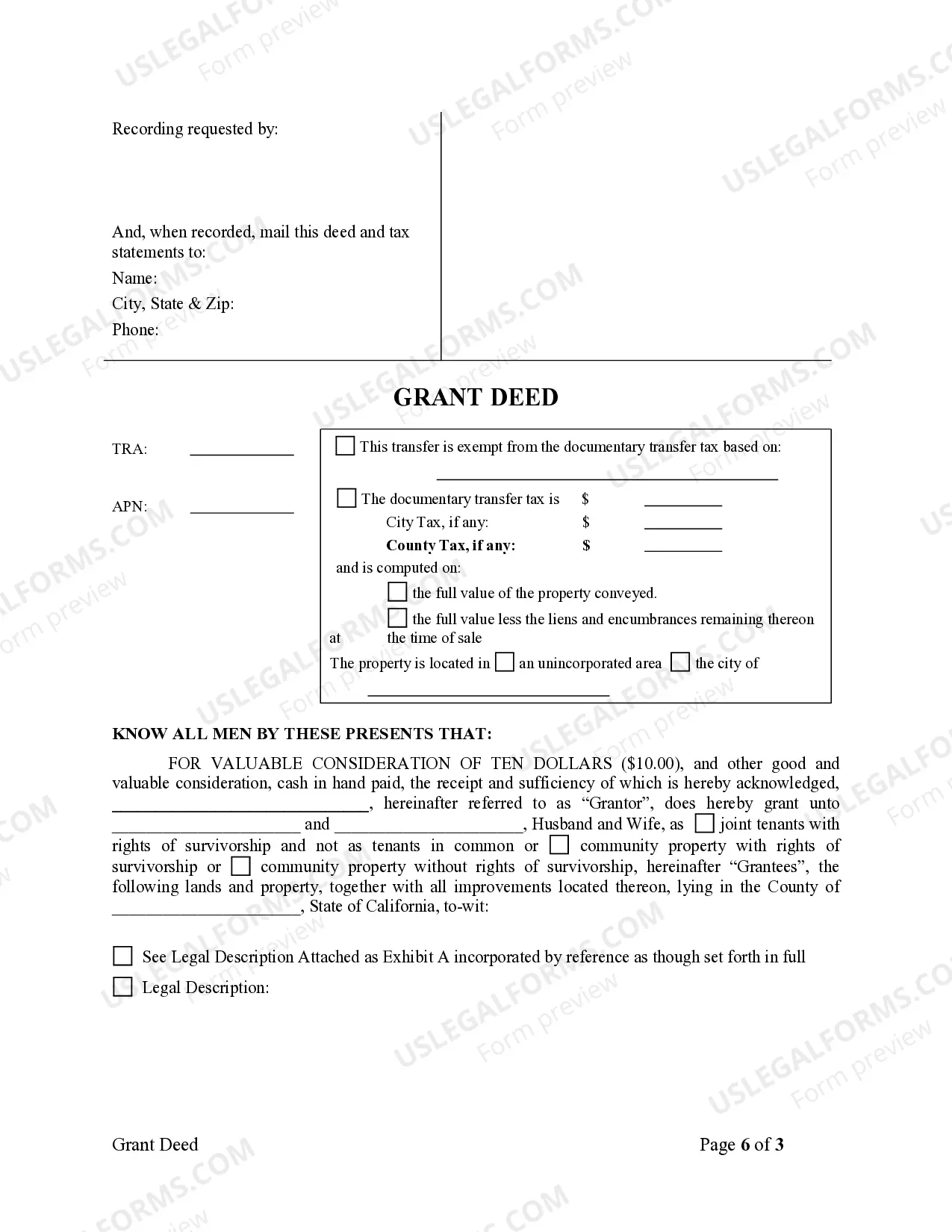

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

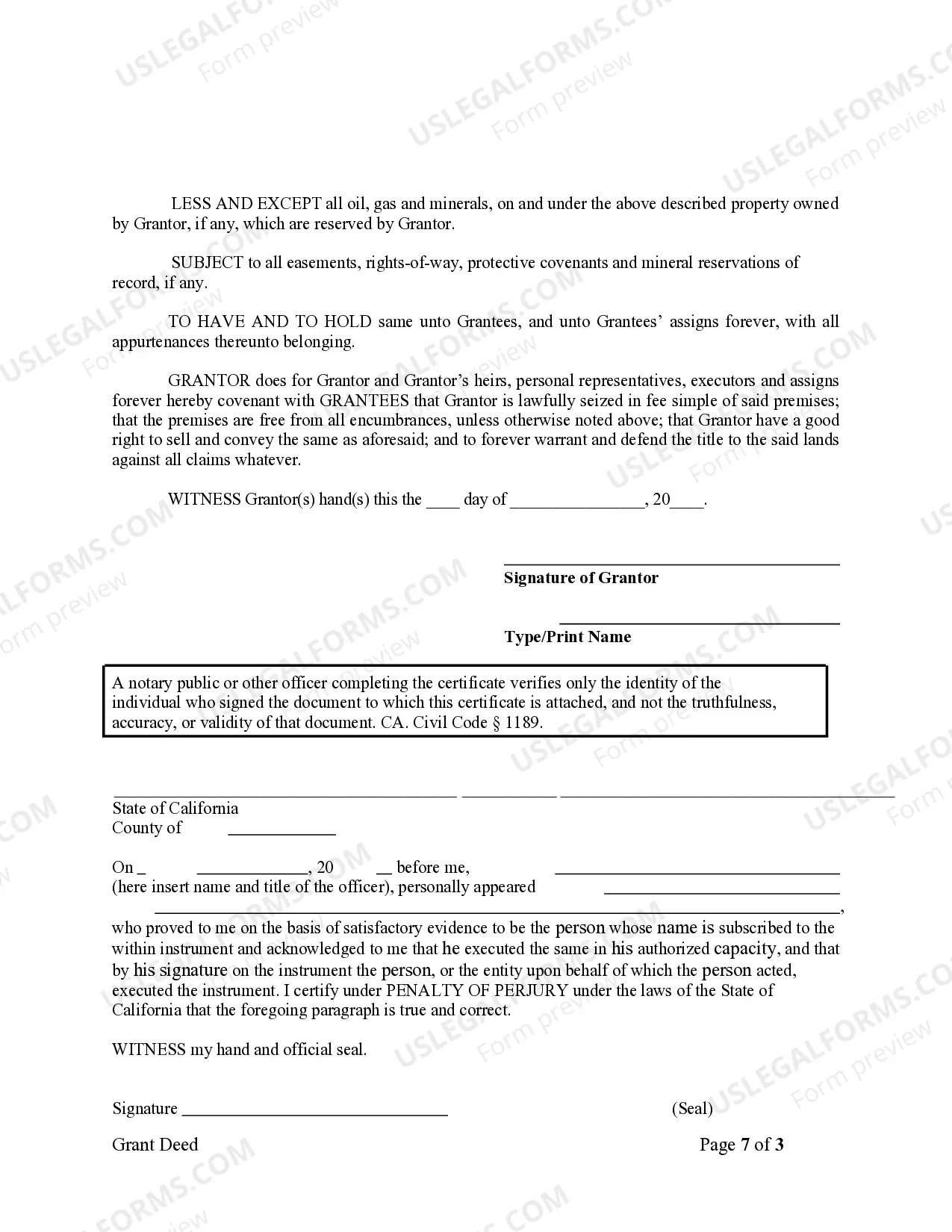

A Garden Grove California Grant Deed from Husband to Himself and Wife is a legal document that transfers ownership of real property from a husband to both himself and his wife. This type of grant deed ensures that both spouses hold an equal interest in the property being transferred. In Garden Grove, California, there are different variations of Grant Deeds from Husband to Himself and Wife, depending on the specific circumstances and requirements of the parties involved. These may include: 1. Joint Tenancy Grant Deed: This type of grant deed establishes joint tenancy, where both the husband and wife have an equal and undivided interest in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share, bypassing probate. 2. Community Property Grant Deed: In community property states like California, this grant deed form ensures that the property being transferred will be held as community (marital) property. Both spouses are equal owners, with each having a 50% interest. In case of a divorce or death, the property is typically divided equally between the spouses. 3. Tenancy in Common Grant Deed: Unlike joint tenancy, a tenancy in common grant deed allows each spouse to hold a specific percentage or fractional interest in the property. This type of grant deed is beneficial when the parties want to allocate unequal shares of ownership. When preparing a Garden Grove California Grant Deed from Husband to Himself and Wife, certain essential information must be included. This typically comprises the full legal names of the husband and wife, the complete property address being transferred, and a clear statement of the intention to transfer the property to both spouses as joint owners. It's important to consult with a qualified real estate attorney to ensure the accurate completion of the grant deed, as any errors or omissions can lead to complications or potential issues with property ownership in the future.A Garden Grove California Grant Deed from Husband to Himself and Wife is a legal document that transfers ownership of real property from a husband to both himself and his wife. This type of grant deed ensures that both spouses hold an equal interest in the property being transferred. In Garden Grove, California, there are different variations of Grant Deeds from Husband to Himself and Wife, depending on the specific circumstances and requirements of the parties involved. These may include: 1. Joint Tenancy Grant Deed: This type of grant deed establishes joint tenancy, where both the husband and wife have an equal and undivided interest in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share, bypassing probate. 2. Community Property Grant Deed: In community property states like California, this grant deed form ensures that the property being transferred will be held as community (marital) property. Both spouses are equal owners, with each having a 50% interest. In case of a divorce or death, the property is typically divided equally between the spouses. 3. Tenancy in Common Grant Deed: Unlike joint tenancy, a tenancy in common grant deed allows each spouse to hold a specific percentage or fractional interest in the property. This type of grant deed is beneficial when the parties want to allocate unequal shares of ownership. When preparing a Garden Grove California Grant Deed from Husband to Himself and Wife, certain essential information must be included. This typically comprises the full legal names of the husband and wife, the complete property address being transferred, and a clear statement of the intention to transfer the property to both spouses as joint owners. It's important to consult with a qualified real estate attorney to ensure the accurate completion of the grant deed, as any errors or omissions can lead to complications or potential issues with property ownership in the future.