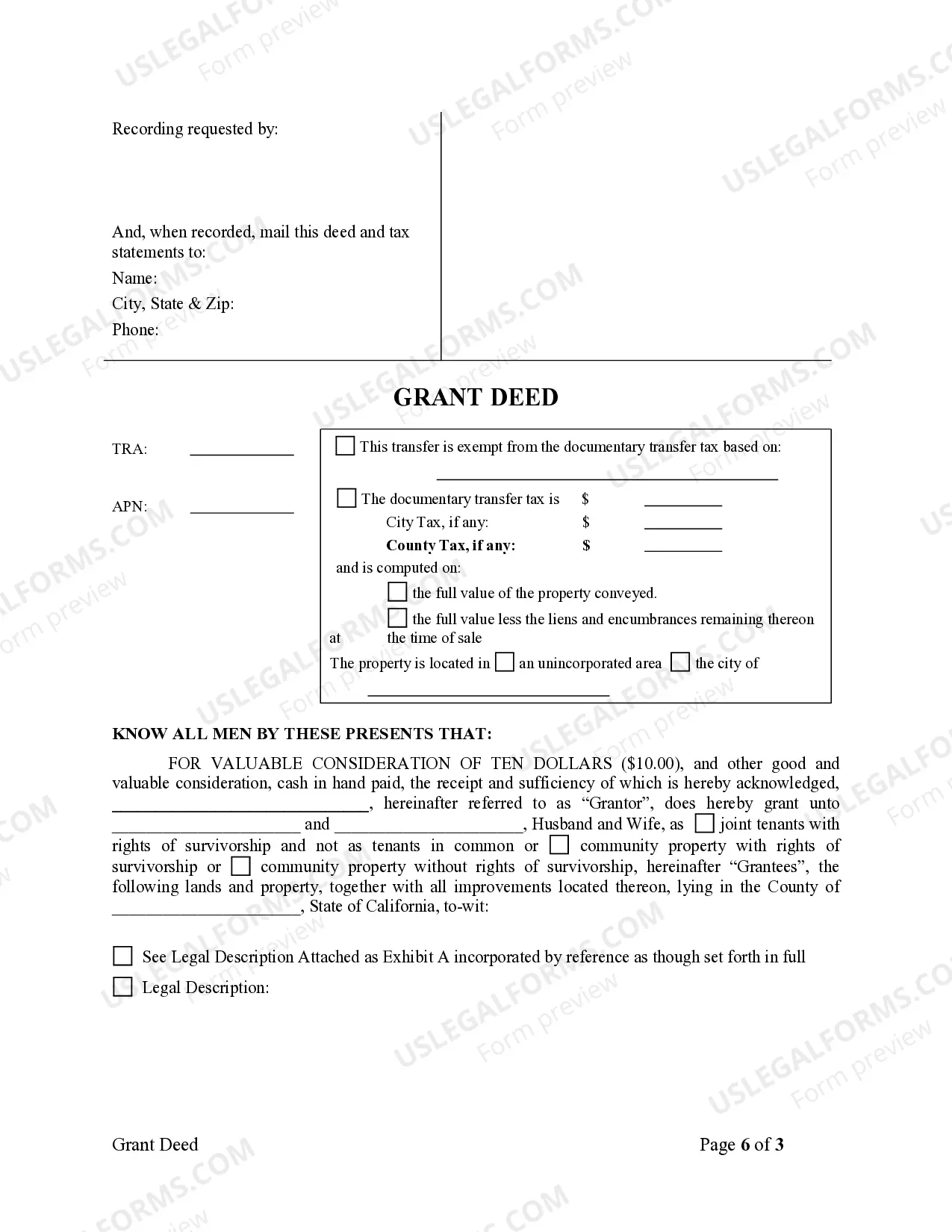

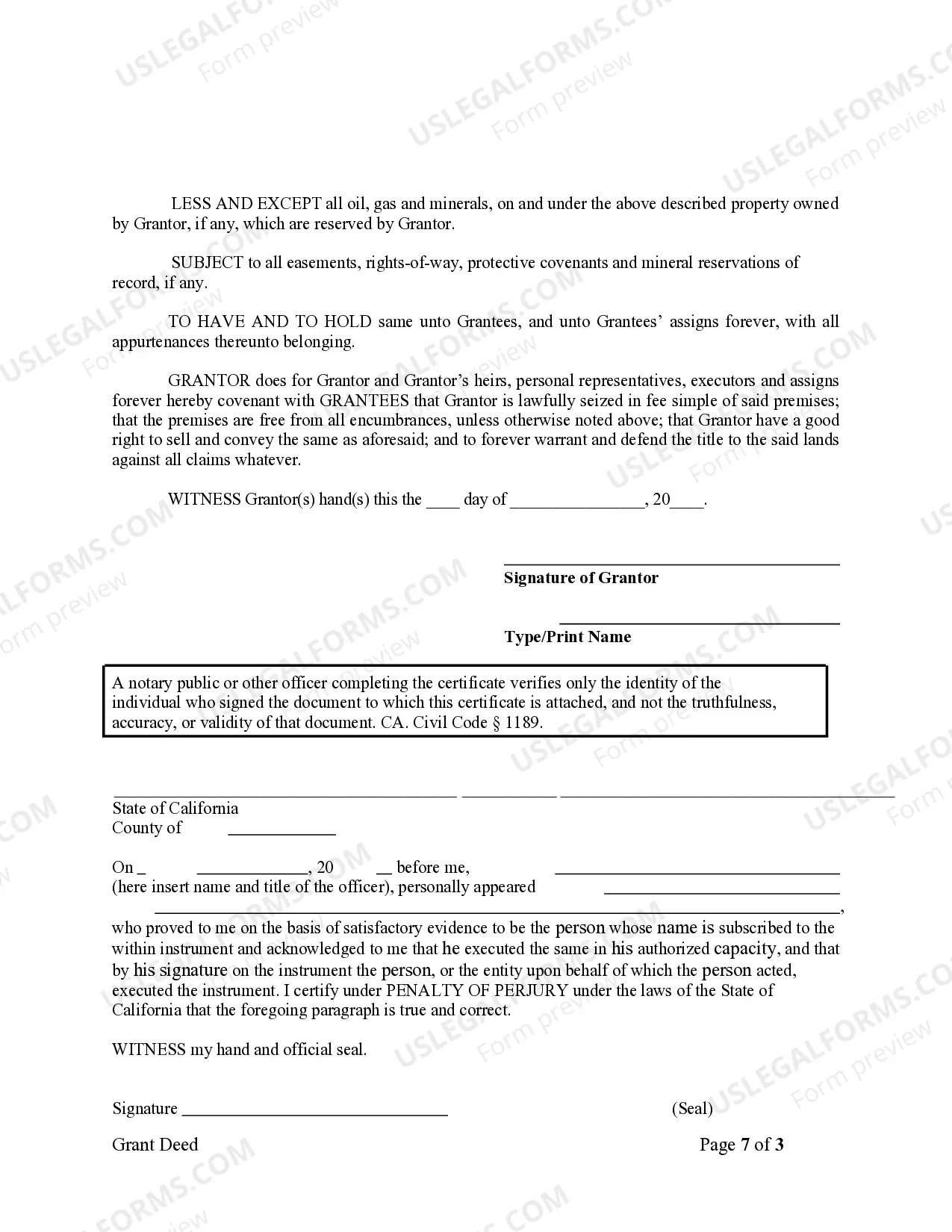

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

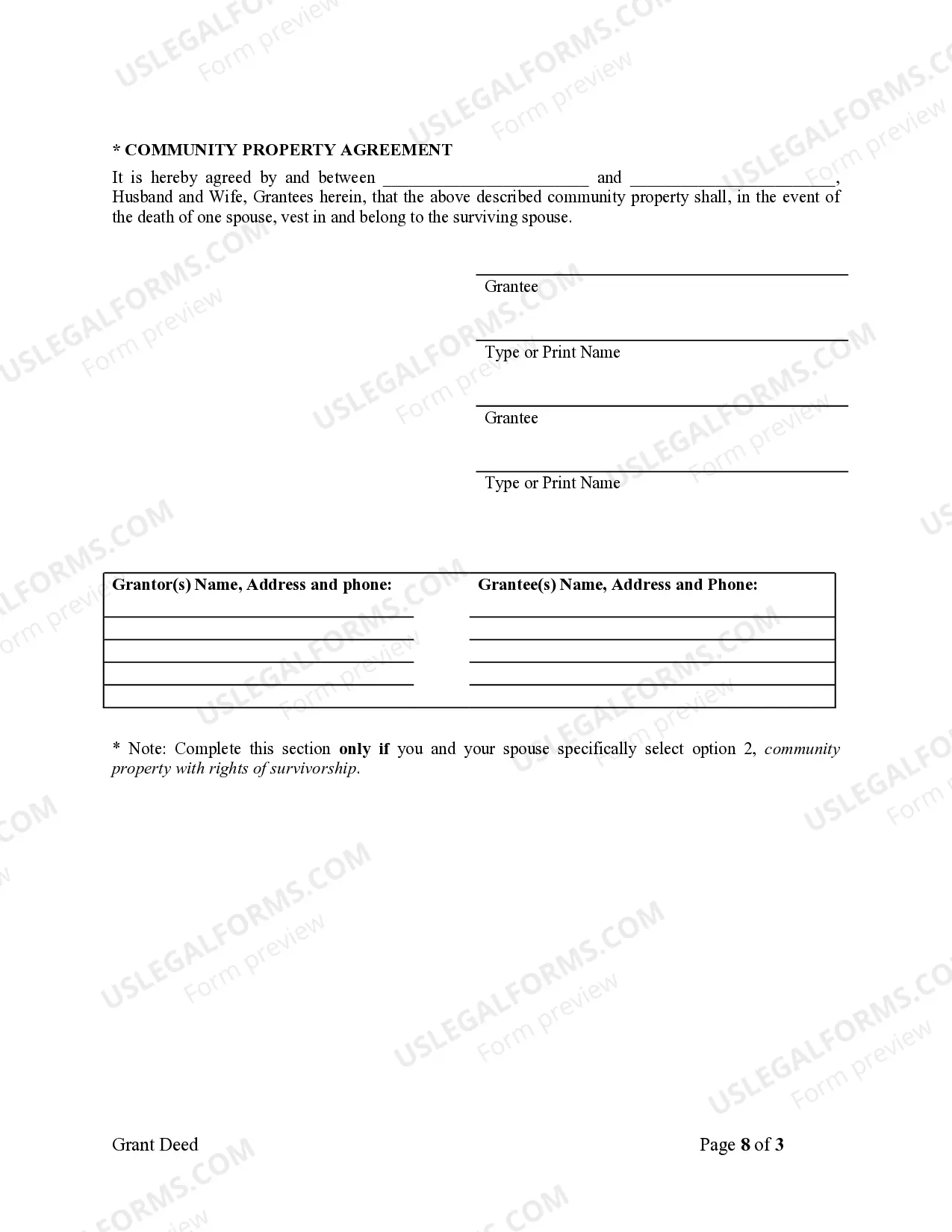

In Norwalk, California, a Grant Deed from Husband to Himself and Wife is a legal document used to transfer ownership of real property between spouses. This type of deed allows the husband—assuming he is the sole owner—to transfer the property to both himself and his wife jointly or as tenants in common. The deed confirms the husband's intention to include his spouse as a co-owner of the property. A Norwalk California Grant Deed from Husband to Himself and Wife is often used to simplify property ownership within a marital relationship, allowing both spouses to have equal rights and interests in the property. By granting the deed, the husband ensures that his wife has a legal claim to the property. There are different variations of Norwalk California Grant Deeds from Husband to Himself and Wife, including: 1. Joint Tenancy Grant Deed: This type of grant deed establishes a joint tenancy between the husband and wife. Each spouse has an undivided equal interest in the property, with the right of survivorship. In the event of the death of either spouse, the surviving spouse automatically inherits the deceased spouse's share of the property. 2. Tenants in Common Grant Deed: In this scenario, the grant deed creates a tenancy in common between the husband and wife. Each spouse holds a distinct, individual ownership interest in the property. In case of death, the deceased spouse's interest in the property does not automatically transfer to the surviving spouse, but rather passes as specified in their respective will or through intestate succession. 3. Community Property Grant Deed: This type of grant deed recognizes the property as community property, which is a marital property classification in California. Under community property laws, each spouse owns an undivided one-half interest in the property acquired during the marriage. In case of divorce or death, the community property is typically divided equally between the spouses. It is crucial to consult with a qualified attorney or a title company to ensure the appropriate type of grant deed is selected based on specific circumstances and the desired outcome. These professionals possess the necessary expertise to navigate the legal complexities involved in property transfers and can provide guidance matching individual needs.In Norwalk, California, a Grant Deed from Husband to Himself and Wife is a legal document used to transfer ownership of real property between spouses. This type of deed allows the husband—assuming he is the sole owner—to transfer the property to both himself and his wife jointly or as tenants in common. The deed confirms the husband's intention to include his spouse as a co-owner of the property. A Norwalk California Grant Deed from Husband to Himself and Wife is often used to simplify property ownership within a marital relationship, allowing both spouses to have equal rights and interests in the property. By granting the deed, the husband ensures that his wife has a legal claim to the property. There are different variations of Norwalk California Grant Deeds from Husband to Himself and Wife, including: 1. Joint Tenancy Grant Deed: This type of grant deed establishes a joint tenancy between the husband and wife. Each spouse has an undivided equal interest in the property, with the right of survivorship. In the event of the death of either spouse, the surviving spouse automatically inherits the deceased spouse's share of the property. 2. Tenants in Common Grant Deed: In this scenario, the grant deed creates a tenancy in common between the husband and wife. Each spouse holds a distinct, individual ownership interest in the property. In case of death, the deceased spouse's interest in the property does not automatically transfer to the surviving spouse, but rather passes as specified in their respective will or through intestate succession. 3. Community Property Grant Deed: This type of grant deed recognizes the property as community property, which is a marital property classification in California. Under community property laws, each spouse owns an undivided one-half interest in the property acquired during the marriage. In case of divorce or death, the community property is typically divided equally between the spouses. It is crucial to consult with a qualified attorney or a title company to ensure the appropriate type of grant deed is selected based on specific circumstances and the desired outcome. These professionals possess the necessary expertise to navigate the legal complexities involved in property transfers and can provide guidance matching individual needs.