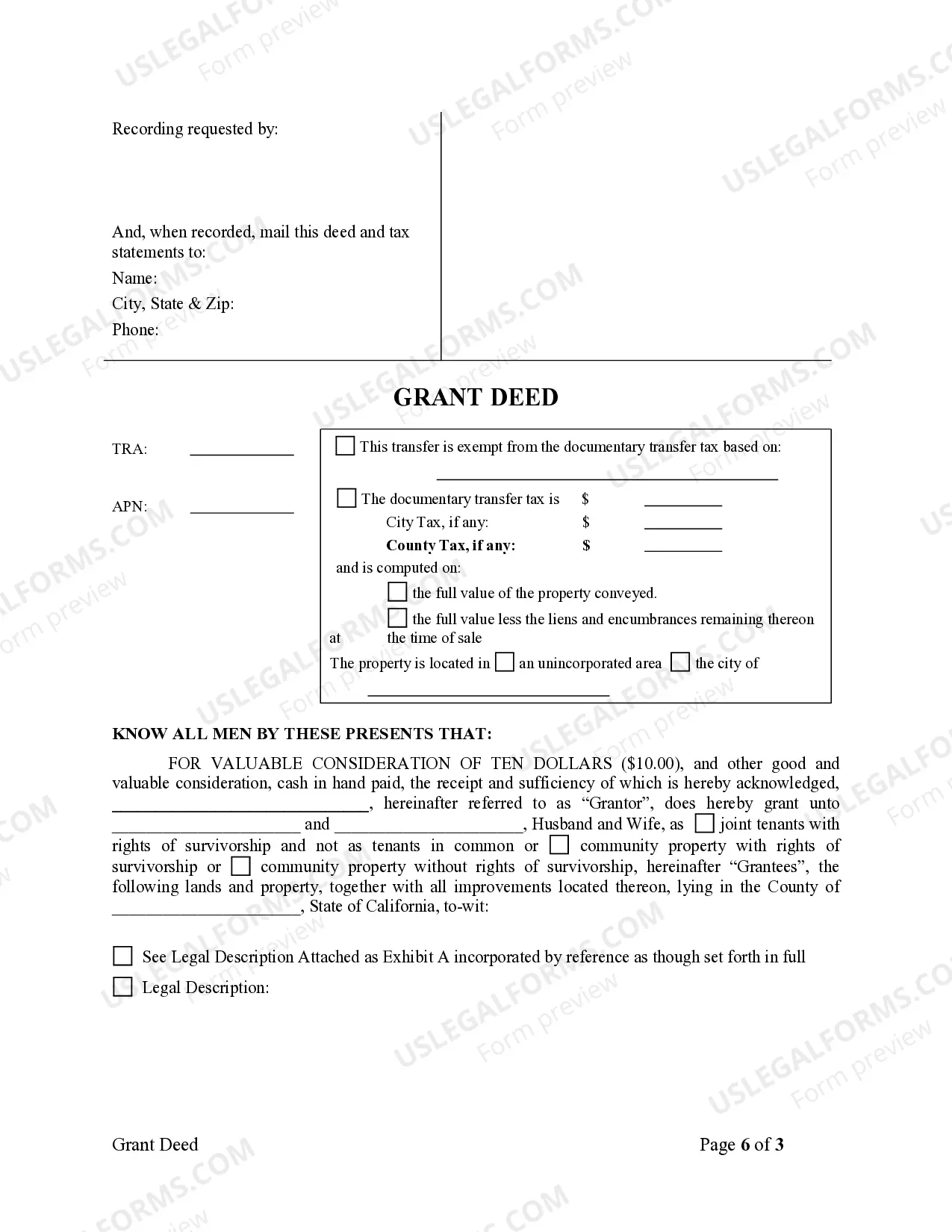

A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

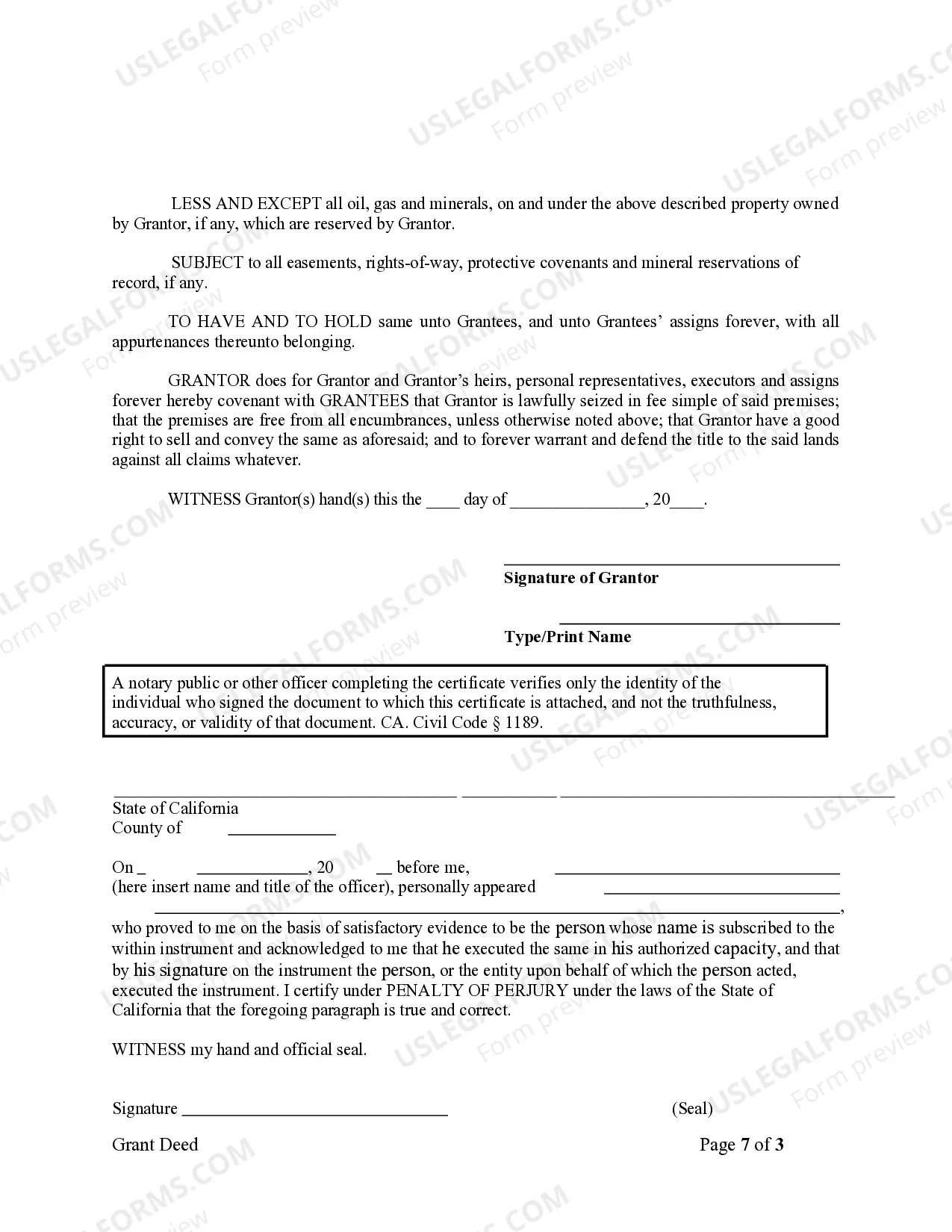

A Victorville California Grant Deed from Husband to Himself and Wife is a legal document that transfers ownership of real property from a husband to himself and his spouse in Victorville, California. This type of deed is typically used when a husband wants to add his wife to the title of a property they both own, or if the husband wishes to transfer the property to both himself and his wife jointly. The Victorville California Grant Deed from Husband to Himself and Wife ensures that both the husband and wife have equal rights and interests in the property. By executing this deed, the husband effectively grants ownership rights to himself and his wife as joint tenants with rights of survivorship. This means that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. It is essential to understand that there are various types of Victorville California Grant Deeds from Husband to Himself and Wife, each serving specific purposes. Some common types include: 1. Joint Tenancy Grant Deed: This type of deed creates a joint tenancy agreement between the husband and wife. Both parties possess an equal and undivided interest in the property, with the right of survivorship. This means that if one spouse dies, their share automatically passes to the surviving spouse. 2. Tenancy in Common Grant Deed: This type of deed allows the husband and wife to each hold a percentage interest in the property. Unlike joint tenancy, the shares do not automatically pass to the surviving spouse upon death. Each spouse can transfer or sell their percentage of ownership without the consent of the other. 3. Community Property with Right of Survivorship Grant Deed: In California, community property is a legal concept that generally provides that assets acquired during marriage are deemed community property. This type of grant deed allows the husband and wife to own the property as community property with the right of survivorship. If one spouse passes away, the surviving spouse becomes the sole owner of the property. It is crucial to consult with a qualified attorney or real estate professional when preparing a Victorville California Grant Deed from Husband to Himself and Wife to ensure compliance with state laws and to address any specific circumstances involved in the transfer of the property. This legal document safeguards the interests of both spouses and clarifies the joint ownership of the property, providing peace of mind and protection in the event of unforeseen circumstances.