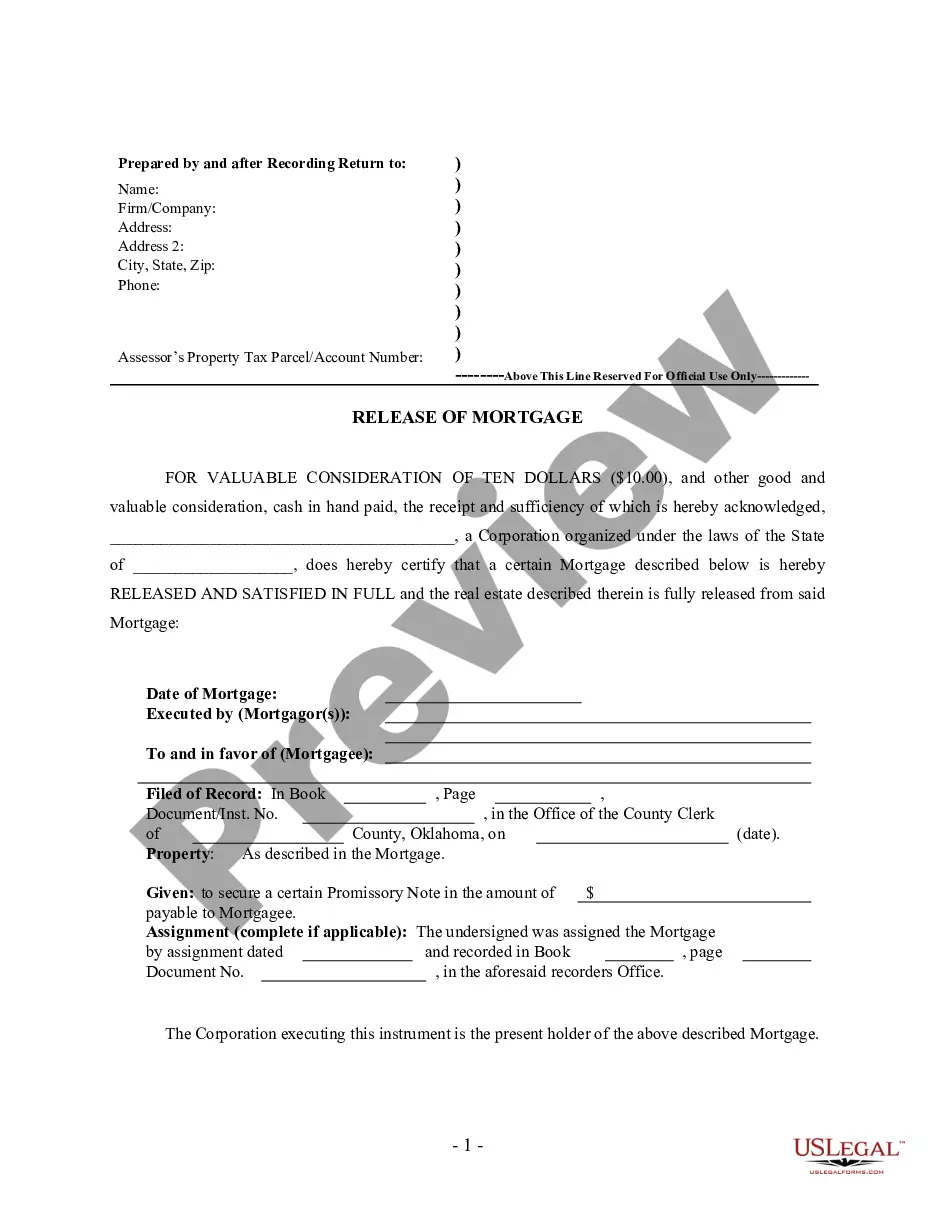

This purpose of this document is to release one of the owners of the property form the obligation of the loan which was used to purchase the property. The party being released will transfer his or her interest in the property to the other owner.

The Vacaville, California Assumption of Deed of Trust and Release of One of the Original Borrowers is a legal process that involves transferring the responsibility of a mortgage loan from the original borrower to a new borrower while also releasing one of the original borrowers from any future obligations. In Vacaville, California, there are two main types of Assumption of Deed of Trust and Release of One of the Original Borrowers: partial assumption and complete assumption. 1. Partial Assumption: This type of assumption occurs when one of the original borrowers wants to be released from the mortgage, and another party is willing to assume their share of the loan. In this case, the lender conducts a thorough review of the new borrower's financial capabilities to ensure they can meet the mortgage obligations. Once approved, the lender modifies the deed of trust to reflect the new borrower's name, accepting the assumption of responsibility while releasing the other original borrower from any future liability. 2. Complete Assumption: In a complete assumption, the new borrower assumes the entire mortgage obligation, including the share of the loan originally taken by the borrower who wants to be released. Similar to the partial assumption, the lender evaluates the new borrower's creditworthiness and financial stability before approving the assumption. Once approved, the lender updates the deed of trust, transferring all responsibilities and removing the original borrower's name from the mortgage. In both types of assumptions, it is crucial to follow the legal steps and procedures outlined by the state of California and the lender to ensure a smooth and valid transfer of responsibility. The process often involves documentation, including an assumption agreement, credit review, and updated deed of trust. Vacaville, California, being a thriving city located between Sacramento and San Francisco, experiences frequent real estate transactions. Therefore, understanding the Vacaville, California Assumption of Deed of Trust and Release of One of the Original Borrowers is essential for those buying or selling properties in the area. It allows for flexibility in managing mortgage obligations and provides an opportunity for borrowers to transfer responsibility or be released from the loan entirely under certain circumstances.

The Vacaville, California Assumption of Deed of Trust and Release of One of the Original Borrowers is a legal process that involves transferring the responsibility of a mortgage loan from the original borrower to a new borrower while also releasing one of the original borrowers from any future obligations. In Vacaville, California, there are two main types of Assumption of Deed of Trust and Release of One of the Original Borrowers: partial assumption and complete assumption. 1. Partial Assumption: This type of assumption occurs when one of the original borrowers wants to be released from the mortgage, and another party is willing to assume their share of the loan. In this case, the lender conducts a thorough review of the new borrower's financial capabilities to ensure they can meet the mortgage obligations. Once approved, the lender modifies the deed of trust to reflect the new borrower's name, accepting the assumption of responsibility while releasing the other original borrower from any future liability. 2. Complete Assumption: In a complete assumption, the new borrower assumes the entire mortgage obligation, including the share of the loan originally taken by the borrower who wants to be released. Similar to the partial assumption, the lender evaluates the new borrower's creditworthiness and financial stability before approving the assumption. Once approved, the lender updates the deed of trust, transferring all responsibilities and removing the original borrower's name from the mortgage. In both types of assumptions, it is crucial to follow the legal steps and procedures outlined by the state of California and the lender to ensure a smooth and valid transfer of responsibility. The process often involves documentation, including an assumption agreement, credit review, and updated deed of trust. Vacaville, California, being a thriving city located between Sacramento and San Francisco, experiences frequent real estate transactions. Therefore, understanding the Vacaville, California Assumption of Deed of Trust and Release of One of the Original Borrowers is essential for those buying or selling properties in the area. It allows for flexibility in managing mortgage obligations and provides an opportunity for borrowers to transfer responsibility or be released from the loan entirely under certain circumstances.