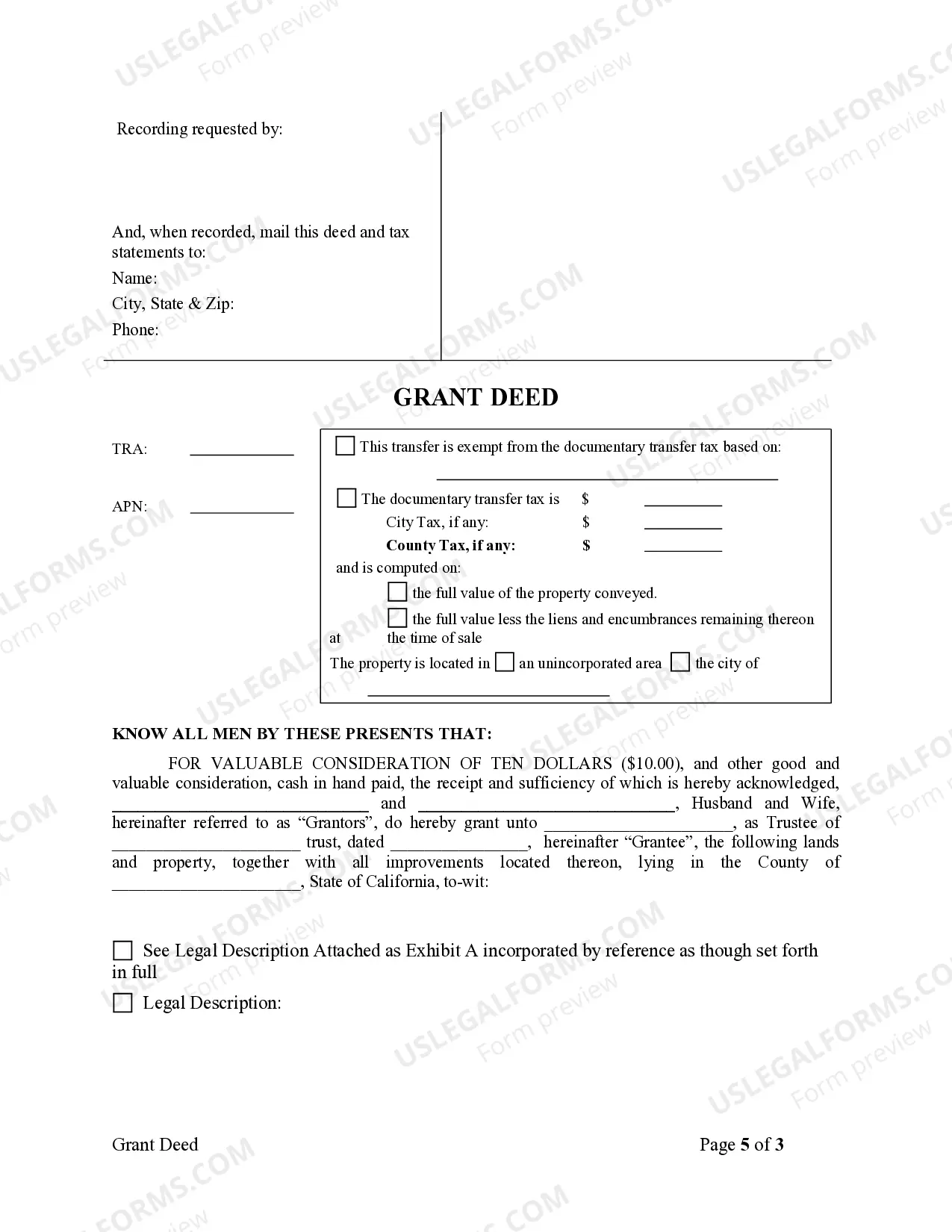

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Vallejo California Grant Deed from Husband and Wife to Trust is a legal document used to transfer property ownership from a married couple to their trust. This type of deed allows the couple, as granters, to convey the title of their real estate or other assets into their trust, which acts as the grantee. By creating a trust, the couple ensures efficient management, distribution, and protection of their assets. Some commonly known types of Vallejo California Grant Deeds from Husband and Wife to Trust include: 1. Revocable Living Trust Grant Deed: This document establishes a revocable living trust, wherein the granters (husband and wife) become the trustees. They have the power to make changes, revoke or terminate the trust while they are alive. The property is transferred to the trust's name, but the granters retain control over it. 2. Irrevocable Trust Grant Deed: Unlike the previous type, this deed creates an irrevocable trust, meaning that once the property is transferred, the granters no longer have control or ownership. This can be used for estate planning, asset protection, or qualifying for certain government benefits. 3. Testamentary Trust Grant Deed: This deed becomes effective upon the death of the granters. It is created within a will and helps to ensure the smooth transfer of assets to the trust after the couple passes away. The testamentary trust can be revocable or irrevocable depending on the granters' preference. 4. Qualified Personnel Residence Trust (PRT) Grant Deed: A PRT is a specialized trust used for estate planning purposes, primarily for high-value residential properties. Granting property to a PRT can help reduce estate taxes as the property's value is frozen at the time of transfer, keeping it outside the granters' taxable estate. Utilizing a Vallejo California Grant Deed from Husband and Wife to Trust allows for seamless asset transfer, centralized management, privacy, and potentially significant tax benefits. It is crucial to consult with an experienced attorney or legal professional to ensure the proper creation and execution of the specific type of grant deed based on individual circumstances and goals.