the granters transfer the ownership of the property to an irrevocable trust, which means that they cannot alter or revoke the trust provisions without the consent of the beneficiaries. This type of trust may offer additional asset protection benefits and potential tax advantages. 3. Special Needs Trust Grant Deed: This grant deed is specifically designed for families with a disabled or special needs' child. It transfers the ownership of the property to a trust that is specifically tailored to provide for the financial and medical needs of the child without endangering their eligibility for government assistance programs. It is essential to consult with an experienced attorney or legal professional familiar with California real estate and trust laws to ensure the proper drafting and execution of an Inglewood, California Grant Deed from Husband and Wife to Trust, as it involves significant legal and financial implications.