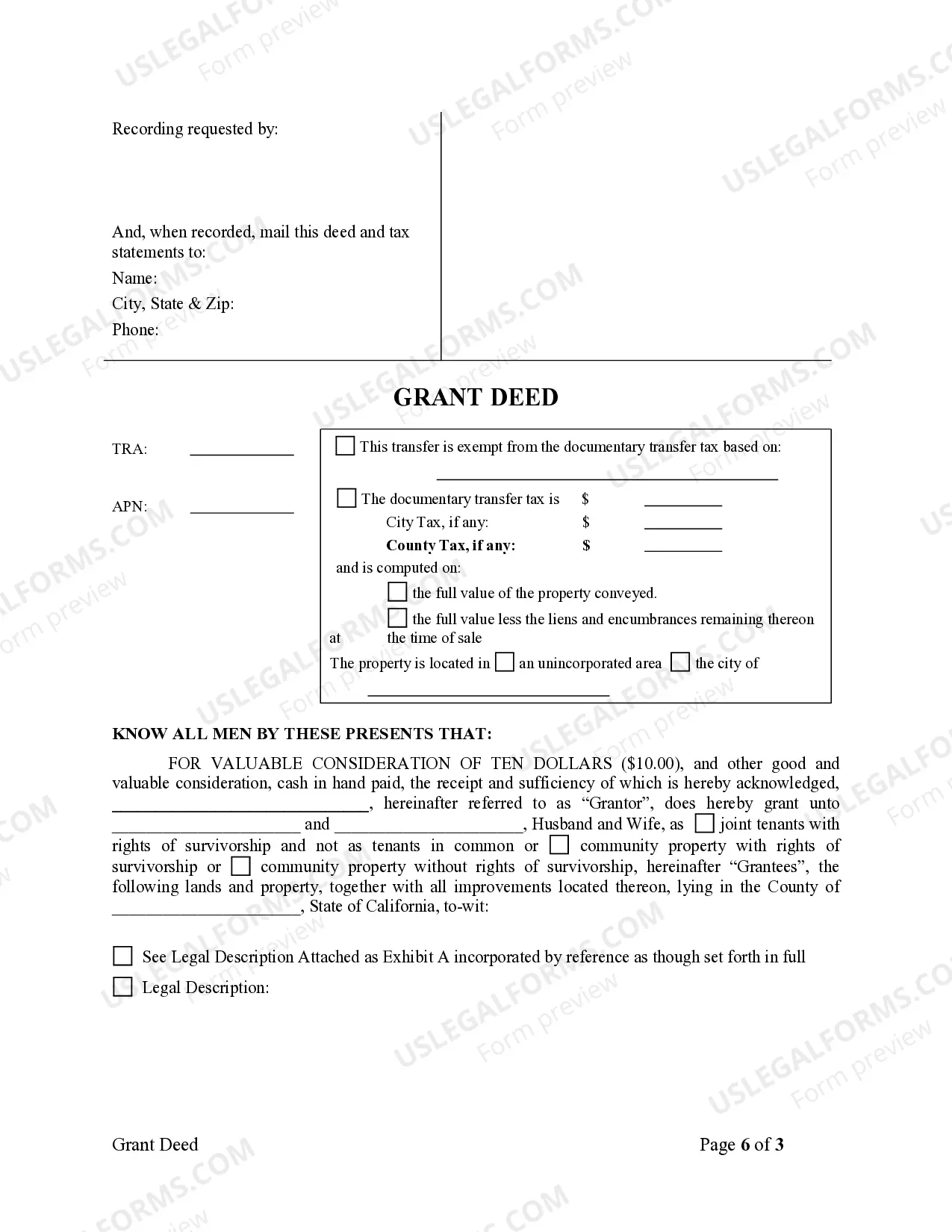

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

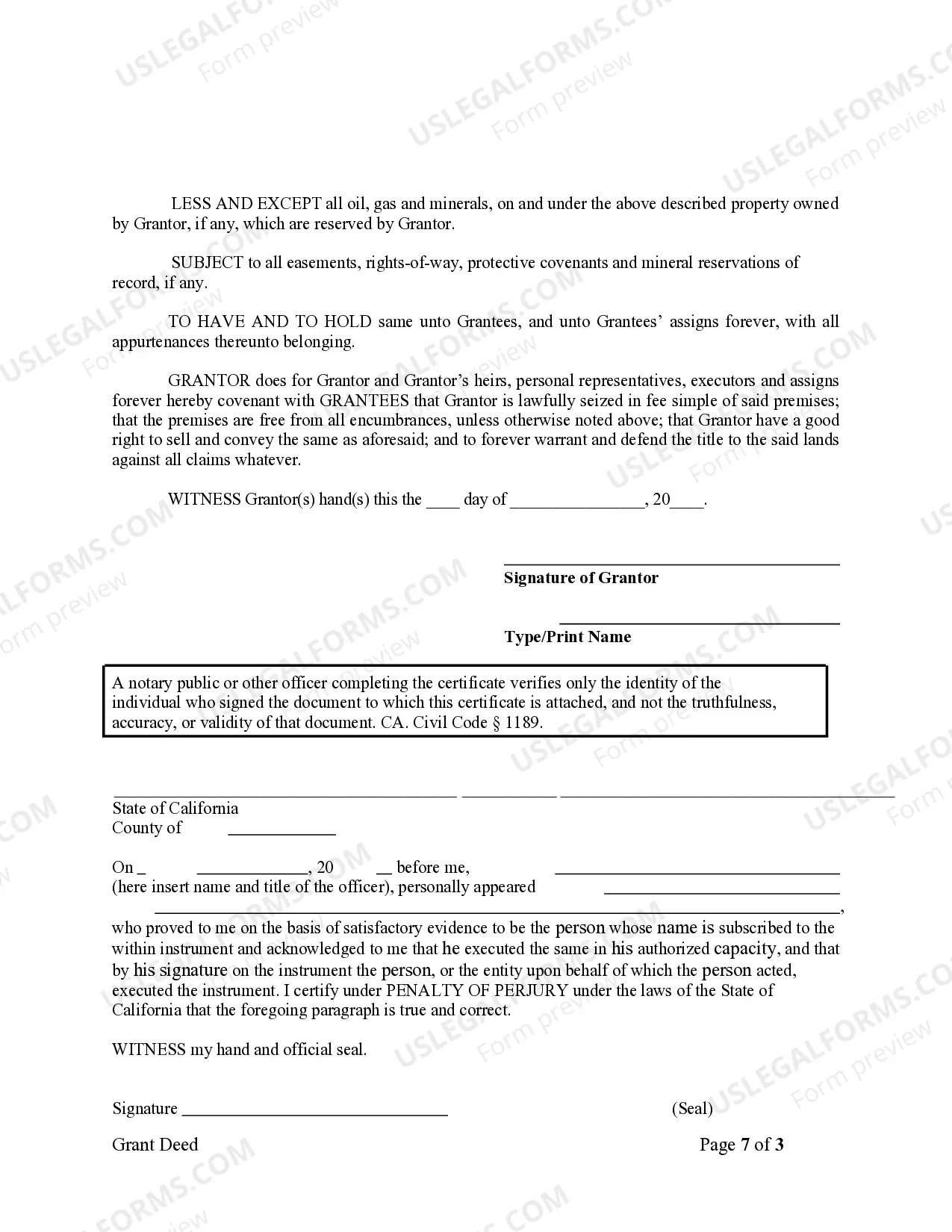

Title: Exploring the Hayward California Grant Deed from Husband to Himself and Wife: Types and Key Insights Introduction: A Hayward California Grant Deed from Husband to Himself and Wife is a legal document that transfers real property ownership from the husband as the granter to both himself and his wife as grantees. This comprehensive article will delve into the specifics of this type of grant deed, its purpose, and outline any distinct variations within this category. 1. Understanding the Hayward California Grant Deed: The Hayward California Grant Deed from Husband to Himself and Wife is a legally binding document recognized within the state. It facilitates the transfer of real estate ownership rights from the husband, commonly referred to as the granter, to both himself and his wife, known as the grantees. 2. Purpose and Significance: Grant deeds serve as a vital legal instrument for property transfers and are typically utilized to convey property ownership between family members, spouses, or co-owners. By executing this type of deed, the husband grants joint ownership to himself and his wife, creating an equal and undivided interest in the property. 3. Key Features and Benefits: — Shared Ownership: The grant deed facilitates equal and undivided ownership of the property between the husband and wife, ensuring rights and responsibilities are shared. — Spousal Protection: By having both spouses named as grantees, the grant deed safeguards the interests of the non-grantor spouse, preventing unilateral property transfers without their consent. — Simplified Transfer Process: Grant deeds are relatively simple to prepare, execute, and record, facilitating a smooth transfer of ownership rights. 4. Different Types of Hayward California Grant Deeds from Husband to Himself and Wife: While the concept remains consistent—transferring property ownership from husband to both himself and his wife—there may be certain subtypes or variations of this grant deed, such as: — Joint Tenants: Creates a joint tenancy, whereby both spouses have an equal undivided interest in the property. In case of the death of one spouse, their interest automatically passes to the surviving spouse. — Tenants in Common: Establishes a tenancy in common, enabling unequal shares of ownership, with each spouse having a specific percentage interest in the property. Their respective shares can be inherited or sold independently. Conclusion: In essence, the Hayward California Grant Deed from Husband to Himself and Wife serves as a legal tool to transfer property ownership rights jointly to both spouses. It empowers married couples while providing necessary safeguards and simplified procedures for real property transfers. Understanding the nuances and variations of this grant deed enables individuals to make informed decisions in their property transactions, ensuring a secure and harmonious real estate ownership experience.Title: Exploring the Hayward California Grant Deed from Husband to Himself and Wife: Types and Key Insights Introduction: A Hayward California Grant Deed from Husband to Himself and Wife is a legal document that transfers real property ownership from the husband as the granter to both himself and his wife as grantees. This comprehensive article will delve into the specifics of this type of grant deed, its purpose, and outline any distinct variations within this category. 1. Understanding the Hayward California Grant Deed: The Hayward California Grant Deed from Husband to Himself and Wife is a legally binding document recognized within the state. It facilitates the transfer of real estate ownership rights from the husband, commonly referred to as the granter, to both himself and his wife, known as the grantees. 2. Purpose and Significance: Grant deeds serve as a vital legal instrument for property transfers and are typically utilized to convey property ownership between family members, spouses, or co-owners. By executing this type of deed, the husband grants joint ownership to himself and his wife, creating an equal and undivided interest in the property. 3. Key Features and Benefits: — Shared Ownership: The grant deed facilitates equal and undivided ownership of the property between the husband and wife, ensuring rights and responsibilities are shared. — Spousal Protection: By having both spouses named as grantees, the grant deed safeguards the interests of the non-grantor spouse, preventing unilateral property transfers without their consent. — Simplified Transfer Process: Grant deeds are relatively simple to prepare, execute, and record, facilitating a smooth transfer of ownership rights. 4. Different Types of Hayward California Grant Deeds from Husband to Himself and Wife: While the concept remains consistent—transferring property ownership from husband to both himself and his wife—there may be certain subtypes or variations of this grant deed, such as: — Joint Tenants: Creates a joint tenancy, whereby both spouses have an equal undivided interest in the property. In case of the death of one spouse, their interest automatically passes to the surviving spouse. — Tenants in Common: Establishes a tenancy in common, enabling unequal shares of ownership, with each spouse having a specific percentage interest in the property. Their respective shares can be inherited or sold independently. Conclusion: In essence, the Hayward California Grant Deed from Husband to Himself and Wife serves as a legal tool to transfer property ownership rights jointly to both spouses. It empowers married couples while providing necessary safeguards and simplified procedures for real property transfers. Understanding the nuances and variations of this grant deed enables individuals to make informed decisions in their property transactions, ensuring a secure and harmonious real estate ownership experience.