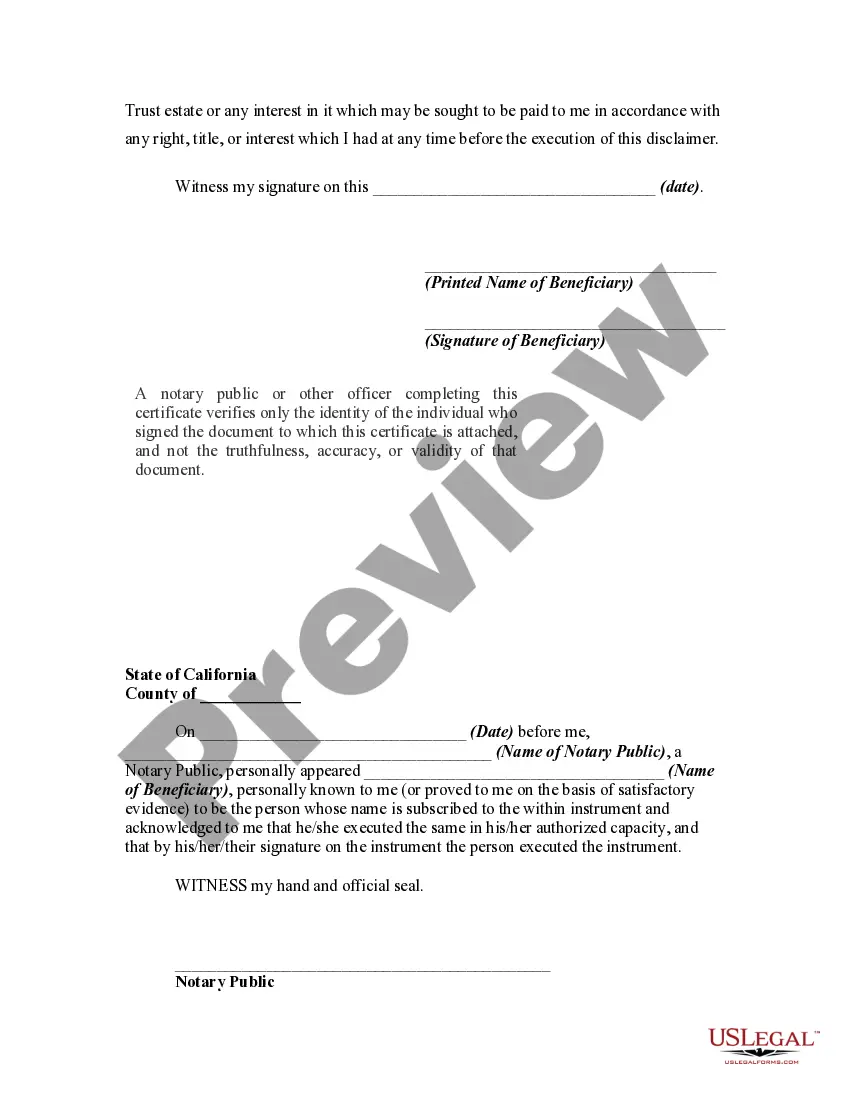

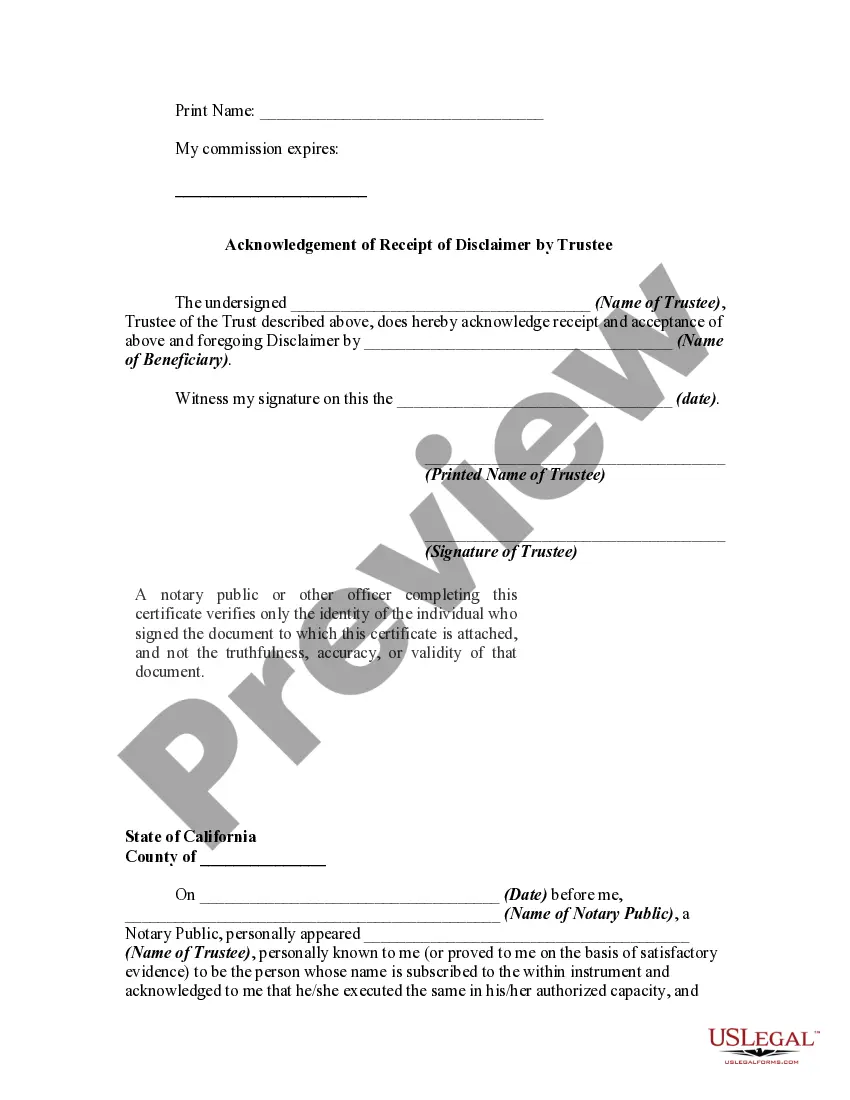

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out California Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Regardless of social or professional standing, finalizing legal documents is an unfortunate requirement in today's society.

Frequently, it is nearly impossible for an individual without a legal background to construct this type of documentation from scratch, primarily due to the complex terminology and legal nuances they entail.

This is where US Legal Forms can come to the rescue.

Make sure the form you have located is tailored to your area since the laws of one state or county may not apply to another.

Preview the document and read a brief description (if available) of the situations the form can be utilized for.

- Our platform provides an extensive library containing over 85,000 ready-to-use state-specific forms suitable for nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency time-wise utilizing our DIY papers.

- Regardless of whether you need the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee or any other document that will be applicable in your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how you can obtain the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee swiftly using our dependable platform.

- If you are already a current customer, you can go ahead to Log In to your account to download the necessary form.

- However, if you are new to our library, ensure you follow these steps before downloading the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

Form popularity

FAQ

To write a disclaimer of interest, start with a brief introduction of your identity and your connection to the estate or property. Clearly express your decision to relinquish any claims or interests in the assets. Ensure this disclaimer follows the guidelines of the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, reinforcing its legality and effectiveness.

To write a beneficiary disclaimer letter, begin with a formal greeting and identify yourself and your relationship to the deceased. Clearly state your intention to disclaim your inheritance and include details about the trust or estate. This letter should comply with the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, so consider using a proper legal template for guidance.

A disclaimer trust typically allows beneficiaries to avoid immediate tax implications by refusing to accept assets directly. Instead, the assets can go into a trust, where they may be managed according to specific terms. This structure aligns with the concept of the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, helping ensure that the trust complies with legal and tax obligations.

To write a simple disclaimer, start with a clear statement indicating your refusal of specific rights or interests. Identify the property or assets involved and provide your contact information. Also, reference your relation to the deceased and ensure it meets the criteria of the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, making the process straightforward and compliant.

An example of a disclaimer of inheritance rights involves a beneficiary explicitly refusing their share of a deceased relative's estate. For instance, a child may choose to decline their inherited property to benefit a sibling or other heirs. This decision should be documented properly to align with Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, ensuring the disclaimer is legally binding.

In California, there is no state inheritance tax, which means you can inherit without facing state taxes. However, federal estate tax may apply if the total value surpasses certain thresholds. Staying informed about the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can help you navigate these financial considerations effectively.

Yes, a beneficiary of a trust can disclaim their interest, provided they follow the proper legal procedures. It is advisable to reference the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure compliance with trust laws. By doing so, you protect your interests and maintain clarity within the trust structure.

In California, the rules for disclaiming inheritance include filing your disclaimer within specific time frames and not accepting any benefits from the estate. The Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee outlines procedural requirements. Familiarizing yourself with these rules ensures your disclaimer is valid and can prevent unintended consequences.

Disclaiming an inheritance in California involves a formal written notice submitted to the appropriate court or trustee. Ensure that your documentation aligns with the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee requirements. This process can sometimes be complex, so consider using resources from uslegalforms to guide you.

To write a letter to disclaim an inheritance, start with your identification details and a clear statement disavowing any claim to the inheritance. Include pertinent information about the estate, maintaining a formal tone throughout, and reference the Antioch California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This formal approach communicates seriousness and intent.