This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Rialto California Grant Deed from Husband and Wife to Trust

Description

How to fill out California Grant Deed From Husband And Wife To Trust?

Utilize the US Legal Forms to gain immediate access to any document you need.

Our convenient platform with numerous document templates simplifies the process of locating and acquiring nearly any document sample you desire.

You can save, complete, and validate the Rialto California Grant Deed from Spouse to Trust in just a few minutes rather than spending hours searching online for the correct template.

Using our collection is an excellent method to enhance the security of your document filing.

The Download button will be activated on all the samples you view. Moreover, you can access all previously saved documents in the My documents section.

If you do not have an account yet, follow the steps outlined below.

- Our knowledgeable lawyers frequently assess all documents to ensure that the templates are suitable for a specific area and adhere to new laws and regulations.

- How can you obtain the Rialto California Grant Deed from Spouse to Trust.

- If you already possess an account, simply Log In to your profile.

Form popularity

FAQ

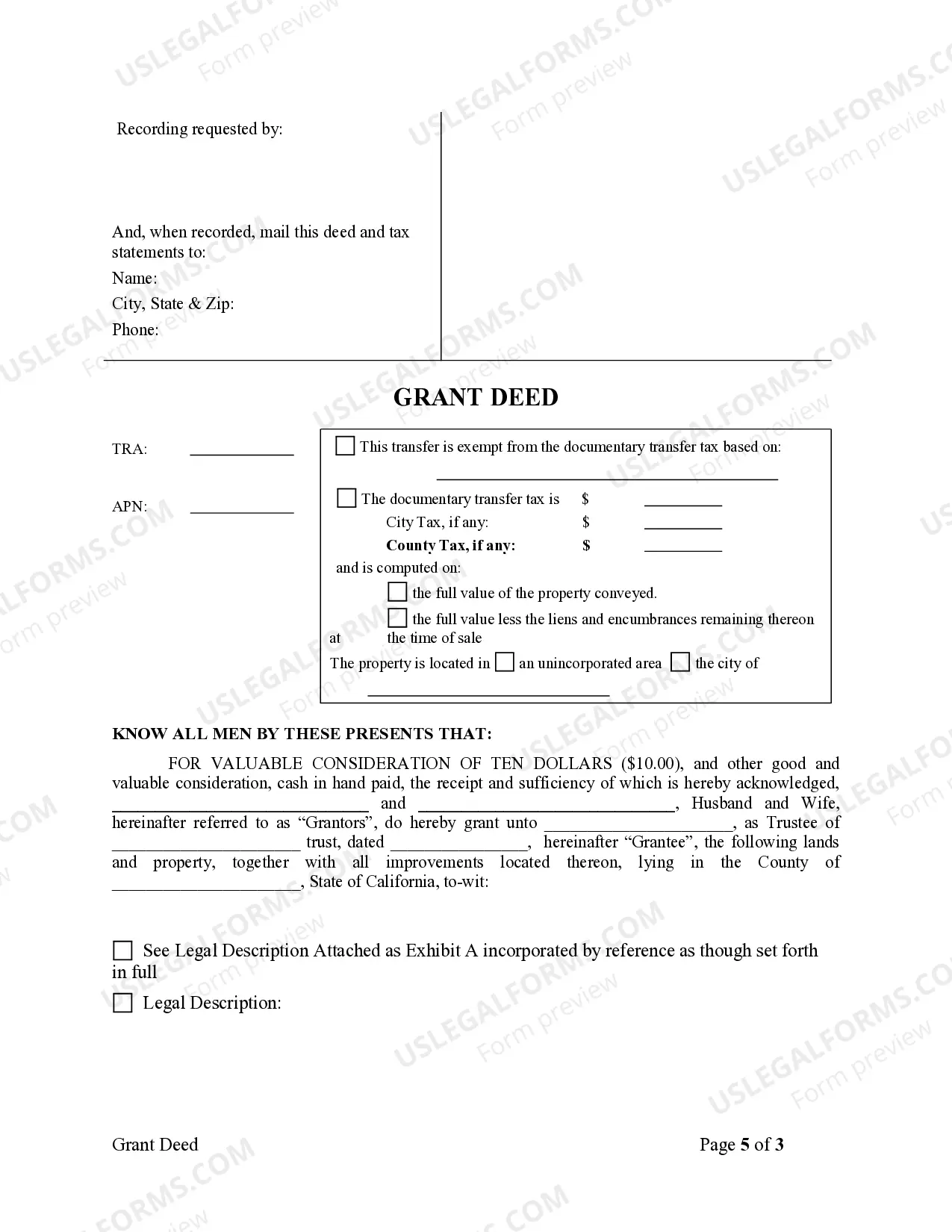

Transferring a deed to a trust in California involves several key steps. First, you need to prepare a California Grant Deed from Husband and Wife to Trust, which requires identifying the property and the trust's name. After drafting this document, you should sign it in front of a notary and then record it with your local county recorder's office. Utilizing a service like US Legal Forms can simplify this process, ensuring your Rialto California Grant Deed from Husband and Wife to Trust is completed correctly and efficiently.

To place your property in a trust in California, you must execute a Rialto California Grant Deed from Husband and Wife to Trust. This legal document transfers ownership of the property from you and your spouse to the trust. It's essential to ensure that the deed is properly drafted and recorded with the county recorder's office. Using a service like US Legal Forms can provide the necessary templates and guidance to streamline this process.

In California, a grant deed must include the names of the grantors and grantees, a sufficient property description, and the date of transfer. It should be signed by the grantors and must be notarized to be legally binding. When transferring property, like in a Rialto California Grant Deed from Husband and Wife to Trust, make sure all details are precise to avoid complications.

To fill out a grant deed form in California, start by providing the grantor's and grantee's names, which will identify the husband and wife transferring the property into the trust. Accurately describe the property, either through its legal address or parcel number. After completing the form, check it for accuracy and sign it to meet the requirements for a Rialto California Grant Deed from Husband and Wife to Trust.

You can prepare a grant deed by drafting the document yourself or using online services, such as USLegalForms. Ensure that the deed contains the necessary information, including the names of the grantors, the name of the grantee, and the property's legal description. Utilizing a trusted platform can streamline the process and ensure you meet all requirements for a Rialto California Grant Deed from Husband and Wife to Trust.

To fill out a California grant deed, start by entering the name of the current property owner, which in this case is the husband and wife. Next, provide the name of the trust that will receive the property. Include a legal description of the property, such as its address or parcel number. Finally, sign and date the document, ensuring that it meets the standards for a Rialto California Grant Deed from Husband and Wife to Trust.

A grant deed is a legal document that transfers ownership of property from one party to another, ensuring that no other party has a claim against that property. On the other hand, a trust transfer deed specifically designates how the property owned by individuals, like a husband and wife, can be managed and distributed through a trust. In the context of a Rialto California Grant Deed from Husband and Wife to Trust, the grant deed conveys property into the trust, providing clarity on ownership and future distribution. Understanding these differences is crucial for anyone looking to securely transfer property in Rialto.