A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

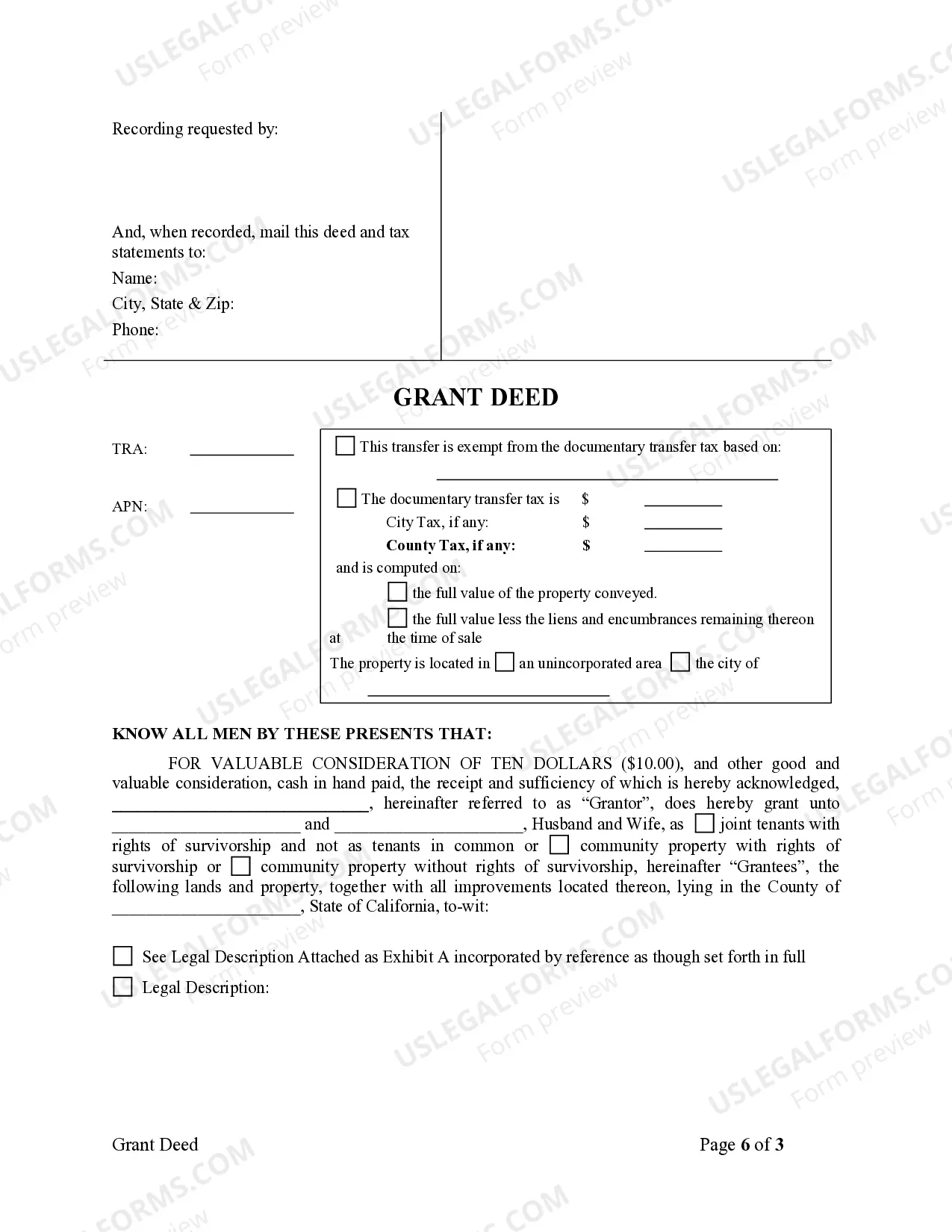

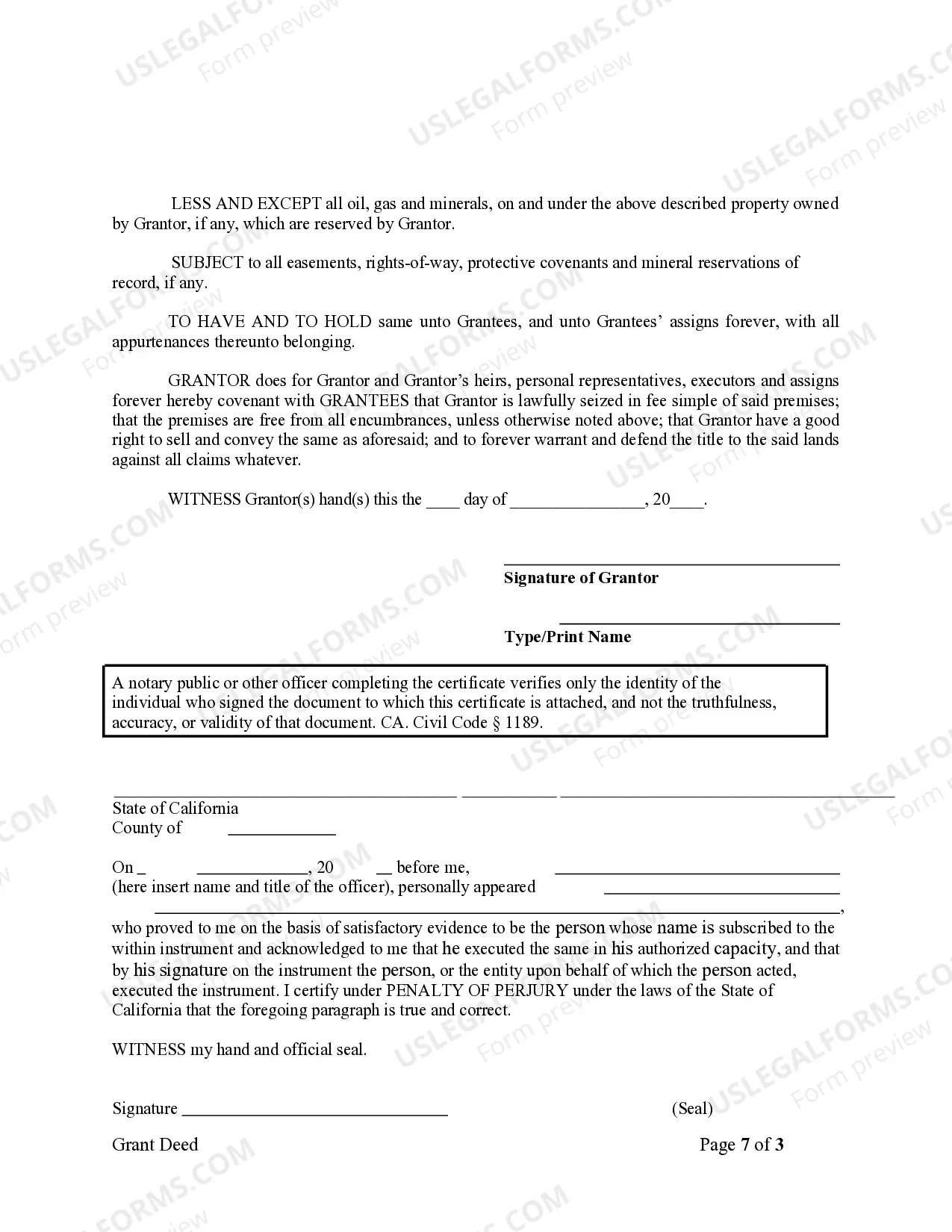

A grant deed is a legal document used in real estate transactions to transfer ownership of property from one party to another. Specifically, a Riverside California Grant Deed from Husband to Himself and Wife involves the transfer of property ownership from a husband to himself and his wife. This type of deed is commonly used when the husband is the sole owner of the property and wants to include his wife as a co-owner. In Riverside, California, there are two different types of Grant Deeds that may be used in this situation: 1. Riverside California Interspousal Transfer Grant Deed: This type of grant deed is used when a husband wants to transfer ownership of the property solely to his wife, thus making her the sole owner. However, both parties must be married at the time of the transfer for this type of deed to be valid. 2. Riverside California Community Property Grant Deed: This grant deed is suitable for couples where the husband wants to transfer a share of the property ownership to his wife, thus making them co-owners. This type of deed is applicable in situations where the property is considered community property, which is a legal classification in California where both spouses have equal ownership rights. Regardless of the specific type of grant deed, it is important to understand that this legal document requires certain information to be included. The content of a Riverside California Grant Deed from Husband to Himself and Wife typically contains the following key details: 1. Names and Addresses: The full legal names and current addresses of both the husband and wife need to be clearly stated. 2. Property Description: A detailed description of the property being transferred, including its address, lot number, and any relevant legal descriptions. 3. Granter and Grantee: The document should clearly identify the husband as the granter (current owner) and himself and his wife as grantees (new owners). 4. Consideration: The consideration refers to the value or form of compensation, if any, being exchanged for the property. While it is common for spouses to transfer property without monetary compensation, this section may still need to be filled out. 5. Signature and Date: The granter(s) must sign the deed in the presence of a notary public, who will notarize the document. The date of execution should also be included. It is important to consult with a real estate attorney or licensed professional to ensure the accuracy and legality of any grant deed transaction. This detailed description aims to provide a general overview of a Riverside California Grant Deed from Husband to Himself and Wife, including important keywords relevant to the topic.