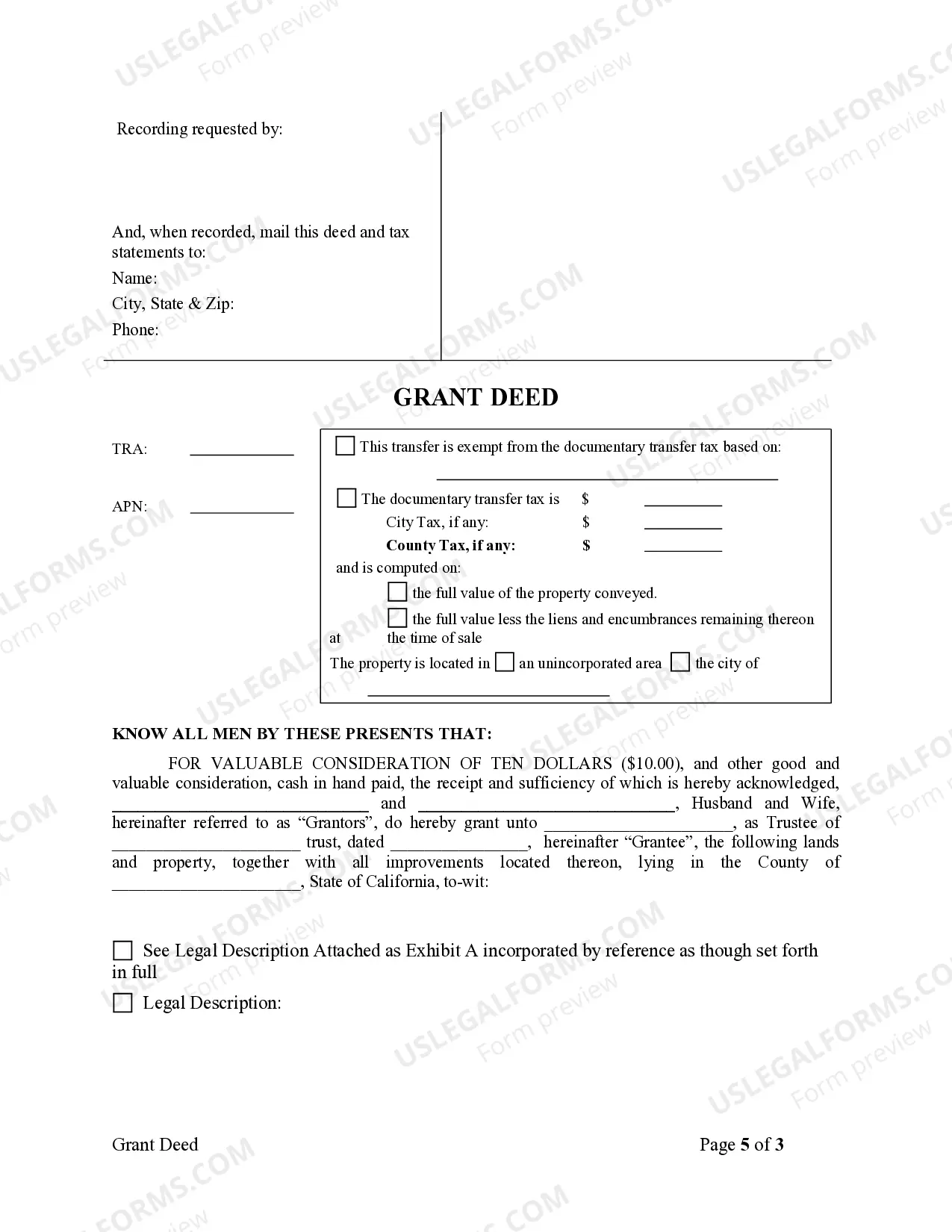

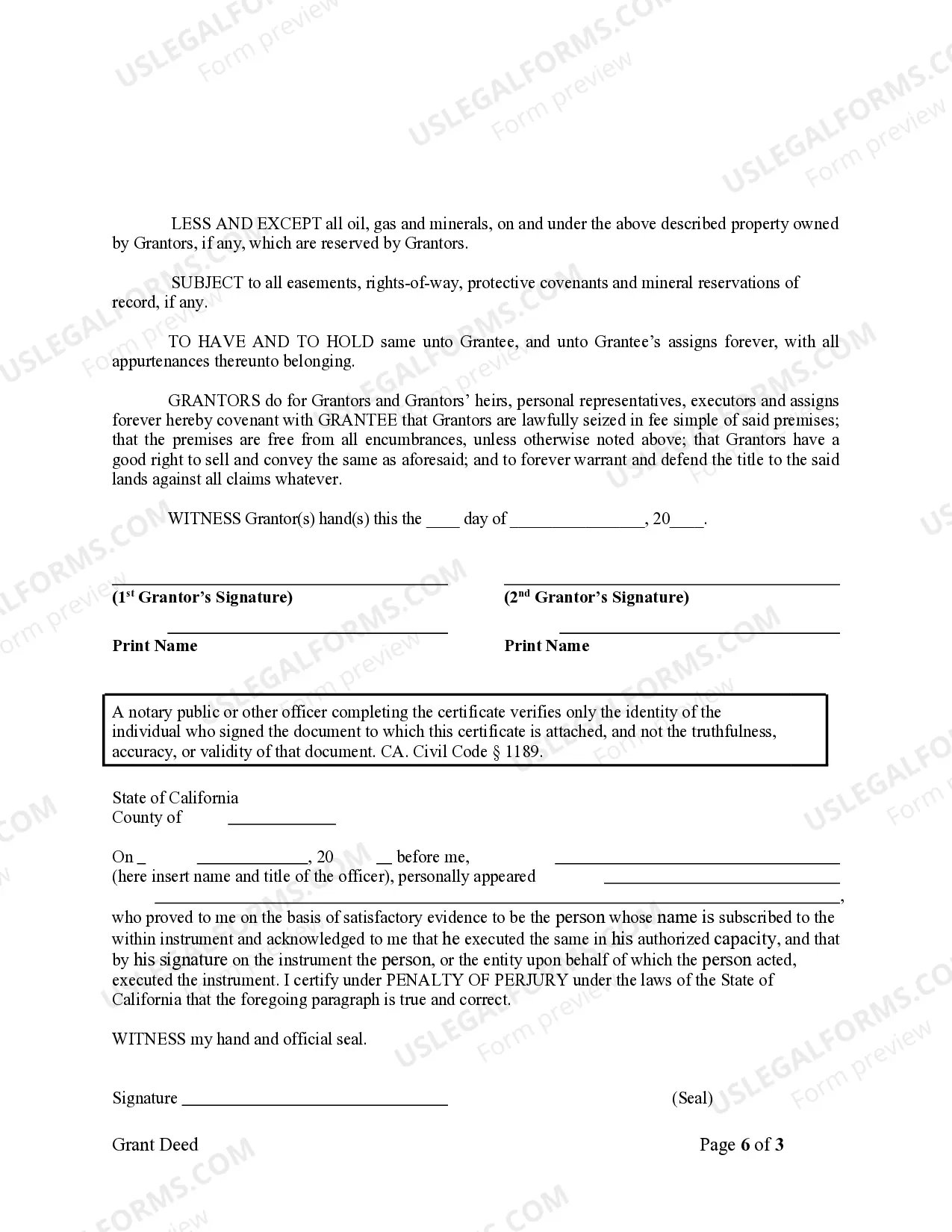

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A San Diego California Grant Deed from Husband and Wife to Trust is a legal document that allows a married couple to transfer ownership of their real property to a trust they have established. This type of deed is commonly used for estate planning purposes, ensuring a smooth transition of property ownership in the event of the couple's incapacitation or passing. The granter, which is the married couple, conveys their interest in the property to themselves as trustees of a trust. The grantee, in this case, is the trust itself. By transferring ownership to the trust, the property becomes an asset of the trust rather than belonging to the individuals directly. This can have various benefits, including avoiding probate, minimizing estate taxes, and allowing for more seamless asset management. Different types of San Diego California Grant Deeds from Husband and Wife to Trust may include: 1. Joint Tenancy Grant Deed: This type of grant deed is used when a husband and wife want to transfer their property into a joint tenancy trust. The joint tenancy structure allows for a right of survivorship, meaning that if one spouse passes away, the other becomes the sole owner of the property without the need for probate. 2. Community Property Grant Deed: In California, property acquired during a marriage is generally considered community property, meaning it belongs equally to both spouses. A community property grant deed allows the couple to transfer their ownership interest into a trust, ensuring that the property remains a part of the community property estate. 3. Tenancy in Common Grant Deed: With a tenancy in common grant deed, the husband and wife can transfer their property to a trust while specifying their ownership as tenants in common. This means that they each hold a separate, undivided interest in the property, which can be inherited or sold individually. 4. Revocable Living Trust Grant Deed: A revocable living trust grant deed is a common type of grant deed used in estate planning. It allows the husband and wife to transfer their property to a revocable living trust, which they can change or terminate during their lifetimes. This type of trust provides flexibility and control over the assets while still facilitating an easy transfer of ownership upon their passing. It's important to consult with a qualified attorney when considering a San Diego California Grant Deed from Husband and Wife to Trust, as they can provide guidance tailored to your specific situation and ensure the legal validity of the document.A San Diego California Grant Deed from Husband and Wife to Trust is a legal document that allows a married couple to transfer ownership of their real property to a trust they have established. This type of deed is commonly used for estate planning purposes, ensuring a smooth transition of property ownership in the event of the couple's incapacitation or passing. The granter, which is the married couple, conveys their interest in the property to themselves as trustees of a trust. The grantee, in this case, is the trust itself. By transferring ownership to the trust, the property becomes an asset of the trust rather than belonging to the individuals directly. This can have various benefits, including avoiding probate, minimizing estate taxes, and allowing for more seamless asset management. Different types of San Diego California Grant Deeds from Husband and Wife to Trust may include: 1. Joint Tenancy Grant Deed: This type of grant deed is used when a husband and wife want to transfer their property into a joint tenancy trust. The joint tenancy structure allows for a right of survivorship, meaning that if one spouse passes away, the other becomes the sole owner of the property without the need for probate. 2. Community Property Grant Deed: In California, property acquired during a marriage is generally considered community property, meaning it belongs equally to both spouses. A community property grant deed allows the couple to transfer their ownership interest into a trust, ensuring that the property remains a part of the community property estate. 3. Tenancy in Common Grant Deed: With a tenancy in common grant deed, the husband and wife can transfer their property to a trust while specifying their ownership as tenants in common. This means that they each hold a separate, undivided interest in the property, which can be inherited or sold individually. 4. Revocable Living Trust Grant Deed: A revocable living trust grant deed is a common type of grant deed used in estate planning. It allows the husband and wife to transfer their property to a revocable living trust, which they can change or terminate during their lifetimes. This type of trust provides flexibility and control over the assets while still facilitating an easy transfer of ownership upon their passing. It's important to consult with a qualified attorney when considering a San Diego California Grant Deed from Husband and Wife to Trust, as they can provide guidance tailored to your specific situation and ensure the legal validity of the document.