Signing Agents are notaries public who usually have experience and/or training concerning the proper execution of loan documents and are hired by mortgage companies, escrow companies, title companies, and signing services to identify loan documents, obtain the necessary signatures, and in some cases deliver the documents to the borrower.

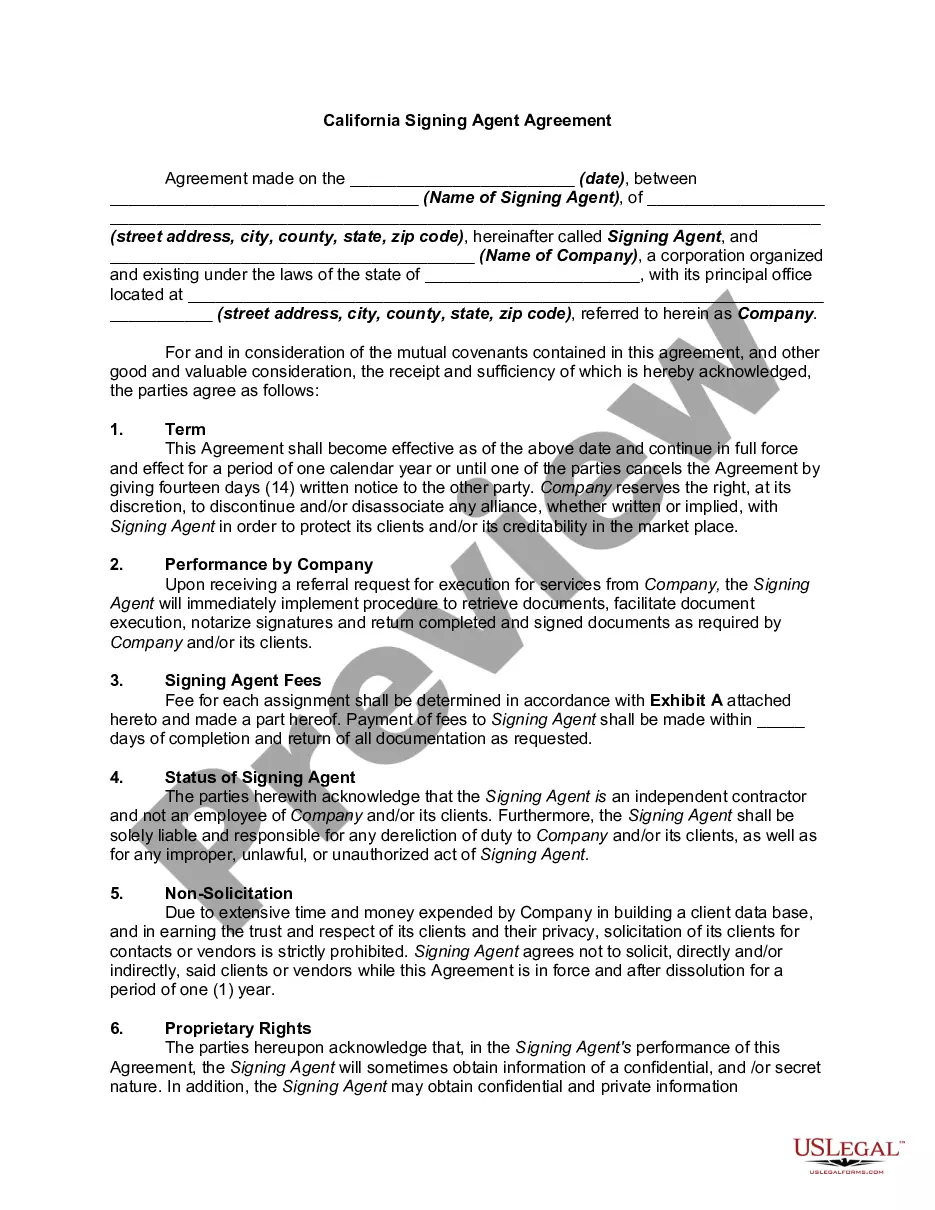

Anaheim California Signing Agent Agreement is a legal document that outlines the terms and conditions between a signing agent and their clients within the Anaheim area of California. This agreement specifies the responsibilities and obligations of both parties involved in signing agent services. As a signing agent, the primary role is to act as a neutral third-party witness during various legal transactions, typically related to real estate, such as loan signings, mortgage refinancing, or other important documents requiring notarization. The Anaheim California Signing Agent Agreement serves as a crucial tool in ensuring that all parties involved are aware of their rights and obligations. The agreement typically covers essential details like the scope of services, compensation, confidentiality, and the conditions under which the signing agent is authorized to perform their duties. It clearly outlines the expectations and professional standards that the signing agent must adhere to, ensuring a smooth and seamless transaction process. In Anaheim, there may be different types of signing agent agreements catering to specific industries or transaction types. Some examples include: 1. Real Estate Signing Agent Agreement: This agreement focuses on transactions related to property sales, leases, or mortgages within Anaheim, ensuring compliance with local regulations and safeguarding the interests of all parties involved. 2. Loan Signing Agent Agreement: This type of agreement specifically caters to loan signings, involving the notarization of loan documents, promissory notes, deeds of trust, and other relevant paperwork. It lays out the specific requirements for loan signings in Anaheim, ensuring adherence to legal obligations. 3. Financial Institution Signing Agent Agreement: This agreement targets financial institutions like banks and credit unions that require signing agent services for various financial transactions, such as account openings, power of attorney paperwork, or beneficiary designation forms. 4. Legal Document Signing Agent Agreement: This agreement encompasses a wide range of legal documents, including but not limited to wills, trusts, affidavits, and divorce papers. It outlines the procedures, confidentiality, and legal responsibilities specific to these types of signings. To generate a successful Anaheim California Signing Agent Agreement, it is essential to ensure precise and clear language, as well as a comprehensive understanding of Californian laws and regulations regarding signing agent services. Seeking legal guidance and tailoring the agreement to specific transaction types can help protect the rights and interests of the signing agent and their clients in Anaheim, California.Anaheim California Signing Agent Agreement is a legal document that outlines the terms and conditions between a signing agent and their clients within the Anaheim area of California. This agreement specifies the responsibilities and obligations of both parties involved in signing agent services. As a signing agent, the primary role is to act as a neutral third-party witness during various legal transactions, typically related to real estate, such as loan signings, mortgage refinancing, or other important documents requiring notarization. The Anaheim California Signing Agent Agreement serves as a crucial tool in ensuring that all parties involved are aware of their rights and obligations. The agreement typically covers essential details like the scope of services, compensation, confidentiality, and the conditions under which the signing agent is authorized to perform their duties. It clearly outlines the expectations and professional standards that the signing agent must adhere to, ensuring a smooth and seamless transaction process. In Anaheim, there may be different types of signing agent agreements catering to specific industries or transaction types. Some examples include: 1. Real Estate Signing Agent Agreement: This agreement focuses on transactions related to property sales, leases, or mortgages within Anaheim, ensuring compliance with local regulations and safeguarding the interests of all parties involved. 2. Loan Signing Agent Agreement: This type of agreement specifically caters to loan signings, involving the notarization of loan documents, promissory notes, deeds of trust, and other relevant paperwork. It lays out the specific requirements for loan signings in Anaheim, ensuring adherence to legal obligations. 3. Financial Institution Signing Agent Agreement: This agreement targets financial institutions like banks and credit unions that require signing agent services for various financial transactions, such as account openings, power of attorney paperwork, or beneficiary designation forms. 4. Legal Document Signing Agent Agreement: This agreement encompasses a wide range of legal documents, including but not limited to wills, trusts, affidavits, and divorce papers. It outlines the procedures, confidentiality, and legal responsibilities specific to these types of signings. To generate a successful Anaheim California Signing Agent Agreement, it is essential to ensure precise and clear language, as well as a comprehensive understanding of Californian laws and regulations regarding signing agent services. Seeking legal guidance and tailoring the agreement to specific transaction types can help protect the rights and interests of the signing agent and their clients in Anaheim, California.