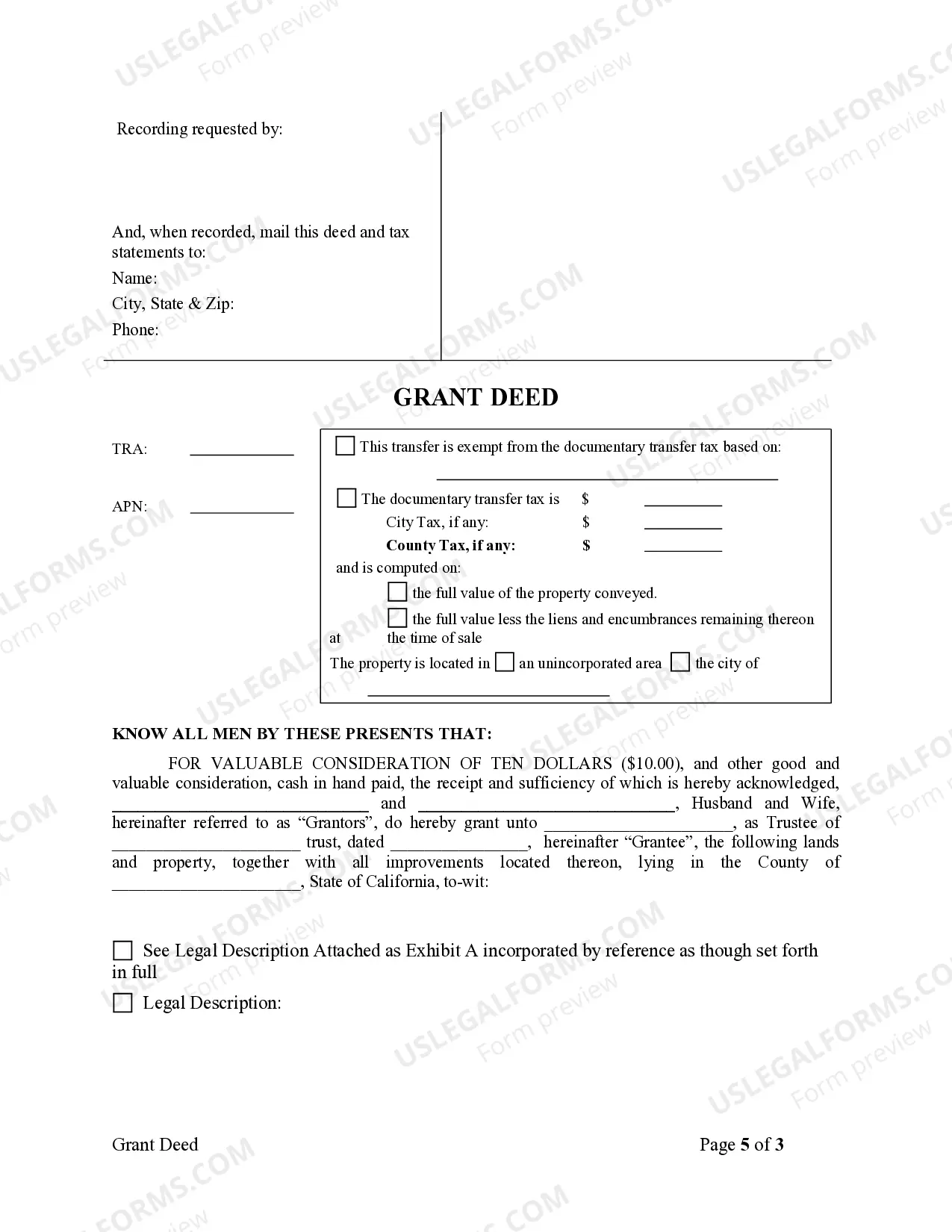

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Santa Clara California Grant Deed from Husband and Wife to Trust is a legal document used to transfer the ownership of real property from a married couple to a trust. This type of deed ensures that the property is properly transferred into the trust, allowing for effective estate planning and asset protection. Here is a detailed description of what this grant deed entails and the various types you may encounter: 1. Definition: A Grant Deed from Husband and Wife to Trust is a legally binding document that conveys ownership of real property from a married couple, acting as granters, to a trust, acting as the grantee. The trust, typically established for estate planning purposes, holds and manages the property on behalf of the beneficiaries designated in the trust agreement. 2. Purpose: The primary purpose of executing a Grant Deed from Husband and Wife to Trust is to transfer property ownership into a trust's name. This helps simplify the process of transferring the property's title, avoiding probate, and ensuring the property's seamless transition in case of the spouses' incapacity or death. 3. Key Elements: A Santa Clara California Grant Deed from Husband and Wife to Trust includes essential elements such as: a. Granter(s): The husband and wife who currently own the property and wish to transfer it to their trust. b. Trustee(s): The individuals who will manage and administer the trust, as designated in the trust agreement. c. Trust Name: The accurate name of the trust, which is typically listed on the trust agreement and must be accurately reflected on the grant deed. d. Legal Description of the Property: A detailed description of the property being transferred, usually sourced from the property's existing title or deed. e. Signatures: Both husband and wife must sign the grant deed, indicating their voluntary consent to transfer the property to their trust. Additionally, the deed must be notarized to ensure its validity. 4. Types: There are a few variations of Grant Deeds from Husband and Wife to Trust that you may come across. Some common types include: a. Interspousal Transfer Grant Deed to Trust: This type of grant deed is used when one spouse transfers their interest in the property to their spouse's trust, typically due to marital or estate planning considerations. b. Joint Tenancy Grant Deed to Trust: In instances where spouses hold the property as joint tenants, this grant deed can be used to transfer their vested interests into their joint trust, maintaining the joint tenancy structure within the trust. c. Community Property Grant Deed to Trust: If the property is classified as community property, this grant deed allows the married couple to transfer their interests as community property to their trust, ensuring proper management and distribution as outlined in the trust agreement. d. Tenancy in Common Grant Deed to Trust: For couples who hold the property as tenants in common, this grant deed is used to transfer their individual shares into their trust, granting the trust the power to manage and distribute the property according to the trust terms. Executing a Santa Clara California Grant Deed from Husband and Wife to Trust is an essential step in establishing a comprehensive estate plan and ensuring the smooth transfer of property ownership within a trusted framework. It is crucial to consult with a qualified attorney or a real estate professional to draft and execute the appropriate grant deed based on your specific circumstances and legal requirements.A Santa Clara California Grant Deed from Husband and Wife to Trust is a legal document used to transfer the ownership of real property from a married couple to a trust. This type of deed ensures that the property is properly transferred into the trust, allowing for effective estate planning and asset protection. Here is a detailed description of what this grant deed entails and the various types you may encounter: 1. Definition: A Grant Deed from Husband and Wife to Trust is a legally binding document that conveys ownership of real property from a married couple, acting as granters, to a trust, acting as the grantee. The trust, typically established for estate planning purposes, holds and manages the property on behalf of the beneficiaries designated in the trust agreement. 2. Purpose: The primary purpose of executing a Grant Deed from Husband and Wife to Trust is to transfer property ownership into a trust's name. This helps simplify the process of transferring the property's title, avoiding probate, and ensuring the property's seamless transition in case of the spouses' incapacity or death. 3. Key Elements: A Santa Clara California Grant Deed from Husband and Wife to Trust includes essential elements such as: a. Granter(s): The husband and wife who currently own the property and wish to transfer it to their trust. b. Trustee(s): The individuals who will manage and administer the trust, as designated in the trust agreement. c. Trust Name: The accurate name of the trust, which is typically listed on the trust agreement and must be accurately reflected on the grant deed. d. Legal Description of the Property: A detailed description of the property being transferred, usually sourced from the property's existing title or deed. e. Signatures: Both husband and wife must sign the grant deed, indicating their voluntary consent to transfer the property to their trust. Additionally, the deed must be notarized to ensure its validity. 4. Types: There are a few variations of Grant Deeds from Husband and Wife to Trust that you may come across. Some common types include: a. Interspousal Transfer Grant Deed to Trust: This type of grant deed is used when one spouse transfers their interest in the property to their spouse's trust, typically due to marital or estate planning considerations. b. Joint Tenancy Grant Deed to Trust: In instances where spouses hold the property as joint tenants, this grant deed can be used to transfer their vested interests into their joint trust, maintaining the joint tenancy structure within the trust. c. Community Property Grant Deed to Trust: If the property is classified as community property, this grant deed allows the married couple to transfer their interests as community property to their trust, ensuring proper management and distribution as outlined in the trust agreement. d. Tenancy in Common Grant Deed to Trust: For couples who hold the property as tenants in common, this grant deed is used to transfer their individual shares into their trust, granting the trust the power to manage and distribute the property according to the trust terms. Executing a Santa Clara California Grant Deed from Husband and Wife to Trust is an essential step in establishing a comprehensive estate plan and ensuring the smooth transfer of property ownership within a trusted framework. It is crucial to consult with a qualified attorney or a real estate professional to draft and execute the appropriate grant deed based on your specific circumstances and legal requirements.