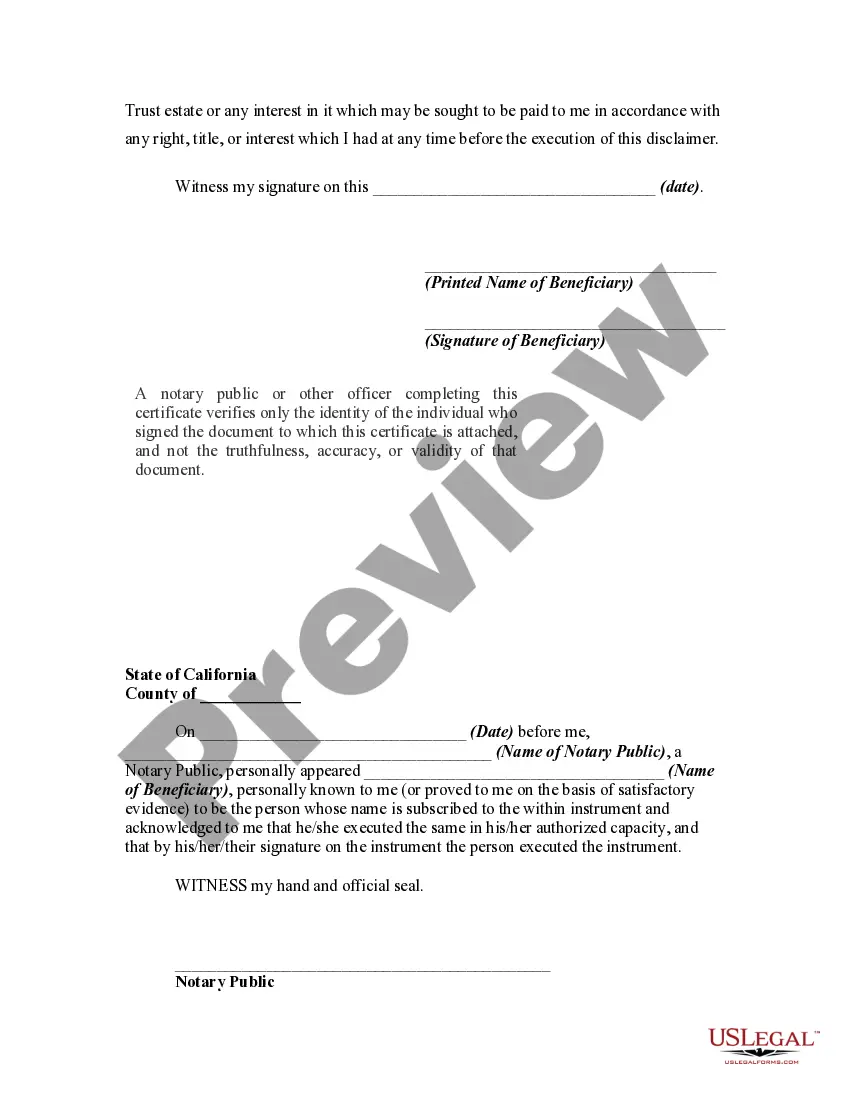

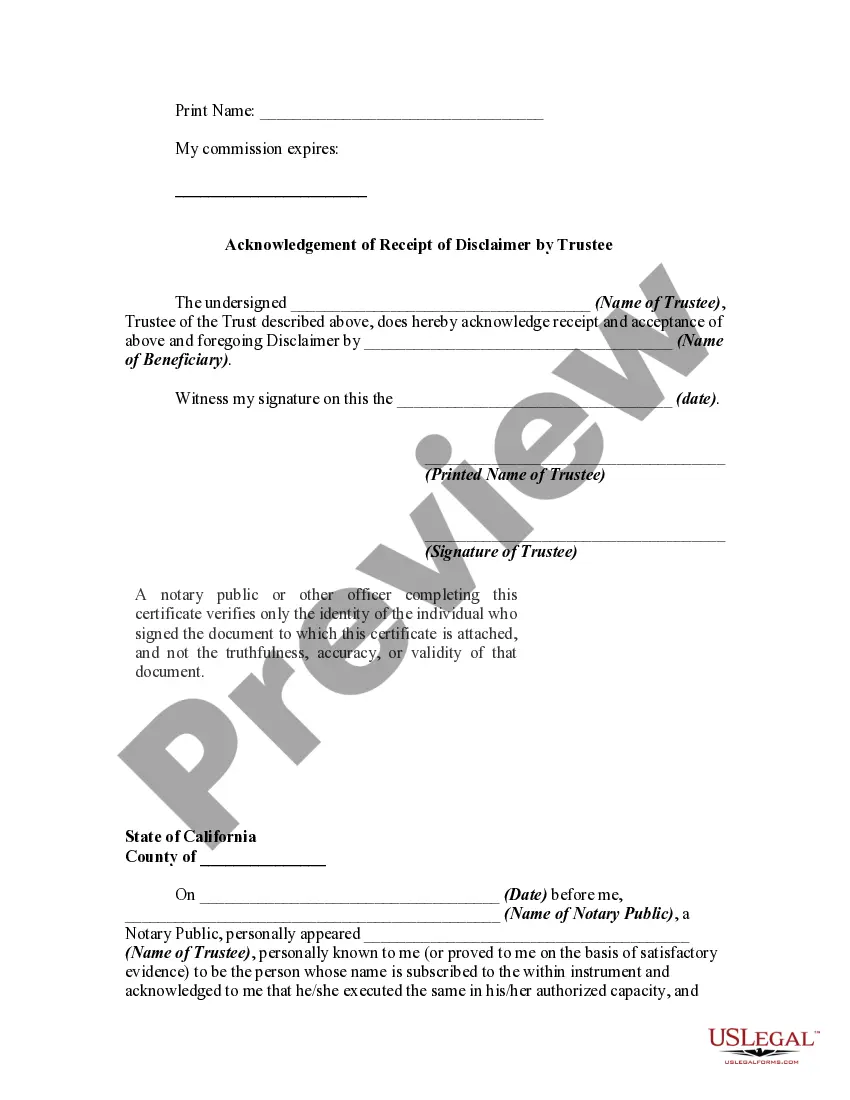

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

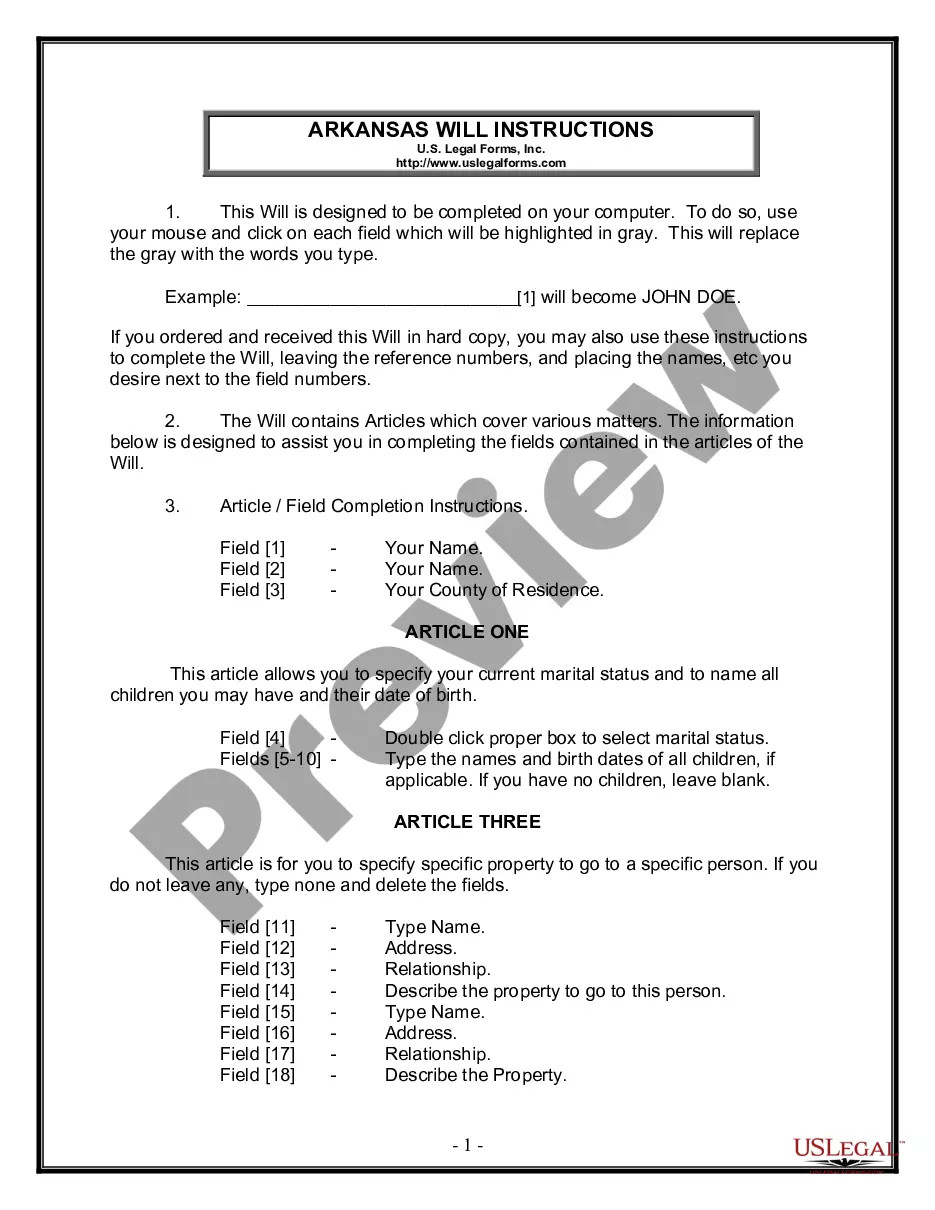

Chico California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: A Chico California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the process by which a beneficiary relinquishes their rights and interests in a trust, while the trustee accepts the disclaimer. This mechanism allows the beneficiary to disclaim all or part of the assets or property they are entitled to receive from the trust, effectively declining their inheritance. The Chico California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is applicable in various situations. It may occur when a beneficiary wishes to avoid the tax liabilities associated with an inheritance, or when they prefer to have the assets distributed to other beneficiaries. This legal document provides a formal way for the beneficiary to renounce their rights to the trust's assets and ensures that the trustee acknowledges and accepts this disclaimer. There can be different types of Chico California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. These types may include, but are not limited to: 1. Partial Disclaimer: In this scenario, the beneficiary may choose to disclaim only a specific portion or certain assets from the trust, rather than rejecting the entire inheritance. This gives them the flexibility to retain certain assets and disclaim those they do not wish to possess. 2. Complete Disclaimer: A complete disclaimer refers to a situation where the beneficiary renounces their rights to the entire trust, disclaiming any entitlement they would generally receive. This type of disclaimer ensures the beneficiary has no involvement or obligations related to the trust's assets. 3. Qualified Disclaimer: A qualified disclaimer occurs when the beneficiary waives their rights to the trust's assets, but with certain conditions attached. These conditions could include stipulations on how the assets should be distributed or passed on to alternate beneficiaries. 4. Time Limit Disclaimer: This type of disclaimer requires the beneficiary to disclaim their rights within a specific timeframe. If they fail to meet the deadline, their rights to disclaim may be considered null and void. It is important to mention that the specific naming conventions or types of disclaimers may vary depending on the jurisdiction and the trust documentation. Additionally, legal advice from an attorney specializing in trusts and estates is recommended to ensure compliance with applicable laws and regulations.