This purpose of this document is to release one of the owners of the property form the obligation of the loan which was used to purchase the property. The party being released will transfer his or her interest in the property to the other owner.

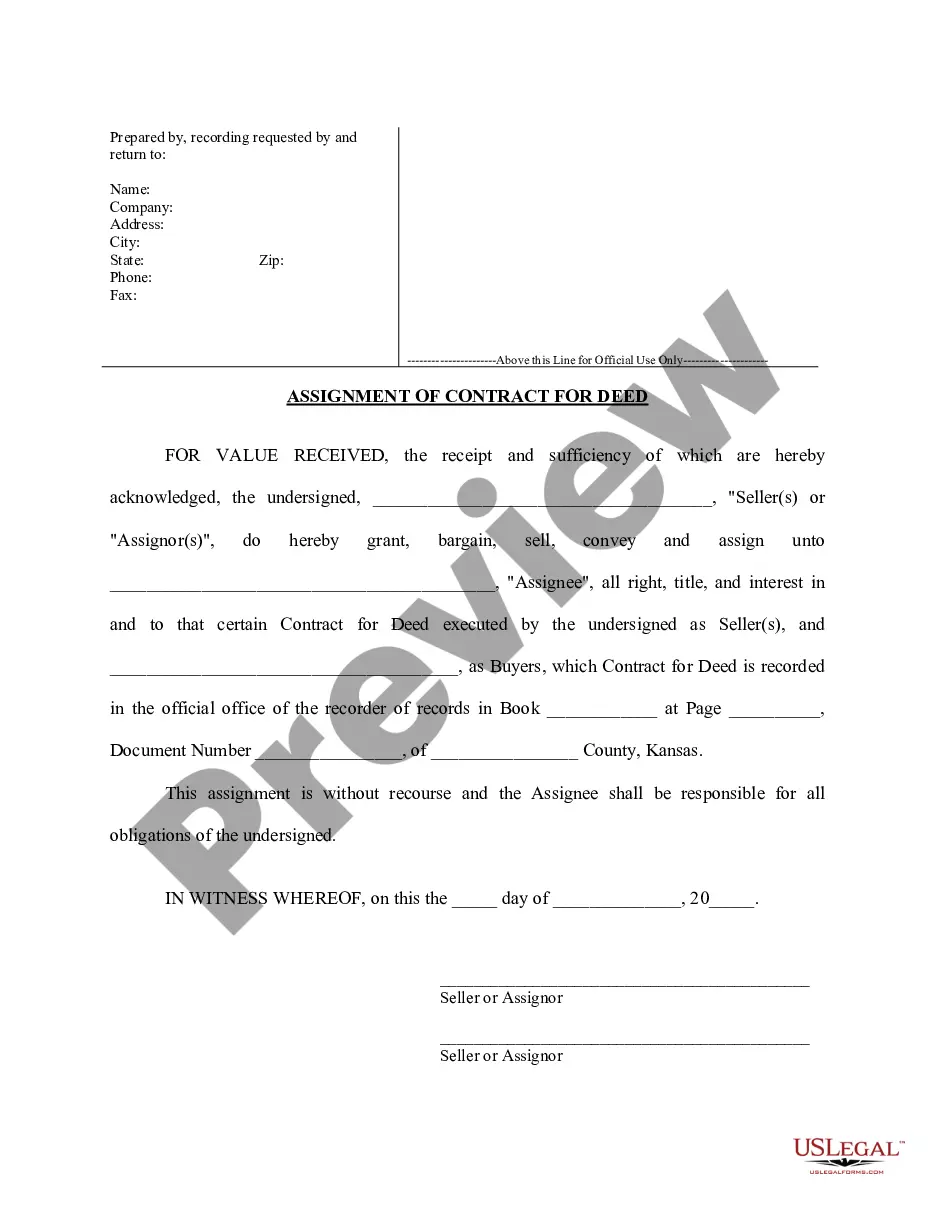

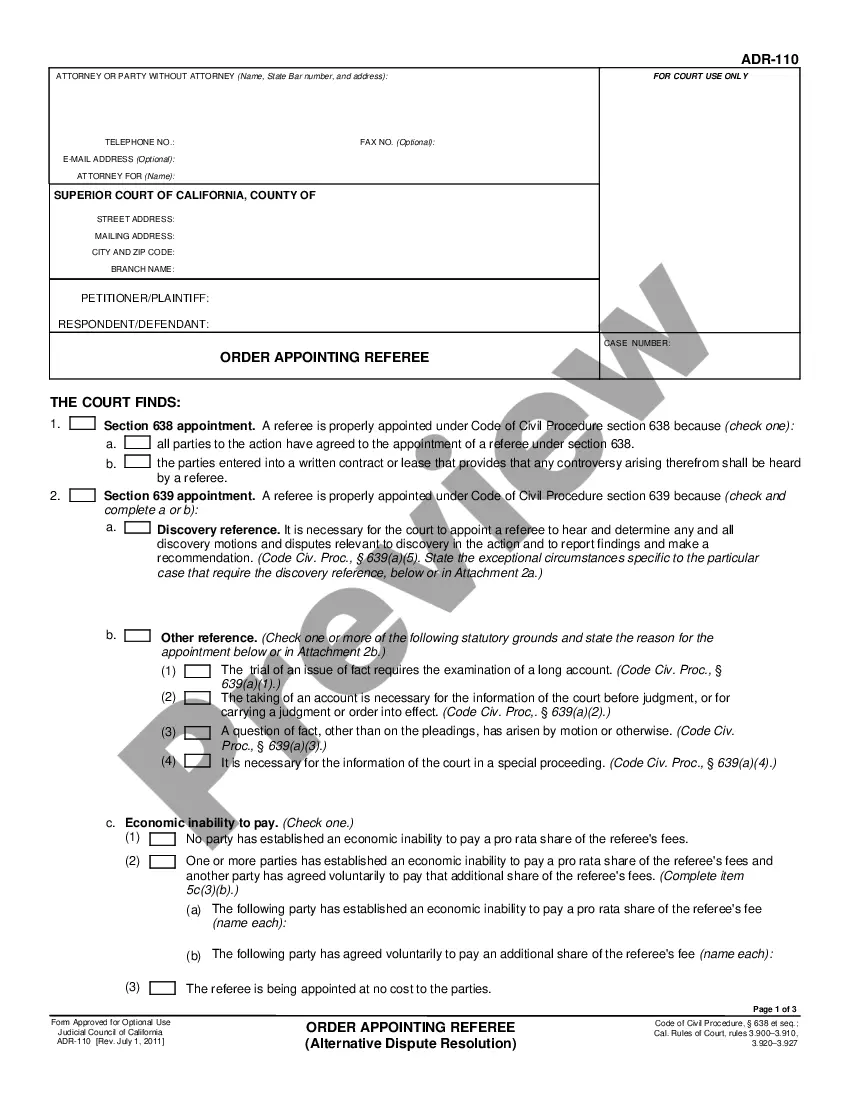

Costa Mesa California Assumption of Deed of Trust and Release of One of Original Borrowers: Understanding the Basics In Costa Mesa, California, the Assumption of Deed of Trust and Release of One of the Original Borrowers is a legal procedure that involves transferring the responsibility of a mortgage loan from one party to another while releasing one of the original borrowers from their obligations. This process can occur in various scenarios, and it's crucial to understand the different types of Assumptions and Releases that can take place. Let's delve deeper into the details. 1. Partial Assumption and Release: In some cases, one of the original borrowers wishes to be released from their mortgage obligations while the remaining borrower(s) intend to assume full responsibility for the loan. This type of assumption allows the remaining borrower(s) to continue making repayments without involving the released borrower. It requires the lender's approval and typically involves a formal process of documenting the assumption and release. 2. Complete Assumption and Release: Alternatively, all the original borrowers may desire to release their obligations entirely, transferring the loan responsibility to a new borrower. This situation usually occurs when the property ownership changes hands, such as during a home sale or transfer of ownership among family members. The new borrower assumes full responsibility for the mortgage, ensuring its consistent repayment. 3. Assumption and Release with Lender Approval: Irrespective of the type of assumption, the lender's approval is paramount in Costa Mesa, California. Lenders evaluate the financial stability of the parties involved, including the creditworthiness of the new borrower, before granting approval for the assumption and release process. Adequate documentation, financial records, and other relevant information may be required to demonstrate the new borrower's ability to assume the mortgage. 4. Legal Documentation and Decoration: To formalize the assumption and release, legal documentation plays a crucial role. A new deed of trust is often prepared and executed, naming the new borrower as the responsible party for the loan. Simultaneously, a release deed relieves the original borrower(s) from their obligations and provides evidence of their release from the mortgage agreement. These documents are then recorded with the appropriate authorities to ensure they are officially recognized. As with any legal matter, seeking professional advice from a real estate attorney or a knowledgeable mortgage professional is highly recommended when undergoing an Assumption of Deed of Trust and Release of One of the Original Borrowers in Costa Mesa, California. They can guide borrowers through the necessary steps, including understanding the specific requirements of lenders and local regulations, ensuring a smooth and legally compliant transition of mortgage responsibilities.Costa Mesa California Assumption of Deed of Trust and Release of One of Original Borrowers: Understanding the Basics In Costa Mesa, California, the Assumption of Deed of Trust and Release of One of the Original Borrowers is a legal procedure that involves transferring the responsibility of a mortgage loan from one party to another while releasing one of the original borrowers from their obligations. This process can occur in various scenarios, and it's crucial to understand the different types of Assumptions and Releases that can take place. Let's delve deeper into the details. 1. Partial Assumption and Release: In some cases, one of the original borrowers wishes to be released from their mortgage obligations while the remaining borrower(s) intend to assume full responsibility for the loan. This type of assumption allows the remaining borrower(s) to continue making repayments without involving the released borrower. It requires the lender's approval and typically involves a formal process of documenting the assumption and release. 2. Complete Assumption and Release: Alternatively, all the original borrowers may desire to release their obligations entirely, transferring the loan responsibility to a new borrower. This situation usually occurs when the property ownership changes hands, such as during a home sale or transfer of ownership among family members. The new borrower assumes full responsibility for the mortgage, ensuring its consistent repayment. 3. Assumption and Release with Lender Approval: Irrespective of the type of assumption, the lender's approval is paramount in Costa Mesa, California. Lenders evaluate the financial stability of the parties involved, including the creditworthiness of the new borrower, before granting approval for the assumption and release process. Adequate documentation, financial records, and other relevant information may be required to demonstrate the new borrower's ability to assume the mortgage. 4. Legal Documentation and Decoration: To formalize the assumption and release, legal documentation plays a crucial role. A new deed of trust is often prepared and executed, naming the new borrower as the responsible party for the loan. Simultaneously, a release deed relieves the original borrower(s) from their obligations and provides evidence of their release from the mortgage agreement. These documents are then recorded with the appropriate authorities to ensure they are officially recognized. As with any legal matter, seeking professional advice from a real estate attorney or a knowledgeable mortgage professional is highly recommended when undergoing an Assumption of Deed of Trust and Release of One of the Original Borrowers in Costa Mesa, California. They can guide borrowers through the necessary steps, including understanding the specific requirements of lenders and local regulations, ensuring a smooth and legally compliant transition of mortgage responsibilities.