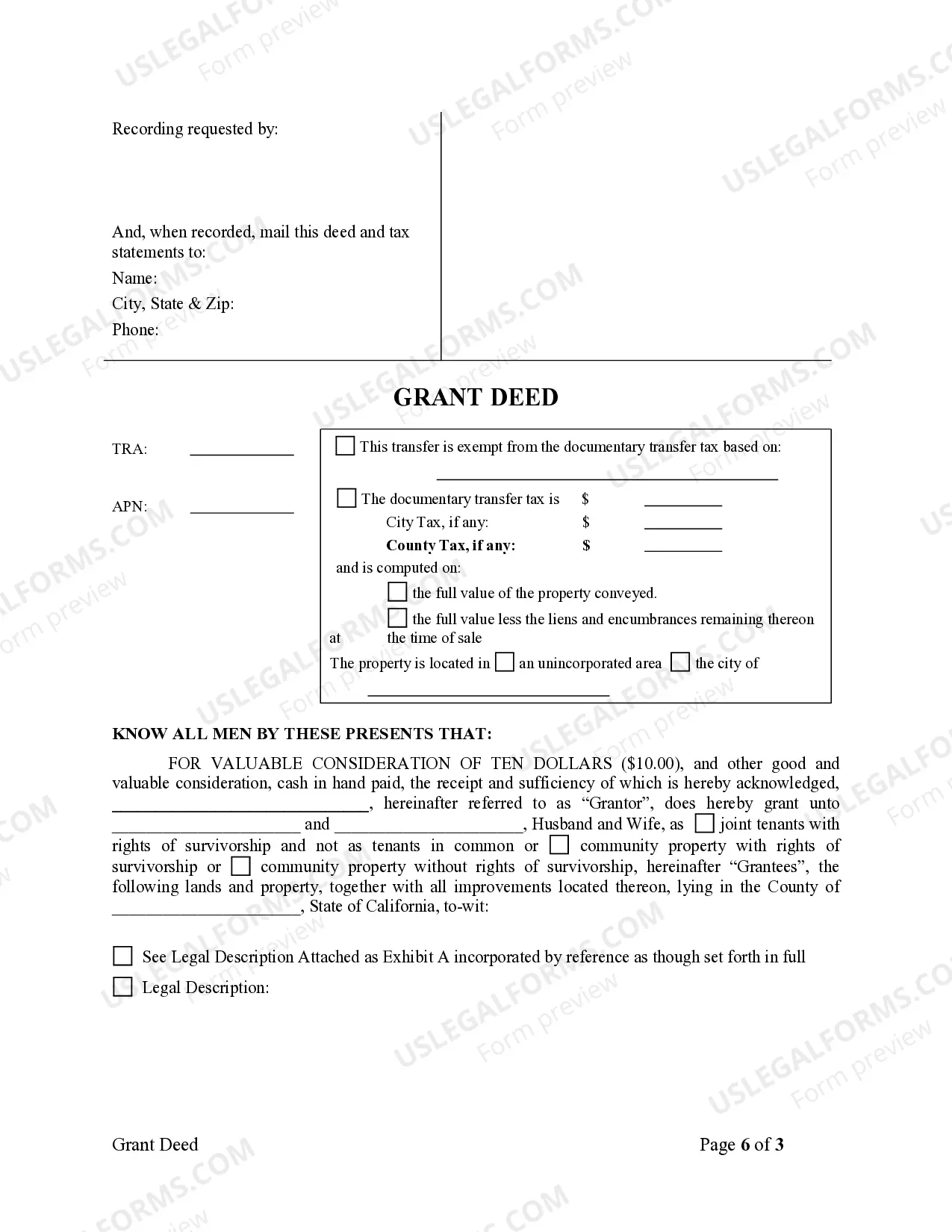

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

San Diego California Grant Deed from Husband to Himself and Wife

Description

How to fill out California Grant Deed From Husband To Himself And Wife?

Utilize US Legal Forms to gain instant access to any form template required.

Our advantageous platform with an extensive range of documents enables you to locate and procure nearly any document example you need.

You can download, fill out, and sign the San Diego California Grant Deed from Husband to Himself and Wife in mere minutes instead of spending hours online searching for a suitable template.

Employing our catalog is an excellent method to enhance the security of your document submissions.

If you have not yet created an account, follow the instructions outlined below.

Access the page with the form you require. Confirm that it is the template you were looking for: review its title and description, and use the Preview feature when it is accessible. Otherwise, use the Search field to locate the necessary one.

- Our experienced legal experts routinely examine all the records to ensure that the templates are suitable for a specific state and adhere to recent laws and regulations.

- How can you acquire the San Diego California Grant Deed from Husband to Himself and Wife.

- If you have a subscription, simply Log In to your account.

- The Download button will be activated on all the documents you review.

- Additionally, you can locate all your previously saved documents in the My documents section.

Form popularity

FAQ

No, a grant deed and title are not the same in California. A grant deed is a legal document that formally transfers ownership of property from one person to another. Meanwhile, the title represents the legal ownership of that property. Understanding this difference is crucial when dealing with property transactions, such as a San Diego California Grant Deed from Husband to Himself and Wife.

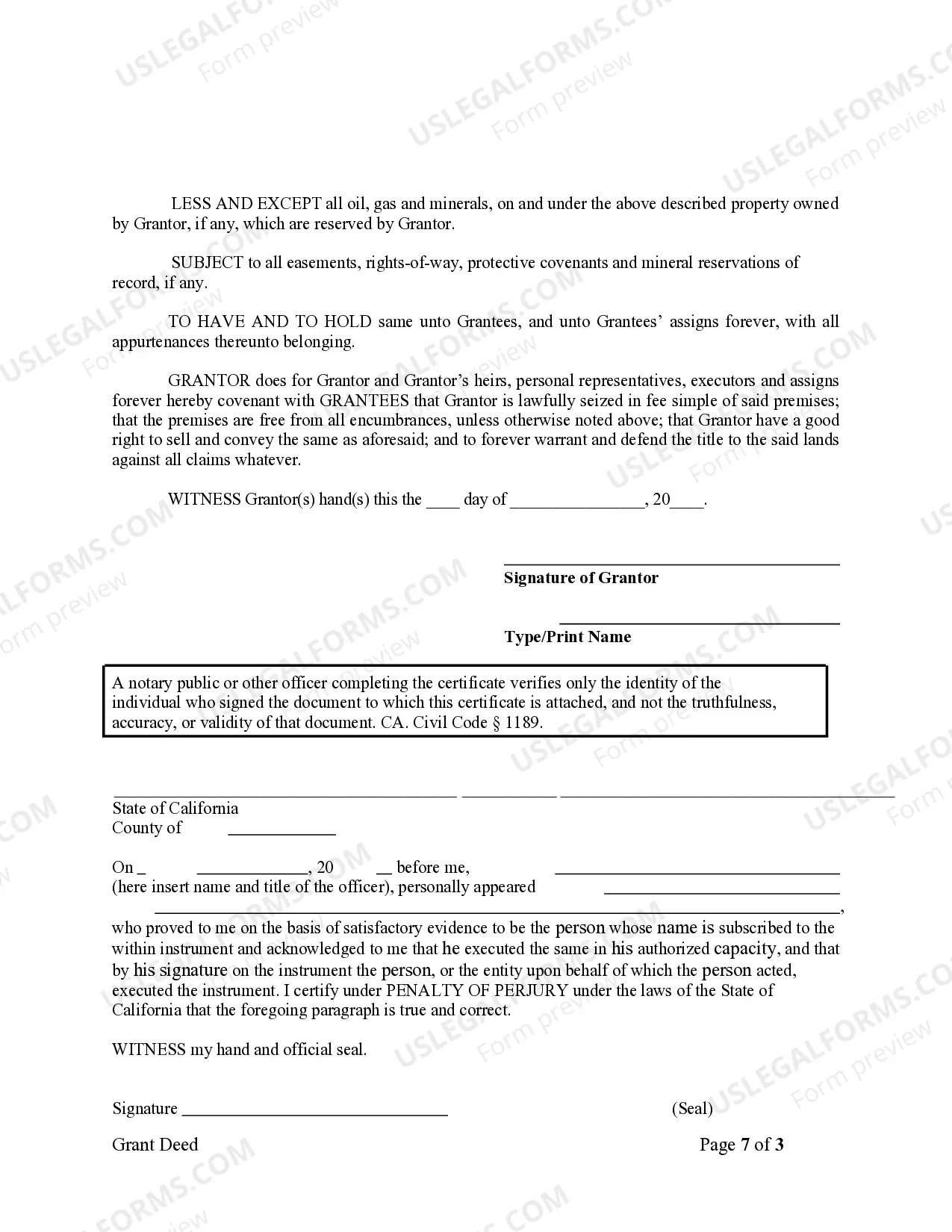

In California, a valid grant deed requires several key elements. It must include the names of the grantor and grantee, a complete property description, and clear intent to transfer ownership. Additionally, the grantor must sign the deed, and it should be notarized. These requirements help facilitate a smooth process when creating a San Diego California Grant Deed from Husband to Himself and Wife.

Correcting a grant deed in California involves a process you can manage with care. First, identify the error on the original deed, whether it's a misspelled name or an incorrect property description. Next, file a grant deed correction form, which will require both parties' signatures. This ensures that the adjustment is legally recognized, especially when transferring a San Diego California Grant Deed from Husband to Himself and Wife.

To fill out a deed successfully, start by gathering all necessary information about the property and the parties involved. Clearly state the names of the grantor and grantee, along with a detailed property description, so there is no confusion. It's important to have their signatures and, when applicable, a notary public's verification to make the deed official. Consider using a resource like US Legal Forms to simplify the process of creating a deed, such as a San Diego California Grant Deed from Husband to Himself and Wife.

Filling out a California grant deed requires precision. Begin by listing the names of both parties involved, such as the husband and wife, as they transfer the property. Additionally, include a clear description of the property, including its address and parcel number, to ensure that the deed is valid. Lastly, both parties should sign the deed and have it notarized before filing it with the county recorder's office.

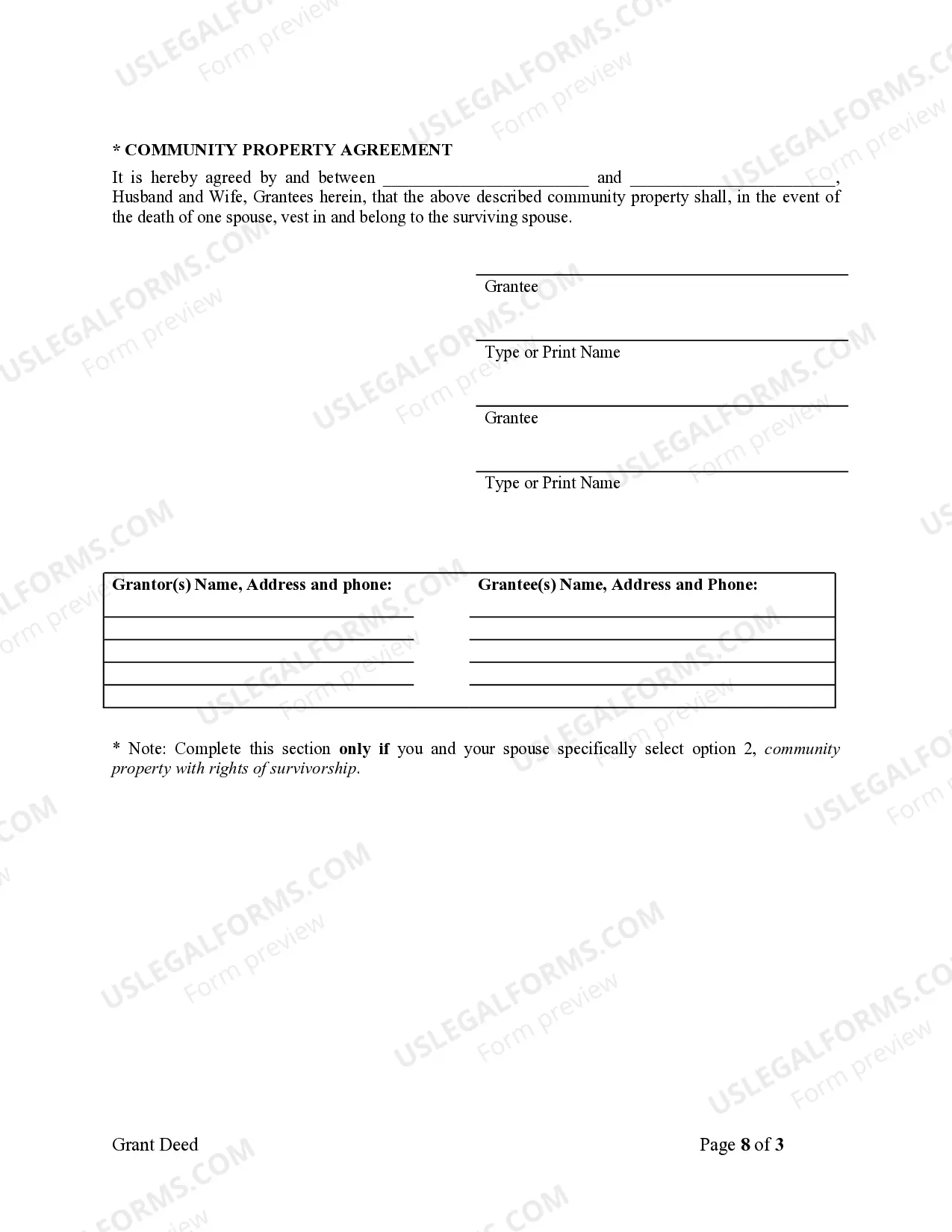

The best tenancy for a married couple typically depends on their financial goals and personal circumstances. Joint tenancy offers seamless transfer of property rights upon death, while community property can be beneficial for shared earnings and tax advantages. Opting for a San Diego California Grant Deed from Husband to Himself and Wife can help clarify ownership intentions and mitigate potential disputes. It's important to evaluate your options carefully and seek advice from professionals.

It is generally advisable for both husband and wife to be listed on the car title, especially if the couple shares the financial responsibility for the vehicle. This inclusion can simplify matters related to ownership and liability, providing clarity in the event of a divorce or other circumstances. If you are considering a San Diego California Grant Deed from Husband to Himself and Wife, this principle of shared ownership can apply to vehicles as well. Discuss your situation with a legal expert to ensure you make the best choice.

The best way for a husband and wife to hold title in California often depends on individual circumstances, such as financial situations and future plans. Joint tenancy provides benefits like simplicity in transferring assets, while community property is beneficial for tax purposes. Using a San Diego California Grant Deed from Husband to Himself and Wife can effectively establish and protect ownership rights in a clear manner. Consider seeking professional advice to find the most advantageous setup for you.

In California, married couples can hold title to property together in several ways, including joint tenancy, community property, and community property with right of survivorship. The choice you make affects how your property is treated during divorce or the passing of a spouse. A San Diego California Grant Deed from Husband to Himself and Wife often helps clarify ownership intentions, especially in community property situations. It's wise to consult a legal expert to determine which option best suits your needs.

To remove someone from a grant deed in California, you’ll typically need to draft and sign a quitclaim deed to transfer the interest out. This process often involves notarizing the quitclaim deed and recording it with the county recorder’s office. Make sure you understand the implications of this action, especially in the context of a San Diego California Grant Deed from Husband to Himself and Wife.