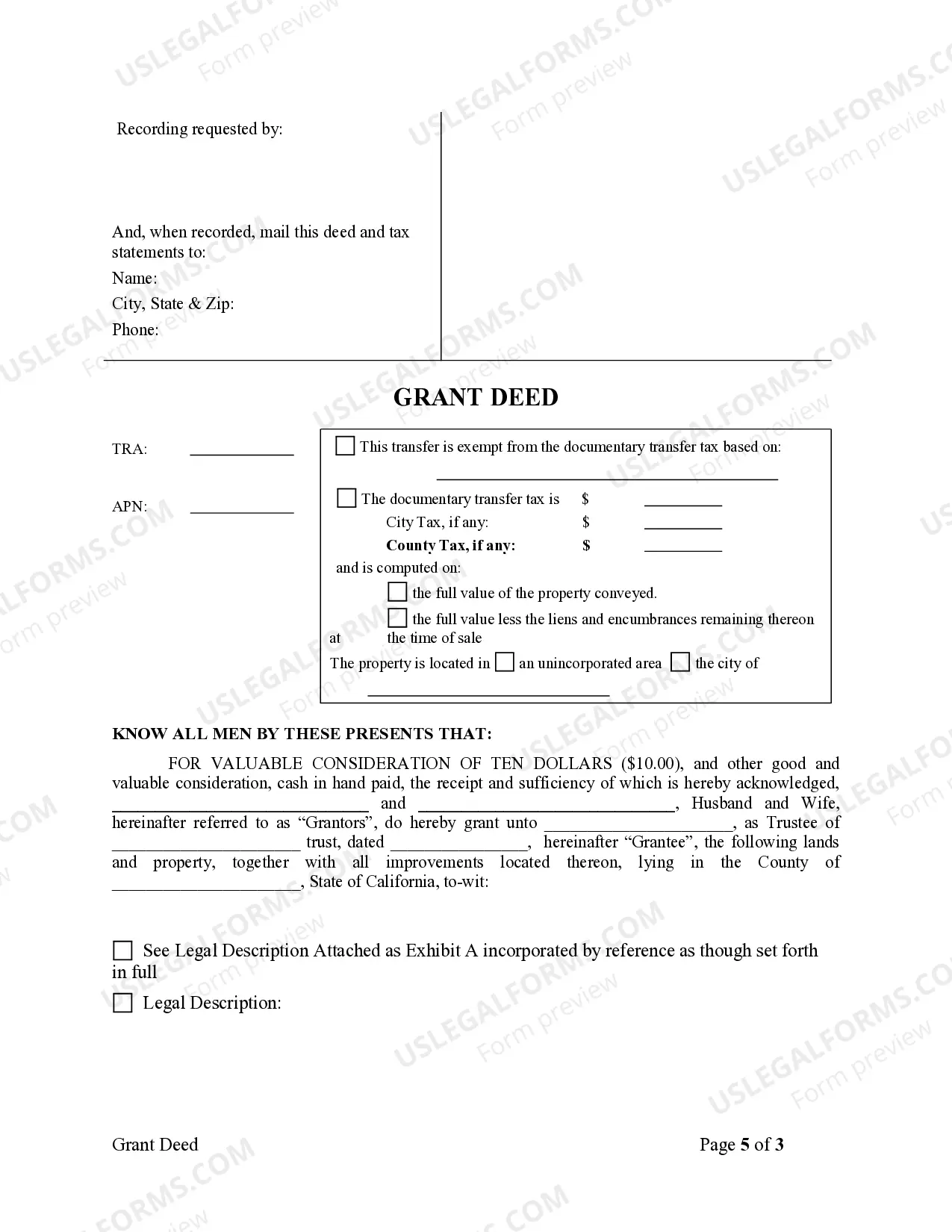

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Riverside California Grant Deed from Husband and Wife to Trust is a legal document that facilitates the transfer of property ownership from a married couple to a trust entity. This mechanism is commonly used to protect assets, ensure proper estate planning, and enable seamless transfer of property upon the death of either or both spouses. In Riverside County, California, several types of Grant Deeds from Husband and Wife to Trust can be executed based on specific requirements and circumstances. These include: 1. Riverside California Inter Vivos Trust: This type of Grant Deed is used when a married couple wishes to transfer property ownership to a revocable living trust during their lifetime. An inter vivos trust allows for flexibility, control, and easier transfer of assets upon the death of the granters (spouses). 2. Riverside California Testamentary Trust: Unlike an inter vivos trust, a testamentary trust is established through a will and comes into effect only after the death of the granters. A Grant Deed from Husband and Wife to Testamentary Trust enables the transfer of property ownership to this trust, which will only be funded upon the death of the granters. 3. Riverside California Irrevocable Trust: An irrevocable trust is a legal arrangement where the granters permanently relinquish ownership and control of the property. The Grant Deed from Husband and Wife to Irrevocable Trust secures the transfer of assets to this trust and ensures that they are protected from potential creditors, estate taxes, or other legal claims. 4. Riverside California Family Trust: A Grant Deed from Husband and Wife to Family Trust is used when a married couple wishes to transfer their jointly owned property to a trust that benefits their family members, including children, grandchildren, or other relatives. This type of trust allows the granters to maintain control over assets and determine the beneficiaries' rights and terms. When drafting and executing a Riverside California Grant Deed from Husband and Wife to Trust, it is crucial to consult with a qualified real estate attorney to ensure compliance with local laws, specific legal requirements, and any potential tax implications. Additionally, it is important to accurately describe the property being transferred and include relevant legal keywords, such as "trust agreement," "granters," "beneficiaries," "revocable/irrevocable trust," "testamentary trust," "inter vivos trust," and "Riverside County, California."A Riverside California Grant Deed from Husband and Wife to Trust is a legal document that facilitates the transfer of property ownership from a married couple to a trust entity. This mechanism is commonly used to protect assets, ensure proper estate planning, and enable seamless transfer of property upon the death of either or both spouses. In Riverside County, California, several types of Grant Deeds from Husband and Wife to Trust can be executed based on specific requirements and circumstances. These include: 1. Riverside California Inter Vivos Trust: This type of Grant Deed is used when a married couple wishes to transfer property ownership to a revocable living trust during their lifetime. An inter vivos trust allows for flexibility, control, and easier transfer of assets upon the death of the granters (spouses). 2. Riverside California Testamentary Trust: Unlike an inter vivos trust, a testamentary trust is established through a will and comes into effect only after the death of the granters. A Grant Deed from Husband and Wife to Testamentary Trust enables the transfer of property ownership to this trust, which will only be funded upon the death of the granters. 3. Riverside California Irrevocable Trust: An irrevocable trust is a legal arrangement where the granters permanently relinquish ownership and control of the property. The Grant Deed from Husband and Wife to Irrevocable Trust secures the transfer of assets to this trust and ensures that they are protected from potential creditors, estate taxes, or other legal claims. 4. Riverside California Family Trust: A Grant Deed from Husband and Wife to Family Trust is used when a married couple wishes to transfer their jointly owned property to a trust that benefits their family members, including children, grandchildren, or other relatives. This type of trust allows the granters to maintain control over assets and determine the beneficiaries' rights and terms. When drafting and executing a Riverside California Grant Deed from Husband and Wife to Trust, it is crucial to consult with a qualified real estate attorney to ensure compliance with local laws, specific legal requirements, and any potential tax implications. Additionally, it is important to accurately describe the property being transferred and include relevant legal keywords, such as "trust agreement," "granters," "beneficiaries," "revocable/irrevocable trust," "testamentary trust," "inter vivos trust," and "Riverside County, California."