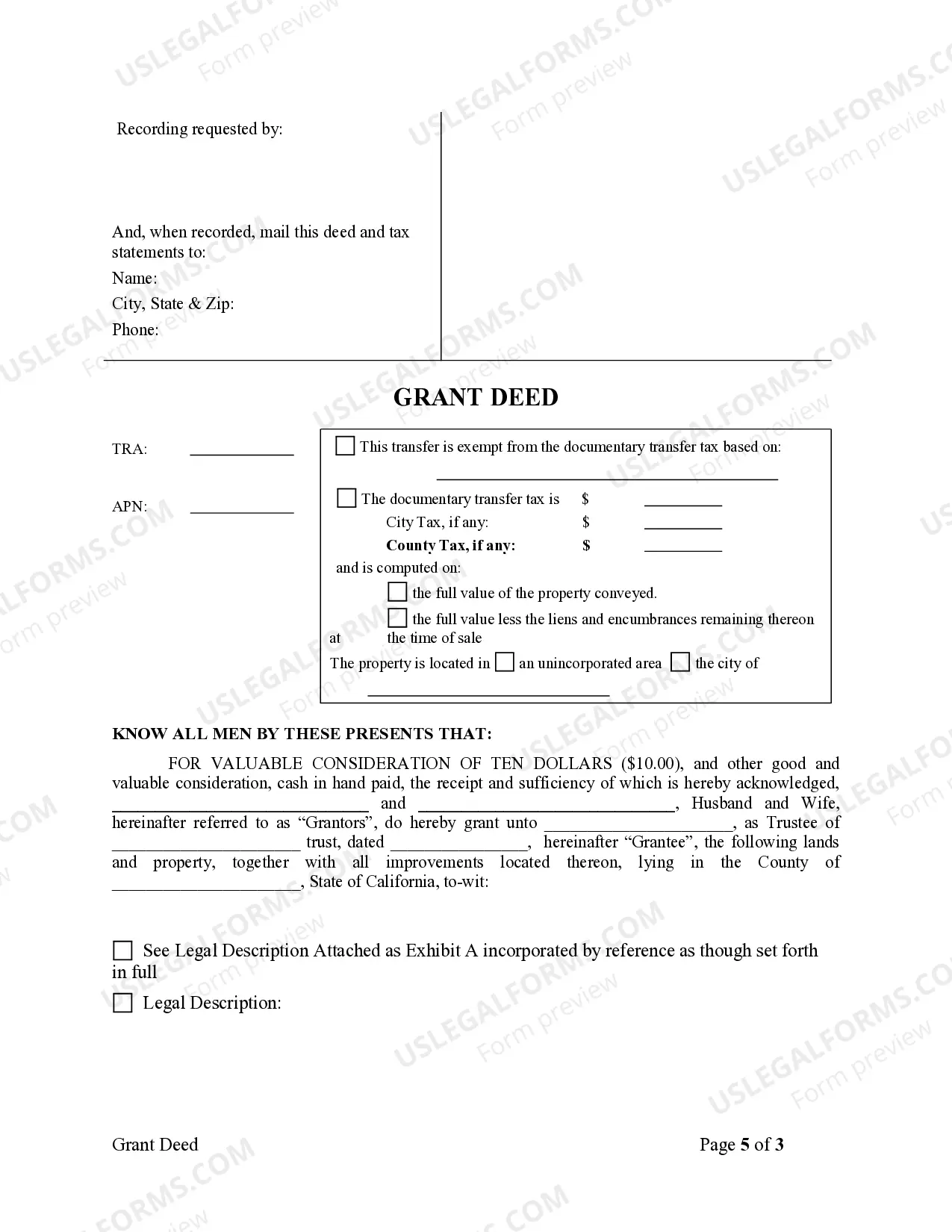

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Salinas California Grant Deed from Husband and Wife to Trust is a legal document that transfers the ownership of real property from a husband and wife to a trust. This type of deed is commonly used in estate planning to ensure smooth asset transfer and avoid probate. The grant deed is a written agreement that transmits the interest of the granter (the husband and wife) to the grantee (the trust). By transferring the property to the trust, the couple effectively removes themselves as individual owners and becomes beneficiaries of the trust. This arrangement provides various estate planning benefits, including asset protection, tax advantages, and the ability to dictate the distribution of assets after their passing. The Salinas California Grant Deed from Husband and Wife to Trust is often utilized to shield assets from potential creditors or lawsuits. It is important to know that this type of property transfer does not relieve the couple of personal liability for existing mortgages or liens on the property. The trust becomes the new legal owner, but the couple remains responsible for any outstanding debts associated with the property. There are primarily two types of Salinas California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This grant deed establishes a revocable living trust, which allows the husband and wife to maintain control over their assets during their lifetime. They can modify or revoke the trust at any time, and they typically serve as trustees while alive. After their passing, the successor trustee named in the trust document takes over the administration and distribution of assets according to the couple's wishes. 2. Irrevocable Living Trust Grant Deed: In contrast to the revocable living trust, an irrevocable living trust is binding and cannot be altered or terminated without the consent of all parties involved. This type of trust is often used for advanced estate planning purposes, such as minimizing estate taxes or protecting assets from Medicaid eligibility requirements. Once the property is transferred to an irrevocable living trust, the couple relinquishes control and ownership rights. In conclusion, a Salinas California Grant Deed from Husband and Wife to Trust is a legal tool to transfer property ownership to a trust, providing estate planning benefits and avoiding probate. The two primary types of such deeds are revocable living trust grant deeds and irrevocable living trust grant deeds. This document safeguards the couple's assets while allowing for efficient asset distribution and potential tax savings.A Salinas California Grant Deed from Husband and Wife to Trust is a legal document that transfers the ownership of real property from a husband and wife to a trust. This type of deed is commonly used in estate planning to ensure smooth asset transfer and avoid probate. The grant deed is a written agreement that transmits the interest of the granter (the husband and wife) to the grantee (the trust). By transferring the property to the trust, the couple effectively removes themselves as individual owners and becomes beneficiaries of the trust. This arrangement provides various estate planning benefits, including asset protection, tax advantages, and the ability to dictate the distribution of assets after their passing. The Salinas California Grant Deed from Husband and Wife to Trust is often utilized to shield assets from potential creditors or lawsuits. It is important to know that this type of property transfer does not relieve the couple of personal liability for existing mortgages or liens on the property. The trust becomes the new legal owner, but the couple remains responsible for any outstanding debts associated with the property. There are primarily two types of Salinas California Grant Deed from Husband and Wife to Trust: 1. Revocable Living Trust Grant Deed: This grant deed establishes a revocable living trust, which allows the husband and wife to maintain control over their assets during their lifetime. They can modify or revoke the trust at any time, and they typically serve as trustees while alive. After their passing, the successor trustee named in the trust document takes over the administration and distribution of assets according to the couple's wishes. 2. Irrevocable Living Trust Grant Deed: In contrast to the revocable living trust, an irrevocable living trust is binding and cannot be altered or terminated without the consent of all parties involved. This type of trust is often used for advanced estate planning purposes, such as minimizing estate taxes or protecting assets from Medicaid eligibility requirements. Once the property is transferred to an irrevocable living trust, the couple relinquishes control and ownership rights. In conclusion, a Salinas California Grant Deed from Husband and Wife to Trust is a legal tool to transfer property ownership to a trust, providing estate planning benefits and avoiding probate. The two primary types of such deeds are revocable living trust grant deeds and irrevocable living trust grant deeds. This document safeguards the couple's assets while allowing for efficient asset distribution and potential tax savings.