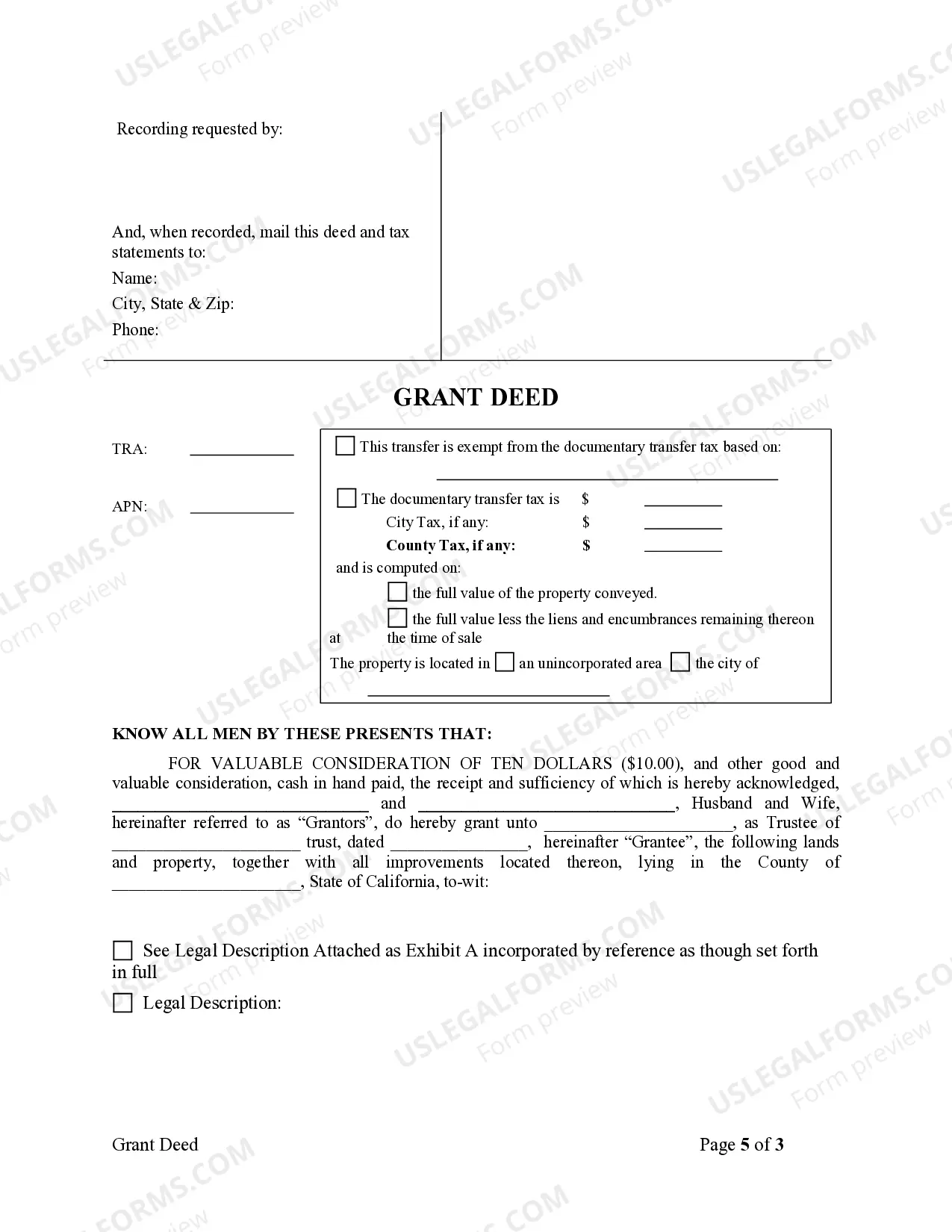

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Oceanside California Grant Deed from Husband and Wife to Trust: A Comprehensive Overview In Oceanside, California, a Grant Deed serves as a legal document used to transfer ownership of real property from the granters, typically a husband and wife, to a trust. This type of transaction facilitates the transfer of property ownership to a trust, providing a secure and efficient way to manage assets, preserve wealth, and facilitate estate planning. The Oceanside California Grant Deed from Husband and Wife to Trust is significant when individuals seek to transfer property to their revocable living or irrevocable trust. It ensures that the trust becomes the lawful owner of the property, giving full control and protection to the trust's beneficiaries. The process of executing a Grant Deed involves the following key steps: 1. Preparation: To initiate the transfer of property, a Grant Deed form is obtained or drafted, which must comply with the legal requirements prescribed by the state of California. 2. Identifying Information: The Grant Deed includes specific details identifying the granters (husband and wife) and the trust. This includes the legal names, addresses, and marital status of the granters, as well as the name of the trust and its established date. 3. Property Description: An accurate and specific legal description of the property being transferred is crucial. This includes the street address, parcel number, and any legal descriptions typically found in the property's title or previous deeds. 4. Granter's Signature: Both husband and wife must sign the Grant Deed in the presence of a notary public or other authorized official. This ensures the legality and authenticity of the document. Upon completion, the Grant Deed is recorded with the San Diego County Recorder's Office, making the transfer official and providing public notice of the change in property ownership. Different Types of Oceanside California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This type of Grant Deed establishes a revocable living trust, allowing the granters to retain control over the transferred property during their lifetime. They have the flexibility to amend or revoke the trust, ensuring increased asset protection, privacy, and efficient estate planning. 2. Irrevocable Trust Grant Deed: In contrast to a revocable living trust, an irrevocable trust Grant Deed transfers the property to an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries. An irrevocable trust provides enhanced asset protection against creditors, potential lawsuits, and estate taxes. 3. Survivorship Community Property Trust Grant Deed: This particular Grant Deed is applicable when the property is classified as community property. It transfers ownership to a survivorship community property trust, ensuring streamlined transfer of assets upon the death of one spouse to the surviving spouse, without the need for probate. By utilizing an Oceanside California Grant Deed from Husband and Wife to Trust, individuals and couples can effectively protect their assets, plan for the future, and ensure seamless distribution of property to their chosen beneficiaries in accordance with their wishes.Oceanside California Grant Deed from Husband and Wife to Trust: A Comprehensive Overview In Oceanside, California, a Grant Deed serves as a legal document used to transfer ownership of real property from the granters, typically a husband and wife, to a trust. This type of transaction facilitates the transfer of property ownership to a trust, providing a secure and efficient way to manage assets, preserve wealth, and facilitate estate planning. The Oceanside California Grant Deed from Husband and Wife to Trust is significant when individuals seek to transfer property to their revocable living or irrevocable trust. It ensures that the trust becomes the lawful owner of the property, giving full control and protection to the trust's beneficiaries. The process of executing a Grant Deed involves the following key steps: 1. Preparation: To initiate the transfer of property, a Grant Deed form is obtained or drafted, which must comply with the legal requirements prescribed by the state of California. 2. Identifying Information: The Grant Deed includes specific details identifying the granters (husband and wife) and the trust. This includes the legal names, addresses, and marital status of the granters, as well as the name of the trust and its established date. 3. Property Description: An accurate and specific legal description of the property being transferred is crucial. This includes the street address, parcel number, and any legal descriptions typically found in the property's title or previous deeds. 4. Granter's Signature: Both husband and wife must sign the Grant Deed in the presence of a notary public or other authorized official. This ensures the legality and authenticity of the document. Upon completion, the Grant Deed is recorded with the San Diego County Recorder's Office, making the transfer official and providing public notice of the change in property ownership. Different Types of Oceanside California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This type of Grant Deed establishes a revocable living trust, allowing the granters to retain control over the transferred property during their lifetime. They have the flexibility to amend or revoke the trust, ensuring increased asset protection, privacy, and efficient estate planning. 2. Irrevocable Trust Grant Deed: In contrast to a revocable living trust, an irrevocable trust Grant Deed transfers the property to an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries. An irrevocable trust provides enhanced asset protection against creditors, potential lawsuits, and estate taxes. 3. Survivorship Community Property Trust Grant Deed: This particular Grant Deed is applicable when the property is classified as community property. It transfers ownership to a survivorship community property trust, ensuring streamlined transfer of assets upon the death of one spouse to the surviving spouse, without the need for probate. By utilizing an Oceanside California Grant Deed from Husband and Wife to Trust, individuals and couples can effectively protect their assets, plan for the future, and ensure seamless distribution of property to their chosen beneficiaries in accordance with their wishes.