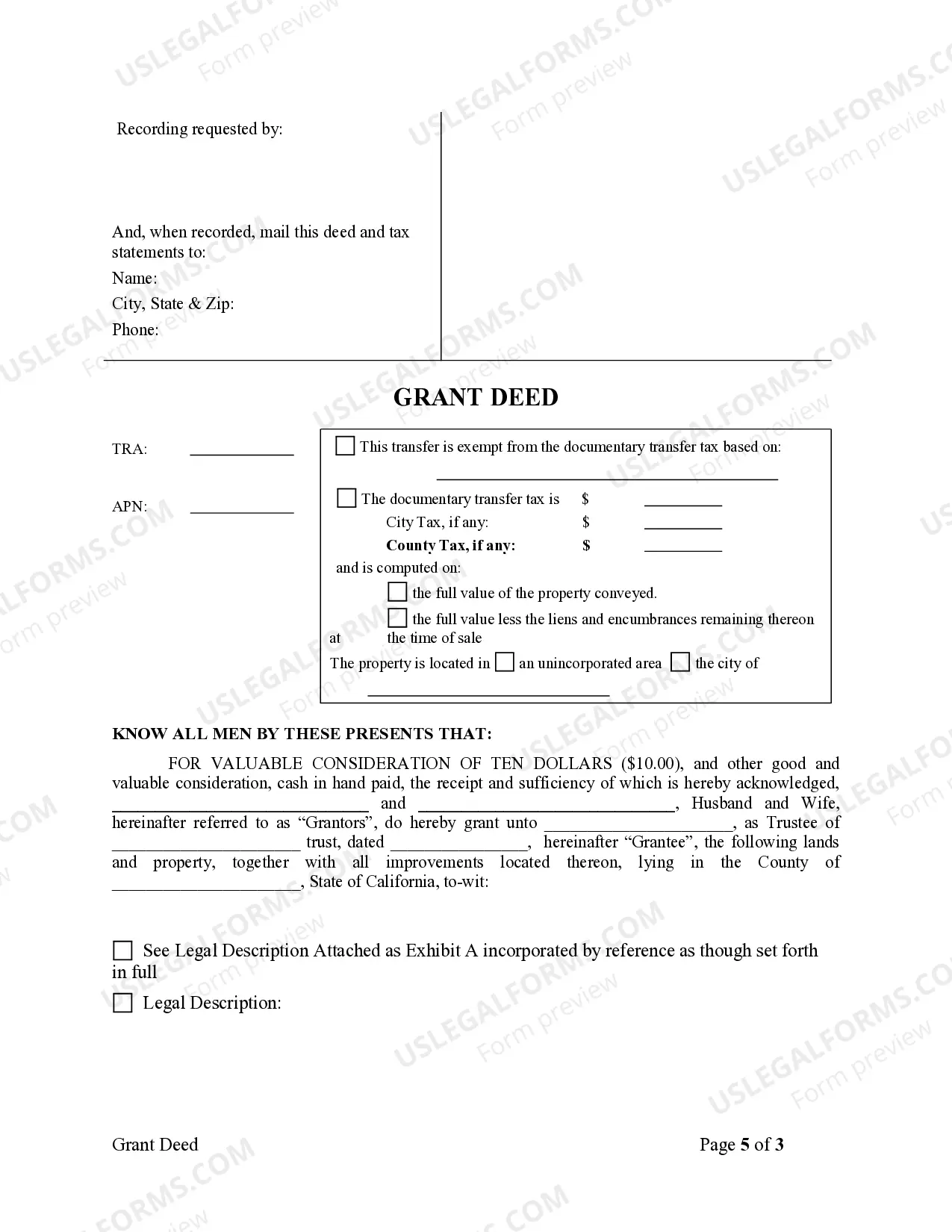

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Temecula California Grant Deed from Husband and Wife to Trust

Description

How to fill out California Grant Deed From Husband And Wife To Trust?

Irrespective of social or occupational standing, finalizing law-related documents is a regrettable requirement in today’s society.

Frequently, it’s virtually unattainable for individuals lacking any legal expertise to develop such documents from scratch due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms comes to the aid.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal matter.

- US Legal Forms also acts as a valuable asset for associates or legal advisors looking to save time using our DIY documents.

- Whether you’re seeking the Temecula California Grant Deed from Husband and Wife to Trust or any other relevant paperwork for your state or region, with US Legal Forms, everything is accessible.

- Here’s how to obtain the Temecula California Grant Deed from Husband and Wife to Trust efficiently using our reliable platform.

- If you’re an existing client, you can proceed to Log In to your account to retrieve the required document.

- However, if you’re new to our service, ensure you follow these steps before downloading the Temecula California Grant Deed from Husband and Wife to Trust.

Form popularity

FAQ

One disadvantage of a trust deed is the potential for complicated tax implications. Depending on your situation, taxes may arise when property is transferred to a trust. This could impact your financial planning, especially in the context of a Temecula California Grant Deed from Husband and Wife to Trust. Therefore, consulting with a legal expert can help clarify any issues and optimize your estate strategy.

A grant deed transfers property from one individual to another, ensuring ownership without encumbrances. In contrast, a trust transfer deed places property into a trust, where it is managed according to the trust’s terms. When engaging with a Temecula California Grant Deed from Husband and Wife to Trust, understanding this distinction is vital. Each serves unique purposes in estate planning and property management.

The main purpose of a grant deed is to convey ownership of property from one party to another. This deed includes assurances that the grantor holds clear title to the property. When you use a Temecula California Grant Deed from Husband and Wife to Trust, you secure your intentions about property transfer. This process is crucial in ensuring that the property is properly included within your trust.

While putting your house in a trust can offer benefits, it can also have disadvantages. For example, transferring property involves paperwork and potential fees that may not be trivial. Additionally, you may lose some control over the property, as the trust becomes the legal owner. It's essential to weigh these factors carefully and consider using US Legal Forms to navigate the complexities of a Temecula California Grant Deed from Husband and Wife to Trust.

To transfer property to a trust in California, you need to create a grant deed. This deed documents the change of ownership from you and your spouse to the trust. Make sure to include specific details, such as the names of the trust and the trustee. Using a reliable service like US Legal Forms can streamline this process and ensure that your Temecula California Grant Deed from Husband and Wife to Trust meets all legal requirements.

If you need to correct a grant deed in California, you can typically do so by filing a new grant deed that reflects the correct information. In some cases, you may need to include an affidavit or a correction deed along with the original document. It’s crucial to follow the proper procedures to ensure the correction is legally recognized. USLegalForms can help provide the necessary documentation for adjustments related to your Temecula California Grant Deed from Husband and Wife to Trust.

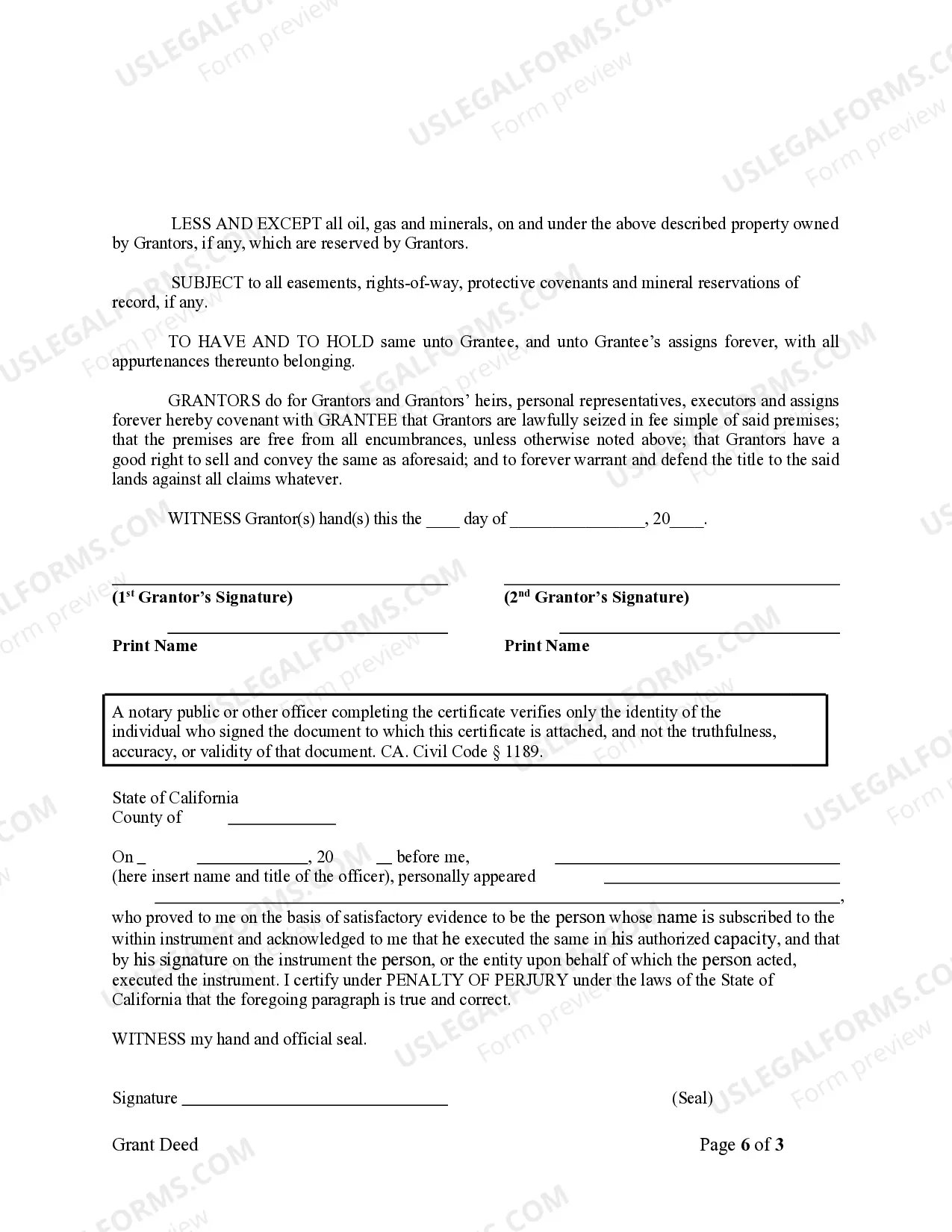

To transfer a deed to a trust in California, you will need to fill out a grant deed that names the trust as the grantee. Include the legal description of the property, and be sure to have the grantor sign the deed in front of a notary. Submitting this deed to the county recorder's office officially transfers the property into the trust. For templates and guidance, consider using USLegalForms for your Temecula California Grant Deed from Husband and Wife to Trust.

In California, the grant deed must be signed by the granters, who are the individuals transferring the property, in this case, the husband and wife. If the property is being transferred into a trust, the trustee might also need to sign. Ensure all signatures are properly notarized to validate the deed. For best practices and templates, USLegalForms can assist with your Temecula California Grant Deed from Husband and Wife to Trust.

To make a grant deed, begin by drafting the document with all necessary information including the names of the husband and wife, the property details, and the trust designation. Be sure to have the grantor sign the deed in front of a notary public, as this step verifies the authenticity of the document. Using USLegalForms can streamline this preparation, ensuring your Temecula California Grant Deed from Husband and Wife to Trust is accurate and compliant.

A grant deed is not the same as a title, although both are related to property ownership in California. The grant deed serves as a legal document that transfers ownership from one party to another, while the title represents the legal right to own the property. When transferring property into a trust, it's crucial to understand these distinctions to ensure a smooth process. For details on how to handle this transition, check out USLegalForms for your Temecula California Grant Deed from Husband and Wife to Trust.