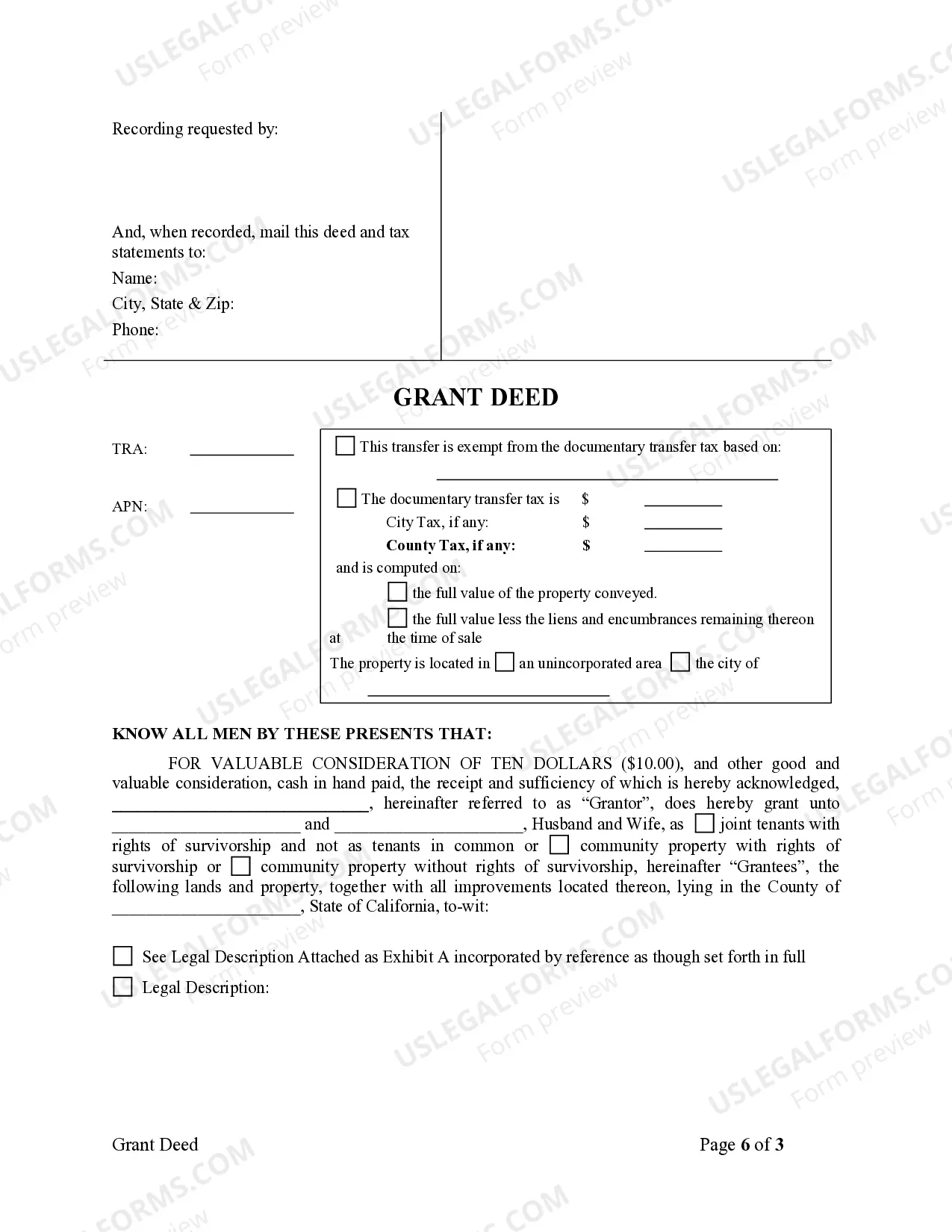

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

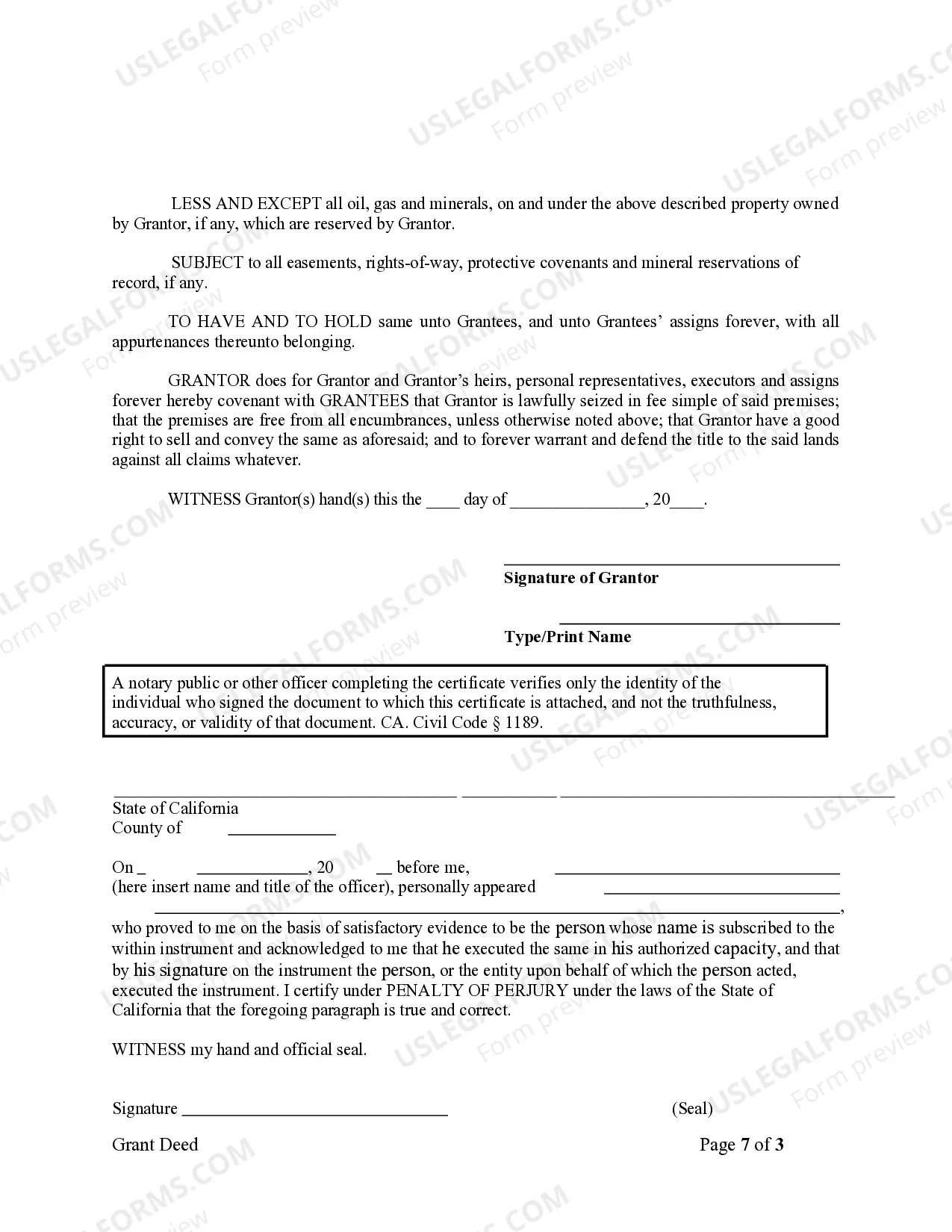

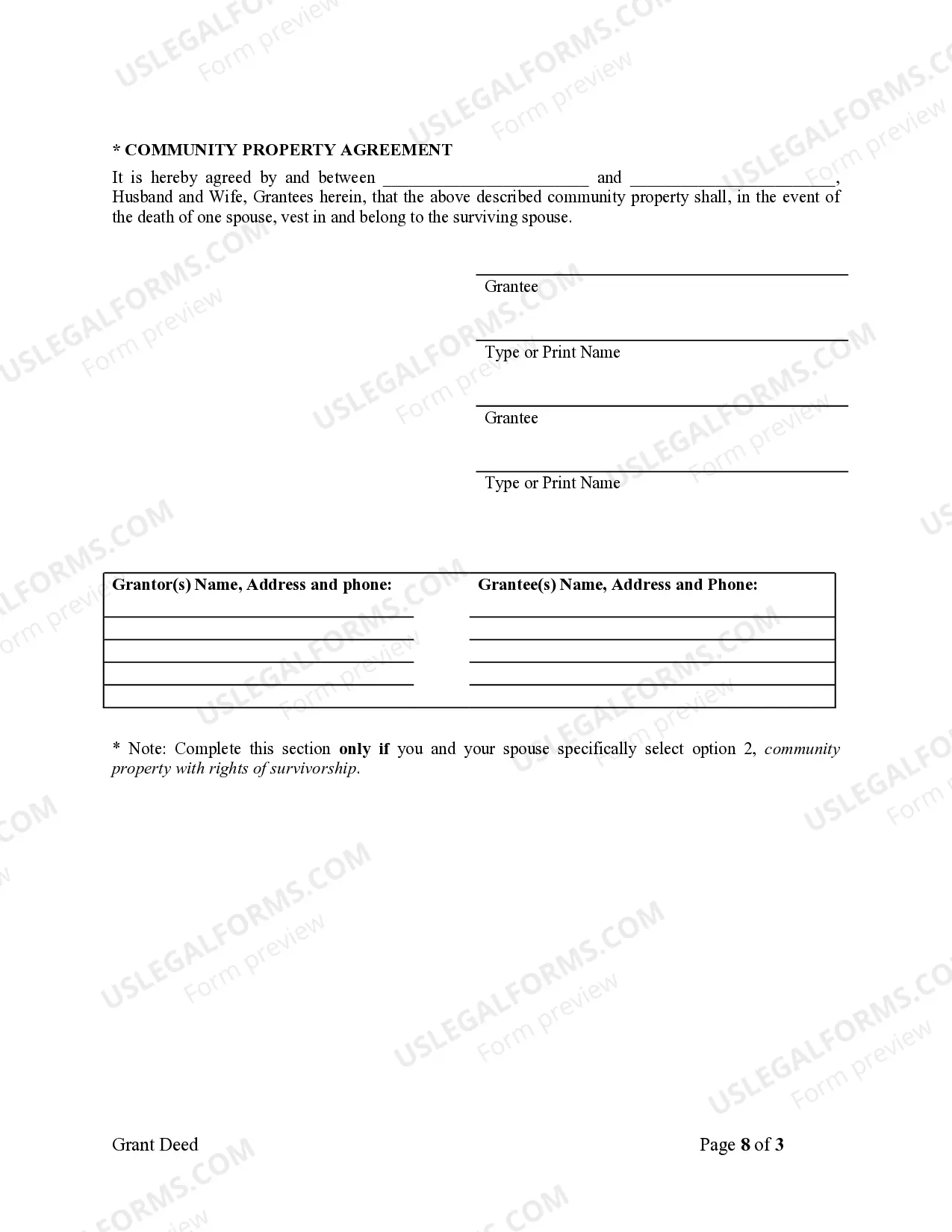

A Thousand Oaks California Grant Deed from Husband to Himself and Wife is a legal document used to transfer ownership of real property within the city of Thousand Oaks, California, from a husband to himself and his wife jointly. This type of grant deed is commonly employed when a husband wishes to add his wife as a co-owner of the property or wants to change the manner in which ownership is held. The Thousand Oaks California Grant Deed from Husband to Himself and Wife ensures that both the husband and the wife have equal ownership rights to the property. It is a legally binding agreement that transfers the husband's interest in the property to the couple as joint tenants or tenants in common, depending on their specific preferences and circumstances. The grant deed includes relevant information such as the names of the husband and wife, the legal description of the property being transferred, and the signatures of both parties involved. Additionally, it contains specific language that assures the granter (the husband) has full rights to convey the property and that there are no outstanding claims against it. Different types of Thousand Oaks California Grant Deed from Husband to Himself and Wife include: 1. Joint Tenancy Grant Deed: This type of grant deed allows both the husband and the wife to have an equal, undivided interest in the property. In the event of the death of one spouse, the ownership automatically passes to the surviving spouse. 2. Tenancy in Common Grant Deed: With this grant deed, the husband and wife hold separate, distinct shares of ownership in the property. Each party can transfer or sell their share independently, and in the event of one spouse's death, their share will pass according to their estate plan or California intestacy laws. The Thousand Oaks California Grant Deed from Husband to Himself and Wife is a vital legal instrument for individuals seeking to establish joint ownership of real estate in Thousand Oaks, California. It provides security, clarity, and legal protection for both the husband and wife. Pursuing the appropriate form of grant deed aligning with your needs and consulting with a legal expert is highly recommended ensuring compliance with state laws and individual circumstances.