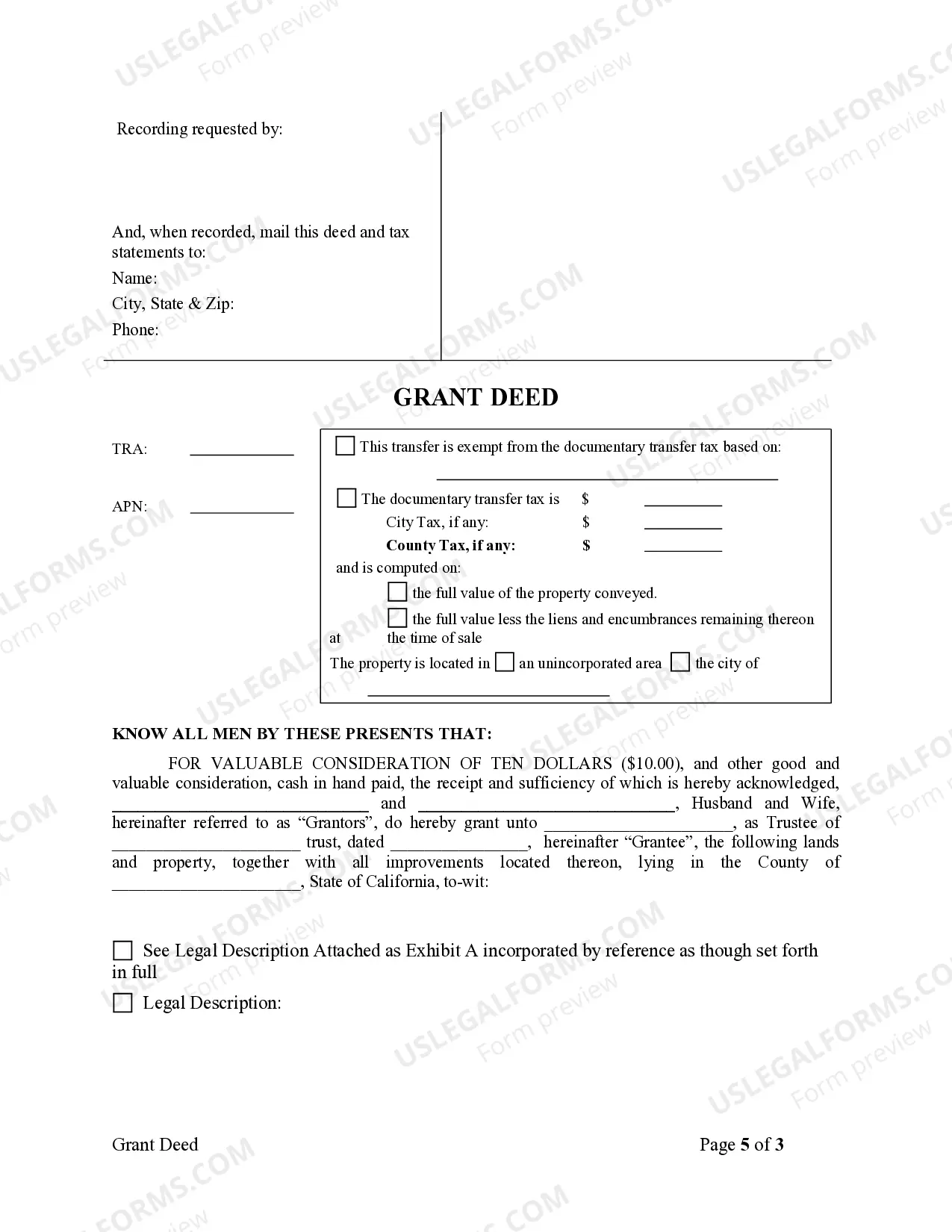

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Los Angeles California Grant Deed from Husband and Wife to Trust is a legal document that facilitates the transfer of property ownership from a married couple to a trust. This type of deed is commonly used for estate planning purposes, allowing the couple to transfer their property into a trust for various reasons, including asset protection, tax planning, and ensuring a smooth transition of ownership upon their passing. The Los Angeles California Grant Deed from Husband and Wife to Trust is executed by the husband and wife as the granters and the trust as the grantee. It conveys the couple's interest in the property to the trust, making the trust the new legal owner. By transferring property into a trust, the couple can benefit from avoiding probate, preserving privacy, and potentially minimizing estate taxes. There are several variations of Los Angeles California Grant Deed from Husband and Wife to Trust, tailored to specific needs and circumstances. Some of these variations include: 1. Revocable Living Trust Grant Deed: This type of grant deed establishes a revocable living trust, which allows the couple to retain control and make changes to the trust during their lifetime. Upon the death of one or both spouses, the trust becomes irrevocable, and the property passes according to the terms of the trust. 2. Irrevocable Trust Grant Deed: This variation of the grant deed establishes an irrevocable trust, meaning that the couple cannot make any changes or revoke the trust once it is established. An irrevocable trust can offer additional creditor protection and potential tax advantages, but the couple relinquishes control over the property. 3. Joint Tenancy Grant Deed with Right of Survivorship to Trust: This type of grant deed is used when the property is jointly held by the husband and wife as joint tenants with the right of survivorship. Upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. This grant deed transfers ownership from the couple to the trust while maintaining the right of survivorship. When preparing a Los Angeles California Grant Deed from Husband and Wife to Trust, it is crucial to consult with an experienced attorney or a licensed professional to ensure compliance with local laws, understand the specific implications of the transfer, and address any unique circumstances or requirements related to the property or the trust.