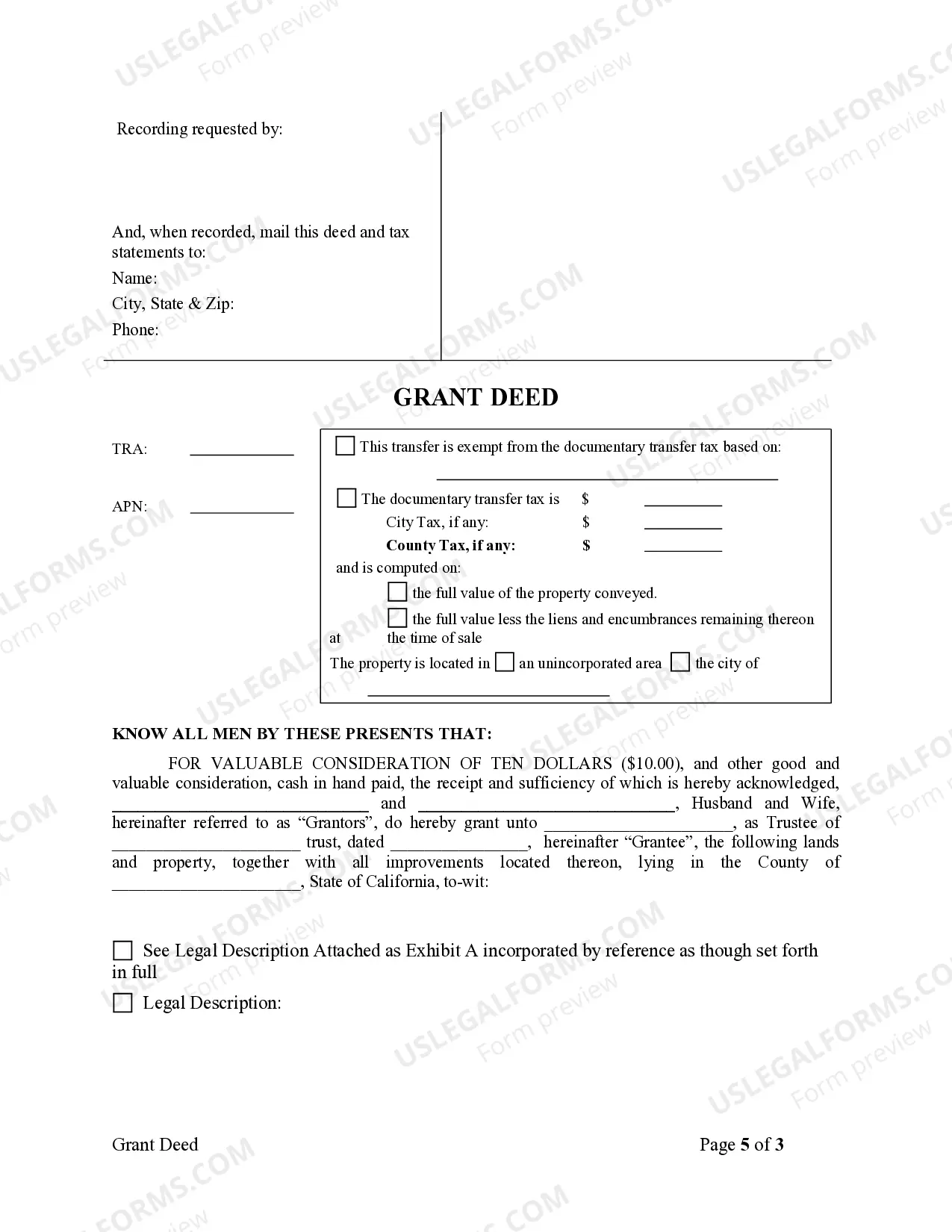

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Thousand Oaks California Grant Deed from Husband and Wife to Trust is a legal document used to transfer property ownership from a married couple to a trust. This type of deed is commonly used in estate planning or when individuals want to protect their assets and ensure smooth transfer of property upon their passing. The grant deed establishes the trust as the new owner of the property, allowing for seamless management and distribution of assets as per the trust's guidelines. In Thousand Oaks, California, there are a few different types of Grant Deeds from Husband and Wife to Trust that individuals can consider based on their specific requirements: 1. Joint Tenancy Grant Deed from Husband and Wife to Trust: This type of grant deed ensures that the property is held in joint tenancy and transferred to the trust upon the death of either spouse. Joint tenancy includes a right of survivorship, so the surviving spouse automatically becomes the sole owner of the property without going through the probate process. 2. Community Property with Right of Survivorship Grant Deed from Husband and Wife to Trust: In California, community property refers to assets acquired during the marriage that belong equally to both spouses. By using a grant deed of this type, the couple transfers the property to their trust, while maintaining the community property classification. The surviving spouse then becomes the sole owner without the need for probate. 3. Tenancy in Common Grant Deed from Husband and Wife to Trust: This type of grant deed allows the property to pass into the trust while retaining the tenancy in common ownership structure. Tenants in common own individual shares of the property, which can be transferred or inherited separately. This grant deed may be chosen by couples who wish to retain flexibility in their ownership arrangements or have specific plans for distributing the property upon their passing. It is important to consult with an experienced attorney or legal professional specializing in estate planning and real estate law to determine the most suitable grant deed type for individual circumstances. The attorney can assist in drafting and executing the required legal documents, ensuring compliance with California laws and effective conveyance of property from the husband and wife to the trust.A Thousand Oaks California Grant Deed from Husband and Wife to Trust is a legal document used to transfer property ownership from a married couple to a trust. This type of deed is commonly used in estate planning or when individuals want to protect their assets and ensure smooth transfer of property upon their passing. The grant deed establishes the trust as the new owner of the property, allowing for seamless management and distribution of assets as per the trust's guidelines. In Thousand Oaks, California, there are a few different types of Grant Deeds from Husband and Wife to Trust that individuals can consider based on their specific requirements: 1. Joint Tenancy Grant Deed from Husband and Wife to Trust: This type of grant deed ensures that the property is held in joint tenancy and transferred to the trust upon the death of either spouse. Joint tenancy includes a right of survivorship, so the surviving spouse automatically becomes the sole owner of the property without going through the probate process. 2. Community Property with Right of Survivorship Grant Deed from Husband and Wife to Trust: In California, community property refers to assets acquired during the marriage that belong equally to both spouses. By using a grant deed of this type, the couple transfers the property to their trust, while maintaining the community property classification. The surviving spouse then becomes the sole owner without the need for probate. 3. Tenancy in Common Grant Deed from Husband and Wife to Trust: This type of grant deed allows the property to pass into the trust while retaining the tenancy in common ownership structure. Tenants in common own individual shares of the property, which can be transferred or inherited separately. This grant deed may be chosen by couples who wish to retain flexibility in their ownership arrangements or have specific plans for distributing the property upon their passing. It is important to consult with an experienced attorney or legal professional specializing in estate planning and real estate law to determine the most suitable grant deed type for individual circumstances. The attorney can assist in drafting and executing the required legal documents, ensuring compliance with California laws and effective conveyance of property from the husband and wife to the trust.