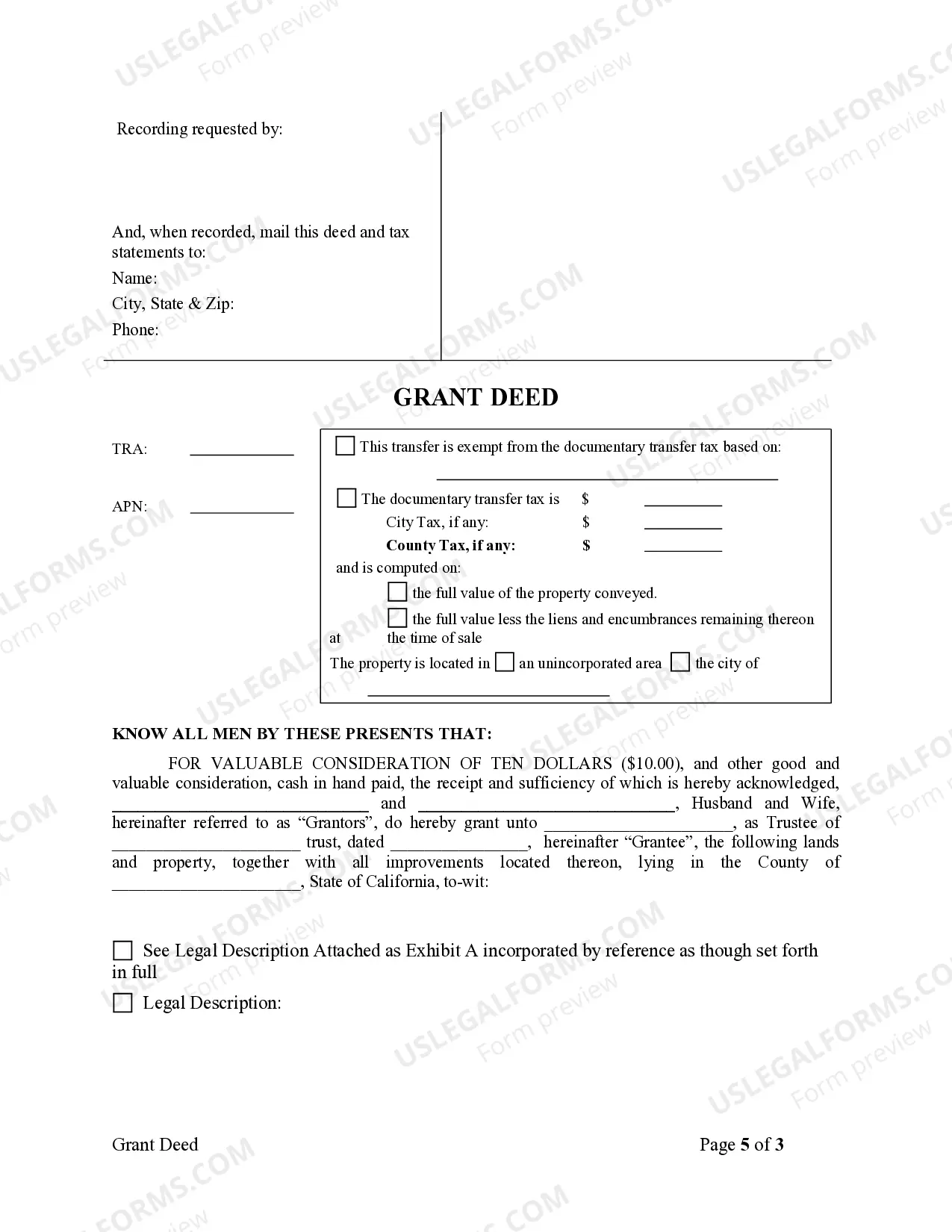

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Sacramento California Grant Deed from Husband and Wife to Trust is a legal document that signifies the transfer of property ownership from a married couple to a trust. This type of deed ensures that the property is held in the name of the trust, rather than being directly owned by the individuals. Several variations of the Sacramento California Grant Deed from Husband and Wife to Trust include: 1. Joint Tenancy Grant Deed: This type of grant deed establishes joint tenancy ownership between the husband and wife, creating equal shares of the property in the trust. It also ensures automatic transfer of ownership to the surviving spouse upon the death of one spouse. 2. Tenancy in Common Grant Deed: In this scenario, the husband and wife each hold a separate undivided interest in the property, without the right of survivorship. If one spouse passes away, their ownership interest passes to their named beneficiaries. 3. Community Property with Right of Survivorship Grant Deed: This grant deed establishes community property ownership, where both spouses equally own the property. With the right of survivorship, the surviving spouse automatically inherits full ownership upon the death of the other spouse, avoiding probate. 4. Community Property Grant Deed: Similar to the Community Property with Right of Survivorship Grant Deed, this type of grant deed designates the property as community property but does not include the right of survivorship. Upon the death of one spouse, their portion can be transferred to beneficiaries through a will or trust. Transferring property to a trust through a Sacramento California Grant Deed from Husband and Wife to Trust offers several benefits, such as asset protection, avoidance of probate, and potential tax advantages. It is crucial to consult with a qualified attorney or real estate professional before completing such legal documentation, as specific requirements and considerations may vary depending on individual circumstances and local laws.A Sacramento California Grant Deed from Husband and Wife to Trust is a legal document that signifies the transfer of property ownership from a married couple to a trust. This type of deed ensures that the property is held in the name of the trust, rather than being directly owned by the individuals. Several variations of the Sacramento California Grant Deed from Husband and Wife to Trust include: 1. Joint Tenancy Grant Deed: This type of grant deed establishes joint tenancy ownership between the husband and wife, creating equal shares of the property in the trust. It also ensures automatic transfer of ownership to the surviving spouse upon the death of one spouse. 2. Tenancy in Common Grant Deed: In this scenario, the husband and wife each hold a separate undivided interest in the property, without the right of survivorship. If one spouse passes away, their ownership interest passes to their named beneficiaries. 3. Community Property with Right of Survivorship Grant Deed: This grant deed establishes community property ownership, where both spouses equally own the property. With the right of survivorship, the surviving spouse automatically inherits full ownership upon the death of the other spouse, avoiding probate. 4. Community Property Grant Deed: Similar to the Community Property with Right of Survivorship Grant Deed, this type of grant deed designates the property as community property but does not include the right of survivorship. Upon the death of one spouse, their portion can be transferred to beneficiaries through a will or trust. Transferring property to a trust through a Sacramento California Grant Deed from Husband and Wife to Trust offers several benefits, such as asset protection, avoidance of probate, and potential tax advantages. It is crucial to consult with a qualified attorney or real estate professional before completing such legal documentation, as specific requirements and considerations may vary depending on individual circumstances and local laws.